Oil Prices Continue to Tumble

July 06 2016 - 7:30AM

Dow Jones News

Crude oil prices extended losses Wednesday, having fallen

sharply in the previous session, as commodities continue to get

hammered by risk-off sentiment after last month's Brexit vote

fueled uncertainty about global growth prospects.

Prices tumbled more than 4% on Tuesday as a pickup in U.S.

drilling activity gave rise to fears of a slowdown in the country's

production decline.

Brent crude, the global oil benchmark, fell 0.7% to $47.62 a

barrel in Wednesday midmorning trade on London's ICE Futures

exchange. On the New York Mercantile Exchange, West Texas

Intermediate futures were trading down 0.6% at $46.33 a barrel.

"Driven by renewed fears over economic contagion from the U.K.'s

decision to exit the European Union and severe problems in the

Italian banking sector, global risk assets were down across the

board," Vienna-based consultancy JBC Energy said in a note.

Sterling remained weak, having earlier dropped to a 31-year low,

pushing the U.S. dollar higher and thereby making oil more

expensive for holders of other currencies. The Wall Street Journal

Dollar Index, which tracks the greenback against a basket of other

currencies, was up 0.04% on Wednesday.

Analysts say even though the U.K. accounts for less than 2% of

the world's oil demand, its decision to leave the EU will rattle

investor confidence in the region, which has been grappling with

economic headwinds for years.

Two big British asset managers blocked investors from pulling

money out of real-estate funds on Tuesday, while the Bank of

England took steps to allow British banks to lend more, as markets

continued to react to the Brexit vote.

The rebound in oil prices from 13-year lows in the first quarter

to more than $50 a barrel last month has prompted investors and

analysts to warn of a rise in new U.S. production, which would have

the impact of reversing price gains.

"Fundamentally, supply and demand continues to shift into

deficit," said Dominic Haywood, an analyst at Energy Aspects,

adding that this trend depends to some extent on what happens with

U.S. production going forward.

A recent pickup in U.S. drilling activity is tempering optimism

on prices, as producers have put more rigs to work since late

May.

According to an analyst survey by pricing agency Platts, U.S.

crude inventory likely declined by 2.6 million barrels in the week

ended July 1, while gasoline stocks are expected to have fallen by

900,000 barrels.

If the official inventory data slated for release Thursday

confirms its estimates, Platts said it would mark the seventh

straight weekly decline in crude stocks, but fall short of the

average 3.4 million-barrel-draw seen the last five years for the

same reporting period.

Previous supply disruptions in Canada and Nigeria helped to take

some surplus barrels offline, but output from those countries is

gradually resuming.

Nymex reformulated gasoline blendstock—the benchmark gasoline

contract—fell 2% to $1.40 a gallon. ICE gasoil changed hands at

$423.25 a metric ton, down $0.75 from the previous settlement.

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

July 06, 2016 07:15 ET (11:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

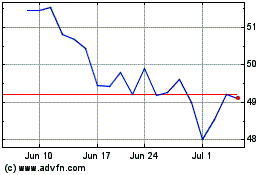

Dominion Energy (NYSE:D)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2023 to Apr 2024