Cemex to Sell Ohio Assets to Eagle Materials

September 12 2016 - 2:20PM

Dow Jones News

MEXICO CITY—Mexican cement and building materials company Cemex

SAB took another step toward meeting its asset-divestment target

with an agreement to sell a cement plant and terminal in Ohio to

Eagle Materials Inc. for about $400 million.

The sale, which is expected to close in the fourth quarter,

includes a cement plant in Fairborn and a distribution terminal in

Columbus, Cemex said Monday.

The assets are expected to generate $79 million this year in

revenue, and $33 million in operating cash flow measured by

earnings before interest, taxes, depreciation and amortization, or

Ebitda.

Cemex said it would use the money from the sale to pay down debt

and for other purposes. The Monterrey company, one of the world's

largest cement makers, is selling assets to reduce its heavy debt

load as it seeks to recover the investment-grade ratings that it

lost during the 2008-2009 global crisis.

Cemex aims to sell assets for $1.5 billion to $2 billion in

2016-2017. The sales are part of the company's plans to lower debt

by between $3 billion and $3.5 billion in that two-year period. It

recently agreed to sell plants in Texas and New Mexico to Grupo de

Cementos Chihuahua SAB for $306 million.

Dallas-based Eagle Materials said the Fairborn cement plant has

capacity to grind nearly one million tons a year of clinker, and

will increase its cement-making capacity by about 20%. Eagle said

the acquisition will contribute to earnings as soon as the deal

closes, and that it expects around $50 million in tax benefits from

the transaction.

"Our strategy has been to grow the cement side of our business.

The Fairborn plant extends our U.S. cement system and connects but

does not overlap with the market reach of our existing plants,"

said Dave Powers, Eagle's president and chief executive in a

statement from the company.

Eagle, which makes cement and other building materials, said it

would use cash and bank credit to finance the acquisition without

raising its debt-to-Ebitda ratio to more than two times.

The sale is positive for Cemex even though it is in one of its

biggest and currently fastest-growing markets, analysts at Mexico's

Intercam brokerage said in a note to clients.

The assets are far from Cemex's main areas of operations in the

U.S., and don't produce concrete or aggregates. "Besides, it's core

for Eagle Materials so they could pay a higher multiple," they

added.

Write to Anthony Harrup at anthony.harrup@wsj.com

(END) Dow Jones Newswires

September 12, 2016 14:05 ET (18:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

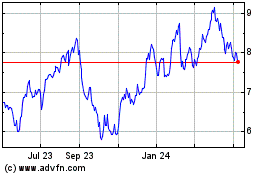

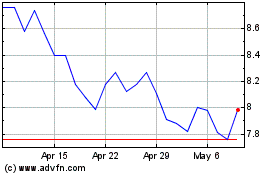

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Apr 2023 to Apr 2024