CVS Misses Sales Expectations as Pharmacy Business Softens

August 02 2016 - 8:40AM

Dow Jones News

CVS Health Corp. logged disappointing sales growth in its latest

quarter as new generic drug introductions cut into its pharmacy

business and store traffic declined.

The Woonsocket, R.I.-based drugstore giant is increasingly

relying on its pharmacy benefits management division for growth.

The business, which manages prescription drug coverage for health

insurers, is attracting more clients by helping lower drug spending

as some manufacturers are pushing through sharp price increases.

Meanwhile, CVS has expanded its retail footprint by folding in

about 1,6000 Target Corp. pharmacies it bought last year.

In the latest period, sales at existing CVS pharmacies increased

2.1% during the quarter, slower than the 4.2% pace notched in the

first quarter and short of the 2.5% rate analysts expected. The

metric rose 3.9% in the company's pharmacy business as prescription

volumes grew 3.5% growth—both down from gains of 5.5% and 5.9%,

respectively, in the first quarter. CVS said recent generic drug

introductions hurt pharmacy sales.

Meanwhile, CVS' front-of-store business weakened during the

period as customer traffic fell and because the early Easter

shifted some sales out of the quarter. Same-store sales in the

front declined 2.5% despite the company's efforts to squeeze out

more profits by increasing sales of private-label items and

expanding its selection of beauty products.

In all for the quarter, CVS reported a profit of $924 million,

or 86 cents a share, down from $1.27 billion, or $1.12 a share, a

year earlier. Excluding intangible asset amortization, among other

items, per-share profit rose to $1.32 from $1.22.

Revenue increased 18% to $43.73 billion.

Analysts predicted $1.30 in adjusted earnings per share and

$44.28 billion in revenue, according to Thomson Reuters.

For the year, CVS cut its overall earnings forecast and narrowed

its view on an adjusted basis. The reduction in overall earnings is

due to acquisition-related integration costs and the impact of a

loss on an early extinguishment of debt.

Excluding those items, CVS said it now sees per-share earnings

of $5.81 to $5.89 this year, compared with an earlier range of

$5.73 to $5.88 and the average analyst estimate of $5.82.

Shares in the company, down 17% over the past 12 months, slipped

0.5% to $93 in premarket trading.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

August 02, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

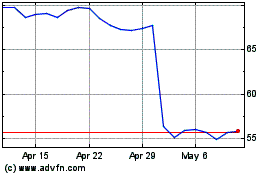

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

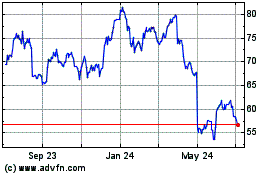

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024