ROCHE

Zika Test Receives Emergency Approval

Roche Holding AG said a Zika virus test developed by its

diagnostics unit has received emergency use authorization from the

U.S. Food and Drug Administration.

The test detects the virus in the blood using Roche's LightMix

or cobas z 480 machines, both small and easy-to-use systems.

It is the latest diagnostic test to receive emergency

authorization in the U.S., in response to the threat posed by the

Zika virus. The virus can be detected in either the blood or

urine.

The FDA grants this status to unapproved products whose use is

deemed necessary in public-health emergencies.

Roche is already providing a test that screens blood donations

for the Zika virus.

That test was made available under an investigational new drug

program, another route for unapproved products to be made available

under special circumstances.

--Denise Roland

AirAsia

Lower Expenses Boost Budget Airline

KUALA LUMPUR, Malaysia -- Budget airline AirAsia Bhd. said its

second-quarter profit rose 41%, driven mainly by lower expenses,

including fuel costs and taxes.

Net profit for the April-June period was 342.12 million ringgit

($84.7 million), compared with 243.03 million ringgit a year

earlier, the Malaysian carrier said in a stock-exchange filing

Monday.

Revenue grew 23% to 1.62 billion ringgit from 1.32 billion

ringgit a year earlier.

"Based on our performance and trend for the first half of the

year, we believe 2016 will be a very good year for the company,"

said Tony Fernandes, AirAsia's group chief executive, in a

statement.

Demand in Malaysia remained extremely robust and he sees this

improving in the coming quarters as consumer sentiment picked up in

the domestic economy, Mr. Fernandes said.

Indian travelers entering Malaysia grew by 34% year on year in

AirAsia, he added.

The airline expects load factor, a measure of how full planes

are, in Malaysia to be 90% in the third quarter ending September,

from 87% in the second quarter ended June.

It forecasts more than 80% load factor for India, Indonesia,

Thailand and the Philippines in the third quarter.

AirAsia, co-founded and run by Mr. Fernandes, is Asia's largest

low-cost airline by passenger numbers. The company has grown from a

two-plane operation in 2002 to become a billion-dollar airline, but

was weighed down by intense competition from rivals such as Lion

Air and Jetstar in Southeast Asia.

The Malaysia-based carrier returned to the black in the quarter

ended in December, thanks to lower fuel costs, improved passenger

numbers and foreign-exchange volatility.

Shares of AirAsia have more than doubled year to date, mainly

driven by anticipated gains on the divestment of its leasing arm,

Asia Aviation Capital or AAC.

On Monday, shares of AirAsia were up 2.05% to end at 2.99

ringgit, ahead of the earnings release.

Research house UOBKayHian said the rise in share price was

overdone. "We expect the accretion to equity from the divestment to

be minimal as the equity portion will have to be adjusted for the

hold company's [AirAsia] debt," UOBKayHian said.

In a separate announcement, AirAsia said its board of directors

has approved plans to carry out a sale process to potentially

divest all or a substantial portion of its equity stake in AAC.

AirAsia has appointed RHB Investment Bank, Credit Suisse

(Singapore) Ltd and BNP Paribas as joint advisers for a potential

sale, according to the filing.

AirAsia has reportedly valued the business unit at up to 4.1

billion ringgit.

AirAsia wholly owns AAC, which provides aircraft-leasing

services within AirAsia. AAC began leasing to third parties last

September. According to notes accompanying AirAsia's financial

statements, ACC's profit after tax in the April-June period surged

to $18.8 million from $1.2 million in the year-earlier period.

AirAsia said AAC's portfolio of aircraft for lease has increased to

55 in the quarter from 19 a year earlier.

Meanwhile, Mr. Fernandes said AirAsia remains a beneficiary of

current low fuel prices, with all of its associates seeing lower

aircraft fuel expense.

For 2016, AirAsia has hedged 75% of its fuel requirements at an

average cost of $56 a barrel, he said. For 2017, it hedged 45% of

its fuel requirements at an average cost of $58 a barrel, he

added.

--Yantoultra Ngui

Paytm

Online Payment Firm To Raise $300 Million

NEW DELHI -- Indian online payment and e-commerce firm Paytm is

raising $300 million from a group of investors led by Taiwanese

chip-design company MediaTek Inc., according to a person familiar

with the situation.

The investment values the Noida, India-based company at $5

billion, up from an earlier valuation of about $2.5 billion, the

person said. MediaTek's contribution amounted to $60 million,

according to the person.

In a country where users are increasingly coming online via

low-cost smartphones, Paytm provides a popular mobile app that can

be used to pay for services like rides from Uber Technologies Inc.

and utility bill payments.

Paytm uses its payment service to help direct traffic to its

other businesses, like e-commerce. The company says it provides

some 135 million mobile wallets in India, where few consumers have

credit cards and many prefer to pay in cash.

The new injection comes after Chinese e-commerce giant Alibaba

Group Holding Ltd.'s and its financial-services affiliate Zhejiang

Ant Small & Micro Financial Services Grouplast year invested

more than $500 million for a 40% stake in One97 Communications.

MediaTek couldn't immediately be reached for comment.

The funding comes as venture capital investments have been

slowing in India amid talk of a bubble in Silicon Valley and

concerns over global economic conditions.

Investors in the first quarter of 2015 pumped $891 million into

Indian tech startups, according to Hong Kong-based AVCJ Research.

That number fell 17% to $736 million for the first quarter of this

year.

--Newley Purnell

KaloBios

Former CEO Shkreli Sells Rest of Stake

Martin Shkreli has sold his remaining stake in KaloBios

Pharmaceuticals Inc., severing his ties with the company he once

led as the small drugmaker seeks to distance itself from its former

chief executive.

Mr. Shkreli made the disclosure in a regulatory filing on

Monday, reporting to regulators that he sold all shares held by him

last week in private transactions, and as a result ceased to be a

KaloBios shareholder. He sold roughly 2 million shares at $3.10

each, according to the filing, valuing the stake at roughly $5.9

million. In November, Mr. Shkreli and a group held a stake worth

about $4.4 million.

Scott Vernick, a lawyer representing Mr. Shkreli, said his

client is "moving on, and wishes the company the best in the

future."

The South San Francisco-based rare disease drugmaker has said

Mr. Shkreli held a less than 14% stake in the company. KaloBios

shares rose 19% to $4.15 in morning trading Monday in New York.

KaloBios in July said it reached an agreement to limit Mr.

Shkreli's shareholder rights as continued attention garnered by Mr.

Shkreli, charged in December for matters unrelated to KaloBios, has

taken a toll on the pharmaceutical company's efforts to get back on

its feet. The agreement included an option for the company to

repurchase his shares.

The company filed for bankruptcy protection not long after Mr.

Shkreli was arrested, and the firm announced it emerged from

chapter 11 in early July. At the time of his arrest, Mr. Shkreli

was trying to land the rights to the drug benznidazole.

On Nov. 13, days before the company announced Mr. Shkreli would

become chief executive, KaloBios said it faced "limited cash

resources" remaining and would wind down its operations. The stock

had hit an all-time low of 44 cents a share on Nov. 16, when Mr.

Shkreli began snapping up shares.

On Nov. 19, the company said Mr. Shkreli and the investor group

now owned 70% of its shares outstanding, and Mr. Shkreli would lead

the company. The stake was valued at $4.4 million at the time.

FBI agents arrested Mr. Shkreli at his Manhattan apartment last

year over accusations he misled investors in his hedge funds and

looted a publicly traded company to cover losses. Mr. Shkreli

denies the criminal charges. He was widely criticized for

increasing the price of anti-parasite drug Daraprim by

fiftyfold.

--Joshua Jamerson

(END) Dow Jones Newswires

August 30, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

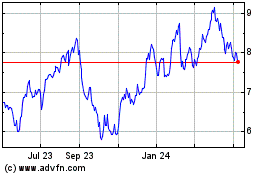

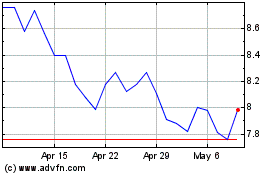

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Apr 2023 to Apr 2024