UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 4, 2015

CVS HEALTH CORPORATION

(Exact Name of Registrant

as Specified in its Charter)

|

| | | | |

| | Delaware | | |

| | (State or Other Jurisdiction of Incorporation) | | |

| | | | |

001-01011 | | | | 05-0494040 |

(Commission File Number) | | | | (IRS Employer Identification No.) |

|

| | |

One CVS Drive | | |

Woonsocket, Rhode Island | | 02895 |

(Address of Principal Executive Offices) | | (Zip Code) |

|

|

Registrant’s telephone number, including area code: (401) 765-1500 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On August 4, 2015, CVS Health Corporation (the “Company”) issued a press release announcing its earnings for the three months ended June 30, 2015. Attached to this Current Report on Form 8-K as Exhibit 99.1, is a copy of the Company’s related press release dated August 4, 2015.

The information in this report is being furnished, not filed. Accordingly, the information in Item 9.01 of this report will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release, dated August 4, 2015, of CVS Health Corporation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| CVS HEALTH CORPORATION |

| |

| By: | /s/ David M. Denton |

| | David M. Denton |

| | Executive Vice President and |

| | Chief Financial Officer |

| | |

| | Dated: | August 4, 2015 |

Exhibit 99.1

|

| | | | | | |

Investor | | Nancy Christal | | Media | | Carolyn Castel |

Contact: | | Senior Vice President | | Contact: | | Vice President |

| | Investor Relations | | | | Corporate Communications |

| | (914) 722-4704 | | | | (401) 770-5717 |

FOR IMMEDIATE RELEASE

CVS HEALTH REPORTS RECORD SECOND QUARTER RESULTS

Second Quarter Year-over-year Highlights:

| |

• | Net revenues increased 7.4% to $37.2 billion |

| |

• | Operating profit increased 2.5% to $2.3 billion |

| |

• | Adjusted EPS of $1.19 and GAAP diluted EPS of $1.12, both include 3 cents of acquisition-related transaction and financing costs |

| |

• | Adjusted EPS increased 7.7% to $1.22, excluding the 3 cents of acquisition-related transaction and financing costs |

Year-to-date Highlights:

| |

• | Generated free cash flow of approximately $2.1 billion |

| |

• | Cash flow from operations of approximately $3.0 billion |

2015 Guidance Narrowed:

| |

• | Full year Adjusted EPS of $5.11 to $5.18, excluding any acquisition-related transaction and financing costs; GAAP diluted EPS of $4.64 to $4.71; both include the effect of the previously-announced reduction in 2015 share repurchases |

| |

• | Provided third quarter Adjusted EPS guidance of $1.27 to $1.30 excluding any acquisition-related transaction and financing costs; GAAP diluted EPS guidance of $1.13 to $1.16 |

| |

• | Confirmed full year free cash flow of $5.9 to $6.2 billion; cash flow from operations of $7.6 to $7.9 billion |

WOONSOCKET, RHODE ISLAND, August 4, 2015 - CVS Health Corporation (NYSE: CVS) today announced operating results for the three months ended June 30, 2015.

Revenues

Net revenues for the three months ended June 30, 2015, increased 7.4%, or $2.6 billion, to $37.2 billion compared to the three months ended June 30, 2014.

Revenues in the Pharmacy Services Segment increased 11.9%, or $2.6 billion, to $24.4 billion in the three months ended June 30, 2015. The increase was primarily driven by growth in specialty pharmacy and pharmacy network claims. Pharmacy network claims processed during the three months ended June 30, 2015, increased 8.7% to approximately 229 million compared to 210 million in the prior year. The increase in the pharmacy network claim volume was primarily due to net new business as well as growth in Managed Medicaid. Mail choice claims processed during the three months ended June 30, 2015, increased 3.9% to 21.3 million, compared to 20.5 million in the prior year. The increase in mail choice claims was driven by specialty claim volume and increased claims associated with the continued adoption of our Maintenance Choice® offerings.

Revenues in the Retail Pharmacy Segment increased 2.2%, or $371 million, to $17.2 billion in the three months ended June 30, 2015. Same store sales increased 0.5% versus the second quarter of last year, with pharmacy same store sales up 4.1% and front store same store sales down 7.8%. On a comparable basis, front store same store sales would have been approximately 780 basis points higher if tobacco and the estimated associated basket sales were excluded from the three months ended June 30, 2014. Front store same store sales were impacted by softer customer traffic, partially offset by an increase in basket size. Pharmacy same store prescription volumes rose 4.8% on a 30-day equivalent basis. Pharmacy same store sales were negatively impacted by approximately 370 basis points from recent generic drug introductions and by approximately 80 basis points from the implementation of Specialty Connect®. The implementation of Specialty Connect had a greater effect on revenues than prescription volumes due to the higher dollar value of specialty products.

For the three months ended June 30, 2015, the generic dispensing rate increased approximately 150 basis points from the prior year in both segments, rising to 83.9% in the Pharmacy Services Segment and 85.0% in the Retail Pharmacy Segment.

Operating Profit and Net Income

Operating profit for the Pharmacy Services Segment increased 7.1% and for the Retail Pharmacy Segment declined 1.4% for the three months ended June 30, 2015. Both segments benefited from the impact of increased generic drugs dispensed and favorable purchasing economics. The Pharmacy Services Segment was also positively impacted by growth in specialty pharmacy and pharmacy network volume, partially offset by price compression. The Retail Pharmacy Segment was negatively impacted by continued reimbursement pressure, partially offset by increased sales and an improved front store margin rate, largely driven by the removal of tobacco products and changes in product mix. The Corporate Segment includes $21 million of acquisition-related transaction costs for the three months ended June 30, 2015 related to the proposed acquisitions of Omnicare, Inc. (“Omnicare”) and the pharmacies and clinics of Target Corporation (“Target”). The acquisition of Omnicare is expected to close prior to the end of 2015, potentially as early as the third quarter. The close of the acquisition of the pharmacies and clinics of Target is uncertain and could occur in either 2015 or 2016.

Net income for the three months ended June 30, 2015, increased 2.1%, or $26 million, to $1.3 billion, compared with approximately $1.2 billion during the three months ended June 30, 2014. In addition to the $21 million of transaction costs discussed above, net income for the three months ended June 30, 2015 also included $36 million of pre-tax acquisition-related financing costs related to the proposed Omnicare and Target acquisitions (combined impact of approximately $0.03 per diluted share). Excluding the acquisition-related transaction and financing costs, net income increased 4.9%(1). Adjusted earnings per share (Adjusted EPS) for the three months ended June 30, 2015 and 2014, was $1.19 and $1.13, respectively. Excluding the acquisition-related transaction and financing costs, Adjusted EPS increased 7.7% to $1.22. Adjusted EPS in the three months ended June 30, excludes $131 million and $133 million in 2015 and 2014, respectively, of intangible asset amortization related to acquisition activity. GAAP earnings per share for the three months ended June 30, 2015 and 2014, was $1.12 and $1.06, respectively, an increase of 5.3%, which includes the acquisition-related transaction and financing costs.

President and Chief Executive Officer Larry Merlo stated, “I’m very pleased to report second quarter results that exceeded our expectations. On an underlying basis, we surpassed the high end of our guidance range by two cents, as operating profit in the retail business exceeded our expectations while operating profit in the PBM was in line with our guidance. We have also generated more than $2.1 billion in free cash flow in the first half of 2015, putting us well on our way to return more than $6 billion to shareholders through dividends and share repurchases this year.”

Mr. Merlo continued, “Additionally, I’m pleased to report that we’re having a highly successful 2016 PBM selling season and have won significant net new business. Our unmatched suite of assets is enabling us to bring innovative, channel-agnostic products and services to the marketplace. In this era of consumer-directed health care, our assets have uniquely positioned us to provide patients with greater choice as to how they receive their pharmacy care while driving positive impacts on adherence through face-to-face interactions. This should result in lower overall health care costs providing savings for clients as well as better health outcomes and convenience for patients.”

Guidance

Given the strong performance this quarter, along with the previously-announced acquisition-related decision to reduce this year's share repurchases by $1 billion, the Company narrowed guidance for the full year 2015 and now expects to deliver Adjusted EPS of $5.11 to $5.18, from $5.08 to $5.19 and GAAP diluted EPS of $4.64 to $4.71, from $4.80 to $4.91. This Adjusted EPS guidance excludes the impact of acquisition-related transaction and financing costs that have been recorded ($21 million of transaction costs and $36 million of financing costs for the three and six months ended June 30, 2015, or approximately $0.03 per share), and any additional costs that would be recorded if the proposed acquisitions of Omnicare and the pharmacies and clinics of Target close prior to the end of 2015. The Company continues to expect to deliver 2015 free cash flow of $5.9 billion to $6.2 billion, and 2015 cash flow from operations of $7.6 billion to $7.9 billion. For the third quarter of 2015, the Company expects to deliver Adjusted EPS of $1.27 to $1.30, excluding any acquisition-related transaction and financing costs, and GAAP diluted EPS of $1.13 to $1.16.

Real Estate Program

During the three months ended June 30, 2015, the Company opened 25 new retail drugstores and closed 5 retail drugstores and one branch for infusion and enteral services. In addition, the Company relocated 16 retail drugstores. As of June 30, 2015, the

| |

(1) | Excluding $21 million of pre-tax ($13 million after-tax) acquisition-related transaction costs and $36 million of pre-tax ($22 million after-tax) acquisition-related financing costs for the three months ended June 30, 2015, net income increased $61 million or 4.9% from $1,246 million for the three months ended June 30, 2014 to $1,307 million for the three months ended June 30, 2015. |

2

Company operated 8,028 locations in 47 states, the District of Columbia, Puerto Rico and Brazil. These locations included 7,870 retail drugstores, 18 onsite pharmacies, 24 retail specialty pharmacy stores, 11 specialty mail order pharmacies, four mail service dispensing pharmacies, and 85 branches for infusion and enteral services, including approximately 72 ambulatory infusion suites and six centers of excellence.

Teleconference and Webcast

The Company will be holding a conference call today for the investment community at 8:30 am (EDT) to discuss its quarterly results. An audio webcast of the call will be broadcast simultaneously for all interested parties through the Investor Relations section of the CVS Health website at http://investors.cvshealth.com. This webcast will be archived and available on the website for a one-year period following the conference call.

About the Company

CVS Health is a pharmacy innovation company helping people on their path to better health. Through its more than 7,800 retail drugstores, nearly 1,000 walk-in medical clinics, a leading pharmacy benefits manager with more than 70 million plan members, and expanding specialty pharmacy services, the Company enables people, businesses and communities to manage health in more affordable, effective ways. This unique integrated model increases access to quality care, delivers better health outcomes and lowers overall health care costs. Find more information about how CVS Health is shaping the future of health at www.cvshealth.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. By their nature, all forward-looking statements involve risks and uncertainties. Actual results may differ materially from those contemplated by the forward-looking statements for a number of reasons as described in our Securities and Exchange Commission filings, including those set forth in the Risk Factors section and under the section entitled "Cautionary Statement Concerning Forward-Looking Statements" in our most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q.

— Tables Follow —

CVS HEALTH CORPORATION

Condensed Consolidated Statements of Income

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

In millions, except per share amounts | | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

Net revenues | | $ | 37,169 |

| | $ | 34,602 |

| | $ | 73,501 |

| | $ | 67,291 |

|

Cost of revenues | | 30,767 |

| | 28,278 |

| | 60,935 |

| | 55,025 |

|

Gross profit | | 6,402 |

| | 6,324 |

| | 12,566 |

| | 12,266 |

|

Operating expenses | | 4,140 |

| | 4,116 |

| | 8,172 |

| | 8,034 |

|

Operating profit | | 2,262 |

| | 2,208 |

| | 4,394 |

| | 4,232 |

|

Interest expense, net | | 166 |

| | 158 |

| | 300 |

| | 316 |

|

Income before income tax provision | | 2,096 |

| | 2,050 |

| | 4,094 |

| | 3,916 |

|

Income tax provision | | 824 |

| | 804 |

| | 1,601 |

| | 1,541 |

|

Net income | | $ | 1,272 |

| | $ | 1,246 |

| | $ | 2,493 |

| | $ | 2,375 |

|

| | | | | | | | |

Net income per share: | | | | | | |

| | |

|

Basic | | $ | 1.13 |

| | $ | 1.07 |

| | $ | 2.20 |

| | $ | 2.03 |

|

Diluted | | $ | 1.12 |

| | $ | 1.06 |

| | $ | 2.19 |

| | $ | 2.01 |

|

Weighted average shares outstanding: | | | | | | | | |

Basic | | 1,124 |

| | 1,165 |

| | 1,126 |

| | 1,172 |

|

Diluted | | 1,132 |

| | 1,174 |

| | 1,134 |

| | 1,182 |

|

Dividends declared per share | | $ | 0.350 |

| | $ | 0.275 |

| | $ | 0.700 |

| | $ | 0.550 |

|

CVS HEALTH CORPORATION

Condensed Consolidated Balance Sheets

(Unaudited)

|

| | | | | | | | |

| | June 30, | | December 31, |

In millions, except per share amounts | | 2015 | | 2014 |

Assets: | | |

| | |

|

Cash and cash equivalents | | $ | 1,244 |

| | $ | 2,481 |

|

Short-term investments | | 160 |

| | 34 |

|

Accounts receivable, net | | 10,892 |

| | 9,687 |

|

Inventories | | 12,384 |

| | 11,930 |

|

Deferred income taxes | | 989 |

| | 985 |

|

Other current assets | | 732 |

| | 866 |

|

Total current assets | | 26,401 |

| | 25,983 |

|

Property and equipment, net | | 9,019 |

| | 8,843 |

|

Goodwill | | 28,122 |

| | 28,142 |

|

Intangible assets, net | | 9,683 |

| | 9,774 |

|

Other assets | | 1,443 |

| | 1,445 |

|

Total assets | | $ | 74,668 |

| | $ | 74,187 |

|

| | | | |

Liabilities: | | |

| | |

|

Accounts payable | | $ | 6,370 |

| | $ | 6,547 |

|

Claims and discounts payable | | 6,961 |

| | 5,404 |

|

Accrued expenses | | 5,543 |

| | 5,816 |

|

Short-term debt | | 1,488 |

| | 685 |

|

Current portion of long-term debt | | 24 |

| | 575 |

|

Total current liabilities | | 20,386 |

| | 19,027 |

|

Long-term debt | | 11,633 |

| | 11,630 |

|

Deferred income taxes | | 4,026 |

| | 4,036 |

|

Other long-term liabilities | | 1,490 |

| | 1,531 |

|

Commitments and contingencies | | — |

| | — |

|

| | | | |

Shareholders’ equity: | | |

| | |

|

CVS Health shareholders’ equity: | | | | |

Preferred stock, par value $0.01: 0.1 shares authorized; none issued or outstanding | | — |

| | — |

|

Common stock, par value $0.01: 3,200 shares authorized; 1,697 shares issued and 1,118 | | | | |

shares outstanding at June 30, 2015 and 1,691 shares issued and 1,140 shares | | | | |

outstanding at December 31, 2014 | | 17 |

| | 17 |

|

Treasury stock, at cost: 578 shares at June 30, 2015 and 550 shares at December 31, | | | | |

2014 | | (26,988 | ) | | (24,078 | ) |

Shares held in trust: 1 share at June 30, 2015 and December 31, 2014 | | (31 | ) | | (31 | ) |

Capital surplus | | 30,840 |

| | 30,418 |

|

Retained earnings | | 33,544 |

| | 31,849 |

|

Accumulated other comprehensive income (loss) | | (255 | ) | | (217 | ) |

Total CVS Health shareholders’ equity | | 37,127 |

| | 37,958 |

|

Noncontrolling interest | | 6 |

| | 5 |

|

Total shareholders’ equity | | 37,133 |

| | 37,963 |

|

Total liabilities and shareholders’ equity | | $ | 74,668 |

| | $ | 74,187 |

|

CVS HEALTH CORPORATION

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

| | | | | | | | |

| | Six Months Ended June 30, |

In millions | | 2015 | | 2014 |

Cash flows from operating activities: | | |

| | |

|

Cash receipts from customers | | $ | 71,014 |

| | $ | 62,932 |

|

Cash paid for inventory and prescriptions dispensed by retail network pharmacies | | (58,129 | ) | | (50,268 | ) |

Cash paid to other suppliers and employees | | (7,935 | ) | | (7,787 | ) |

Interest received | | 9 |

| | 6 |

|

Interest paid | | (311 | ) | | (331 | ) |

Income taxes paid | | (1,627 | ) | | (1,483 | ) |

Net cash provided by operating activities | | 3,021 |

| | 3,069 |

|

| | | | |

Cash flows from investing activities: | | |

| | |

|

Purchases of property and equipment | | (942 | ) | | (891 | ) |

Proceeds from sale-leaseback transactions | | 34 |

| | 5 |

|

Proceeds from sale of property and equipment and other assets | | 14 |

| | 7 |

|

Acquisitions (net of cash acquired) and other investments | | (112 | ) | | (2,248 | ) |

Purchase of available-for-sale investments | | (124 | ) | | (161 | ) |

Sale or maturity of available-for-sale investments | | 40 |

| | 103 |

|

Net cash used in investing activities | | (1,090 | ) | | (3,185 | ) |

| | | | |

Cash flows from financing activities: | | |

| | |

|

Increase in short-term debt | | 803 |

| | — |

|

Repayments of long-term debt | | (550 | ) | | (41 | ) |

Dividends paid | | (794 | ) | | (647 | ) |

Proceeds from exercise of stock options | | 211 |

| | 266 |

|

Excess tax benefits from stock-based compensation | | 97 |

| | 65 |

|

Repurchase of common stock | | (2,934 | ) | | (2,001 | ) |

Net cash used in financing activities | | (3,167 | ) | | (2,358 | ) |

Effect of exchange rates on cash and cash equivalents | | (1 | ) | | (3 | ) |

Net decrease in cash and cash equivalents | | (1,237 | ) | | (2,477 | ) |

Cash and cash equivalents at the beginning of the period | | 2,481 |

| | 4,089 |

|

Cash and cash equivalents at the end of the period | | $ | 1,244 |

| | $ | 1,612 |

|

| | | | |

Reconciliation of net income to net cash provided by operating activities: | | |

| | |

|

Net income | | $ | 2,493 |

| | $ | 2,375 |

|

Adjustments required to reconcile net income to net cash provided by operating activities: | | |

| | |

Depreciation and amortization | | 978 |

| | 965 |

|

Stock-based compensation | | 88 |

| | 77 |

|

Deferred income taxes and other non-cash items | | 6 |

| | 44 |

|

Change in operating assets and liabilities, net of effects of acquisitions: | | |

| | |

|

Accounts receivable, net | | (1,211 | ) | | (584 | ) |

Inventories | | (465 | ) | | (235 | ) |

Other current assets | | 131 |

| | (74 | ) |

Other assets | | (48 | ) | | (23 | ) |

Accounts payable and claims and discounts payable | | 1,383 |

| | 521 |

|

Accrued expenses | | (241 | ) | | 33 |

|

Other long-term liabilities | | (93 | ) | | (30 | ) |

Net cash provided by operating activities | | $ | 3,021 |

| | $ | 3,069 |

|

Adjusted Earnings Per Share

(Unaudited)

For internal comparisons, management finds it useful to assess year-over-year performance by adjusting diluted earnings per share for amortization, which primarily relates to acquisition activities.

The Company defines adjusted earnings per share as income before income tax provision plus amortization, less adjusted income tax provision and other, which is comprised of earnings allocated to participating securities, divided by the weighted average diluted shares outstanding.

The following is a reconciliation of income before income tax provision to adjusted earnings per share:

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

In millions, except per share amounts | | 2015 | | 2014 | | 2015 | | 2014 |

Income before income tax provision(1) | | $ | 2,096 |

| | $ | 2,050 |

| | $ | 4,094 |

| | $ | 3,916 |

|

Amortization | | 131 |

| | 133 |

| | 260 |

| | 264 |

|

Adjusted income before income tax provision | | 2,227 |

| | 2,183 |

| | 4,354 |

| | 4,180 |

|

Adjusted income tax provision and other(2) | | 882 |

| | 856 |

| | 1,714 |

| | 1,645 |

|

Adjusted net income | | $ | 1,345 |

| | $ | 1,327 |

| | $ | 2,640 |

| | $ | 2,535 |

|

| | | | | | | | |

Weighted average diluted shares outstanding | | 1,132 |

| | 1,174 |

| | 1,134 |

| | 1,182 |

|

Adjusted earnings per share | | $ | 1.19 |

| | $ | 1.13 |

| | $ | 2.33 |

| | $ | 2.15 |

|

Adjustments for acquisition-related costs: | | | | | | | | |

Add back: Per share acquisition-related transaction costs recorded during the three and six months ended June 30, 2015(1) | | 0.01 |

| | — |

| | 0.01 |

| | — |

|

Add back: Per share acquisition-related financing costs recorded during the three and six months ended June 30, 2015(1) | | 0.02 |

| | — |

| | 0.02 |

| | — |

|

Adjusted earnings per share (excluding acquisition-related transaction and financing costs) | | $ | 1.22 |

| | $ | 1.13 |

| | $ | 2.36 |

| | $ | 2.15 |

|

| |

(1) | Includes $21 million of acquisition-related transaction costs and $36 million of acquisition-related financing costs (for a total impact of approximately $0.03 per diluted share) during the three and six months ended June 30, 2015 related to the proposed acquisitions of Omnicare Inc. and the pharmacies and clinics of Target Corporation. Excluding these items, Adjusted EPS for the three and six months ended June 30, 2015 was $1.22 and $2.36, respectively, an increase of 7.7% and 9.9%, respectively, from the prior year. |

| |

(2) | The adjusted income tax provision is computed using the effective income tax rate computed from the condensed consolidated statement of income. “Other” includes earnings allocated to participating securities of $7 million and $12 million for the three and six months ended June 30, 2015, respectively. |

Free Cash Flow

(Unaudited)

The Company defines free cash flow as net cash provided by operating activities less net additions to properties and equipment (i.e., additions to property and equipment plus proceeds from sale-leaseback transactions).

The following is a reconciliation of net cash provided by operating activities to free cash flow:

|

| | | | | | | | |

| | Six Months Ended June 30, |

In millions | | 2015 | | 2014 |

| | | | |

Net cash provided by operating activities(1) | | $ | 3,021 |

| | $ | 3,069 |

|

Subtract: Additions to property and equipment | | (942 | ) | | (891 | ) |

Add: Proceeds from sale-leaseback transactions | | 34 |

| | 5 |

|

Free cash flow | | $ | 2,113 |

| | $ | 2,183 |

|

| |

(1) | Cash provided by operating activities for the six months ended June 30, 2015 includes $21 million of pre-tax acquisition-related transaction costs ($13 million after-tax). |

Supplemental Information

(Unaudited)

The Company evaluates its Pharmacy Services and Retail Pharmacy Segment performance based on net revenue, gross profit and operating profit before the effect of nonrecurring charges and gains and certain intersegment activities. The Company evaluates the performance of its Corporate Segment based on operating expenses before the effect of nonrecurring charges and gains and certain intersegment activities. The following is a reconciliation of the Company’s segments to the accompanying condensed consolidated financial statements:

|

| | | | | | | | | | | | | | | | | | | | |

In millions | | Pharmacy Services Segment(1) | | Retail Pharmacy Segment | | Corporate Segment | | Intersegment Eliminations(2) | | Consolidated Totals |

Three Months Ended | | |

| | |

| | |

| | |

| | |

|

June 30, 2015: | | | | | | | | | | |

Net revenues | | $ | 24,442 |

| | $ | 17,242 |

| | $ | — |

| | $ | (4,515 | ) | | $ | 37,169 |

|

Gross profit | | 1,241 |

| | 5,322 |

| | — |

| | (161 | ) | | 6,402 |

|

Operating profit (loss)(3) | | 940 |

| | 1,681 |

| | (215 | ) | | (144 | ) | | 2,262 |

|

June 30, 2014: | | |

| | |

| | |

| | |

| | |

|

Net revenues | | 21,836 |

| | 16,871 |

| | — |

| | (4,105 | ) | | 34,602 |

|

Gross profit | | 1,195 |

| | 5,299 |

| | — |

| | (170 | ) | | 6,324 |

|

Operating profit (loss) | | 878 |

| | 1,705 |

| | (205 | ) | | (170 | ) | | 2,208 |

|

Six Months Ended | | |

| | |

| | |

| | |

| | |

|

June 30, 2015: | | |

| | |

| | |

| | |

| | |

|

Net revenues | | 48,321 |

| | 34,193 |

| | — |

| | (9,013 | ) | | 73,501 |

|

Gross profit | | 2,267 |

| | 10,617 |

| | — |

| | (318 | ) | | 12,566 |

|

Operating profit (loss)(3) | | 1,675 |

| | 3,408 |

| | (404 | ) | | (285 | ) | | 4,394 |

|

June 30, 2014: | | |

| | |

| | |

| | |

| | |

|

Net revenues | | 42,031 |

| | 33,351 |

| | — |

| | (8,091 | ) | | 67,291 |

|

Gross profit | | 2,129 |

| | 10,483 |

| | — |

| | (346 | ) | | 12,266 |

|

Operating profit (loss) | | 1,518 |

| | 3,455 |

| | (395 | ) | | (346 | ) | | 4,232 |

|

(1) Net revenues of the Pharmacy Services Segment include approximately $2.2 billion and $2.0 billion of retail co-payments for the three months ended June 30, 2015 and 2014, respectively, as well as $4.7 billion and $4.2 billion of retail co-payments for the six months ended June 30, 2015 and 2014, respectively.

| |

(2) | Intersegment eliminations relate to two types of transactions: (i) Intersegment revenues that occur when Pharmacy Services Segment customers use Retail Pharmacy Segment stores to purchase covered products. When this occurs, both the Pharmacy Services and Retail Pharmacy segments record the revenue on a stand-alone basis, and (ii) Intersegment revenues, gross profit and operating profit that occur when Pharmacy Services Segment customers, through the Company’s intersegment activities (such as the Maintenance Choice® program), elect to pick-up their maintenance prescriptions at Retail Pharmacy Segment stores instead of receiving them through the mail. When this occurs, both the Pharmacy Services and Retail Pharmacy segments record the revenue, gross profit and operating profit on a standalone basis. The following amounts are eliminated in consolidation in connection with the intersegment activity described in item (ii) above: net revenues of $1.2 billion for both the three months ended June 30, 2015 and 2014, and $2.4 billion and $2.3 billion for the six months ended June 30, 2015 and 2014, respectively; gross profit of $161 million and $170 million for the three months ended June 30, 2015 and 2014, respectively, and $318 million and $346 million for the six months ended June 30, 2015 and 2014, respectively; and operating profit of $144 million and $170 million for the three months ended June 30, 2015 and 2014, respectively, and $285 million and $346 million for the six months ended June 30, 2015 and 2014, respectively. |

| |

(3) | The Corporate Segment operating loss includes $21 million of acquisition-related transaction costs for the three and six months ended June 30, 2015. |

Supplemental Information

(Unaudited)

Pharmacy Services Segment

The following table summarizes the Pharmacy Services Segment’s performance for the respective periods:

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

In millions | | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

Net revenues | | $ | 24,442 |

| | $ | 21,836 |

| | $ | 48,321 |

| | $ | 42,031 |

|

Gross profit | | 1,241 |

| | 1,195 |

| | 2,267 |

| | 2,129 |

|

Gross profit % of net revenues | | 5.1 | % | | 5.5 | % | | 4.7 | % | | 5.1 | % |

Operating expenses | | 301 |

| | 317 |

| | 592 |

| | 611 |

|

Operating expense % of net revenues | | 1.2 | % | | 1.5 | % | | 1.2 | % | | 1.5 | % |

Operating profit | | 940 |

| | 878 |

| | 1,675 |

| | 1,518 |

|

Operating profit % of net revenues | | 3.8 | % | | 4.0 | % | | 3.5 | % | | 3.6 | % |

Net revenues(1): | | |

| | |

| | |

| | |

|

Mail choice(2) | | $ | 9,107 |

| | $ | 7,753 |

| | $ | 17,857 |

| | $ | 14,587 |

|

Pharmacy network(3) | | 15,267 |

| | 14,025 |

| | 30,326 |

| | 27,327 |

|

Other | | 68 |

| | 58 |

| | 138 |

| | 117 |

|

Pharmacy claims processed(1): | | |

| | |

| | | | |

|

Total | | 250.1 |

| | 230.9 |

| | 501.3 |

| | 458.7 |

|

Mail choice(2) | | 21.3 |

| | 20.5 |

| | 41.7 |

| | 40.3 |

|

Pharmacy network(3) | | 228.8 |

| | 210.4 |

| | 459.6 |

| | 418.4 |

|

Generic dispensing rate(1): | | | | |

| | |

| | |

|

Total | | 83.9 | % | | 82.4 | % | | 83.7 | % | | 82.0 | % |

Mail choice(2) | | 76.3 | % | | 74.6 | % | | 76.2 | % | | 72.5 | % |

Pharmacy network(3) | | 84.6 | % | | 83.2 | % | | 84.4 | % | | 83.0 | % |

Mail choice penetration rate | | 20.7 | % | | 21.6 | % | | 20.2 | % | | 21.4 | % |

| |

(1) | Pharmacy network net revenues, claims processed and generic dispensing rates do not include Maintenance Choice, which are included within the mail choice category. |

| |

(2) | Mail choice is defined as claims filled at a Pharmacy Services mail facility, which include specialty mail claims, as well as 90-day claims filled at retail under the Maintenance Choice program. |

| |

(3) | Pharmacy network is defined as claims filled at retail pharmacies, including our retail drugstores, but excluding Maintenance Choice activity. |

Supplemental Information

(Unaudited)

Retail Pharmacy Segment

The following table summarizes the Retail Pharmacy Segment’s performance for the respective periods:

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

In millions | | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

Net revenues | | $ | 17,242 |

| | $ | 16,871 |

| | $ | 34,193 |

| | $ | 33,351 |

|

Gross profit | | 5,322 |

| | 5,299 |

| | 10,617 |

| | 10,483 |

|

Gross profit % of net revenues | | 30.9 | % | | 31.4 | % | | 31.0 | % | | 31.4 | % |

Operating expenses | | 3,641 |

| | 3,594 |

| | 7,209 |

| | 7,028 |

|

Operating expense % of net revenues | | 21.1 | % | | 21.3 | % | | 21.1 | % | | 21.1 | % |

Operating profit | | 1,681 |

| | 1,705 |

| | 3,408 |

| | 3,455 |

|

Operating profit % of net revenues | | 9.7 | % | | 10.1 | % | | 10.0 | % | | 10.4 | % |

Retail prescriptions filled (90 Day = 3 Rx) (1) | | 244.1 |

| | 230.3 |

| | 485.5 |

| | 457.4 |

|

Net revenue increase (decrease): | | |

| | |

| | |

| | |

|

Total | | 2.2 | % | | 4.5 | % | | 2.5 | % | | 3.6 | % |

Pharmacy | | 5.2 | % | | 5.4 | % | | 5.2 | % | | 4.8 | % |

Front store | | (5.1 | )% | | 1.1 | % | | (4.4 | )% | | (0.6 | )% |

Total prescription volume (90 Day = 3 Rx) (1) | | 6.0 | % | | 4.8 | % | | 6.1 | % | | 3.8 | % |

Same store increase (decrease)(2): | | |

| | |

| | | | |

|

Total sales | | 0.5 | % | | 3.3 | % | | 0.8 | % | | 2.4 | % |

Pharmacy sales | | 4.1 | % | | 5.0 | % | | 4.2 | % | | 4.4 | % |

Front store sales(3) | | (7.8 | )% | | (0.4 | )% | | (7.0 | )% | | (2.1 | )% |

Prescription volume (90 Day = 3 Rx) (1) | | 4.8 | % | | 3.9 | % | | 4.9 | % | | 3.0 | % |

Generic dispensing rate | | 85.0 | % | | 83.5 | % | | 84.7 | % | | 83.2 | % |

Pharmacy % of total revenues | | 71.6 | % | | 69.6 | % | | 71.6 | % | | 69.8 | % |

Third party % of pharmacy revenue | | 98.8 | % | | 98.7 | % | | 98.7 | % | | 98.5 | % |

| |

(1) | Includes the adjustment to convert 90-day, non-specialty prescriptions to the equivalent of three 30-day prescriptions. This adjustment reflects the fact that these prescriptions include approximately three times the amount of product days supplied compared to a normal prescription. |

| |

(2) | Same store sales exclude revenues from MinuteClinic and stores in Brazil. |

| |

(3) | On a comparable basis, front store same store sales would have been approximately 780 and 790 basis points higher for the three and six months ended June 30, 2015, respectively, if tobacco and the estimated associated basket sales were excluded from the three and six months ended June 30, 2014. |

Adjusted Earnings Per Share Guidance

(Unaudited)

The following reconciliation of estimated income before income tax provision to estimated adjusted earnings per share contains forward-looking information. All forward-looking information involves risks and uncertainties. Actual results may differ materially from those contemplated by the forward-looking information for a number of reasons as described in our Securities and Exchange Commission filings, including those set forth in the Risk Factors section and under the section entitled “Cautionary Statement Concerning Forward-Looking Statements” in our most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q. For internal comparisons, management finds it useful to assess year-over-year performance by adjusting diluted earnings per share for amortization, which primarily relates to acquisition activities.

|

| | | | | | | | |

In millions, except per share amounts | | Year Ending December 31, 2015 |

| | | | |

Income before income tax provision(2)(3)(4) | | $ | 8,638 |

| | $ | 8,776 |

|

Amortization | | 522 |

| | 521 |

|

Adjusted income before income tax provision | | 9,160 |

| | 9,297 |

|

Adjusted income tax provision and other(1) | | 3,622 |

| | 3,676 |

|

Adjusted net income | | $ | 5,538 |

| | $ | 5,621 |

|

| | | | |

Weighted average diluted shares outstanding | | 1,126 |

| | 1,126 |

|

Adjusted earnings per share | | $ | 4.92 |

| | $ | 4.99 |

|

Adjustments for acquisition-related costs: | | | | |

Add back: Per share acquisition-related transaction and financing costs recorded during the six months ended June 30, 2015(2) | | 0.03 |

| | 0.03 |

|

Add back: Per share acquisition-related transaction and financing costs estimated from July 1, 2015 to December 31, 2015(3)(4) | | 0.16 |

| | 0.16 |

|

Adjusted earnings per share (excluding acquisition-related transaction and financing costs) | | $ | 5.11 |

| | $ | 5.18 |

|

|

| | | | | | | | |

In millions, except per share amounts | | Three Months Ending September 30, 2015 |

| | | | |

Income before income tax provision | | $ | 2,103 |

| | $ | 2,165 |

|

Amortization | | 131 |

| | 131 |

|

Adjusted income before income tax provision | | 2,234 |

| | 2,296 |

|

Adjusted income tax provision and other(1) | | 889 |

| | 914 |

|

Adjusted net income | | $ | 1,345 |

| | $ | 1,382 |

|

| | | | |

Weighted average diluted shares outstanding | | 1,122 |

| | 1,122 |

|

Adjusted earnings per share | | $ | 1.20 |

| | $ | 1.23 |

|

Adjustments for acquisition-related costs: | | | | |

Add back: Financing costs estimated for the third quarter(5) | | 0.07 |

| | 0.07 |

|

Adjusted earnings per share (excluding acquisition-related financing costs) | | $ | 1.27 |

| | $ | 1.30 |

|

| |

(1) | The adjusted income tax provision is computed using the effective income tax rate from the consolidated statement of income. Other includes earnings allocated to participating securities. |

| |

(2) | During the three and six months ended June 30, 2015, the Company recorded $21 million of acquisition-related transaction costs and $36 million of acquisition-related financing costs related to the proposed acquisitions of Omnicare, Inc. and the pharmacies and clinics of Target Corporation. The total impact of these costs was approximately $0.03 per share. |

| |

(3) | The acquisition-related transaction costs for the proposed acquisition of Omnicare, Inc. for the period from July 1, 2015 through December 31, 2015 are estimated to be $0.03 per share. Depending on the timing of the close of the proposed acquisition of the pharmacies and clinics of Target Corporation, there could be another $0.02 of transaction costs. |

| |

(4) | The acquisition-related financing costs for the period from July 1, 2015 to December 31, 2015 are estimated to be $0.13 per share. |

| |

(5) | The acquisition-related financing costs for the three months ending September 30, 2015 are estimated to be $0.07 per share. |

Free Cash Flow Guidance

(Unaudited)

The following reconciliation of net cash provided by operating activities to free cash flow contains forward-looking information. All forward-looking information involves risks and uncertainties. Actual results may differ materially from those contemplated by the forward-looking information for a number of reasons as described in our Securities and Exchange Commission filings, including those set forth in the Risk Factors section and under the section entitled “Cautionary Statement Concerning Forward-Looking Statements” in our most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q. For internal comparisons, management finds it useful to assess year-over-year cash flow performance by adjusting cash provided by operating activities, by capital expenditures and proceeds from sale-leaseback transactions.

|

| | | | | | | | |

In millions | | Year Ending December 31, 2015 |

| | | | |

Net cash provided by operating activities | | $ | 7,550 |

| | $ | 7,949 |

|

Subtract: Additions to property and equipment | | (2,300 | ) | | (2,200 | ) |

Add: Proceeds from sale-leaseback transactions | | 600 |

| | 500 |

|

Free cash flow | | $ | 5,850 |

| | $ | 6,249 |

|

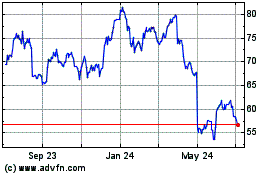

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

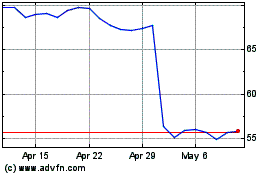

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024