By Paul Ziobro

CVS Health Inc. is getting a taste of its own medicine.

The biggest U.S. drugstore chain warned that it stands to lose

40 million prescriptions next year as deals signed by rival

Walgreens Boots Alliance Inc. with other participants in the drug

supply chain shut out CVS pharmacies.

The company, which had pioneered a business model that put drug

insurance and nearly 9,700 pharmacies under the same roof, lowered

its profit outlook for the rest of this year and next. Shares

tumbled 13% in early Tuesday trading.

Chief Executive Larry Merlo said two recent partnerships that

Walgreens struck with health plans that entirely excluded CVS

drugstores from their networks were the main reason for the

expected decline in prescriptions. CVS filled 1.03 billion

prescriptions in 2015, the last full year available, up from 722

million five years earlier.

"We have always said that our last scripts are our most

profitable," Mr. Merlo said on a conference call with analysts.

"Unfortunately, this means that the scripts we lose will tend to be

our most profitable scripts."

Pharmacy-benefits managers, which include companies like Express

Scripts Holding Co. and CVS Health's Caremark, operate as middlemen

between insurance companies, corporations that pay for health

coverage, drugmakers, and pharmacies. They help process claims for

prescriptions drugs while also negotiating with drugmakers and

insurance companies over the price of medications.

By owning Caremark as well as thousands of drugstores, CVS

Health has been able to closely align both businesses to encourage

patients to fill their prescriptions somewhere within the CVS

empire. For instance, under its Maintenance Choice program,

patients can get 90-day prescriptions filled either through the

pharmacy-benefit program's mail-order business or at CVS stores at

the same lower price.

But that leaves an opening for Walgreens to partner with other

pharmacy-benefit managers. "CVS can't have that same relations with

other competing PBMs," said Adam Fein of Philadelphia-based

Pembroke Consulting, who tracks drug distribution. "Walgreens is

using CVS Health's strengths against it."

Under CEO Stefano Pessina, Walgreens Boots has been aggressively

pursuing deals that make its pharmacies part of preferred networks

where patients can fill their prescriptions at a discount. It has

had a number of wins, too, including becoming the preferred

pharmacy for United Healthcare Inc.'s OptumRx and for Prime

Therapeutics, which manages drug benefits for 14 Blue Cross and

Blue Shield health plans.

Last month, Walgreens signed a deal to become the preferred

network for Tricare, the Defense Department's health-care network,

supplanting CVS Health. It has also struck a deal to acquire the

No. 3 U.S. chain, Rite Aid Corp., though the transaction awaits

regulatory approval. Walgreens filled 929 million prescriptions in

the fiscal year ended Aug. 31.

"Walgreens is trying to be the best friend of every PBM that's

not named Caremark," said Mr. Fein. Walgreens is courting

prescriptions because it wants to drive more traffic to its stores,

so it can sell shoppers beauty and other products. CVS Health has

been less willing to chase foot traffic with discounts, and even

encourages customers to fill prescriptions by mail.

Mr. Merlo said Walgreens' deals with Prime and Tricare cut out

CVS pharmacies entirely, and that weighs on profitability because

of the fixed costs tied to running the locations. It also means

fewer people coming into stores and spending money on snacks,

household items and other sundries.

But Mr. Merlo defended the CVS Health model compared with the

partnerships that Walgreens has made. "While they may get part of

the way there, we don't believe they can extract the full value

that we do through our truly integrated model," he said.

In 4 p.m. trading Tuesday, CVS Health shares were down 12% at

$73.53. The shares had already fallen nearly 15% this year, as

investors fretted over pushback to rising drug prices and unease

over the presidential election. Shares of Walgreens Boots fell 4%

on Tuesday.

CVS Health lowered its financial targets. For 2017 it now

expects adjusted earnings per share of $5.77 to $5.93. Analysts

polled by Thomson Reuters had expected earnings per share of

$6.52.

The Woonsocket, R.I.-based giant has increasingly relied on its

Caremark division for growth. In the latest quarter, CVS Health had

a profit of $1.54 billion, or $1.43 a share, up from $1.25 billion,

or $1.11 a share, a year earlier.

Revenue increased 15% to $44.62 billion, Revenue in the pharmacy

services segment, which includes Caremark, rose 19.2% to $30.4

billion.

Sales at existing pharmacy locations rose 2.3%, with a 3.4%

increase in prescription sales offset by a 1% decline in the

front-end of the business.

Austen Hufford contributed to this article

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

November 09, 2016 02:48 ET (07:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

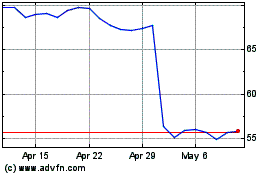

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

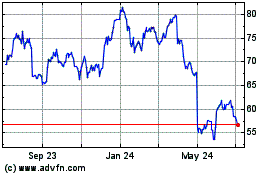

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024