UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

UNDER THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO.8)

SCHEDULE 13D/A

CHINA YUCHAI INTERNATIONAL

(Name of Issuer)

Common Stock

(Title of Class of Securities)

G21082105

(CUSIP Number)

Shah Capital Management

8601 Six Forks Road, Suite 630

Raleigh, NC 27615

Tel. No.: (919) 719-6360

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

December 16, 2015

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of 240.13d 1(e), 240.13d 1(f)

or 240.13d 1(g), check the following box.

Note: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See Rule 13d 7

for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting

person's initial filing on this form with respect to the subject class

of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be

deemed to be filed for the purpose of section 18 of the Securities Exchange

Act of 1934 (Act) or otherwise subject to the liabilities of that section

of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

(1) Names of reporting persons:

Shah Capital Management

(2) Check the appropriate box if a member of a group:

(a)

(b)

(3) SEC use only

(4) Source of funds (see instructions)

OO

(5) Check if disclosure of legal proceedings is required pursuant

to Items 2(d) or 2(e) of Schedule 13D

N/A

(6) Citizenship or place of organization

NORTH CAROLINA

Number of shares beneficially owned by each reporting person with:

(7) Sole voting power

0

(8) Shared voting power

3,140,078 (including options to purchase 200,000 shares)

(9) Sole dispositive power

0

(10) Shared dispositive power

3,140,078 (including options to purchase 200,000 shares)

(11) Aggregate amount beneficially owned by each reporting person

3,140,078 (including options to purchase 200,000 shares)

(12) Check if the aggregate amount in Row (11) excludes certain shares

(see instructions)

N/A

(13) Percent of class represented by amount in Row (11)

8.05%

(14) Type of reporting person (see instructions)

IA

(1) Names of reporting persons:

Shah Capital Opportunity Fund LP

(2) Check the appropriate box if a member of a group:

(a)

(b)

(3) SEC use only

(4) Source of funds (see instructions)

OO

(5) Check if disclosure of legal proceedings is required pursuant

to Items 2(d) or 2(e) of Schedule 13D

N/A

(6) Citizenship or place of organization

DELAWARE

Number of shares beneficially owned by each reporting person with:

(7) Sole voting power

0

(8) Shared voting power

2,566,382 (including options to purchase 200,000 shares)

(9) Sole dispositive power

0

(10) Shared dispositive power

2,566,382 (including options to purchase 200,000 shares)

(11) Aggregate amount beneficially owned by each reporting person

2,566,382 (including options to purchase 200,000 shares)

(12) Check if the aggregate amount in Row (11) excludes certain shares

(see instructions)

N/A

(13) Percent of class represented by amount in Row (11)

6.58%

(14) Type of reporting person (see instructions)

PN

(1) Names of reporting persons:

Himanshu H. Shah

(2) Check the appropriate box if a member of a group:

(a)

(b)

(3) SEC use only

(4) Source of funds (see instructions)

PF

(5) Check if disclosure of legal proceedings is required pursuant

to Items 2(d) or 2(e) of Schedule 13D

N/A

(6) Citizenship or place of organization

UNITED STATES

Number of shares beneficially owned by each reporting person with:

(7) Sole voting power

101,421

(8) Shared voting power

3,241,499 (including options to purchase 200,000 shares)

(9) Sole dispositive power

101,421

(10) Shared dispositive power

3,241,499 (including options to purchase 200,000 shares)

(11) Aggregate amount beneficially owned by each reporting person

3,241,499 (including options to purchase 200,000 shares)

(12) Check if the aggregate amount in Row (11) excludes certain shares

(see instructions)

N/A

(13) Percent of class represented by amount in Row (11)

8.31%

(14) Type of reporting person (see instructions)

IN

SCHEDULE 13D

Item 1. Security and Issuer

Common Stock of CHINA YUCHAI INTERNATIONAL.

CHINA YUCHAI INTERNATIONAL

16 RAFFLES QUAY #26-00

HONG LEONG BLDG

SINGAPORE 048581

Item 2. Identity and Background

(a). Name: SHAH CAPITAL MANAGEMENT.

(b). Business Address: 8601 Six Forks Road, Suite 630, Raleigh, NC 27615

(c). Principal business: Asset management

(d). During the last five years, the reporting person has not been convicted

in a criminal proceeding.

(e). During the last five years, the reporting person has not been a party to

a civil proceeding of a judicial or administrative body of competent

jurisdiction.

(f). N/A

Item 3. Source and Amount of Funds or Other Consideration

In making the purchases of the shares of Common Stock, the

reporting person uses the assets under management.

The total purchase price for the Owned Shares was $30,500,000,

including brokerage commissions.

Item 4. Purpose of the Transaction

The Reporting Person acquired the Shares because it believes

the Shares are undervalued and represent an attractive

investment opportunity. The reporting person intends to

review its investment in the Issuer on a continuing basis

and in connection therewith, had engaged in discussions with

the Board of Directors, members of management, and/or other

shareholders which discussions included proposing or

considering one or more of the actions described in

subsections (a) through (j) of Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer

(a) Aggregate number of shares owned:

(b) Percentage of class of securities owned:

(c) Number of Shares to which reporting person has:

(i) Sole Voting Power

(ii) Shared Voting Power

(iii) Sole Dispositive Power

(iv) Shared Dispositive Power

SCM Shah Capital Opportunity Himanshu

Fund LP

(a) 3,140,078 2,566,382 101,421

(b) 8.05% 6.58% 8.31%

(i) N/A N/A 101,421

(ii) 3,140,078 2,566,382 3,241,499

(iii) N/A N/A 101,421

(iv) 3,140,078 2,566,382 3,241,499

|

(c) N/A

(d) to (e). Not Applicable

Item 6. Contracts, Arrangements, Understandings or Relationships with

Respect to Securities of the Issuer

The Reporting Person beneficially owns 3,041,499 and 2000 call options

with strike prices of $10.00 which expires on February 19, 2016,

for a total of 3,241,499 Shares.

Except as otherwise set forth herein, the Reporting Person does not

have any contract, arrangement, understanding or relationship with

any person with respect to the securities of the Issuer.

Item 7. Material to be Filed as Exhibits

Not applicable

Signature

After reasonable inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true,

complete and correct.

Date: December 17, 2015

Signature: Himanshu H. Shah/Sd.

Name/Title: Himanshu H. Shah, President and CIO

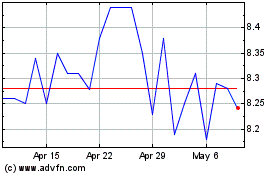

China Yuchai (NYSE:CYD)

Historical Stock Chart

From Mar 2024 to Apr 2024

China Yuchai (NYSE:CYD)

Historical Stock Chart

From Apr 2023 to Apr 2024