CVS Shares Drop as Guidance is Cut, Retail Prescriptions Leave Its Network

November 08 2016 - 8:12AM

Dow Jones News

By Austen Hufford

CVS Health Inc. warned that fewer people will fulfill retail

prescriptions at its pharmacies, as its integrated model is being

challenged by competitors including Walgreens Boots Alliance

Inc.

Shares dropped 11% to $73.94 in premarket trading as the company

also slashed its annual expectations and gave downbeat projections

for the coming fiscal year.

CVS Health's model of operating both a chain of retail

store-pharmacies and a pharmacy benefit manager has been pressured

by other pharmacy-benefit managers who have struck deals with

competitors. In August, Walgreens struck a deal with Prime

Therapeutics to become its preferred pharmacy.

Chief Executive Larry Merlo said recent pharmacy network changes

have caused some retail prescriptions to move out of its network in

the quarter.

He also cited slowing prescription growth in the market overall.

The drug industry has recently shown signs that it is slowing the

pace of price increases after years of hefty hikes, after pressure

from politicians, consumers and employers.

CVS also cut its guidance. It now expects full-year adjusted

earnings per share to be between $5.77 and $5.83, down from $5.81

to $5.89 previously. Analysts polled by Thomson Reuters had

expected earnings per share of $5.85. For 2017 it expects adjusted

earnings per share of $5.77 to $5.93. Analysts had expected

$6.52.

Pharmacy-benefits managers, which include companies like Express

Scripts Holding Co. and CVS Health's Caremark, operate as middlemen

between insurance companies, corporations that pay for health

coverage, drugmakers, and pharmacies. They help process claims for

prescriptions drugs while also negotiating with drugmakers and

insurance companies over the price of medications.

The Woonsocket, R.I.-based drugstore giant has increasingly

relied on its pharmacy benefits management division for growth.

In all for the quarter, CVS reported a profit of $1.54 billion,

or $1.43 a share, up from $1.25 billion, or $1.11 a share, a year

earlier. Excluding certain items, per-share profit rose to $1.64

from $1.28.

Revenue increased 15% to $44.62 billion.

Analysts predicted $1.57 in adjusted earnings a share and $45.29

billion in revenue, according to Thomson Reuters.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

November 08, 2016 07:57 ET (12:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

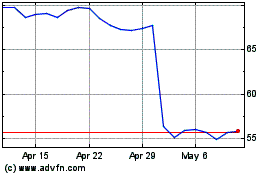

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

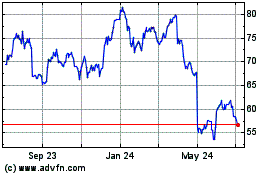

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024