UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 20-F

| ¨ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 1-13522

China Yuchai

International Limited

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

| Not Applicable |

|

Bermuda |

| (Translation of Registrant’s Name

Into English) |

|

(Jurisdiction of Incorporation or

Organization) |

16 Raffles Quay #39-01A

Hong Leong Building

Singapore 048581

+65-6220-8411

(Address and Telephone Number of Principal Executive Offices)

Leong Kok

Ho

Chief Financial Officer

16 Raffles Quay

#39-01A Hong Leong Building

Singapore 048581

Tel: +65 6220 8411

Fax: +65 6221 1172

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of Each Class |

|

Name of Each Exchange on Which

Registered |

| Common Stock, par value US$0.10 per Share |

|

The New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

None

(Title of Class)

Indicate the

number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2014, 38,195,706 shares of common stock, par value US$0.10 per share, and one special share, par value US$0.10, were issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934. Yes ¨ No x

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those

Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in

Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨

Accelerated filer x Non-accelerated

filer ¨

Indicate by check mark which basis of accounting the

registrant has used to prepare the financial statements included in this filing:

|

|

|

|

|

| U.S. GAAP ¨ |

|

International Financial Reporting Standards as issued

by the International Accounting Standards Board x |

|

Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which

financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this report is an annual report, indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ¨ No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of

securities under a plan confirmed by a court. Yes ¨ No ¨

TABLE OF CONTENTS

CHINA YUCHAI INTERNATIONAL LIMITED

1

Certain Definitions and Supplemental Information

All references to “China,” “PRC” and the “State” in this Annual Report are references to

the People’s Republic of China. Unless otherwise specified, all references in this Annual Report to “US dollars,” “dollars,” “US$” or “$” are to United States dollars; all references to

“Renminbi,” “RMB” or “Rmb” are to Renminbi, the legal tender currency of China; all references to “S$” are to Singapore dollars, the legal tender currency of Singapore; all references to “RM” are to

Ringgit, the legal tender currency of Malaysia. Unless otherwise specified, translation of amounts for the convenience of the reader has been made in this Annual Report (i) from Renminbi to US dollars at the rate of Rmb 6.1563 = US$1.00, the

rate quoted by the People’s Bank of China, or PBOC, on March 9, 2015, (ii) from Singapore dollar to US dollars at the rate of S$1.3792 = US$1.00, the noon buying rate in New York for cable transfers payable in foreign currencies as

certified for customs purposes by the Federal Reserve Bank of New York on March 9, 2015, and (iii) from Ringgit to US dollars at the rate of RM 3.6770 = US$1.00, the noon buying rate in New York for cable transfers payable in foreign

currencies as certified for customs purposes by the Federal Reserve Bank of New York on March 9, 2015. No representation is made that the Renminbi amounts, Singapore dollar amounts or Ringgit amounts could have been, or could be, converted into

US dollars at rates specified herein or any other rate.

Our consolidated financial statements are reported in

Renminbi and prepared in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). We adopted IFRS effective as of and for the fiscal year ended December 31, 2009

by applying IFRS 1: First Time Adoption of International Reporting Standards. For the years prior to 2009, we prepared our financial statements, in accordance with accounting principles generally accepted in the United States (“US GAAP”),

which differs in certain significant respects from and is not comparable with IFRS. Totals presented in this Annual Report may not correctly total due to rounding of numbers. References to a particular fiscal year are to the period ended

December 31 of such year.

As used in this Annual Report, unless the context otherwise requires, the

terms “the Company”, “the Group”, “CYI”, “we”, “us”, “our” and “our company” refer to China Yuchai International Limited and its subsidiaries. All references herein to

“Yuchai” are to Guangxi Yuchai Machinery Company Limited and its subsidiaries and, prior to its incorporation in July 1992, to the machinery business of its predecessor, Guangxi Yulin Diesel Engine Factory, or Yulin Diesel, which was

founded in 1951 and became a state-owned enterprise in 1959. In the restructuring of Yulin Diesel in July 1992, its other businesses were transferred to Guangxi Yuchai Machinery Holdings Company, also sometimes referred to as Guangxi Yuchai

Machinery Group Company Limited, or the State Holding Company, which became a shareholder of Yuchai. All references to “HLGE” are to HL Global Enterprises Limited (formerly known as HLG Enterprise Limited); and all references to the

“HLGE group” are to HLGE and its subsidiaries. All references to “TCL” are to Thakral Corporation Ltd; and all references to the “TCL group” are to TCL and its subsidiaries.

As of December 31, 2014, 38,195,706 shares of our common stock, par value US$0.10 per share, or Common Stock, and

one special share, par value US$0.10, of our Common Stock were issued and outstanding. The weighted average shares of common stock outstanding during the year were 37,720,248. Unless otherwise indicated herein, all percentage share amounts with

respect to the Company are based on the weighted average number of shares of 37,720,248 for 2014. As of March 9, 2015, 38,195,706 shares of our Common Stock, and one special share, par value US$0.10 were issued and outstanding.

In China, Euro emission standards are equivalent to National emission standards and references to National emission

standards are equivalent to references to Euro emission standards. All references to Tier 2, 3 and 4 emission standards are to emission standards adopted by the Ministry of Environmental Protection of the People’s Republic of China applicable

to diesel engines used in non-road machinery.

Cautionary Statements with Respect to

Forward-Looking Statements

We wish to caution readers that the forward-looking statements contained in

this Annual Report, which include all statements which, at the time made, address future results of operations, are based upon our interpretation of factors affecting our business and operations. We believe that the following important factors,

among others, in some cases have affected, and in the future could affect our consolidated results and could cause our consolidated results for 2015 and beyond to differ materially from those described in any forward-looking statements made by us or

on our behalf:

| • |

|

political, economic and social conditions in China, including the Chinese government’s specific policies with respect to foreign investment,

economic growth and the availability of credit, particularly to the extent such current or future conditions and policies affect the diesel and natural gas engine industries and markets in China, our diesel and natural gas engine customers, the

demand, sales volume and sales prices for our diesel and natural gas engines and our levels of accounts receivable; |

2

| • |

|

the effects of a weaker than expected recovery in the global economy subject to continued fragilities and certain downside risks such as

persistently weak global trade, possible financial market volatility as interest rates in major economies rise on varying timelines, protracted recovery in the Euro Area, weaker than expected growth in China, possible set-backs in the restructuring

of China’s economy, the escalating geo-political crisis in Eastern Europe, Middle East and South East Asia, on the overall global economy and our business, operating results and growth rates; |

| • |

|

the effects of competition and excess capacity in the diesel engine market on the demand, sales volume and sales prices for our diesel engines;

|

| • |

|

the effects of previously reported material weaknesses in our internal control over financial reporting and our ability to implement and maintain

effective internal control over financial reporting; |

| • |

|

our ability to collect and control our levels of accounts receivable; |

| • |

|

our dependence on Dongfeng Automobile Co., Ltd. and other major diesel truck manufacturers controlled by or affiliated with Dongfeng Automobile Co.,

Ltd.; |

| • |

|

our ability to successfully manage and implement our joint ventures and manufacture and sell our diesel and natural gas engines and any new

products; |

| • |

|

our ability to finance our working capital and capital expenditure requirements, including obtaining any required external debt or other financing;

|

| • |

|

the effects of fluctuating interest rates in China on our borrowing costs or the availability of funding; |

| • |

|

the effects of inflation and deflation on our financial condition and results of operations; |

| • |

|

our ability to successfully implement the Reorganization Agreement, as amended by the Cooperation Agreement (both as defined in “Item 4.

Information on the Company — History and Development); |

| • |

|

our ability to control Yuchai and consolidate Yuchai’s financial results; |

| • |

|

the effects of uncertainties in the Chinese legal system, which could limit the legal protection available to foreign investors, including with

respect to the enforcement of foreign judgments in China; |

| • |

|

the ability of HLGE to continue as a going concern or raise sufficient funds to repay its debt obligations to us; |

| • |

|

the ability of HLGE to remain listed; |

| • |

|

the effects of changes to the international, regional and economic climate and market conditions in countries where the HLGE group’s

hospitality operations are located, as well as related global economic trends that adversely impact the travel and tourism industries; |

| • |

|

the outbreak of communicable diseases, if not contained, and its potential effects on the operations of the HLGE group and its business in the

hospitality industry; and |

| • |

|

the impact of terrorism, terrorist events, airline strikes, hostilities between countries or increased risk of natural disasters or viral epidemics

that may affect travel patterns and reduce the number of travelers and tourists to the HLGE group’s hospitality operations. |

Our actual results, performance, or achievement may differ from those expressed in, or implied by, the forward-looking statements contained in this Annual Report. Accordingly, we can give no assurances

that any of the events anticipated by these forward-looking statements will transpire or occur or, if any of the foregoing factors or other risks and uncertainties described elsewhere in this Annual Report were to occur, what impact they will have

on these forward-looking statements, including our results of operations or financial condition. In view of these uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. We expressly disclaim any obligation

to publicly revise any forward-looking statements contained in this Annual Report to reflect the occurrence of events after the date of this Annual Report.

3

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

Selected Financial Data

The selected consolidated statement of financial position data as of December 31, 2013 and 2014, and the selected consolidated statement of profit or loss data and the selected consolidated statement

of cash flows data set forth below for the years ended December 31, 2012, 2013 and 2014 are derived from our audited consolidated financial statements included in this Annual Report. The selected consolidated statement of financial position

data as of December 31, 2010, 2011 and 2012, and the selected consolidated statement of profit or loss data and the selected consolidated statement of cash flows data set forth below for the years ended December 31, 2010 and 2011 are

derived from our audited consolidated financial statements not included in this Annual Report. Our consolidated financial statements as of and for the years ended December 31, 2010, 2011, 2012, 2013 and 2014 have been prepared in conformity

with IFRS. We adopted IFRS effective as of and for the fiscal year ended December 31, 2009 by applying IFRS 1: First Time Adoption of International Reporting Standards.

In accordance with rule amendments adopted by the U.S. Securities Exchange Commission, or SEC, which became effective on

March 4, 2008, we do not provide a reconciliation to US GAAP for financial information prepared in accordance with IFRS. The selected financial information as of and for the years ended December 31, 2012, 2013 and 2014 set forth below

should be read in conjunction with, and is qualified in its entirety by reference to “Item 5. Operating and Financial Review and Prospects” and our audited consolidated financial statements and the notes thereto.

We currently own, through six of our wholly-owned subsidiaries, 76.4% of the outstanding shares of Yuchai. Our ownership

interest in Yuchai is our main business asset. As a result, our financial condition and results of operations depend primarily upon Yuchai’s financial condition and results of operations, and the implementation of the Reorganization Agreement,

as amended by the Cooperation Agreement.

Following an announcement in February 2005 by the Board of Directors

of the Company of its approval of the implementation of our business expansion and diversification plan, we looked for new business opportunities to seek to reduce our financial dependence on Yuchai. As of December 31, 2014, we had a 48.9%

interest in the outstanding ordinary shares of HLGE and a 7.7% interest in the outstanding ordinary shares of TCL. As of March 9, 2015, our interest in the outstanding ordinary shares of HLGE and TCL remain unchanged.

Relating to our interest in HLGE:

On January 13, 2012, our wholly-owned subsidiary, Grace Star Services Limited (“Grace Star”) transferred

24,189,170 Series B redeemable convertible preference shares in the capital of HLGE (the “Trust Preference Shares”) to Amicorp Trustees (Singapore) Limited ( the “Trustee”) pursuant to a trust deed entered into between HLGE and

the Trustee (the “Trust”). On January 16, 2012, the Trust Preference Shares were mandatorily converted into 24,189,170 new ordinary shares in the capital of HLGE (the “Trust Shares”) resulting in our shareholding interest in

HLGE decreasing from 49.4% to 48.1%. On April 4, 2012, as a result of the conversion of all the outstanding Series A redeemable convertible preference shares held by our wholly-owned subsidiaries, Venture Delta Limited (“Venture

Delta”) and Grace Star, into new ordinary shares in the capital of HLGE, our shareholding interest in HLGE increased from 48.1% to 48.9%.

The Trust Shares are accounted for as treasury shares by HLGE as they are issued by HLGE and held by the Trust, which is considered as part of HLGE. As a result, based on the total outstanding ordinary

shares of HLGE net of the Trust Shares, our shareholding interest in HLGE is stated as 50.2% for accounting purposes in the Company’s consolidated financial statements for the year ended December 31, 2014. However, these Trust Shares are

not regarded as treasury shares under the Singapore Companies Act, Chapter 50, and the Trustee has the power, inter alia, to vote or abstain from voting in respect of the Trust Shares at any general meeting of HLGE in its absolute discretion and to

waive its right to receive dividends in respect of the Trust Shares as it deems fit. Accordingly, based on the total outstanding ordinary shares of HLGE including the Trust Shares, our shareholding interest in HLGE is 48.9% as of December 31,

2014 and March 9, 2015. We consolidate the results of HLGE as a subsidiary. See Note 1.4 to the accompanying consolidated financial statements in Item 18.

Relating to our interest in TCL:

In July 2010, we reduced our total shareholding in TCL from 34.4% to 13.9%. As a result of the subsequent sales of TCL

shares in the open market, our shareholding interest in TCL decreased to 12.2% as of December 31, 2012, to 7.7% as of December 31, 2013 and remained unchanged as of December 31, 2014 and March 9, 2015. We classify our

shareholding in TCL as held for trading investment.

4

For further information on the Company’s investments in HLGE and TCL,

see “Item 5. Operating and Financial Review and Prospects — Business Expansion and Diversification Plan.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year ended December 31, |

|

| |

|

2010 |

|

|

2011 |

|

|

2012 |

|

|

2013 |

|

|

2014 |

|

|

2014 |

|

| |

|

Rmb |

|

|

Rmb |

|

|

Rmb |

|

|

Rmb |

|

|

Rmb |

|

|

US$(1) |

|

| |

|

(in thousands) |

|

| Selected Consolidated Statement of Profit or Loss Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

16,208,184 |

|

|

|

15,444,428 |

|

|

|

13,449,489 |

|

|

|

15,902,355 |

|

|

|

16,436,142 |

|

|

|

2,669,809 |

|

| Gross profit |

|

|

4,008,931 |

|

|

|

3,442,279 |

|

|

|

2,879,884 |

|

|

|

3,264,904 |

|

|

|

3,290,990 |

|

|

|

534,573 |

|

| Research and development costs |

|

|

(324,123 |

) |

|

|

(328,140 |

) |

|

|

(373,732 |

) |

|

|

(468,612 |

) |

|

|

(494,594 |

) |

|

|

(80,339 |

) |

| Other operating income, net |

|

|

87,628 |

|

|

|

73,078 |

|

|

|

132,350 |

|

|

|

156,352 |

|

|

|

94,892 |

|

|

|

15,414 |

|

| Operating profit |

|

|

1,949,672 |

|

|

|

1,535,088 |

|

|

|

1,163,464 |

|

|

|

1,402,416 |

|

|

|

1,292,618 |

|

|

|

209,968 |

|

| Share of results of associates and joint ventures |

|

|

(54,023 |

) |

|

|

(79,632 |

) |

|

|

(36,869 |

) |

|

|

(79,086 |

) |

|

|

(29,755 |

) |

|

|

(4,834 |

) |

| Profit before tax from continuing operations |

|

|

1,765,203 |

|

|

|

1,299,282 |

|

|

|

913,576 |

|

|

|

1,162,119 |

|

|

|

1,201,385 |

|

|

|

195,148 |

|

| Income tax expense |

|

|

(327,946 |

) |

|

|

(226,780 |

) |

|

|

(142,238 |

) |

|

|

(222,147 |

) |

|

|

(179,639 |

) |

|

|

(29,180 |

) |

| Profit for the year from continuing operations |

|

|

1,437,257 |

|

|

|

1,072,502 |

|

|

|

771,338 |

|

|

|

939,972 |

|

|

|

1,021,746 |

|

|

|

165,968 |

|

| Profit after tax for the year from discontinued operations |

|

|

12,655 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

| Profit for the year |

|

|

1,449,912 |

|

|

|

1,072,502 |

|

|

|

771,338 |

|

|

|

939,972 |

|

|

|

1,021,746 |

|

|

|

165,968 |

|

| Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity holders of the parent |

|

|

1,117,297 |

|

|

|

818,532 |

|

|

|

567,333 |

|

|

|

700,423 |

|

|

|

730,280 |

|

|

|

118,624 |

|

| Non-controlling interests |

|

|

332,615 |

|

|

|

253,970 |

|

|

|

204,005 |

|

|

|

239,549 |

|

|

|

291,466 |

|

|

|

47,344 |

|

| Basic and diluted earnings per common share attributable to ordinary equity holders of the parent |

|

|

29.98 |

|

|

|

21.96 |

|

|

|

15.22 |

|

|

|

18.79 |

|

|

|

19.36 |

|

|

|

3.14 |

|

| Profit from continuing operations per share |

|

|

38.57 |

|

|

|

28.78 |

|

|

|

20.70 |

|

|

|

25.22 |

|

|

|

27.09 |

|

|

|

4.40 |

|

| Profit for the year per share |

|

|

38.91 |

|

|

|

28.78 |

|

|

|

20.70 |

|

|

|

25.22 |

|

|

|

27.09 |

|

|

|

4.40 |

|

| Weighted average number of shares |

|

|

37,268 |

|

|

|

37,268 |

|

|

|

37,268 |

|

|

|

37,268 |

|

|

|

37,720 |

|

|

|

37,720 |

|

5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, |

|

| |

|

2010 |

|

|

2011 |

|

|

2012 |

|

|

2013 |

|

|

2014 |

|

|

2014 |

|

| |

|

Rmb |

|

|

Rmb |

|

|

Rmb |

|

|

Rmb |

|

|

Rmb |

|

|

US$(1) |

|

| |

|

(in thousands) |

|

| Selected Consolidated Statement of Financial Position Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Working capital (2) |

|

|

2,553,495 |

|

|

|

2,754,111 |

|

|

|

2,906,300 |

|

|

|

4,333,904 |

|

|

|

4,925,945 |

|

|

|

800,147 |

|

| Property, plant and equipment |

|

|

3,276,302 |

|

|

|

3,748,233 |

|

|

|

4,016,593 |

|

|

|

4,036,163 |

|

|

|

4,460,842 |

|

|

|

724,598 |

|

| Trade and bills receivables |

|

|

4,234,475 |

|

|

|

6,690,917 |

|

|

|

6,591,736 |

|

|

|

7,437,948 |

|

|

|

8,113,094 |

|

|

|

1,317,852 |

|

| Total assets |

|

|

16,246,263 |

|

|

|

19,151,019 |

|

|

|

17,923,673 |

|

|

|

19,293,168 |

|

|

|

18,773,336 |

|

|

|

3,049,451 |

|

| Trade and other payables |

|

|

7,902,317 |

|

|

|

7,234,151 |

|

|

|

6,921,197 |

|

|

|

7,718,488 |

|

|

|

6,547,296 |

|

|

|

1,063,512 |

|

| Short-term interest-bearing loans and borrowings |

|

|

423,543 |

|

|

|

3,551,848 |

|

|

|

2,339,273 |

|

|

|

1,230,981 |

|

|

|

1,209,001 |

|

|

|

196,384 |

|

| Long-term interest-bearing loans and borrowings |

|

|

201,850 |

|

|

|

144,883 |

|

|

|

111,422 |

|

|

|

1,028,396 |

|

|

|

1,077,716 |

|

|

|

175,059 |

|

| Non-controlling interests |

|

|

1,687,980 |

|

|

|

1,807,958 |

|

|

|

1,869,954 |

|

|

|

2,042,592 |

|

|

|

2,163,382 |

|

|

|

351,409 |

|

| Issued capital |

|

|

1,724,196 |

|

|

|

1,724,196 |

|

|

|

1,724,196 |

|

|

|

1,724,196 |

|

|

|

1,840,227 |

|

|

|

298,918 |

|

| Equity attributable to equity holders of the parent |

|

|

5,097,947 |

|

|

|

5,542,203 |

|

|

|

5,901,913 |

|

|

|

6,391,573 |

|

|

|

6,988,432 |

|

|

|

1,135,167 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year ended December 31, |

|

| |

|

2010 |

|

|

2011 |

|

|

2012 |

|

|

2013 |

|

|

2014 |

|

|

2014 |

|

| |

|

Rmb |

|

|

Rmb |

|

|

Rmb |

|

|

Rmb |

|

|

Rmb |

|

|

US$(1) |

|

| |

|

(in thousands) |

|

| Selected Consolidated Statement of Cash Flows Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

1,464,964 |

|

|

|

(1,762,386 |

) |

|

|

1,512,192 |

|

|

|

589,642 |

|

|

|

535,686 |

|

|

|

87,015 |

|

| Capital expenditures(3) |

|

|

644,305 |

|

|

|

931,764 |

|

|

|

736,727 |

|

|

|

429,631 |

|

|

|

683,929 |

|

|

|

111,094 |

|

|

(1) |

The Company’s functional currency is US dollar and its reporting currency is Renminbi. The functional currency of Yuchai is Renminbi.

Translation of amounts from Renminbi to US dollars is solely for the convenience of the reader. Translation of amounts from Renminbi to US dollars has been made at the rate of Rmb 6.1563 = US$1.00, the rate quoted by the People’s Bank of China

at the close of business on March 9, 2015. No representation is made that the Renminbi amounts could have been, or could be, converted into US dollars at that rate or at any other rate prevailing on March 9, 2015 or any other date. The

rate quoted by the People’s Bank of China (the “PBOC”) at the close of business on December 31, 2014 was Rmb 6.1190 = US$1.00. |

|

(2) |

Current assets less current liabilities. |

|

(3) |

Purchase of property, plant and equipment and payment for construction in progress. |

6

Dividends

Our principal source of cash flow has historically been our share of the dividends, if any, paid to us by Yuchai, as

described under “Item 5. Operating and Financial Review and Prospects — Liquidity and Capital Resources.”

In May 1993, in order to finance further expansion, Yuchai sold shares to the Company, or Foreign Shares, and became a Sino-foreign joint stock company.

Chinese laws and regulations applicable to a Sino-foreign joint stock company require that before Yuchai distributes

profits, it must (i) recover losses in previous years; (ii) satisfy all tax liabilities; and (iii) make contributions to the statutory reserve fund in an amount equal to 10% of net income for the year determined in accordance with

generally accepted accounting principles in the PRC, or PRC GAAP. However, the allocation of statutory reserve fund will not be further required once the accumulated amount of such fund reaches 50% of the registered capital of Yuchai.

Any determination by Yuchai to declare a dividend will be at the discretion of Yuchai’s shareholders and will be

dependent upon Yuchai’s financial condition, results of operations and other relevant factors. Yuchai’s Articles of Association provide that dividends shall be paid at least once a year out of after-tax profits (if any). To the extent

Yuchai has foreign currency available, dividends declared by shareholders at a shareholders’ meeting to be paid to holders of Foreign Shares (currently only us) will be payable in foreign currency, and such shareholders will have priority

thereto. If the foreign currency available is insufficient to pay such dividends, such dividends may be payable partly in Renminbi and partly in foreign currency. Dividends allocated to holders of Foreign Shares may be remitted in accordance with

the relevant Chinese laws and regulations. In the event that the dividends are distributed in Renminbi, such dividends may be converted into foreign currency and remitted in accordance with the relevant Chinese laws, regulations and policies.

The following table sets forth a five-year summary of dividends we have paid to our shareholders as well as

dividends paid to us by Yuchai:

|

|

|

|

|

| Fiscal Year |

|

Dividend paid by

the

Company

to its shareholders for the

fiscal year/ in the

fiscal year

(per share) |

|

Dividend paid by Yuchai

to the Company (1)

for the fiscal year /in the fiscal

year

(in thousands) |

| 2010 |

|

US$0.25 (2) |

|

Rmb 451,775 (US$69,213) (3) |

| 2011 |

|

US$1.50 (4) |

|

Rmb 234,917 (US$36,829)

(5) |

| 2012 |

|

US$0.90 (6) |

|

Rmb 234,923

(7) |

| 2013 |

|

US$0.90 (8) (9) |

|

Rmb 343,349 (US$54,999) (10) |

| 2014 |

|

US$1.20 (11) |

|

Rmb 325,278 (12) |

|

(1) |

Dividends paid by Yuchai to us, as well as to other shareholders of Yuchai, were declared in Renminbi and paid in US dollars (as shown in

parentheses) based on the exchange rates at local designated foreign exchange banks on the respective payment dates. For dividends paid for fiscal years 2010 and 2011, the exchange rates used were Rmb 6.5273 = US$1.00 and Rmb 6.3786 = US$1.00

respectively. |

|

(2) |

On March 5, 2010, we declared a dividend of US$0.25 per ordinary share amounting to US$9.3 million for fiscal year 2009. This dividend was paid

to our shareholders on March 30, 2010. |

|

(3) |

The dividend declared by Yuchai for fiscal year 2010 was paid to us on May 5, 2011. |

|

(4) |

On May 11, 2011, we declared a dividend of US$0.50 per ordinary share and a special dividend of US$1.00 per ordinary share amounting to a total

of US$55.9 million for fiscal year 2010. This dividend was paid to our shareholders on May 31, 2011. |

|

(5) |

The dividend declared by Yuchai for fiscal year 2011 was paid to us on June 12, 2012. |

|

(6) |

On June 15, 2012, we declared a dividend of US$0.50 per ordinary share and a special dividend of US$0.40 per ordinary share amounting to a

total of US$33.5 million for fiscal year 2011. This dividend was paid to our shareholders on July 9, 2012. |

|

(7) |

The dividend declared by Yuchai for fiscal year 2012 was paid to us on June 7, 2013. For dividends paid for fiscal year 2012, Rmb

68.4 million was paid in Renminbi and the remaining Rmb 166.5 million was paid in US dollars at an exchange rate of Rmb 6.1474 = US$1.00. |

|

(8) |

On June 17, 2013, we declared a dividend of US$0.40 per ordinary share and a special dividend of US$0.40 per ordinary share amounting to a

total of US$29.8 million for fiscal year 2012. This dividend was paid to our shareholders on July 10, 2013. |

|

(9) |

On August 5, 2013, we declared an interim dividend of US$0.10 per ordinary share for fiscal year 2013 amounting to a total of US$3.7 million.

This dividend was paid to our shareholders on August 26, 2013. |

|

(10) |

The dividend declared by Yuchai for fiscal year 2013 was paid to us on May 16, 2014. For dividends paid for fiscal year 2013, Rmb

343.3 million was paid in US dollars at an exchange rate of Rmb 6.2428 = US$1.00. |

7

|

(11) |

On May 12, 2014, we declared a dividend of US$1.20 per ordinary share amounting to a total of US$44.7 million for fiscal year 2013 payable

either wholly in cash or new shares at the election of shareholders. Based on the elections by shareholders, the aggregate dividend was paid in the form of approximately US$26 million in cash and 928,033 ordinary shares.

|

|

(12) |

The dividend declared by Yuchai for fiscal year 2014 has been approved for payment by Yuchai’s Board of Directors. It will be paid to us upon

the issuance of Yuchai’s audited financial statements for fiscal year 2014 and upon the receipt of approval by Yuchai’s shareholders. |

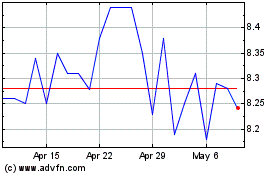

Historical Exchange Rate Information

On December 31,

2014, the PBOC rate was Rmb 6.1190 = US$1.00. On March 9, 2015, the PBOC rate was Rmb 6.1563 = US$1.00.

On December 31, 2014, the noon buying rate was Rmb 6.2046 = US$1.00. On March 9, 2015, the noon buying rate was

Rmb 6.2635 = US$1.00.

The following tables set forth certain information concerning exchange rates between

Renminbi and US dollars based on the noon buying rate in New York for cable transfers payable in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York for the periods indicated:

|

|

|

|

|

|

|

|

|

| |

|

Noon Buying

Rate (1) (Rmb per US$1.00) |

|

| Period |

|

High |

|

|

Low |

|

| October 2014 |

|

|

6.1385 |

|

|

|

6.1107 |

|

| November 2014 |

|

|

6.1429 |

|

|

|

6.1117 |

|

| December 2014 |

|

|

6.2256 |

|

|

|

6.1490 |

|

| January 2015 |

|

|

6.2535 |

|

|

|

6.1870 |

|

| February 2015 |

|

|

6.2695 |

|

|

|

6.2399 |

|

| March 2015 |

|

|

6.2741 |

|

|

|

6.1955 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Noon Buying Rate (1) (Rmb per US$1.00) |

|

| Period |

|

Period

End |

|

|

Average (2) |

|

|

High |

|

|

Low |

|

| 2010 |

|

|

6.6000 |

|

|

|

6.7696 |

|

|

|

6.8330 |

|

|

|

6.6000 |

|

| 2011 |

|

|

6.2939 |

|

|

|

6.4630 |

|

|

|

6.6364 |

|

|

|

6.2939 |

|

| 2012 |

|

|

6.2301 |

|

|

|

6.3088 |

|

|

|

6.3879 |

|

|

|

6.2221 |

|

| 2013 |

|

|

6.0537 |

|

|

|

6.1478 |

|

|

|

6.2438 |

|

|

|

6.0537 |

|

| 2014 |

|

|

6.2046 |

|

|

|

6.1620 |

|

|

|

6.2591 |

|

|

|

6.0402 |

|

| 2015 (through March 9, 2015) |

|

|

6.2635 |

|

|

|

6.2390 |

|

|

|

6.2741 |

|

|

|

6.1870 |

|

|

(1) |

The noon buying rate in New York for cable transfers payable in foreign currencies as certified for customs purposes by the Federal Reserve Bank of

New York. Since April 1994, the noon buying rate has been based on the rate quoted by the PBOC. As a result, since April 1994, the noon buying rate and the PBOC rate have been substantially similar. The PBOC rate at the end of December 31, 2014

was Rmb 6.1190 compared with Rmb 6.2046 for the noon buying rate at the end of December 31, 2014. |

|

(2) |

Determined by averaging the rates on each business day of each month during the relevant period. |

Risk Factors

Risks relating to our shares and share ownership

Our controlling

shareholder’s interests may differ from those of our other shareholders.

As of March 9,

2015, our controlling shareholder, Hong Leong Asia Ltd., or Hong Leong Asia, indirectly owns 14,137,961 or 37.0%, of the outstanding shares of our Common Stock, as well as a special share that entitles it to elect a majority of our directors. Hong

Leong Asia controls us through its wholly-owned subsidiary, Hong Leong (China) Limited, or Hong Leong China, and through HL Technology Systems Pte Ltd, or HL Technology, a wholly-owned subsidiary of Hong Leong China. HL Technology owns approximately

21.7% of the outstanding shares of our Common Stock and has, since August 2002 been the registered holder of the special share. Hong Leong Asia also owns, through another wholly-owned subsidiary, Well Summit Investments Limited, approximately 15.3%

of the outstanding shares of our Common Stock as of March 9, 2015. Hong Leong Asia is a member of the Hong Leong Investment Holdings Pte. Ltd. or Hong Leong Investment group of companies. Prior to August 2002, we were controlled by Diesel

Machinery (BVI) Limited, or Diesel Machinery, which, until its dissolution, was a holding company controlled by Hong Leong China and was the prior owner of the special share. Through HL Technology’s stock ownership and the rights accorded to

the Special Share under our Bye-Laws and various agreements among shareholders, Hong Leong Asia is able to effectively approve and effect most corporate transactions. See “Item 7. Major Shareholders and Related Party Transactions — Related

Party Transactions — Shareholders Agreement.” In addition, our shareholders do not have cumulative voting rights. There can be no assurance that Hong Leong Asia’s actions will be in the best interests of our other shareholders. See

also “Item 7. Major Shareholders and Related Party Transactions — Major Shareholders.”

8

We may experience a change of control as a result of sale or disposal of shares of our

Common Stock by our controlling shareholders.

As described above, HL Technology, a subsidiary of Hong

Leong Asia, owns 8,297,905 shares of our Common Stock, as well as the special share. If HL Technology reduces its shareholding to less than 7,290,000 shares of our Common Stock, our Bye-Laws provide that the special share held by HL Technology will

cease to carry any rights, and Hong Leong Asia may as a result cease to have control over us. See “Item 7. Major Shareholders and Related Party Transactions — The Special Share.” If HL Technology sells or disposes of all of the shares

of our Common Stock, we cannot determine what control arrangements will arise as a result of such sale or disposal (including changes in our management arising therefrom), or assess what effect those control arrangements may have, if any, on our

financial condition, results of operations, business, prospects or share price.

In addition, certain of our

financing arrangements have covenants requiring Hong Leong Asia to retain ownership of the special share and that we remain a principal subsidiary (as defined in such arrangements) of Hong Leong Asia. A breach of that covenant may require us to pay

all outstanding amounts under those financing arrangements. There can be no assurance that we will be able to pay such amounts or obtain alternate financing.

The market price for our Common Stock may be volatile.

There continues to be volatility in the market price for our Common Stock. See “Item 9. The Offer and Listing.” The market price could fluctuate substantially in the future in response to a

number of factors, including:

| • |

|

our operating results whether audited or unaudited; |

| • |

|

the public’s reaction to our press releases and announcements and our filings with the SEC; |

| • |

|

changes in financial estimates or recommendations by stock market analysts regarding us, our competitors or other companies that investors may deem

comparable; |

| • |

|

operating and stock price performance of our competitors or other companies that investors may deem comparable; |

| • |

|

political, economic, and social conditions in China; |

| • |

|

any negative perceptions about corporate governance or accounting practices at listed companies with significant operations in China;

|

| • |

|

changes in general economic conditions, especially the effects of a weaker than expected recovery in the global economy subject to continued

fragilities and certain downside risks such as persistently weak global trade, possible financial market volatility as interest rates in major economies rise on varying timelines, protracted recovery in the Euro Area, weaker than expected growth in

China, possible set-backs in the restructuring of China’s economy and increasing geopolitical tensions in Eastern Europe, the Middle East and South East Asia — see “Item 3. Key Information — Risk Factors — Risks relating to

our company and our business — The diesel engine business in China is dependent in large part on the performance of the Chinese and the global economy. As a result, our financial condition, results of operations, business and prospects could be

adversely affected by slowdowns in the Chinese and the global economy;” |

| • |

|

future sales of our Common Stock in the public market, or the perception that such sales could occur; or |

| • |

|

the announcement by us or our competitors of a significant acquisition. |

Any of the above factors either individually or together may result in market fluctuations which may materially adversely

affect our stock price.

We may be classified as a passive foreign investment company, which could result in adverse

United States federal income tax consequences to US Holders.

A non-United States corporation is

considered a passive foreign investment company, or PFIC, for United States federal income tax purposes for any taxable year if either (1) at least 75% of its gross income is passive income or (2) at least 50% of the total value of its

assets (based on an average of the quarterly values of the assets during a taxable year) is attributable to assets that produce or are held for the production of passive income. For this purpose, the total value of our assets generally will be

determined by reference to the market price of our shares. We believe that our shares should not be treated as stock of a PFIC for United States federal income tax purposes for the taxable year that ended on December 31, 2014. However, there is

no guarantee that the United States Internal Revenue Service will not take a contrary position or that our shares will not be treated as stock of a PFIC for any future taxable year. Our PFIC status will be affected by, among other things, the market

value of our shares and the assets and operations of our company and subsidiaries. If we were to be treated as a PFIC for any taxable year during which a US Holder (defined below) holds our shares, certain adverse United States federal income tax

consequences could apply to the US Holder. See “Item 10. Additional Information — Taxation — United States Federal Income Taxation — PFIC Rules.”

9

Risks relating to our company and our business

The diesel engine business in China is dependent in large part on the performance of the Chinese and the global economy. As a

result, our financial condition, results of operations, business and prospects could be adversely affected by slowdowns in the Chinese and the global economy.

Our operations and performance depend significantly on worldwide economic conditions. During periods of economic

expansion, the demand for trucks, construction machinery and other applications of diesel engines generally increases. Conversely, uncertainty about current global economic conditions or adverse changes in the economy could lead to a significant

decline in the diesel engine industry which is generally adversely affected by a decline in demand. According to the World Bank’s latest Global Economic Prospects issued in January 2015, the world economy is still struggling to gain momentum as

many high income countries continued to grapple with legacies of the global financial crisis. While activity in the high income countries of the United States and United Kingdom had exceeded pre-crisis output peaks as labor markets recover and

monetary policy remains loose, growth in the Euro Area and Japan had stalled and growth in middle- and low-income countries slipped as a result of cyclical factors, domestic policy tightening and political tensions.

The world economy is expected to grow 3% in 2015 compared with 2.6% in 2014, strengthening to 3.3% and 3.2% in 2016 and

2017 respectively. This should be supported by continued recovery in the United States, a gradual acceleration of activity in the Euro Area, and receding headwinds to growth among slower growing developing regions. The sharp decline in oil prices

since mid-2014 is projected to be sustained and to contribute to global growth, with significant income shifts from oil-exporting to oil-importing economies. However, underneath the fragile global recovery lie increasingly divergent trends with

significant implications for global growth. The risks to the global growth outlook are tilted to the downside as a result of persistently weak global trade, possibility of financial market volatility as interest rates in major economies rise on

varying timelines, the impact of low oil prices on oil-producing countries and the risk of a prolonged period of stagnation or deflation in the Euro Area or Japan.

In addition, the performance of the Chinese economy affects, to a significant degree, our financial condition, results of

operations, business and prospects. For example, the various measures taken by the Chinese government from time to time to regulate economic growth and control inflation have in prior periods, significantly weakened demand for trucks in China, and

may have a similar effect in the future. Uncertainty and adverse changes in the Chinese economy could also increase costs associated with developing our products, increase the cost and decrease the availability of potential sources of financing, and

increase our exposure to material losses from our investments, any of which could have a material adverse impact on our financial condition and operating results.

On November 15, 2013, after the closure of the Third Plenum of the 18th Chinese Communist Party Congress, the new government issued a

comprehensive reform document detailing extensive new social and economic policies with the primary aim to restructure and rebalance the economy to a more sustainable model by focusing more on domestic consumption away from investment and export

fuelled growth. On March 5, 2015, at the National People’s Congress in Beijing, Premier Li Keqiang in his annual policy report announced the lowering of the growth target for China in 2015 to 7% from 7.5% in 2014 acknowledging that

China’s economic development had entered a new normal as it deals simultaneously with the economic slowdown and implementation of structural adjustments as it reforms its growth model. Premier Li also advocated a proactive fiscal policy and

prudent monetary policy and placed an emphasis on wide-ranging reforms in a continuation of the goals set out in the November 2013 reform document. In addition, Premier Li announced that the government would spend Rmb 477.6 billion (US$77.6 billion)

on new major projects covering clean energy, oil, natural gas supply; energy-saving, environmental protection and ecological conservation; major railway; highway transport projects in the central and western regions of China; and urbanization

projects. As the Chinese government has stated that its top priority is to pursue a range of reforms, the new leadership is expected to implement new economic and social policies already announced and make further changes to existing ones. The

business and prospects for the diesel engine industry, and thus the business and prospects of our company, may also be adversely affected by changes in Chinese government policies.

Further, in recent years, as a result of recurring liquidity tightening in the banking system, alternative lending and

borrowing outside of traditional banking practices, generally known as “shadow banking”, has grown to become an integral and significant aspect of the Chinese economy. Such alternative lending is loosely regulated and has led to an

increase in China’s debt levels leading to concern over rising bad debts and financial problems. As some of the funds obtained from shadow banking are being used for investments in speculative and risky products, should a widespread default on

such investments occur, this could harm the growth prospects of the Chinese economy. In 2014, there were reports of a number of shadow banking defaults in China resulting in increased scrutiny and oversight by regulators who have proposed draft

rules to control the industry. Even if the Chinese government increases regulation over such alternative lending and borrowing, there is no assurance that such regulations will be successful, or that they would not have an adverse impact on the

overall loan markets and liquidity in China, which will negatively impact the Chinese economy.

10

The diesel engine business in China is dependent in large part on Chinese government

policy. As a result, our financial condition, results of operations, business and prospects could be adversely affected by Chinese government policies affecting our business.

Our business is dependent on the state of the commercial vehicle market in China. According to the China Association of

Automobile Manufacturers (“CAAM”), the sales of commercial vehicles have experienced fluctuations over the years. This is primarily the result of government incentives and subsidies introduced from time to time as well as the replacement

cycle of commercial vehicles. In 2010, the sales of commercial vehicles (excluding gasoline-powered vehicles) increased 29.8% over 2009 which was partly due to the Chinese government’s stimulus measures to counter the effects of the global

financial crisis and maintain economic stability as well as the evolving emission standards for automotive vehicles which contributed to the demand for new vehicles. Thereafter, in 2011 and 2012, sales of commercial vehicles declined by 5.4% and

8.2%, respectively. This was due to a variety of factors including the phasing out of government incentives for commercial vehicle purchases and a slowing pace in the implementation of infrastructure projects. In 2013, the commercial vehicles market

rebounded by 6.6% mainly due to the pre-buying of commercial vehicles prior to the implementation of the National IV emission standards nationwide on July 1, 2013. In 2014, the commercial vehicle market declined by 10.8% mainly due to a 13%

decline in the truck segment. This was primarily due to the strict enforcement of the National IV emission standards from January 1, 2015.

In recent years, the policies of the Chinese government have encouraged energy conservation and emissions reduction. China’s 12th Five-Year Plan, which was officially adopted in 2011, targets a 16%

and 17% reduction in energy use and carbon dioxide emissions respectively per unit of economic output by 2015. Out of seven strategic investment areas identified under the 12th Five-Year Plan, three relate to energy, namely clean energy, energy

conservation and clean energy vehicles. On June 16, 2012, in an effort to strengthen the country’s energy saving and emission reduction efforts, the Chinese government issued the 12th Five-Year Development Plan for the Energy Saving and

Environmental Protection Industry (the “Energy Plan”). While the Energy Plan recognized that China’s energy saving and environmental protection industry has grown rapidly and is expected to continue to do so through 2015, it also

acknowledged that the scale and strength of the industry is not sufficient to meet the needs of the nation’s economic and social development. On August 11, 2013, the new Chinese government released a guideline titled “Opinions of the

State Council on Accelerating the Development of Energy-Saving and Environmental Protection Industries.” According to the guideline, the government plans to upgrade the environmental sector to a key industry by 2015 and the sector is expected

to grow at the rate of 15% annually. The government announced that it would fund through investments, tax breaks and direct subsidies, environmental protection industries across a range of technologies addressing air, water and soil pollution

including energy saving products, electrical vehicles and pollution monitoring. On November 19, 2014, the State Council unveiled a new Energy Development Strategy Action Plan (2014 - 2020) focusing on the development of renewables and

limiting its primary energy consumption growth rate to 3.5% per year until 2020. Premier Li Keqiang in his 2015 annual policy report acknowledged the concern over environmental pollution and stated that the Chinese government would implement an

action plan to conserve energy, reduce emissions and improve the environment such as promoting the use of new-energy vehicles, improving the quality of fuel and prohibiting the use of commercial vehicles registered prior to the end of 2005. Although

a series of policy measures have been formulated to create a sustainable environment for the rapid growth of the energy saving and environmental protection industry, there is no assurance that these measures will be successful. We cannot assure you

that the Chinese government will not change its policies in the future to de-emphasize the use of diesel engines and encourage increased use of cleaner energy alternatives, and any such change will adversely affect our financial condition, results

of operations, business or prospects.

The government incentive schemes have, from time to time contributed to

an increase in our engine sales in the past. However, since government incentive schemes may be changed from time to time, there can be no assurance that sales of our engines will continue to grow at the same rate as in the past or at all.

Our financial condition, results of operations, business and prospects may be adversely affected if we are unable to

implement the Reorganization Agreement and the Cooperation Agreement.

We own 76.4% of the outstanding

shares of Yuchai, and one of our primary sources of cash flow continues to be our share of the dividends, if any, paid by Yuchai and investment earnings thereon. As a result of the agreement reached with Yuchai and its related parties pursuant to

the July 2003 Agreement, we discontinued legal and arbitration proceedings initiated by us in May 2003 relating to difficulties with respect to our investment in Yuchai. In furtherance of the terms of the July 2003 Agreement, we, Yuchai and Coomber

Investments Limited, or Coomber, entered into the Reorganization Agreement in April 2005, as amended in December 2005 and November 2006, and agreed on a restructuring plan intended to be beneficial to our shareholders. In June 2007, we, along with

Yuchai, Coomber and the State Holding Company, entered into the Cooperation Agreement. The Cooperation agreement amends certain terms of the Reorganization Agreement and as so amended, incorporates the terms of the Reorganization Agreement. Pursuant

to the amendments to the Reorganization Agreement, the Company has agreed that the restructuring and spin-off of Yuchai will not be effected, and, recognizing the understandings that have been reached between the Company and the State Holding

Company to jointly undertake efforts to expand the business of Yuchai, the Company will not seek to recover the anti-dilution fee of US$20 million that was due from Yuchai. For more information on these agreements see “Item 4. Information on

the Company — History and Development.” No assurance can be given as to when the business expansion requirements relating to Yuchai as contemplated by the Reorganization Agreement and the Cooperation Agreement will be fully implemented, or

that implementation of the Reorganization Agreement and the Cooperation Agreement will effectively resolve all of the difficulties faced by us with respect to our investment in Yuchai.

11

In addition, the Reorganization Agreement contemplates the continued

implementation of our business expansion and diversification plan adopted in February 2005. One of the goals of this business expansion and diversification plan is to reduce our financial dependence on Yuchai. Subsequently, we acquired strategic

stakes in TCL and HLGE. See “Item 5. Operating and Financial Review and Prospects — Business Expansion and Diversification Plan.” Nonetheless, no assurance can be given that we will be able to successfully expand and diversify our

business. We may also not be able to continue to identify suitable acquisition opportunities, or secure funding to consummate such acquisitions or successfully integrate such acquired businesses within our operations. Any failure to implement the

terms of the Reorganization Agreement and Cooperation Agreement, including our continued expansion and diversification, could have a material adverse effect on our financial condition, results of operations, business or prospects. Additionally,

although the Cooperation Agreement amends certain provisions of the Reorganization Agreement and also acknowledges the understandings that have been reached between us and the State Holding Company to jointly undertake efforts to expand and

diversify the business of Yuchai, no assurance can be given that we will be able to successfully implement those efforts or as to when the transactions contemplated therein will be consummated.

We have in the past and may in the future experience disagreements and difficulties with the Chinese shareholders in Yuchai.

Although we own 76.4% of the outstanding shares of Yuchai, and believe we have proper legal ownership

of our investment and a controlling financial interest in Yuchai, in the event there is a dispute with Yuchai’s Chinese shareholders regarding our investment in Yuchai, we may have to rely on the Chinese legal system for remedies. The Chinese

legal system may not be as effective as compared to other more developed countries, such as the United States. See “Item 3. Key Information — Risk Factors — Risks relating to China — The Chinese legal system embodies

uncertainties which could limit the legal protection available to foreign investors.” We have, in the past experienced problems from time to time in obtaining assistance and cooperation of Yuchai’s Chinese shareholders in the daily

management and operation of Yuchai. We have, in the past also experienced problems from time to time in obtaining the assistance and cooperation of the State Holding Company in dealing with other various matters, including the implementation of

corporate governance procedures, the payment of dividends, the holding of Yuchai board meetings and the resolution of employee-related matters. Examples of these problems are described elsewhere in this Annual Report. The July 2003 Agreement, the

Reorganization Agreement and the Cooperation Agreement are intended to resolve certain issues relating to our share ownership in Yuchai and the continued corporate governance and other difficulties which we have had with respect to Yuchai. As part

of the terms of the Reorganization Agreement, Yuchai agreed that it would seek the requisite shareholder approval prior to entering into any material transactions (including any agreements or arrangements with parties related to Yuchai or any of its

shareholders) and that it would comply with its governance requirements. Yuchai also acknowledged and affirmed the Company’s continued rights as majority shareholder to direct the management and policies of Yuchai through Yuchai’s Board of

Directors. Yuchai’s Articles of Association have been amended and such amended Articles of Association as approved by the Guangxi Department of Commerce on December 2, 2009, entitle the Company to elect nine of Yuchai’s 13 directors,

thereby reaffirming the Company’s right to effect all major decisions relating to Yuchai. While Yuchai has affirmed the Company’s continued rights as Yuchai’s majority shareholder and authority to direct the management and policies of

Yuchai, no assurance can be given that disagreements and difficulties with Yuchai’s management and/or Yuchai’s Chinese shareholders will not recur, including implementation of the Reorganization Agreement and the Cooperation Agreement,

corporate governance matters or related party transactions. Such disagreements and difficulties could ultimately have a material adverse impact on our consolidated financial position, results of operations and cash flows.

We have previously identified material weaknesses in our internal control over financial reporting and cannot assure you that

material weaknesses will not be identified in the future. Our failure to implement and maintain effective internal control over financial reporting could result in material misstatements in our financial statements which could require us to restate

financial statements in the future, or cause us not to be able to provide timely financial information, which may cause investors to lose confidence in our reported financial information and have a negative effect on our stock price.

We reported material weaknesses in our internal control over financial reporting as of

December 31, 2005 to 2011, and concluded that our disclosure controls and procedures and our internal control over financial reporting were not effective as of December 31, 2006 to 2011. However, since the year ending December 31,

2012, we have not identified any material weaknesses in our internal control over financial reporting. Our management concluded that our disclosure controls and procedures and our internal control over financial reporting were effective as of

December 31, 2012 to 2014. See “Item 15. Controls and Procedures.” Our independent registered public accounting firm has expressed an unqualified opinion on the effectiveness of our internal control over financial reporting as of

December 31, 2012 to 2014.

12

We cannot assure you that material weaknesses or significant deficiencies in

our internal control over financial reporting will not be identified in the future. Any failure to maintain or improve existing controls or implement new controls could result in material weaknesses or significant deficiencies and cause us to fail

to meet our periodic reporting obligations which in turn could cause our shares to be delisted or suspended from trading on the New York Stock Exchange (“NYSE”). In addition, any such failure could result in material misstatements in our

financial statements and require us to restate our financial statements and adversely affect the results of annual management evaluations regarding the effectiveness of our internal control over financial reporting. Any of the foregoing could cause

investors to lose confidence in our reported financial information, leading to a decline in our share price.

We depend

on and expect to continue to depend on the Dongfeng Group for a significant percentage of our sales.

Our sales are concentrated among the Dongfeng Group, which includes Dongfeng Automobile Co., Ltd., one of the largest

state-owned automobile companies in China, and other major diesel truck manufacturers controlled by or affiliated with Dongfeng Automobile Co., Ltd. In 2014, sales to the Dongfeng Group accounted for 22.4% of our total revenue, of which sales to our

two largest customers, Dongfeng Liuzhou Motor Co., Ltd. and Dongfeng Commercial Vehicle Co., Ltd., accounted for 6.4% and 4.0% respectively. In 2014, our sales to our top five customers including the Dongfeng Group accounted for 36.3% of our total

revenue. Although we consider our relationship with the Dongfeng Group and the other top four customers to be good, the loss of one or more of the companies within the Dongfeng Group as a customer or any one of our other top four customers whether

singly or combined together would have a material adverse effect on our financial condition, results of operations, business or prospects.

As we are dependent on the purchases made by the Dongfeng Group from us, we have exposure to their liquidity arising from the high level of accounts receivable from them. We cannot assure you that the

Dongfeng Group will be able to repay all the money they owe to us. In addition, the Dongfeng Group may not be able to continue purchasing the same volume of products from us which would reduce our overall sales volume.

The Dongfeng Group also competes with us in the diesel engine market in China. Although we believe that the companies

within the Dongfeng Group generally make independent purchasing decisions based on end-user preferences, we cannot assure you that truck manufacturers affiliated with Dongfeng Automobile Co., Ltd. will not preferentially purchase diesel engines

manufactured by companies within the Dongfeng Group over those manufactured by us.

Competition in China from other

diesel engine manufacturers may adversely affect our financial condition, results of operations, business or prospects.

The diesel engine industry in China is highly competitive. We compete with many other China domestic companies, most of which are state-owned enterprises. Some of our competitors have formed joint

ventures with or have technology assistance relationships with foreign diesel engine manufacturers or foreign engine design consulting firms and use foreign technology that is more advanced than ours. We expect competition to intensify as a result

of:

| • |

|

improvements in competitors’ products; |

| • |

|

increased production capacity of competitors; |

| • |

|

increased utilization of unused capacity by competitors; and |

In addition, we believe there has been excess capacity in the diesel engine industry in the past from time to time due to fluctuations in market demand. For example, the stimulus measures announced by the

Chinese government in 2009 to counter the effects of the global financial crisis and maintain economic stability led to significantly increased demand for commercial vehicles in China in 2010, which we believe led our competitors to invest in

significant capacity expansion. These investments significantly increased the overall capacity in the industry in 2012. The market for commercial vehicles in China softened in 2011 and this continued into 2012 due to a variety of factors including

the phasing out of government incentives for car purchases, the introduction of policies to restrict automotive growth in Beijing and other major cities to curb emissions and ease traffic congestion and a slowdown in China’s economy. The market

rebounded in 2013 mainly due to the pre-buying of commercial vehicles prior to the implementation of the National IV emission standards nationwide on July 1, 2013. In 2014, the commercial vehicle market declined by 10.8% mainly due to a 13%

decline in the truck segment. This was primarily due to the strict enforcement of the National IV emission standards from January 1, 2015. Any excess capacity or decrease in demand in the diesel engine industry in the future could lead to a

decrease in prices in the diesel engine market and as we and our competitors compete through lower prices, this could adversely impact our revenues, margins and overall profitability. Furthermore, if restrictions and tariffs on the import of motor

vehicles and motor vehicle parts into China are reduced, foreign competition could increase significantly. An increase in competition as a result of these various factors operating singly or together may adversely affect our financial condition,

results of operations, business or prospects as a result of lower gross margins, higher fixed costs or decreasing market share.

13

Our long-term business prospects will depend largely upon our ability to

develop and introduce new or improved products at competitive prices. Our competitors in the diesel engine markets may be able to introduce new or improved engine models that are more favorably received by customers. Competition in the end-user

markets, mainly the truck market, may also lead to technological improvements and advances that render our current products obsolete at an earlier than expected date, in which case we may have to depreciate or impair our production equipment more

rapidly than planned. Failure to introduce or delays in the introduction of new or improved products at competitive prices could have a material adverse effect on our financial condition, results of operations, business or prospects.

If we are not able to continuously improve our existing engine products and develop new engine products or successfully enter into

other markets, we may become less competitive, and our financial condition, results of operations, business and prospects will be adversely affected.

As the diesel engine industry in China is highly competitive and continues to develop, we will have to continuously improve our existing engine products, develop new engine products and enter into new

markets in order to remain competitive. As a result, our long-term business prospects will largely depend upon our ability to develop and introduce new or improved products at competitive prices and enter into new markets. Future products may

utilize different technologies and may require knowledge of markets that we do not currently possess. Moreover, our competitors may be able to introduce new or improved engine models that are more favorably received by customers than our products or

enter into new markets with an early-entrant advantage. Any failure by us to introduce, or any delays in the introduction of, new or improved products at competitive prices or entering into new markets could have a material adverse effect on our

financial condition, results of operations, business or prospects.

We have entered into several joint

ventures in order to expand our product portfolio. There can be no assurance that our joint ventures will be successful or profitable. We have recognized impairment losses in the past related to our investments in the joint ventures and may do so