CEMEX Increases New Bank Loan to U.S.$1.87 Billion and Successfully Concludes Amendment to Facilities Agreement

November 03 2014 - 5:20PM

Business Wire

- Incremental amount further extends

CEMEX´s debt maturity profile and reduces cost of debt

CEMEX, S.A.B. de C.V. (“CEMEX”) (NYSE: CX) announced today that

it has received U.S.$515 million of commitments from banks that

have agreed to join the credit agreement entered into on September

30, 2014 (the “Credit Agreement”).

Following the completion of customary closing conditions, the

banks that provided the new commitments will accede the Credit

Agreement as additional lenders, increasing the total amount of the

Credit Agreement from U.S.$1.35 billion to U.S.$1.87 billion.

The incremental amount raised will be applied to partially

prepay the Facilities Agreement dated September 17, 2012 (as

amended from time to time, the "Facilities Agreement") and to pay

other debt. After the prepayment of the Facilities Agreement, the

remaining outstanding amount under this facility will be reduced to

approximately U.S.$2.05 billion, scheduled to mature in 2017.

Additionally, CEMEX announced it has obtained the required

consents to amend the Facilities Agreement so the covenants and

undertakings under this facility are conformed to those of the

Credit Agreement. The main amendments include:

- The amounts allowed for capital

expenditures are increased from U.S.$800 million to U.S.$1 billion

per year;

- The amounts allowed for permitted

acquisitions and investments in joint ventures are increased from

U.S.$250 million to U.S.$400 million per year;

- The restrictions on asset swaps are

eliminated; and

- A new mandatory prepayment regime that

eliminates the cash sweep covenant and provides CEMEX with more

discretion to use its cash is introduced.

CEMEX is a global building materials company that provides

high-quality products and reliable services to customers and

communities in more than 50 countries. CEMEX has a rich history of

improving the well-being of those it serves through innovative

building solutions, efficiency advancements, and efforts to promote

a sustainable future.

This press release contains forward-looking statements and

information that are necessarily subject to risks, uncertainties,

and assumptions. No assurance can be given that the transactions

described herein will be consummated or as to the ultimate terms of

any such transactions. CEMEX assumes no obligation to update or

correct the information contained in this press release. Terms like

“capital expenditures”, permitted acquisitions” and “permitted

investments” have the meaning ascribed to them in the Facilities

Agreement and in the Credit Agreement.

Media RelationsJorge Pérez, +52 (81)

8888-4334mr@cemex.comorInvestor RelationsEduardo Rendón, +52 (81)

8888-4256ir@cemex.comorAnalyst RelationsLuis Garza, +52 (81)

8888-4136ir@cemex.com

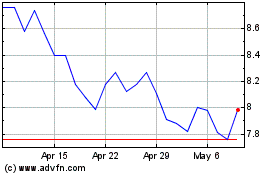

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Mar 2024 to Apr 2024

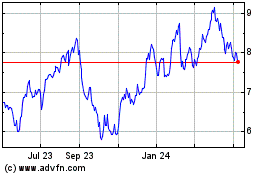

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Apr 2023 to Apr 2024