Oil Prices Surge Nearly 6%

September 16 2015 - 4:00PM

Dow Jones News

Oil prices surged to a two-week high after data showed an

unexpectedly large decline in U.S. crude stockpiles, raising

expectations that a lingering supply glut is about to ease.

Crude climbed 4% in less than an hour late Wednesday morning

after data from the U.S. Energy Information Administration showed

stockpiles fell by 2.1 million barrels last week. Analysts had

forecast an increase of 1.1 million barrels, and the surprise

decline ignited hopes that long-discussed cutbacks in U.S. oil

production are starting to make an impact.

"For months and months and months, we've talked about production

falling, and it hasn't been as steep of a fall as many people

thought," said Todd Garner, managing partner at hedge fund Protec

Energy Partners LLC in Boca Raton, Fla. "It's finally starting to

happen."

Light, sweet crude for October delivery settled up $2.56, or

5.7%, to $47.15 a barrel on the New York Mercantile Exchange.

Brent, the global benchmark, gained $2.00, or 4.2%, to $49.75 a

barrel on ICE Futures Europe.

Oil prices are still down more than 55% from their highs of

2014, a swing sparked by a boom in production from U.S. shale. Many

analysts and others in the oil market warned that the boom is still

going strong, with producers pumping to help pay debts and keep

their companies afloat.

But Wednesday's move appears to fit a pattern this year in which

investors bet big on signs that the collapse in prices is forcing

producers to cut back. Oil futures climbed 25% in three days less

than a month ago on speculation that Russia and other exporters

would pull back on their efforts to keep pumping cheap oil to outdo

U.S. competitors. Oil prices surged in April on signs U.S.

production had passed a peak and oil surged more than 8% on one day

in January after a steep drop in the number of rigs drilling for

U.S. oil.

The latest run came after EIA said domestic crude inventories

fell to 456 million barrels last week from 458 million the week

before. The data added to an optimistic picture painted by the

price of actual physical oil, which has frequently been higher than

futures, said John Saucer, vice president of research and analysis

at Mobius Risk Group in Houston. "The market balance is probably

tighter than people have given it credit for," he said.

Bulls were also ignoring several factors that could cause a

rally to fall apart just as every other rally has so far this year,

brokers and analysts said. Domestic production dropped by just 0.2%

to 9.1 million barrels a day, EIA said. Gasoline stockpiles grew by

2.8 million barrels, compared with analysts' expectations for a

200,000-barrel decline. Diesel supplies rose by 3.1 million

barrels, more than the 900,000-barrel increase that analysts had

expected.

Refineries are still taking cheap oil and turning it into more

gasoline and diesel. Crude stockpiles will eventually start to back

up once those refineries go into maintenance, which usually happens

at this time of year, brokers and analysts said. Because they are

still running at an unusually strong rate, gasoline and diesel

stockpiles are growing at an exceptionally fast pace and Gulf Coast

storage has hit a record of nearly 70 million barrels, Citigroup

Inc. said in a research note about the inventory data. "The crude

surplus is just being converted into a petroleum product surplus,"

the bank's analysts said.

Gasoline and diesel futures initially dipped on the news, but

quickly rebounded and followed oil prices higher. Gasoline futures

settled up 4.92 cents, or 3.7%, at $1.3821 a gallon. Diesel futures

gained 4.14 cents, or 2.8%, to $1.5414 a gallon.

Mr. Garner, the trader at Protec Energy with $100 million under

management, said the firm is largely betting against oil prices,

though it has had to close out some of those positions in recent

days. He and Ric Navy, senior vice president for energy futures at

brokerage R.J. O'Brien & Associates LLC, warned that traders

should not overlook the bearish indicators in the EIA data.

"I don't think this is a fundamental shift in the market," Mr.

Navy said.

Write to Timothy Puko at tim.puko@wsj.com

Access Investor Kit for "Commerzbank AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=DE000CBK1001

Access Investor Kit for "Commerzbank AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US2025976059

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 16, 2015 15:45 ET (19:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

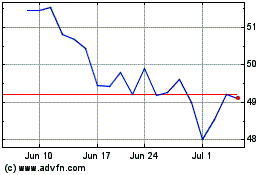

Dominion Energy (NYSE:D)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2023 to Apr 2024