UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

China Yuchai

International Limited

(Exact name of the registrant as specified in its charter)

|

|

|

|

|

| Bermuda |

|

1-13522 |

|

Not Applicable |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

16 Raffles Quay

#39-01A Hong Leong Building

Singapore 048581

|

|

|

|

|

|

|

|

| (Address of principle executive offices) |

|

(Zip code) |

Leong Kok Ho

Chief Financial Officer

16 Raffles Quay

#39-01A

Hong Leong Building

Singapore 048581

Tel: +65 6220 8411

Fax:

+65 6221 1172

(Name and telephone number, including area code, of the person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed and provide the period to which the information in this form

applies:

| x |

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

Under the final rule, a company that uses any of the designated minerals is required to conduct a reasonable ‘country of origin’ inquiry that must

be performed in good faith and be reasonably designed to determine whether any of its minerals originated in the covered countries or are from scrap or recycled sources.

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report, Exhibit

A copy of China Yuchai International Limited’s Conflict Minerals Report is filed as Exhibit 1.01 hereto and is publicly available at www.cyilimited.com

under “Investor Relations”.

Item 1.02 Exhibits

Section 2 - Exhibits

Item 2.01 Exhibits

The following exhibit is filed as part of this report:

Exhibit 1.01 - Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly

authorized undersigned.

|

|

|

|

|

|

|

| CHINA YUCHAI INTERNATIONAL LIMITED |

|

|

|

|

| By: |

|

/s/Weng Ming Hoh |

|

|

|

Date: May 29, 2015 |

| Name: |

|

Weng Ming Hoh |

|

|

|

|

| Title: |

|

President/Director |

|

|

|

|

Exhibit 1.01

Conflict Minerals Report of China Yuchai International Limited

For the Year Ended December 31, 2014

This is the Conflict Minerals Report (“Report”) of China Yuchai International Limited (“CYI”) for the year ended December 31, 2014 in

accordance with Rule 13p-1 under the Securities Exchange Act of 1934 (“the Rule”). The Rule was adopted by the United States Securities and Exchange Commission (“SEC”) pursuant to Section 1502 of the Dodd-Frank Wall Street

Reform and Consumer Protection Act of 2010, to implement reporting and disclosure requirements on all SEC registrants (including foreign issuers) about the use of specified “conflict minerals” emanating from the Democratic Republic of

Congo and nine adjoining countries, in their products.

The terms used in this Report are as defined in Rule 13p-1, Form Statutory Declaration (“Form

SD”) and the 1934 Act Release No. 34-67716 unless otherwise defined herein.

This Report prepared by the management of CYI includes the

activities of all majority-owned subsidiaries and variable interest entities that are required to be consolidated. It does not include the activities of variable interest entities that are not required to be consolidated. CYI engaged the services of

an independent third party (“Advisor”) to advice on the implementation of the Rule across the CYI Group. This Report has not been subject to an independent private sector audit (“IPSA”).

A. Company and Product Overview

CYI, through its main operating subsidiary, is one of the largest engine manufacturers in China. It engages in the manufacture, assembly, and sale of a wide

variety of light-, medium- and heavy-duty engines for trucks, buses, passenger vehicles, construction equipment, marine and agriculture applications in China. It also produces diesel power generators. The engines produced range from diesel to

natural gas and hybrid engines over 14 engine platforms. A listing of the engine models produced in financial year 2014 is set out in Table 1 of this Report.

CYI manufactures the engine blocks, cylinder heads, crankshaft, camshaft and certain other key parts of the engines with the remaining engine parts supplied

by third party suppliers. It purchases raw materials, principally scrap steel and cast iron, from domestic suppliers and certain engine components such as the electronic combustion system and its software, and the exhaust after-treatment system are

imported from foreign suppliers. In addition, different alloys and additives such as tin, zinc, magnesium, and manganese are utilized during the manufacturing process. Further to the conduct of an analysis of our engine products produced in

financial year 2014, we concluded in good faith that certain minerals such as tantalum, tin, tungsten and gold (“3TGs”) which are necessary to the functionality or production of our engines, are used in the manufacturing process.

B. Reasonable Country of Origin Inquiry (“RCOI”)

We conducted an RCOI on our suppliers using the latest version of the Electronic Industry Citizenship Coalition and the Global e-Sustainability Initiative

Conflict Mineral Reporting Template (“CMRT”), to determine whether any of the 3TGs that are not from recycled or scrap sources, originated in the Covered Countries. The inquiry requested our suppliers to transfer information through their

supply chain regarding country of origin of 3TGs used and smelters and refiners being utilized. In order to make this inquiry as complete as possible, our suppliers were requested to send the same CMRT to their suppliers (direct and indirect) and

based on the responses received, complete their CMRT.

1

We sent the CMRT to a total of 174 suppliers and as of May 8, 2015, we have received 160 responses to the CMRT or provided on company letterhead. There were 148 suppliers who have confirmed

that the products they supply to us are DRC Conflict-Free. Twelve (12) suppliers failed to provide complete responses and 14 suppliers did not provide any response to the CMRT.

Although we have received responses from approximately 92% of our suppliers, it will take time for our suppliers to verify the origin of the 3TGs supplied to

us including sources of 3TGs that are supplied to them from sub-tier suppliers. We rely, to a large extent, on our suppliers in the RCOI who are similarly reliant upon information provided by their own suppliers. As a result, certain information

provided may be inaccurate or incomplete and hence subject to further verification.

C. Due Diligence Program

CYI designed its due diligence measures to conform to the Second Edition of the Organization of Economic Co-operation and Development Due Diligence Guidance

for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (“OECD Guidance”).

A summary of the due diligence measures

that we undertook in order to comply with the Rule were:

| |

1. |

Establish strong company management systems |

| |

(a) |

Established an internal interdisciplinary team of personnel from various departments, namely, purchasing, procurement, research & development, technical, operations and legal and providing regular updates to

our management and Board of Directors; |

| |

(b) |

Instituted regular meetings commencing in October 2014 with our Advisor in relation to the continued implementation of the Rule including advising on a system for the conduct of the RCOI, the requisite elements of a

risk management framework and processes to be instituted and disclosure requirements of the Conflict Minerals Report covering financial year 2014; |

| |

(c) |

Documented and maintained records of our due diligence measures undertaken and minutes of all monthly meetings with our Advisor; |

| |

(d) |

Together with our Advisor, conducted a Conflict Minerals training session at our main operating subsidiary to enhance familiarity with the Rule and the RCOI. The training materials were also translated into Chinese, the

local language for ease of understanding. A summary of the training materials were also made available to our suppliers during the annual suppliers’ conference which was convened in December 2014; |

| |

(e) |

A Conflict Minerals Policy Statement setting out our position on the Rule, was approved by our Board of Directors on November 10, 2014 and is made available publicly at the below link on our website

http://investor.cyilimited.com/phoenix.zhtml?c=87828&p=irol-govhighlights in both English and Chinese as well as on the website of our main operating subsidiary in Chinese which can be located at

http://www.yuchaidiesel.com/news/2302.htm; and |

| |

(f) |

The inclusion of a Conflict Minerals clause in the standard procurement contracts to be entered into with suppliers. |

2

| |

2. |

Identify and assess risks in the supply chain |

| |

(a) |

Identified direct suppliers that supply 3TGs or products that may contain 3TGs; |

| |

(b) |

Conducted a supply chain inquiry using the latest version of the CMRT requesting our suppliers to identify their sub-suppliers, smelters and the country of origin of the 3TGs that are used in the engine products and

complete the CMRT within a specified timeline; |

| |

(c) |

A cover letter accompanying the CMRT explaining the Rule, how to complete the CMRT together with an example of how the CMRT should be completed and a number to call in the event of any inquiries, were sent to our

suppliers; |

| |

(d) |

Followed up on a regular basis with suppliers who provided inconsistent, incomplete and inaccurate responses and sent a number of reminders to suppliers who failed to respond to our CMRT request within the given

timeline; and |

| |

(e) |

Communicated with our suppliers at the annual supplier’s conference held in December 2014 on the requirements of the Rule. |

| |

3. |

Design and implement a strategy to respond to identified risks |

We identified and

considered the risks arising from our due diligence measures and communicated our findings to our management and Board of Directors.

| |

4. |

Carry out independent third-party audit of smelter/ refiner’s due diligence practices |

We do not have direct relationships with any mines, smelters or refiners of 3TGs who may be present in our supply chain and do not perform or

direct audits of these identified entities.

| |

5. |

Report on supply chain due diligence |

In preparation for the IPSA to be conducted

covering financial year 2015 and in our efforts to follow the OECD Framework, we determined that requesting information from our suppliers using the CMRT represents the most reasonable effort in the due diligence process on the source and chain of

custody of any 3TGs. This specialized disclosure report will be posted as part of our SEC filings and on our website.

D. Future

steps towards Conflict Minerals compliance

In the next compliance period covering the year 2015, we intend to further improve our due

diligence efforts in accordance with the criteria set forth in the OECD Guidance, such as:

| |

• |

|

Continuing to engage our suppliers to obtain current, accurate, and complete information about their smelters and refiners through their supply chain; and |

| |

• |

|

Advancing collaboration through Conflict Minerals awareness building among our suppliers to help them better understand and satisfy the requirements of the Rule. |

3

Table 1

The

table below lists the engine models produced by us in financial year 2014.

Trucks

YC4D, YC4E, YC4F, YC4FA, YC4DN, YC4S, YC6A, YC6B, YC6J, YC6JN, YC6K, YC6KN, YC6L, YC6MK, YC6MKN, YC6G, YC6GN, YC6LN

Bus

YC6MK, YC6MKN, YC6L, YC6J, YC6JN, YC6G, YC6GN,

YC6LN, YC6K, YC6KN, YG6A, YC4G, YC4GN, YC4E, YC4D, YC4DN, YC4FA, YC4F, YC4S

Construction

YC4A, YC4B, YC4D, YC4DN, YC4F, YC4G, YC4GN, YC6B, YC6J, YC6JN, YC6G, YC6L, YC6LN, YC6MK, YC6M, YC6A

Agriculture

YC4A, YC4B, YC4F, YC6A, YC6B, YC4D, YC6J,

YC6L

Marine

YC4D, YC4G, YC6A/6B, YC6T, YC6TD, YC6C,

YC6CL, YC6J, YC6L, YC6MK, YC6M

Power Generator

YC4FA, YC4F, YC4D, YC4G, YC6A, YC6G, YC6L, YC6LN, YC6MK, YC6MJ, YC6T, YC6C, YC6CL, YC6MKN, YC6K, YC6KN, YC6M

Passenger Vehicle

YC4W, YC4Y

4

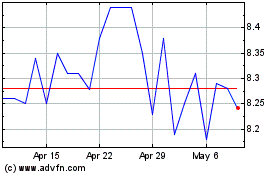

China Yuchai (NYSE:CYD)

Historical Stock Chart

From Mar 2024 to Apr 2024

China Yuchai (NYSE:CYD)

Historical Stock Chart

From Apr 2023 to Apr 2024