IEA Chief Reiterates Forecast for $80 Oil

December 01 2015 - 3:10PM

Dow Jones News

NEW YORK—Oil prices will start climbing in 2017, rising to $80 a

barrel in coming years as production declines in some regions and

global demand continues to grow, the executive director of the

International Energy Agency said Tuesday.

Robust output in the U.S., Saudi Arabia and other countries has

resulted in a glut of crude, which has pushed oil prices down about

40% in the past year. U.S. and global prices are currently hovering

slightly above $40 a barrel.

Oil prices at $50 a barrel or lower are "not sustainable," said

Fatih Birol, head of the IEA, in an interview with The Wall Street

Journal. Mr. Birol's comments reiterate the agency's forecasts

released last month.

The Paris-based IEA expects production in nations outside the

Organization of the Petroleum Exporting Countries to drop by more

than 600,000 barrels a day in 2016, the largest decline since 1992,

as companies have sharply cut spending on new drilling.

Next year, prices are likely to remain under pressure from huge

commercial inventories of crude oil, which stood at a record high

of nearly three billion barrels at the end of September, the IEA

said in a report last month. That is roughly equivalent to a

month's worth of world-wide consumption.

"2016 will be a year where we will still have a lot of oil

around," Mr. Birol said. But "After that…we would expect to see

upward pressure on prices."

The past year's plunge in oil prices has rippled through the

global economy, providing a boon to drivers but hurting the

government revenues and currencies of large oil-producing nations.

Energy producers, facing anemic cash flow and tumbling stock

prices, have cut hundreds of thousands of jobs around the

world.

Mr. Birol's comments come ahead of OPEC's meeting in Vienna

later this week. The group of oil-producing nations opted last year

to keep its production high despite falling oil prices and is

currently producing above its target of 30 million barrels a day.

OPEC isn't expected to announce a change in strategy this week.

Market watchers expect increased Iranian crude exports to weigh

on oil prices next year if sanctions on the country are lifted. Mr.

Birol said Iran could increase its production by 500,000 barrels a

day within a year of sanctions being lifted, but beyond that the

country would need new investment to add to its output.

Global investment in new oil production fell by more than 20%

this year and will likely drop again next year, which would mark

the first time investment dropped for two straight years in at

least three decades, Mr. Birol said.

Current low oil prices pose dual threats to consuming nations,

he said.

First, the expected drop in non-OPEC production will make

consumers more dependent on Middle Eastern oil, and that supply

could be threatened due to violence in the region, Mr. Birol said.

Second, low prices could deter consuming countries from investing

in energy efficiency.

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

December 01, 2015 14:55 ET (19:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

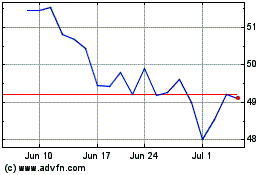

Dominion Energy (NYSE:D)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2023 to Apr 2024