CVS Profit Grows on Higher Sales of Prescription Drugs -- 3rd Update

February 09 2016 - 12:18PM

Dow Jones News

By Chelsey Dulaney and Paul Ziobro

CVS Health Corp. reported higher profit and sales in its fourth

quarter, as rising sales of prescription drugs offset a slight drop

in sales in the front-end of its stores, where traffic continues to

erode.

The quarter was broadly in line with Wall Street expectations,

as CVS drugstores and its large pharmacy benefits management

business continued to cover more patients and dispense more drugs.

In Tuesday morning trading, CVS shares rose 2% to $91.51.

The results were also boosted by two recent acquisitions that

allow CVS to cover more patients: Omnicare Inc., which dispenses

drugs to places like nursing homes; and Target Corp.'s pharmacy

business, which gives CVS nearly 1,700 more locations. As both

those acquisitions become integrated, CVS plans to market them

aggressively to help sign up more clients to its network.

Building scale is one part of CVS's answer to falling

reimbursement rates as more patients are covered through federal

Medicare and Medicaid programs, which carry lower margins than

private insurers.

Still, private insurers are trying to squeeze more costs out of

their drug plans as well. The health insurer Anthem Inc. last month

said it would drop its longtime benefits manager Express Scripts

Holding Co. unless it could deliver more than $3 billion in savings

on drug prices.

The rare public dispute puts the valuable contract up for grabs.

CVS executives declined Tuesday to comment on their plans to pursue

it, but did say that Anthem's move hasn't affected negotiations

with other clients. "We're not really seeing any repercussions or

halo to pricing in the marketplace from that event, but I think it

continues to be competitive," Jonathan Roberts, head of CVS's

Caremark business, said on Tuesday's earnings call.

For the period ended Dec. 31, CVS reported a profit of $1.5

billion, or $1.34 a share, up from $1.32 billion, or $1.14 a share,

a year earlier. Quarterly revenue rose 11% to $41.15 billion, after

eliminating inter-segment sales. Analysts were forecasting revenue

of $41.13 billion in revenue.

Sales in its retail business increased 12.5% to $19.9 billion,

with about half of that growth owing to CVS's recent acquisition of

Omnicare Inc.

Sales at stores, excluding newly opened or closed locations,

rose 3.5%, though front-of-store sales edged down 0.5%. The decline

in the front-end, where CVS sells over-the-counter medicine, snacks

and beauty products, comes as CVS focuses more on deals targeted at

specific customers using data from a loyalty program while

downplaying broader discounts from its circulars.

The retail pharmacy sales remained strong. Both pharmacy sales

and prescription volumes, on a same-store basis, rose 5%.

The Caremark and other pharmacy-services businesses posted a 11%

increase in sales to $26.5 billion, driven by growth in selling

specialty drugs and a 7.2% increase in processed claims.

While backing its guidance for this year, CVS projected

first-quarter earnings of $1.14 to $1.17 a share, just below

analyst expectations of $1.18 a share, according to Thomson

Reuters.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com and Paul

Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

February 09, 2016 12:03 ET (17:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

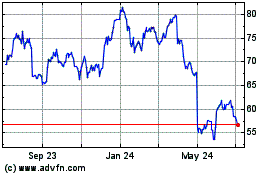

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

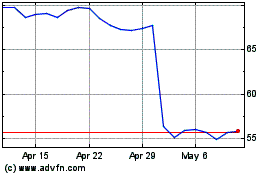

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024