OPEC's Oil Production Cut in Doubt as Output Flows

November 11 2016 - 7:30AM

Dow Jones News

LONDON—The Organization of the Petroleum Exporting Countries

pumped more crude oil last month even as the group geared up to

complete a plan to cut output at its meeting at the end of this

month in an effort to stabilize oil prices.

OPEC's crude oil output increased by 240,000 barrels a day in

October to 33.64 million barrels a day, the group said in its

monthly oil market report Friday, with Nigeria, Libya and Iraq

driving the supply boost.

OPEC's October production is now well in excess of the high-end

of the output range the group agreed to at a meeting in Algiers in

September, highlighting the challenge members will face

implementing that deal at its next meeting in Nov. 30 in Vienna.

According to the report, the group was pumping almost 1 million

barrels a day more than what is expects demand for its crude to be

next year.

The countries driving the bulk of the increase—Nigeria, Libya

and Iraq—are those seeking exemptions from the cut.

Without a cut, the world's oil stockpiles are likely to keep

building, putting further pressure on oil prices, which are still

trading below $50 a barrel, down from the more than $100 levels

seen in mid-2014.

"Looking ahead, it is important to consider the immediate impact

that the assumed global supply/demand balance has on inventories,

given the expected demand for OPEC crude in 2017 of 32.7 million

barrels a day," OPEC said in its report.

"Adjustments in both OPEC and non-OPEC supply will accelerate

the drawdown of the existing substantial overhang in global oil

stocks and help bring forward the rebalancing of the market," the

report said.

OPEC's task of trimming global oil supplies is further

challenged by producers outside the cartel, such as Russia, Brazil,

Canada and Kazakhstan, which are also ramping up the amount they

produce.

The potential for increased oil supplies comes as OPEC kept its

outlook for world oil demand growth next year unchanged at 1.15

million b/d as economic activity has been muted, despite the more

than two-year slump in oil prices.

The collapse in oil prices from over $100 a barrel in mid-2014

to below $50 currently has roiled the oil sector, forcing companies

to cut spending and jobs and hammering the economies of OPEC

producers, notably Venezuela, that rely on oil revenues.

Write to Selina Williams at selina.williams@wsj.com

(END) Dow Jones Newswires

November 11, 2016 07:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

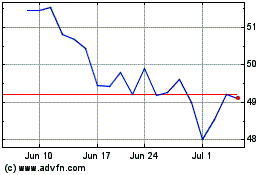

Dominion Energy (NYSE:D)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2023 to Apr 2024