CEMEX Reports First-Quarter 2016 Results

April 21 2016 - 6:15AM

Business Wire

- Net income was US$35 million during the

quarter and was positive in a first quarter for the first time in 7

years.

- Operating EBITDA increased 12% on a

like-to-like basis during the quarter and was the highest

first-quarter EBITDA, as well as the highest EBITDA margin since

2009.

- First positive free cash flow after

maintenance capital expenditures in a first quarter since

2009.

CEMEX, S.A.B. de C.V. ("CEMEX") (NYSE: CX), announced today that

consolidated net sales reached US$3.2 billion during the first

quarter of 2016, an increase of 3% on a like-to-like basis for the

ongoing operations and adjusting for currency fluctuations, versus

the comparable period in 2015. Operating EBITDA increased 12% on a

like-to-like basis during the quarter to US$583 million versus the

same period in 2015.

CEMEX’s Consolidated First-Quarter 2016

Financial and Operational Highlights

- The increase in consolidated net sales

was due to higher prices of our products, in local currency terms,

in most of our operations, as well as higher volumes in the U.S.,

and our Europe and AME&A regions.

- On a like-to-like basis, operating

earnings before other expenses, net, in the first quarter increased

19% to US$358 million versus the comparable period in 2015.

- Controlling interest net income

improved to US$35 million during the first quarter of 2016 from a

loss of US$149 million in the same period last year.

- Operating EBITDA increased during the

quarter 12% on a like-to-like basis to US$583 million.

- Operating EBITDA margin grew by 1.2

percentage points on a year-over-year basis reaching 18.2%.

- Free cash flow after maintenance

capital expenditures for the quarter was US$8 million, compared

with negative US$281 million in the same quarter of 2015.

- Free cash flow for the quarter was

negative US$35 million, an improvement of US$322 million, compared

with the same quarter of 2015.

Fernando A. Gonzalez, CEMEX Chief Executive Officer, said, “We

continue to see favorable results from the implementation of our

value-before-volume strategy, with increases in sequential pricing

in our three core products. Higher consolidated prices led to a

like-to-like increase in net sales of 3%. Prices increased more

than our costs and we had a favorable operating leverage in many of

our markets leading to a 12% increase in EBITDA on a like-to-like

basis, as well as an EBITDA margin expansion of 1.2 percentage

points.

We are particularly pleased with both our free cash flow after

maintenance capital expenditures and our net income being positive

in a first quarter for the first time in 7 years.”

Consolidated Corporate Results

During the first quarter of 2016, controlling interest net

income was US$35 million, an improvement over a loss of US$149

million in the same period last year.

Total debt plus perpetual notes increased by US$672 million

during the quarter.

Geographical Markets First-Quarter 2016

Highlights

Net sales in our operations in Mexico decreased 17% in

the first quarter of 2016 to US$633 million, compared with US$766

million in the first quarter of 2015. Operating EBITDA decreased by

13% to US$227 million versus the same period of last year.

CEMEX’s operations in the United States reported net

sales of US$920 million in the first quarter of 2016, up 6% from

the same period in 2015. Operating EBITDA increased 71% to US$109

million in the quarter, versus the comparable period of 2015.

CEMEX’s operations in South, Central America and the

Caribbean reported net sales of US$422 million during the first

quarter of 2016, representing a decrease of 10% over the same

period of 2015. Operating EBITDA decreased 8% to US$136 million in

the first quarter of 2016, from US$148 million in the first quarter

of 2015.

In Europe, net sales for the first quarter of 2016

decreased 3% to US$729 million, compared with US$748 million in the

first quarter of 2015. Operating EBITDA was US$52 million for the

quarter, 2% lower than the same period last year.

Operations in Asia, Middle East and Africa reported a 4%

increase in net sales for the first quarter of 2016, to US$420

million, versus the first quarter of 2015, and operating EBITDA for

the quarter was US$103 million, up 16% from the same period last

year.

CEMEX is a global building materials company that provides high

quality products and reliable service to customers and communities

in more than 50 countries. Celebrating its 110th anniversary, CEMEX

has a rich history of improving the well-being of those it serves

through innovative building solutions, efficiency advancements, and

efforts to promote a sustainable future.

This press release contains forward-looking statements and

information that are necessarily subject to risks, uncertainties

and assumptions. Many factors could cause the actual results,

performance or achievements of CEMEX to be materially different

from those expressed or implied in this release, including, among

others, changes in general economic, political, governmental and

business conditions globally and in the countries in which CEMEX

does business, changes in interest rates, changes in inflation

rates, changes in exchange rates, the level of construction

generally, changes in cement demand and prices, changes in raw

material and energy prices, changes in business strategy and

various other factors. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

herein. CEMEX assumes no obligation to update or correct the

information contained in this press release.

Operating EBITDA is defined as operating income plus

depreciation and operating amortization. Free Cash Flow is defined

as Operating EBITDA minus net interest expense, maintenance and

expansion capital expenditures, change in working capital, taxes

paid, and other cash items (net other expenses less proceeds from

the disposal of obsolete and/or substantially depleted operating

fixed assets that are no longer in operation). Net debt is defined

as total debt minus the fair value of cross-currency swaps

associated with debt minus cash and cash equivalents. The

Consolidated Funded Debt to Operating EBITDA ratio is calculated by

dividing Consolidated Funded Debt at the end of the quarter by

Operating EBITDA for the last twelve months. All of the above items

are presented under the guidance of International Financial

Reporting Standards as issued by the International Accounting

Standards Board. Operating EBITDA and Free Cash Flow (as defined

above) are presented herein because CEMEX believes that they are

widely accepted as financial indicators of CEMEX's ability to

internally fund capital expenditures and service or incur debt.

Operating EBITDA and Free Cash Flow should not be considered as

indicators of CEMEX's financial performance, as alternatives to

cash flow, as measures of liquidity or as being comparable to other

similarly titled measures of other companies.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160421005518/en/

CEMEX, S.A.B. de C.V.Media Relations:Jorge

Perez, +52(81) 8888-4334mr@cemex.comorInvestor

Relations:Eduardo Rendon, +52(81)

8888-4256ir@cemex.comorAnalyst Relations:Lucy

Rodriguez, +1(212) 317-6007ir@cemex.com

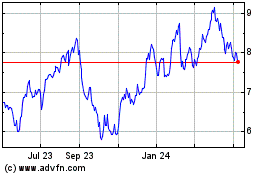

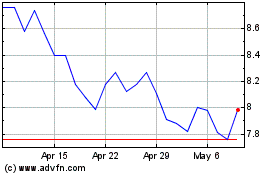

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Apr 2023 to Apr 2024