UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

February 24, 2016

Commission File Number 1—13522

China Yuchai

International Limited

(Translation of Registrant’s name into English)

16 Raffles Quay #26-00

Hong Leong Building

Singapore 048581

(Address

of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the Registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨

No x

If “Yes” is marked, indicate below the file number assigned to registrant in

connection with Rule 12g3-2(b): Not applicable.

TABLE OF CONTENTS

Exhibit Index

|

|

|

|

|

| 99.1 |

|

Press release dated February 24, 2016 – China Yuchai International Announces 2015 Unaudited Fourth Quarter and Full Year Financial Results |

|

|

| 99.2 |

|

Unaudited Financial Statements for Year Ended December 31, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: February 24, 2016

|

|

|

| CHINA YUCHAI INTERNATIONAL LIMITED |

|

|

| By: |

|

/s/ Weng Ming Hoh |

| Name: |

|

Weng Ming Hoh |

| Title: |

|

President and Director |

Exhibit 99.1

China Yuchai International Announces 2015 Unaudited

Fourth Quarter and Full Year Financial Results

SINGAPORE, Singapore – February 24, 2016 – China Yuchai International Limited (NYSE: CYD) (“China Yuchai” or the

“Company”), a leading automotive manufacturer and distributor of engines in China through its main operating subsidiary, Guangxi Yuchai Machinery Company Limited (“GYMCL”), announced today its unaudited consolidated financial

results for the fourth quarter and the year ended December 31, 2015. The financial information presented herein for 2015 and 2014 is reported using International Financial Reporting Standards (“IFRS”) as issued by the International

Accounting Standards Board.

Financial Highlights for the Fourth Quarter of 2015

| |

• |

|

Net revenue declined to RMB 2.9 billion (US$ 450.7 million) compared with RMB 3.9 billion in the fourth quarter of 2014; |

| |

• |

|

Gross profit was RMB 692.1 million (US$ 106.6 million), with a gross margin of 23.7% compared with RMB 970.1 million and a gross margin of 24.7% in the fourth quarter of 2014; |

| |

• |

|

Operating profit decreased to RMB 162.2 million (US$ 25.0 million) compared with RMB 391.1 million in the same quarter of 2014; |

| |

• |

|

Net earnings attributable to China Yuchai’s shareholders decreased to RMB 59.0 million (US$ 9.1 million) from RMB 241.2 million in the fourth quarter of 2014; |

| |

• |

|

Earnings per share were RMB 1.50 (US$ 0.23) compared with RMB 6.31 in the fourth quarter of 2014; |

| |

• |

|

Total number of engines sold was 60,143 units compared with 93,094 units in the fourth quarter of 2014. |

Net

revenue for the fourth quarter of 2015 decreased by 25.4% to RMB 2.9 billion (US$ 450.7 million) compared with RMB 3.9 billion in the fourth quarter of 2014.

The total number of GYMCL engines sold in the fourth quarter of 2015 was 60,143 units compared with 93,094 units in the same quarter a year ago, representing

a decrease of 35.4%. As reported by the China Association of Automobile Manufacturers (“CAAM”), in the fourth quarter of 2015, sales of commercial vehicles (excluding gasoline-powered and electric-powered vehicles) decreased by 4.7%. The

market remained weak in the heavy- and medium-duty truck segments, which registered a decline in sales of 12.2% and 9.0%, respectively. The market was also weak in the heavy- and medium-duty bus segments, which registered a decline in sales of 29.4%

and 31.6%, respectively.

Page 1

Gross profit decreased by 28.7% to RMB 692.1 million (US$ 106.6 million) compared with RMB

970.1 million in the same quarter of 2014. The gross profit decline was mainly attributable to lower unit sales in the fourth quarter of 2015 compared with the same quarter of 2014. Gross margin was 23.7% in the fourth quarter of 2015 compared

with 24.7% in the same quarter of 2014.

Other operating income was RMB 25.8 million (US$ 4.0 million), compared with RMB 13.8 million in the

same quarter of 2014. This increase was mainly due to foreign exchange gain in the fourth quarter of 2015 as compared to a loss in the corresponding quarter of 2014.

Research and development (“R&D”) expenses declined by 7.6% to RMB 122.5 million (US$ 18.9 million) from RMB 132.6 million in the same

quarter of 2014. As a percentage of net revenue, R&D spending was 4.2% compared with 3.4% in the same quarter of 2014. R&D expenses reflected development and testing costs as new engines were introduced to the market and GYMCL continued its

initiatives to improve engine quality. Although the market condition softened, the Company maintained its efforts in R&D to prepare for the transition from Tier 2 to Tier 3 emission standards in the off-road segment and continued to introduce

new engine models.

Selling, general & administrative (“SG&A”) expenses decreased by 5.9% to RMB 433.3 million (US$ 66.7

million) from RMB 460.2 million in the fourth quarter of 2014. SG&A expenses represented 14.8% of net revenue compared with 11.7% in the fourth quarter of 2014. The increase in the SG&A percentage was mainly due to the effect of lower

unit sales.

Operating profit decreased by 58.5% to RMB 162.2 million (US$ 25.0 million) from RMB 391.1 million in the fourth quarter of 2014.

The decrease was mainly due to lower revenue and lower gross profit in the fourth quarter of 2015. The operating margin was 5.5% compared with 10.0% in the fourth quarter of 2014.

Finance costs decreased by 39.5% to RMB 22.1 million (US$ 3.4 million) from RMB 36.5 million in the same quarter of 2014. Lower finance costs mainly

resulted from lower costs for term loans.

The share of joint ventures was a gain of RMB 16.3 million (US$ 2.5 million), compared with a loss of RMB

3.6 million in the same quarter of 2014. This was mainly due to the reversal of impairment made for a joint venture of our subsidiary that was booked in 2013.

In the fourth quarter of 2015, total net profit attributable to China Yuchai’s shareholders was RMB 59.0 million (US$ 9.1 million), or earnings per

share of RMB 1.50 (US$ 0.23), compared with RMB 241.2 million, or earnings per share of RMB 6.31 in the same quarter in 2014.

Earnings per share in

the fourth quarter 2015 was based on a weighted average of 39,298,340 shares compared with earnings per share in the fourth quarter 2014 which was based on a weighted average of 38,195,706 shares. In July 2015, 1,102,634 new shares were issued to

shareholders who elected to receive shares in lieu of dividend in cash.

Page 2

Financial Highlights 2015

| |

• |

|

Net revenue decreased by 16.4% to RMB 13.7 billion (US$ 2.1 billion) compared with RMB 16.4 billion in 2014; |

| |

• |

|

Gross profit decreased by 15.2% to RMB 2.8 billion (US$ 429.7 million) with a gross margin of 20.3%, compared with RMB 3.3 billion and a gross margin of 20.0% in 2014; |

| |

• |

|

Operating profit decreased by 37.7% to RMB 805.2 million (US$ 124.0 million) compared with RMB 1.3 billion in 2014; |

| |

• |

|

Earnings per share were RMB 8.81 (US$ 1.36) compared with RMB 19.36 in 2014; |

| |

• |

|

Total number of engines sold declined by 24.6% to 364,567 units compared with 483,825 units in 2014. |

Net

revenue decreased by 16.4% to RMB 13.7 billion (US$ 2.1 billion) compared with RMB 16.4 billion in 2014.

The total number of engines sold by GYMCL in

2015 was 364,567 units compared with 483,825 units in 2014, representing a decrease of 119,258 units, or 24.6%. As reported by CAAM, sales of commercial vehicles (excluding gasoline-powered and electric-powered vehicles) decreased by 14.4% in 2015.

The market remained weak in the heavy- and medium-duty truck segments, which registered a decline in sales of 26.0% and 21.0%, respectively. The market was also weak in the heavy- and medium-duty bus segments, which registered a decline in sales of

25.5% and 19.8%, respectively.

Gross profit decreased by 15.2% to RMB 2.8 billion (US$ 429.7 million) compared with RMB 3.3 billion in 2014. The gross

profit decline was mainly attributable to lower unit sales. Gross profit margin increased to 20.3% compared with 20.0% in 2014. The higher gross margin was mainly due to higher average selling price and lower raw material costs.

Other operating income was RMB 19.3 million (US$ 3.0 million) compared with RMB 94.9 million in 2014, a decrease of RMB 75.6 million. This decrease

was mainly due to foreign exchange losses and losses from the disposal of GYMCL’s shareholding interest in Xiamen Yuchai Diesel Engines Co., Ltd. (“Xiamen Factory”).

Research and development (“R&D”) expenses increased by 2.5% to RMB 507.0 million (US$ 78.1 million) compared with RMB 494.6 million in

2014. As a percentage of net revenue, R&D spending was 3.7% compared with 3.0% in 2014. R&D expenses increased mainly due to the ongoing research and development of new and existing engine products as well as continued initiatives to improve

engine quality. Although the market condition softened, the Company maintained its efforts in R&D to prepare for the transition from Tier 2 to Tier 3 emission standards in the off-road segment and continued to introduce new engine models.

Selling, general & administrative (“SG&A”) expenses declined 6.3% to RMB 1.5 billion (US$ 230.7 million) compared with RMB 1.6 billion

in 2014. SG&A expenses represented 10.9% of net revenue, compared with 9.7% in 2014. The increase in the SG&A percentage was mainly due to the effect of lower unit sales.

Page 3

Operating profit decreased by 37.7% to RMB 805.2 million (US$ 124.0 million) from RMB 1.3 billion in 2014.

The decrease was mainly due to lower revenues. The operating margin was 5.9% compared with 7.9% in 2014.

Finance costs declined 25.7% to RMB

116.4 million (US$ 17.9 million) from RMB 156.7 million in 2014. Lower finance costs mainly resulted from lower costs for term loans and less bills discounting.

The share of joint ventures was a loss of RMB 2.9 million (US$ 0.5 million), compared with a loss of RMB 30.7 million in 2014. This was mainly due

to the reversal of impairment made for a joint venture of our subsidiary that was booked in 2013.

In 2015, there was a loss of RMB 17.3 million (US$

2.7 million) relating to Xiamen Factory’s disposal. However, in 2014, there were gains arising from acquisitions of RMB 95.2 million.

The net profit

attributable to China Yuchai’s shareholders was RMB 341.1 million (US$ 52.5 million), or earnings per share of RMB 8.81 (US$ 1.36), compared with RMB 730.3 million, or earnings per share of RMB 19.36 in 2014.

Earnings per share were based on a weighted average of 38,712,282 shares compared with earnings per share in 2014 which were based on a weighted average of

37,720,248 shares. In July 2015, 1,102,634 new shares were issued to shareholders who elected to receive shares in lieu of dividend in cash.

Balance

Sheet Highlights as at December 31, 2015

| |

• |

|

Cash and bank balances were RMB 3.8 billion (US$ 582.4 million) compared with RMB 2.5 billion at December 31, 2014; |

| |

• |

|

Trade and bills receivables were RMB 7.2 billion (US$ 1,105.5 million) compared with RMB 8.1 billion at the end of 2014; |

| |

• |

|

Inventories were RMB 1.7 billion (US$ 263.5 million) compared with RMB 1.9 billion at the end of 2014; |

| |

• |

|

Short- and long-term borrowings were RMB 2.5 billion (US$ 378.2 million) compared with RMB 2.3 billion at the end of 2014; |

| |

• |

|

Trade and bills payables were RMB 3.9 billion (US$ 594.5 million) compared with RMB 4.2 billion at the end of 2014. |

Mr. Weng Ming Hoh, President of China Yuchai, commented, “2015 was a challenging year for the diesel engine industry in China due to the sluggish

macroeconomic environment as well as emission standard transitions in both the on- and off-road segments. We managed to improve our average selling price and maintained our profitability despite the decline in unit sales in a weaker than usual

market environment.”

“While we wait for the economy to improve, we will continue to focus on costs control, expanding our product offerings,

improving engine quality and strengthening our financial position,” Mr. Hoh concluded.

Page 4

Disclaimer Regarding Unaudited Financial Results

Investors should note that the Company has not yet finalized its consolidated financial results for fiscal year 2015. The financial information of the Company

presented above is unaudited and may differ materially from the audited financial statements of the Company for fiscal year 2015 to be released when it is available.

Exchange Rate Information

The Company’s functional

currency is the U.S. dollar and its reporting currency is Renminbi. The translation of amounts from Renminbi to U.S. dollars is solely for the convenience of the reader. Translation of amounts from Renminbi to U.S. dollars has been made at the rate

of RMB 6.4936 = US$ 1.00, the rate quoted by the People’s Bank of China at the close of business on December 31, 2015. No representation is made that the Renminbi amounts could have been, or could be, converted into U.S. dollars at that

rate or at any other certain rate on December 31, 2015 or at any other date.

Unaudited Full Year 2015 Conference Call

A conference call and audio webcast for the investment community has been scheduled for 8:00 A.M. Eastern Standard Time on February 24, 2016. The call

will be hosted by Mr. Weng Ming HOH, President, and Mr. Kok Ho LEONG, Chief Financial Officer of China Yuchai. They will present on and discuss the financial results and business outlook of the Company followed with a Q&A session.

Analysts and institutional investors may participate in the conference call by dialing +1-866-519-4004 (United States), +800-906-601 (Hong Kong), 400-620-8038

(China) or +65 67135090 (International), Conference Code: 37474119, approximately five to ten minutes before the call start time.

For all other

interested parties, a simultaneous webcast can be accessed at the investor relations section of the Company’s website located at http://www.cyilimited.com. Participants are requested to log into the webcast at least 10 minutes prior to

the scheduled start time. The recorded webcast will be available on the website shortly after the earnings call.

About China Yuchai International

China Yuchai International Limited, through its subsidiary, Guangxi Yuchai Machinery Company Limited (“GYMCL”), engages in the manufacture,

assembly, and sale of a wide variety of light-, medium- and heavy-duty engines for trucks, buses, passenger vehicles, construction equipment, marine and agriculture applications in China. GYMCL also produces diesel power generators. The engines

produced by GYMCL range from diesel to natural gas and hybrid engines. Through its regional sales offices and authorized customer service centers, the Company distributes its engines directly to auto OEMs and retailers and provides maintenance and

retrofitting services throughout China. Founded in 1951, GYMCL has established a reputable brand name, strong research and development team and significant market share in China with high-quality products and reliable after-sales support. In 2015,

GYMCL sold 364,567 engines and is recognized as a leading manufacturer and distributor of engines in China. For more information, please visit http://www.cyilimited.com.

Page 5

Safe Harbor Statement

This news release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words

“believe”, “expect”, “anticipate”, “project”, “targets”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking

statements. All statements other than statements of historical fact are statements that may be deemed forward-looking statements. These forward-looking statements are based on current expectations or beliefs, including, but not limited to,

statements concerning the Company’s operations, financial performance and condition. The Company cautions that these statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of

important factors, including those discussed in the Company’s reports filed with the Securities and Exchange Commission from time to time. The Company specifically disclaims any obligation to maintain or update the forward-looking information,

whether of the nature contained in this release or otherwise, in the future.

For more information, please contact:

Shiwei Yin

Grayling

Tel: +1-646-284-9409

Email: cyd@grayling.com

— Tables Follow —

Page 6

Exhibit 99.2

CHINA YUCHAI INTERNATIONAL LIMITED

UNAUDITED

CONSOLIDATED INCOME STATEMENTS

For the quarters ended December 31, 2015 and 2014

(RMB and US$ amounts expressed in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, 2015 |

|

|

December 31, 2014 |

|

| |

|

RMB’000 |

|

|

US$’000 |

|

|

RMB’000 |

|

|

US$’000 |

|

| Revenue |

|

|

2,926,451 |

|

|

|

450,667 |

|

|

|

3,920,895 |

|

|

|

603,809 |

|

| Cost of goods sold |

|

|

(2,234,311 |

) |

|

|

(344,079 |

) |

|

|

(2,950,802 |

) |

|

|

(454,417 |

) |

| Gross profit |

|

|

692,140 |

|

|

|

106,588 |

|

|

|

970,093 |

|

|

|

149,392 |

|

| Other operating income |

|

|

25,798 |

|

|

|

3,973 |

|

|

|

13,786 |

|

|

|

2,123 |

|

| Research and development costs |

|

|

(122,478 |

) |

|

|

(18,861 |

) |

|

|

(132,553 |

) |

|

|

(20,413 |

) |

| Selling, distribution and administrative costs |

|

|

(433,276 |

) |

|

|

(66,724 |

) |

|

|

(460,219 |

) |

|

|

(70,873 |

) |

| Operating profit |

|

|

162,184 |

|

|

|

24,976 |

|

|

|

391,107 |

|

|

|

60,229 |

|

| Finance costs |

|

|

(22,067 |

) |

|

|

(3,398 |

) |

|

|

(36,485 |

) |

|

|

(5,619 |

) |

| Share of gain of associates |

|

|

188 |

|

|

|

29 |

|

|

|

804 |

|

|

|

124 |

|

| Share of gain / (loss) of joint ventures |

|

|

16,316 |

|

|

|

2,513 |

|

|

|

(3,591 |

) |

|

|

(553 |

) |

| Gains arising from acquisitions |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Profit before tax |

|

|

156,621 |

|

|

|

24,120 |

|

|

|

351,835 |

|

|

|

54,181 |

|

| Income tax expense |

|

|

(57,729 |

) |

|

|

(8,890 |

) |

|

|

(27,209 |

) |

|

|

(4,190 |

) |

| Profit for the period |

|

|

98,892 |

|

|

|

15,230 |

|

|

|

324,626 |

|

|

|

49,991 |

|

| Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity holders of the parent |

|

|

59,004 |

|

|

|

9,087 |

|

|

|

241,171 |

|

|

|

37,139 |

|

| Non-controlling interests |

|

|

39,888 |

|

|

|

6,143 |

|

|

|

83,455 |

|

|

|

12,852 |

|

|

|

|

98,892 |

|

|

|

15,230 |

|

|

|

324,626 |

|

|

|

49,991 |

|

| Net earnings per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

1.50 |

|

|

|

0.23 |

|

|

|

6.31 |

|

|

|

0.97 |

|

| Diluted |

|

|

1.50 |

|

|

|

0.23 |

|

|

|

6.31 |

|

|

|

0.97 |

|

| Unit sales |

|

|

60,143 |

|

|

|

|

|

|

|

93,094 |

|

|

|

|

|

Page 1

CHINA YUCHAI INTERNATIONAL LIMITED

UNAUDITED CONSOLIDATED INCOME STATEMENTS

For the years

ended December 31, 2015 and 2014

(RMB and US$ amounts expressed in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, 2015 |

|

|

December 31, 2014 |

|

| |

|

RMB’000 |

|

|

US$’000 |

|

|

RMB’000 |

|

|

US$’000 |

|

| Revenue |

|

|

13,733,437 |

|

|

|

2,114,919 |

|

|

|

16,436,142 |

|

|

|

2,531,129 |

|

| Cost of goods sold |

|

|

(10,942,865 |

) |

|

|

(1,685,177 |

) |

|

|

(13,145,152 |

) |

|

|

(2,024,324 |

) |

| Gross profit |

|

|

2,790,572 |

|

|

|

429,742 |

|

|

|

3,290,990 |

|

|

|

506,805 |

|

| Other operating income |

|

|

19,337 |

|

|

|

2,978 |

|

|

|

94,892 |

|

|

|

14,613 |

|

| Research and development costs |

|

|

(506,955 |

) |

|

|

(78,070 |

) |

|

|

(494,594 |

) |

|

|

(76,166 |

) |

| Selling, distribution and administrative costs |

|

|

(1,497,774 |

) |

|

|

(230,654 |

) |

|

|

(1,598,670 |

) |

|

|

(246,192 |

) |

| Operating profit |

|

|

805,180 |

|

|

|

123,996 |

|

|

|

1,292,618 |

|

|

|

199,060 |

|

| Finance costs |

|

|

(116,351 |

) |

|

|

(17,918 |

) |

|

|

(156,670 |

) |

|

|

(24,127 |

) |

| Share of gain of associates |

|

|

245 |

|

|

|

38 |

|

|

|

956 |

|

|

|

147 |

|

| Share of loss of joint ventures |

|

|

(2,936 |

) |

|

|

(452 |

) |

|

|

(30,711 |

) |

|

|

(4,729 |

) |

| Gains arising from acquisitions |

|

|

— |

|

|

|

— |

|

|

|

95,192 |

|

|

|

14,659 |

|

| Profit before tax |

|

|

686,138 |

|

|

|

105,664 |

|

|

|

1,201,385 |

|

|

|

185,010 |

|

| Income tax expense |

|

|

(176,818 |

) |

|

|

(27,230 |

) |

|

|

(179,638 |

) |

|

|

(27,664 |

) |

| Profit for the period |

|

|

509,320 |

|

|

|

78,434 |

|

|

|

1,021,747 |

|

|

|

157,346 |

|

| Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity holders of the parent |

|

|

341,108 |

|

|

|

52,530 |

|

|

|

730,281 |

|

|

|

112,461 |

|

| Non-controlling interests |

|

|

168,212 |

|

|

|

25,904 |

|

|

|

291,466 |

|

|

|

44,885 |

|

|

|

|

509,320 |

|

|

|

78,434 |

|

|

|

1,021,747 |

|

|

|

157,346 |

|

| Net earnings per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

8.81 |

|

|

|

1.36 |

|

|

|

19.36 |

|

|

|

2.98 |

|

| Dilute |

|

|

8.81 |

|

|

|

1.36 |

|

|

|

19.36 |

|

|

|

2.98 |

|

| Unit sales |

|

|

364,567 |

|

|

|

|

|

|

|

483,825 |

|

|

|

|

|

Page 2

CHINA YUCHAI INTERNATIONAL LIMITED

SELECTED UNAUDITED CONSOLIDATED BALANCE SHEET ITEMS

For the years ended December 31, 2015 and 2014

(RMB and US$ amounts expressed in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, 2015

(Unaudited) |

|

|

As of December 31, 2014

(Audited) |

|

| |

|

RMB’000 |

|

|

US$’000 |

|

|

RMB’000 |

|

| Cash and bank balances |

|

|

3,782,123 |

|

|

|

582,439 |

|

|

|

2,509,034 |

|

| Trade and bills receivables |

|

|

7,178,530 |

|

|

|

1,105,478 |

|

|

|

8,113,095 |

|

| Inventories |

|

|

1,711,330 |

|

|

|

263,541 |

|

|

|

1,921,180 |

|

| Trade and bills payables |

|

|

3,860,723 |

|

|

|

594,543 |

|

|

|

4,214,289 |

|

| Short-term and long-term interest bearing loans and borrowings |

|

|

2,455,704 |

|

|

|

378,173 |

|

|

|

2,286,717 |

|

| Equity attributable to equity holders of the parent |

|

|

7,239,617 |

|

|

|

1,114,885 |

|

|

|

6,988,434 |

|

# # #

Page 3

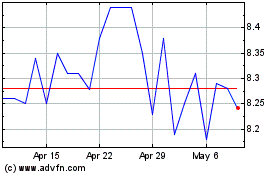

China Yuchai (NYSE:CYD)

Historical Stock Chart

From Mar 2024 to Apr 2024

China Yuchai (NYSE:CYD)

Historical Stock Chart

From Apr 2023 to Apr 2024