CEMEX Obtains Required Consents to Amend Its Credit Agreement

March 07 2016 - 6:30AM

Business Wire

CEMEX, S.A.B. de C.V. ("CEMEX") (NYSE:CX), announced today that,

in line with CEMEX’s current initiatives of enhancing financial

flexibility and reducing risk, it has obtained the required

consents to amend its facilities agreement dated September 29,

2014, as amended and restated (the “Credit Agreement”), in order to

delay the scheduled tightening in its consolidated financial

leverage and coverage ratio limits by one year. The formalization

of the amendment is subject to customary conditions and is expected

to be finalized in the following days. Pursuant to the amendment,

the leverage ratio covenant in the Credit Agreement will remain at

6.0 times until and including March 31, 2017, and will gradually

decline to 4.0 times by June 30, 2020, and the margin grid in the

Credit Agreement will be modified such that if the consolidated

leverage ratio is greater than 5.50 times in the reference periods

ending on December 31, 2016, March 31, 2017, June 30, 2017, and

September 30, 2017, the applicable margin will be 425 bps instead

of 400 bps. All other levels in the margin grid remain

unchanged.

In addition, the Credit Agreement will be amended to allow CEMEX

the right, subject to meeting local requirements in the

Philippines, to sell a minority stake in a subsidiary that directly

and indirectly mainly owns CEMEX’s cement manufacturing assets in

the Philippines.

"The amendment underscores the recognition given to CEMEX's

business and financial strategy by its core banks," said Jose

Antonio Gonzalez, CEMEX’s Chief Financial Officer. “We are pleased

by their continued support and we remain committed to our stated

targets of enhancing free cash flow, asset disposals and debt

reduction, which should contribute to our objective of receiving an

investment grade credit rating."

CEMEX is a global building materials company that provides

high-quality products and reliable service to customers and

communities in more than 50 countries throughout the world. CEMEX

has a rich history of improving the well-being of those it serves

through its efforts to pursue innovative industry solutions and

efficiency advancements and to promote a sustainable future.

This press release contains forward-looking statements and

information that are necessarily subject to risks, uncertainties

and assumptions. Many factors could cause the actual results,

performance or achievements of CEMEX to be materially different

from those expressed or implied in this release, including, among

others, the non-formalization of the amendments to the Credit

Agreement, changes in general economic, political, governmental and

business conditions globally and in the countries in which CEMEX

does business, changes in interest rates, changes in inflation

rates, changes in exchange rates, the level of construction

generally, changes in cement demand and prices, changes in raw

material and energy prices, changes in business strategy and

various other factors. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

herein. CEMEX assumes no obligation to update or correct the

information contained in this press release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160307005519/en/

CEMEX, S.A.B. de C.V.Media Relations:Jorge Pérez, +52(81)

8888-4334mr@cemex.comorInvestor Relations:Eduardo Rendón, +52(81)

8888-4256ir@cemex.comorAnalyst Relations:Lucy Rodriguez, +1

212-317-6007ir@cemex.com

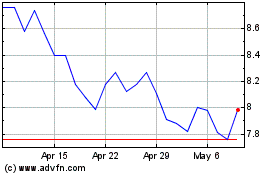

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Mar 2024 to Apr 2024

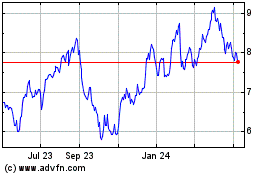

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Apr 2023 to Apr 2024