Gogo Earnings, Revenue Beat Expectations

May 06 2016 - 8:20AM

Dow Jones News

Gogo Inc. said revenue climbed in the first quarter, though the

in-flight wireless Internet provider's loss deepened amid increased

spending.

Still, the results beat Wall Street expectations.

Gogo lately has fought hard to fend off competition from rival

ViaSat Inc. Earlier this week, Gogo announced awards with Delta Air

Lines Inc. and International Airlines Group for its faster,

satellite-based 2Ku service. Gogo recently said it would partner

with satellite operator SES SA to provide a major boost for

in-flight connectivity over the U.S., Latin America and the North

Atlantic.

During the first three months of the year, Gogo said it added

service on 113 commercial aircraft, bringing the total number of

aircraft online to 2,500.

The company said its average monthly service revenue per

aircraft in its commercial aviation edged down by about 0.2% in the

first quarter, driven in part by an increase in the number of

regional jets online.

Over all, Gogo posted a loss of $24.1 million, or 31 cents a

share, compared with a year-earlier loss of $20.1 million, or 24

cents a share. Revenue rose 23% to $141.7 million.

Analysts were expecting a loss of 41 cents a share on $138

million in revenue.

Operating expenses climbed 20% to $150.3 million as Gogo

launched new services.

The company backed its forecast for revenue in 2016, projecting

a range of $575 million to $595 million.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

May 06, 2016 08:05 ET (12:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

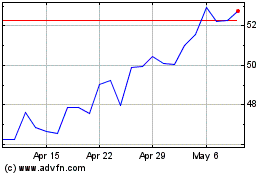

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

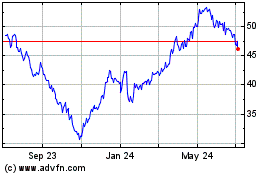

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024