UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended March 31, 2015

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to _________.

Commission File Number 001-01011

CVS HEALTH CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | | | 05-0494040 |

(State of Incorporation) | | | | (I.R.S. Employer Identification Number) |

One CVS Drive, Woonsocket, Rhode Island 02895

(Address of principal executive offices)

Registrant's telephone number, including area code: (401) 765-1500

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes[X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | |

Large accelerated filer [X] | | Accelerated filer [ ] |

Non-accelerated filer [ ] (Do not check if a smaller reporting company) | | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Common Stock, $0.01 par value, issued and outstanding at April 24, 2015:

1,128,330,774 shares

INDEX

|

| | |

| Page |

| |

| |

Item 1. | Financial Statements | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

CVS Health Corporation

Condensed Consolidated Statements of Income

(Unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

In millions, except per share amounts | 2015 | | 2014 |

| | | |

Net revenues | $ | 36,332 |

| | $ | 32,689 |

|

Cost of revenues | 30,168 |

| | 26,747 |

|

Gross profit | 6,164 |

| | 5,942 |

|

Operating expenses | 4,032 |

| | 3,918 |

|

Operating profit | 2,132 |

| | 2,024 |

|

Interest expense, net | 134 |

| | 158 |

|

Income before income tax provision | 1,998 |

| | 1,866 |

|

Income tax provision | 777 |

| | 737 |

|

Net income | $ | 1,221 |

| | $ | 1,129 |

|

| | | |

Net income per share: | |

| | |

|

Basic | $ | 1.08 |

| | $ | 0.96 |

|

Diluted | $ | 1.07 |

| | $ | 0.95 |

|

Weighted average shares outstanding: | | | |

Basic | 1,128 |

| | 1,180 |

|

Diluted | 1,136 |

| | 1,190 |

|

Dividends declared per share | $ | 0.350 |

| | $ | 0.275 |

|

See accompanying notes to condensed consolidated financial statements.

CVS Health Corporation

Condensed Consolidated Statements of Comprehensive Income

(Unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

In millions | 2015 | | 2014 |

| | | |

Net income | $ | 1,221 |

| | $ | 1,129 |

|

Other comprehensive income (loss): | |

| | |

|

Foreign currency translation adjustments, net of tax | (48 | ) | | 9 |

|

Cash flow hedges, net of tax | 1 |

| | 1 |

|

Total other comprehensive income (loss) | (47 | ) | | 10 |

|

Comprehensive income | $ | 1,174 |

| | $ | 1,139 |

|

See accompanying notes to condensed consolidated financial statements.

CVS Health Corporation

Condensed Consolidated Balance Sheets

(Unaudited)

|

| | | | | | | |

In millions, except per share amounts | March 31,

2015 | | December 31,

2014 |

| | | |

Assets: | | | |

Cash and cash equivalents | $ | 1,518 |

| | $ | 2,481 |

|

Short-term investments | 116 |

| | 34 |

|

Accounts receivable, net | 10,162 |

| | 9,687 |

|

Inventories | 12,231 |

| | 11,930 |

|

Deferred income taxes | 1,001 |

| | 985 |

|

Other current assets | 594 |

| | 866 |

|

Total current assets | 25,622 |

| | 25,983 |

|

Property and equipment, net | 8,871 |

| | 8,843 |

|

Goodwill | 28,123 |

| | 28,142 |

|

Intangible assets, net | 9,759 |

| | 9,774 |

|

Other assets | 1,555 |

| | 1,510 |

|

Total assets | $ | 73,930 |

| | $ | 74,252 |

|

| | | |

Liabilities: | |

| | |

|

Accounts payable | $ | 6,431 |

| | $ | 6,547 |

|

Claims and discounts payable | 6,273 |

| | 5,404 |

|

Accrued expenses | 5,936 |

| | 5,816 |

|

Short-term debt | 500 |

| | 685 |

|

Current portion of long-term debt | 573 |

| | 575 |

|

Total current liabilities | 19,713 |

| | 19,027 |

|

Long-term debt | 11,689 |

| | 11,695 |

|

Deferred income taxes | 4,020 |

| | 4,036 |

|

Other long-term liabilities | 1,513 |

| | 1,531 |

|

Commitments and contingencies (Note 8) | — |

| | — |

|

| | | |

Shareholders’ equity: | |

| | |

|

CVS Health shareholders’ equity: | | | |

Preferred stock, par value $0.01: 0.1 share authorized; none issued or outstanding | — |

| | — |

|

Common stock, par value $0.01: 3,200 shares authorized; 1,693 shares issued and 1,127 | | | |

shares outstanding at March 31, 2015 and 1,691 shares issued and 1,140 shares | | | |

outstanding at December 31, 2014 | 17 |

| | 17 |

|

Treasury stock, at cost: 565 shares at March 31, 2015 and 550 shares at December 31, | | | |

2014 | (25,634 | ) | | (24,078 | ) |

Shares held in trust: 1 share at March 31, 2015 and December 31, 2014 | (31 | ) | | (31 | ) |

Capital surplus | 30,235 |

| | 30,418 |

|

Retained earnings | 32,667 |

| | 31,849 |

|

Accumulated other comprehensive income (loss) | (264 | ) | | (217 | ) |

Total CVS Health shareholders’ equity | 36,990 |

| | 37,958 |

|

Noncontrolling interest | 5 |

| | 5 |

|

Total shareholders’ equity | 36,995 |

| | 37,963 |

|

Total liabilities and shareholders’ equity | $ | 73,930 |

| | $ | 74,252 |

|

See accompanying notes to condensed consolidated financial statements.

CVS Health Corporation

Condensed Consolidated Statements of Cash Flows

(Unaudited) |

| | | | | | | |

| Three Months Ended March 31, |

In millions | 2015 | | 2014 |

Cash flows from operating activities: | | | |

Cash receipts from customers | $ | 34,570 |

| | $ | 30,505 |

|

Cash paid for inventory and prescriptions dispensed by retail network pharmacies | (28,276 | ) | | (23,966 | ) |

Cash paid to other suppliers and employees | (4,162 | ) | | (4,196 | ) |

Interest received | 3 |

| | 3 |

|

Interest paid | (87 | ) | | (104 | ) |

Income taxes paid | (64 | ) | | (70 | ) |

Net cash provided by operating activities | 1,984 |

| | 2,172 |

|

| | | |

Cash flows from investing activities: | |

| | |

|

Purchases of property and equipment | (419 | ) | | (388 | ) |

Proceeds from sale-leaseback transactions | 25 |

| | 5 |

|

Proceeds from sale of property and equipment and other assets | 8 |

| | 5 |

|

Acquisitions (net of cash acquired) and other investments | (61 | ) | | (2,194 | ) |

Purchase of available-for-sale investments | (113 | ) | | (43 | ) |

Sales/maturities of available-for-sale investments | 16 |

| | 55 |

|

Net cash used in investing activities | (544 | ) | | (2,560 | ) |

| | | |

Cash flows from financing activities: | |

| | |

|

Decrease in short-term debt | (185 | ) | | — |

|

Dividends paid | (399 | ) | | (325 | ) |

Proceeds from exercise of stock options | 126 |

| | 154 |

|

Excess tax benefits from stock-based compensation | 59 |

| | 37 |

|

Repurchase of common stock | (2,007 | ) | | (801 | ) |

Net cash used in financing activities | (2,406 | ) | | (935 | ) |

Effect of exchange rate changes on cash and cash equivalents | 3 |

| | — |

|

Net decrease in cash and cash equivalents | (963 | ) | | (1,323 | ) |

Cash and cash equivalents at beginning of period | 2,481 |

| | 4,089 |

|

Cash and cash equivalents at end of period | $ | 1,518 |

| | $ | 2,766 |

|

| | | |

Reconciliation of net income to net cash provided by operating activities: | |

| | |

|

Net income | $ | 1,221 |

| | $ | 1,129 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | |

| | |

|

Depreciation and amortization | 490 |

| | 477 |

|

Stock-based compensation | 44 |

| | 35 |

|

Deferred income taxes and other noncash items | (31 | ) | | 16 |

|

Change in operating assets and liabilities, net of effects from acquisitions: | |

| | |

|

Accounts receivable, net | (481 | ) | | (139 | ) |

Inventories | (313 | ) | | (64 | ) |

Other current assets | 269 |

| | 70 |

|

Other assets | (52 | ) | | (39 | ) |

Accounts payable and claims and discounts payable | 756 |

| | 339 |

|

Accrued expenses | 153 |

| | 362 |

|

Other long-term liabilities | (72 | ) | | (14 | ) |

Net cash provided by operating activities | $ | 1,984 |

| | $ | 2,172 |

|

See accompanying notes to condensed consolidated financial statements.

CVS Health Corporation

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1 – Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of CVS Health Corporation and its subsidiaries (collectively “CVS Health” or the “Company”) have been prepared in accordance with the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) regarding interim financial reporting. In accordance with such rules and regulations, certain information and accompanying note disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) have been condensed or omitted, although the Company believes the disclosures included herein are adequate to make the information presented not misleading. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto, which are included in Exhibit 13 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 (“2014 Form 10-K”).

In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all adjustments consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the interim periods presented. Because of the influence of various factors on the Company’s operations, including business combinations, certain holidays and other seasonal influences, net income for any interim period may not be comparable to the same interim period in previous years or necessarily indicative of income for the full year.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of the Company and its majority-owned subsidiaries and variable interest entities (“VIE's”) for which the Company is the primary beneficiary. All material intercompany balances and transactions have been eliminated.

The Company continually evaluates its investments to determine if they represent variable interests in a VIE. If the Company determines that it has a variable interest in a VIE, the Company then evaluates if it is the primary beneficiary of the VIE. The evaluation is a qualitative assessment as to whether the Company has the ability to direct the activities of a VIE that most significantly impact the entity’s economic performance. The Company consolidates a VIE if it is considered to be the primary beneficiary.

Assets and liabilities of VIEs for which the Company is the primary beneficiary were not significant to the Company’s condensed consolidated financial statements. VIE creditors do not have recourse against the general credit of the Company.

Fair Value of Financial Instruments

The Company utilizes the three-level valuation hierarchy for the recognition and disclosure of fair value measurements. The categorization of assets and liabilities within this hierarchy is based upon the lowest level of input that is significant to the measurement of fair value. The three levels of the hierarchy consist of the following:

| |

• | Level 1 – Inputs to the valuation methodology are unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date. |

| |

• | Level 2 – Inputs to the valuation methodology are quoted prices for similar assets and liabilities in active markets, quoted prices in markets that are not active or inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the instrument. |

| |

• | Level 3 – Inputs to the valuation methodology are unobservable inputs based upon management’s best estimate of inputs market participants could use in pricing the asset or liability at the measurement date, including assumptions about risk. |

As of March 31, 2015, the carrying value of cash and cash equivalents, short-term and long-term investments, accounts receivable and accounts payable approximated their fair value due to the nature of these financial instruments. The Company

invests in money market funds, commercial paper and time deposits that are classified as cash and cash equivalents within the accompanying condensed consolidated balance sheets, as these funds are highly liquid and readily convertible to known amounts of cash. These investments are classified within Level 1 of the fair value hierarchy because they are valued using quoted market prices. The Company’s short-term investments consist of certificates of deposit with initial maturities of greater than three months when purchased that mature in less than one year from the balance sheet date. The Company’s long-term investments of $44 million at March 31, 2015, which are classified as noncurrent other assets within the accompanying condensed consolidated balance sheet, consist of certificates of deposit. These investments, which are classified within Level 1 of the fair value hierarchy, are carried at fair value, which approximated historical cost at March 31, 2015. The carrying amount and estimated fair value of the Company’s total long-term debt was $12.3 billion and $13.4 billion, respectively, as of March 31, 2015. The fair value of the Company’s long-term debt was estimated based on quoted prices currently offered in active markets for the Company’s debt, which is considered Level 1 of the fair value hierarchy.

Related Party Transactions

The Company has an equity method investment in SureScripts, LLC (“SureScripts”), which operates a clinical health information network. The Pharmacy Services and Retail Pharmacy segments utilize this clinical health information network in providing services to client plan members and retail customers. The Company expensed fees of approximately $13 million and $16 million in the three months ended March 31, 2015 and 2014, respectively, for the use of this network.

The Company's investment in and equity in earnings in SureScripts for all periods presented is immaterial.

New Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (Topic 606). ASU No. 2014-09 outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. This new guidance is expected to be effective for annual reporting periods (including interim reporting periods within those periods) beginning January 1, 2018; early adoption in 2017 is permitted. Companies have the option of using either a full retrospective or a modified retrospective approach to adopt the guidance. This update could impact the timing and amounts of revenue recognized. The Company is currently evaluating the effect that implementation of this update will have on its consolidated financial position and results of operations upon adoption, as well as the method of transition and required disclosures.

In April 2015, the FASB issued ASU No. 2015-03, Simplifying the Presentation of Debt Issuance Costs (Topic 835-30). ASU No. 2015-03 requires the presentation of debt issuance costs in the balance sheet as a direct deduction from the related debt liability rather than as an asset. Amortization of such costs is reported as interest expense. This change conforms the presentation with that of debt discounts. The ASU is effective for annual reporting periods (including interim reporting periods within those periods) beginning after December 15, 2015; early adoption is permitted. The guidance is required to be applied retrospectively to all prior periods. Had the Company adopted this ASU, other noncurrent assets and long-term debt would both have been $62 million and $65 million lower as of March 31, 2015 and December 31, 2014, respectively.

Note 2 – Changes in Accounting Principle

Effective January 1, 2015, the Company changed its methods of accounting for “front store” inventories in the Retail Pharmacy Segment. Prior to 2015, the Company valued front store inventories at the lower of cost or market on a first-in, first-out (“FIFO”) basis in retail stores using the retail inventory method and in distribution centers using the FIFO cost method. Effective January 1, 2015, all front store inventories in the Retail Pharmacy Segment have been valued at the lower of cost or market using the weighted average cost method. These changes affected approximately 36% of consolidated inventories.

These changes were made primarily to provide the Company with better information to manage its retail front store operations and to bring all of the Company’s inventories to a common inventory valuation methodology. The Company believes the weighted average cost method is preferable to the retail inventory method and the FIFO cost method because it results in greater precision in the determination of cost of revenues and inventories at the stock keeping unit (“SKU”) level and results in a consistent inventory valuation method for all of the Company’s inventories as all of the Company’s remaining inventories, which consist of prescription drugs, were already being valued using the weighted average cost method.

The Company recorded the cumulative effect of these changes in accounting principle as of January 1, 2015. The Company determined that retrospective application for periods prior to 2015 is impracticable, as the period-specific information necessary

to value front store inventories in the Retail Pharmacy Segment under the weighted average cost method is unavailable. The Company implemented a new perpetual inventory system to manage front store inventory at the SKU level and valued front store inventory as of January 1, 2015 and calculated the cumulative impact. The effect of these changes in accounting principle as of January 1, 2015, was a decrease in inventories of $7 million, an increase in current deferred income tax assets of $3 million and a decrease in retained earnings of $4 million.

Had the Company not made these changes in accounting principle, for the three months ended March 31, 2015, net income would have been $4 million higher, and basic and diluted net income per share would have been the same as reported.

Note 3 – Share Repurchase Programs

As of March 31, 2015, the Company had the following outstanding share repurchase programs that were authorized by the Company's Board of Directors:

|

| | | | | | | | | | |

In billions | | | | | | |

Authorization Date | Authorized | Remaining |

December 15, 2014 (“2014 Repurchase Program”) | | $ | 10.0 |

| | | $ | 10.0 |

| |

December 17, 2013 (“2013 Repurchase Program”) | | $ | 6.0 |

| | | 0.7 |

| |

| | | | | $ | 10.7 |

| |

The share repurchase programs, each of which was effective immediately, permit the Company to effect repurchases from time to time through a combination of open market repurchases, privately negotiated transactions, accelerated share repurchase transactions, and/or other derivative transactions. The repurchase programs may be modified or terminated by the Board of Directors at any time.

During the three months ended March 31, 2015, the Company repurchased an aggregate of approximately 16.8 million shares of common stock for approximately $2.0 billion pursuant to the 2013 Repurchase Program as discussed below.

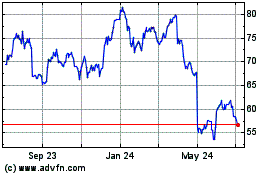

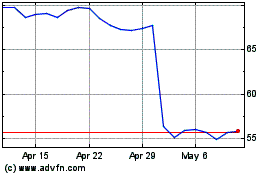

Pursuant to the authorization under the 2013 Repurchase Program, effective January 2, 2015, the Company entered into a $2.0 billion fixed dollar accelerated share repurchase (“ASR”) agreement with JPMorgan Chase Bank (“JPMorgan”). Upon payment of the $2.0 billion purchase price on January 5, 2015, the Company received a number of shares of our common stock equal to 80% of the $2.0 billion notional amount of the ASR agreement or approximately 16.8 million shares. At the conclusion of the ASR program, the Company will receive additional shares equal to the remaining 20% of the $2.0 billion notional amount. The ultimate number of shares the Company receives fluctuates based on changes in the daily volume weighted average price of the Company's stock over the period which began on January 2, 2015 and ended on April 30, 2015. If the mean daily volume weighted average price of the Company's common stock, less a discount (the “forward price”), during the ASR program falls below $94.49 per share, the Company would receive a higher number of shares from JPMorgan. If the forward price rises above $94.49 per share, the Company would either receive fewer shares from JPMorgan or, potentially have an obligation to JPMorgan which, at the Company's option, could be settled in additional cash or by issuing shares. Under the terms of the ASR agreement, the maximum number of shares that could be received or delivered, including the initial shares received, is 42.0 million. The initial 16.8 million shares of common stock delivered to the Company by JPMorgan were placed into treasury stock in January 2015. On May 1, 2015, the Company received approximately 3.1 million shares of common stock, representing the remaining 20% of the $2.0 billion notional amount of the ASR agreement, thereby concluding the agreement. This brings the average price per share for the total 19.9 million shares delivered to $100.64 per share. The remaining 3.1 million shares of common stock delivered to the Company by JPMorgan were placed into treasury stock in May 2015.

The ASR agreement was accounted for as an initial treasury stock transaction for approximately $1.6 billion and a forward contract for approximately $0.4 billion. The forward contract was classified as an equity instrument and was recorded within capital surplus on the condensed consolidated balance sheet at March 31, 2015. The forward contract will be reclassified to treasury stock upon the settlement of the agreement in May 2015. The initial repurchase of the shares resulted in an immediate reduction of the outstanding shares used to calculate the weighted average common shares outstanding for basic and diluted net income per share.

Note 4 – Accumulated Other Comprehensive Income

Accumulated other comprehensive income (loss) consists of foreign currency translation adjustments, unrealized losses on cash flow hedges executed in previous years associated with the issuance of long-term debt, and changes in the net actuarial gains and losses associated with pension and other postretirement benefit plans. The following table summarizes the activity within the components of accumulated other comprehensive income (loss).

Changes in accumulated other comprehensive income (loss) by component are shown below(1):

|

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2015 |

In millions | Foreign Currency | | Losses on Cash Flow Hedges | | Pension and Other Postretirement Benefits | | Total |

Balance, December 31, 2014 | $ | (65 | ) | | $ | (9 | ) | | $ | (143 | ) | | $ | (217 | ) |

Other comprehensive income (loss) before reclassifications | (48 | ) | | — |

| | — |

| | (48 | ) |

Amounts reclassified from accumulated other comprehensive income (2) | — |

| | 1 |

| | — |

| | 1 |

|

Other comprehensive income (loss) | (48 | ) | | 1 |

| | — |

| | (47 | ) |

Balance, March 31, 2015 | $ | (113 | ) | | $ | (8 | ) | | $ | (143 | ) | | $ | (264 | ) |

| | | | | | | |

| Three Months Ended March 31, 2014 |

| Foreign Currency | | Losses on Cash Flow Hedges | | Pension and Other Postretirement Benefits | | Total |

Balance, December 31, 2013 | $ | (30 | ) | | $ | (13 | ) | | $ | (106 | ) | | $ | (149 | ) |

Other comprehensive income before reclassifications | 9 |

| | — |

| | — |

| | 9 |

|

Amounts reclassified from accumulated other comprehensive income (2) | — |

| | 1 |

| | — |

| | 1 |

|

Other comprehensive income | 9 |

| | 1 |

| | — |

| | 10 |

|

Balance, March 31, 2014 | $ | (21 | ) | | $ | (12 | ) | | $ | (106 | ) | | $ | (139 | ) |

| | | | | | | |

| |

(1) | All amounts are net of tax. |

| |

(2) | The amounts reclassified from accumulated other comprehensive income for losses on cash flow hedges are recorded within interest expense, net on the condensed consolidated statement of income. The amounts reclassified from accumulated other comprehensive income for pension and other postretirement benefits are included in operating expenses on the condensed consolidated statement of income. |

Note 5 – Interest Expense

The following are the components of net interest expense:

|

| | | | | | | |

| Three Months Ended March 31, |

In millions | 2015 | | 2014 |

Interest expense | $ | 137 |

| | $ | 161 |

|

Interest income | (3 | ) | | (3 | ) |

Interest expense, net | $ | 134 |

| | $ | 158 |

|

Note 6 – Earnings Per Share

Earnings per share is computed using the two-class method. Options to purchase less than one million shares of common stock were outstanding, but were not included in the calculation of diluted earnings per share for the three months ended March 31, 2015 and 2014, because the options’ exercise prices were greater than the average market price of the common shares and, therefore, the effect would be antidilutive.

The following is a reconciliation of basic and diluted net income per share for the respective periods:

|

| | | | | | | |

| Three Months Ended

March 31, |

In millions, except per share amounts | 2015 | | 2014 |

Numerator for earnings per share calculations: | | | |

Net income(1) | $ | 1,216 |

| | $ | 1,129 |

|

| | | |

Denominators for earnings per share calculations: | |

| | |

|

Weighted average shares, basic | 1,128 |

| | 1,180 |

|

Effect of dilutive securities | 8 |

| | 10 |

|

Weighted average shares, diluted | 1,136 |

| | 1,190 |

|

| | | |

Net income per share: | |

| | |

|

Basic | $ | 1.08 |

| | $ | 0.96 |

|

Diluted | $ | 1.07 |

| | $ | 0.95 |

|

| |

(1) | Comprised of net income less amounts allocable to participating securities of $5 million for the three months ended March 31, 2015. |

Note 7 – Segment Reporting

The Company has three reportable segments: Pharmacy Services, Retail Pharmacy and Corporate. The Company’s segments maintain separate financial information for which operating results are evaluated on a regular basis by the Company’s chief operating decision maker in deciding how to allocate resources and in assessing performance. The Company evaluates its Pharmacy Services and Retail Pharmacy segments’ performance based on net revenue, gross profit and operating profit before the effect of nonrecurring charges and gains and certain intersegment activities. The Company evaluates the performance of its Corporate Segment based on operating expenses before the effect of nonrecurring charges and gains and certain intersegment activities.

The Pharmacy Services Segment provides a full range of pharmacy benefit management (“PBM”) services including plan design and administration, formulary management, Medicare Part D services, mail order, specialty pharmacy and infusion services, retail pharmacy network management services, prescription management systems, clinical services, disease management services and medical spend management. The Company’s clients are primarily employers, insurance companies, unions, government employee groups, health plans, Managed Medicaid plans and other sponsors of health benefit plans, and individuals throughout the United States. A portion of covered lives primarily within the Managed Medicaid, health plan and employer markets have access to our services through public and private exchanges. Through the Company’s SilverScript Insurance Company subsidiary, the Company is a national provider of drug benefits to eligible beneficiaries under the federal government’s Medicare Part D program. The Pharmacy Services Segment operates under the CVS/caremarkTM Pharmacy Services, Caremark®, CVS CaremarkTM, CVS/caremarkTM, CarePlus CVS/pharmacy®, CVS/specialtyTM, RxAmerica®, Accordant®, SilverScript®, Novologix®, Coram® and Navarro® Health Services names. As of March 31, 2015, the Pharmacy Services Segment operated 24 retail specialty pharmacy stores, 11 specialty mail order pharmacies, four mail service dispensing pharmacies, and 86 branches for infusion and enteral services, including approximately 70 ambulatory infusion suites and six centers of excellence, located in 40 states, Puerto Rico and the District of Columbia.

The Retail Pharmacy Segment sells prescription drugs and a wide assortment of general merchandise, including over-the-counter drugs, beauty products and cosmetics, personal care products, convenience foods, photo finishing, seasonal merchandise and greeting cards through the Company’s CVS/pharmacy®, CVS®, Longs Drugs®, Navarro Discount Pharmacy® and Drogaria Onofre® retail stores and online through CVS.com®, Navarro.comTM and Onofre.com.brTM. As of March 31, 2015, the Retail Pharmacy Segment included 7,850 retail drugstores (of which 7,794 operated a pharmacy), 17 onsite pharmacies, 986 retail medical clinics, and the online retail websites, CVS.com, Navarro.com and Onofre.com.br. The retail drugstores are

located in 44 states, the District of Columbia, Puerto Rico and Brazil. The retail health care clinics operate under the MinuteClinic® name, and 978 are located within CVS/pharmacy stores. MinuteClinics utilize nationally-recognized medical protocols to diagnose and treat minor health conditions, perform health screenings, monitor chronic conditions and deliver vaccinations. The clinics are staffed by board-certified nurse practitioners and physician assistants who provide access to affordable care without appointment.

The Corporate Segment provides management and administrative services to support the Company. The Corporate Segment consists of certain aspects of executive management, corporate relations, legal, compliance, human resources, corporate information technology and finance departments.

|

| | | | | | | | | | | | | | | | | | | |

In millions | Pharmacy Services Segment(1) | | Retail Pharmacy Segment | | Corporate Segment | | Intersegment Eliminations(2) | | Consolidated Totals |

Three Months Ended | | | | | | | | | |

March 31, 2015: | | | | | | | | | |

Net revenues | $ | 23,879 |

| | $ | 16,951 |

| | $ | — |

| | $ | (4,498 | ) | | $ | 36,332 |

|

Gross profit | 1,026 |

| | 5,295 |

| | — |

| | (157 | ) | | 6,164 |

|

Operating profit (loss) | 734 |

| | 1,727 |

| | (189 | ) | | (140 | ) | | 2,132 |

|

March 31, 2014: | |

| | |

| | |

| | |

| | |

|

Net revenues | 20,195 |

| | 16,480 |

| | — |

| | (3,986 | ) | | 32,689 |

|

Gross profit | 934 |

| | 5,184 |

| | — |

| | (176 | ) | | 5,942 |

|

Operating profit (loss) | 640 |

| | 1,750 |

| | (190 | ) | | (176 | ) | | 2,024 |

|

(1) Net revenues of the Pharmacy Services Segment include approximately $2.5 billion and $2.2 billion of retail co-payments for the three months ended March 31, 2015 and 2014, respectively.

(2) Intersegment eliminations relate to two types of transactions: (i) Intersegment revenues that occur when Pharmacy Services Segment customers use Retail Pharmacy Segment stores to purchase covered products. When this occurs, both the Pharmacy Services and Retail Pharmacy segments record the revenue on a stand-alone basis, and (ii) Intersegment revenues, gross profit and operating profit that occur when Pharmacy Services Segment customers, through the Company’s intersegment activities (such as the Maintenance Choice® program), elect to pick-up their maintenance prescriptions at Retail Pharmacy Segment stores instead of receiving them through the mail. When this occurs, both the Pharmacy Services and Retail Pharmacy segments record the revenue, gross profit and operating profit on a standalone basis. The following amounts are eliminated in consolidation in connection with the intersegment activity described in item (ii) above: net revenues of $1.2 billion and $1.1 billion for the three months ended March 31, 2015 and 2014, respectively; gross profit of $157 million and $176 million for the three months ended March 31, 2015 and 2014, respectively; and operating profit of $140 million and $176 million for the three months ended March 31, 2015 and 2014, respectively.

Note 8 – Commitments and Contingencies

Lease Guarantees

Between 1991 and 1997, the Company sold or spun off a number of subsidiaries, including Bob’s Stores, Linens ‘n Things, Marshalls, Kay-Bee Toys, Wilsons, This End Up and Footstar. In many cases, when a former subsidiary leased a store, the Company provided a guarantee of the store’s lease obligations. When the subsidiaries were disposed of, the Company’s guarantees remained in place, although each initial purchaser has agreed to indemnify the Company for any lease obligations the Company was required to satisfy. If any of the purchasers or any of the former subsidiaries were to become insolvent and failed to make the required payments under a store lease, the Company could be required to satisfy these obligations.

As of March 31, 2015, the Company guaranteed approximately 72 such store leases (excluding the lease guarantees related to Linens ‘n Things, which have been recorded as a liability on the condensed consolidated balance sheet), with the maximum remaining lease term extending through 2026. Management believes the ultimate disposition of any of the remaining guarantees will not have a material adverse effect on the Company’s consolidated financial condition, results of operations or future cash flows.

Legal Matters

The Company is a party to legal proceedings, investigations and claims in the ordinary course of its business, including the matters described below. The Company records accruals for outstanding legal matters when it believes it is probable that a loss will be incurred and the amount can be reasonably estimated. The Company evaluates, on a quarterly basis, developments in legal matters that could affect the amount of any accrual and developments that would make a loss contingency both probable

and reasonably estimable. If a loss contingency is not both probable and estimable, the Company does not establish an accrued liability. None of the Company’s accruals for outstanding legal matters are material individually or in the aggregate to the Company’s financial position.

The Company’s contingencies are subject to significant uncertainties, including, among other factors: (i) the procedural status of pending matters; (ii) whether class action status is sought and certified; (iii) whether asserted claims or allegations will survive dispositive motion practice; (iv) the extent of potential damages, fines or penalties, which are often unspecified or indeterminate; (v) the impact of discovery on the legal process; (vi) whether novel or unsettled legal theories are at issue; (vii) the settlement posture of the parties, and/or (viii) in the case of certain government agency investigations, whether a sealed qui tam lawsuit (“whistleblower” action) has been filed and whether the government agency makes a decision to intervene in the lawsuit following investigation.

Except as otherwise noted, the Company cannot predict with certainty the timing or outcome of the legal matters described below, and is unable to reasonably estimate a possible loss or range of possible loss in excess of amounts already accrued for these matters.

| |

• | In December 2007, the Company received a document subpoena from the Office of Inspector General (“OIG”) within the U.S. Department of Health and Human Services, requesting information relating to the processing of Medicaid and certain other government agency claims on behalf of its clients (which allegedly resulted in underpayments from our pharmacy benefit management clients to the applicable government agencies) on one of the Company’s adjudication platforms. In September 2014, the Company settled the OIG’s claims, as well as related claims by the Department of Justice and private plaintiffs, without any admission of liability. The Company is in discussions with the OIG concerning other claim processing issues. |

| |

• | Caremark (the term “Caremark” being used herein to generally refer to any one or more PBM subsidiaries of the Company, as applicable) was named in a putative class action lawsuit filed in October 2003 in Alabama state court by John Lauriello, purportedly on behalf of participants in the 1999 settlement of various securities class action and derivative lawsuits against Caremark and others. Other defendants include insurance companies that provided coverage to Caremark with respect to the settled lawsuits. The Lauriello lawsuit seeks approximately $3.2 billion in compensatory damages plus other non-specified damages based on allegations that the amount of insurance coverage available for the settled lawsuits was misrepresented and suppressed. A similar lawsuit was filed in November 2003 by Frank McArthur, also in Alabama state court, naming as defendants, among others, Caremark and several insurance companies involved in the 1999 settlement. This lawsuit was stayed as a later-filed class action, but McArthur was subsequently allowed to intervene in the Lauriello action. Following the close of class discovery, the trial court entered an Order on August 15, 2012 that granted the plaintiffs’ motion to certify a class pursuant to Alabama Rule of Civil Procedures 23(b)(3) but denied their request that the class also be certified pursuant to Rule 23(b)(1). In addition, the August 15, 2012 Order appointed class representatives and class counsel. On September 12, 2014, the Alabama Supreme Court affirmed the trial court’s August 15, 2012 Order, and the case is proceeding. |

| |

• | Various lawsuits have been filed alleging that Caremark has violated applicable antitrust laws in establishing and maintaining retail pharmacy networks for client health plans. In August 2003, Bellevue Drug Co., Robert Schreiber, Inc. d/b/a Burns Pharmacy and Rehn-Huerbinger Drug Co. d/b/a Parkway Drugs #4, together with Pharmacy Freedom Fund and the National Community Pharmacists Association filed a putative class action against Caremark in Pennsylvania federal court, seeking treble damages and injunctive relief. This case was initially sent to arbitration based on the contract terms between the pharmacies and Caremark. In October 2003, two independent pharmacies, North Jackson Pharmacy, Inc. and C&C, Inc. d/b/a Big C Discount Drugs, Inc., filed a putative class action complaint in Alabama federal court against Caremark and two PBM competitors, seeking treble damages and injunctive relief. The North Jackson Pharmacy case against two of the Caremark entities named as defendants was transferred to Illinois federal court, and the case against a separate Caremark entity was sent to arbitration based on contract terms between the pharmacies and Caremark. The Bellevue arbitration was then stayed by the parties pending developments in the North Jackson Pharmacy court case. |

In August 2006, the Bellevue case and the North Jackson Pharmacy case were both transferred to Pennsylvania federal court by the Judicial Panel on Multidistrict Litigation for coordinated and consolidated proceedings with other cases before the panel, including cases against other PBMs. Motions for class certification in the coordinated cases within the multidistrict litigation, including the North Jackson Pharmacy case, remain pending, and the court has permitted certain additional class discovery and briefing. The consolidated action is now known as the In Re Pharmacy Benefit Managers Antitrust Litigation.

| |

• | In November 2009, a securities class action lawsuit was filed in the United States District Court for the District of Rhode Island by Richard Medoff, purportedly on behalf of purchasers of CVS Health Corporation stock between May 5, 2009 and November 4, 2009. The lawsuit names the Company and certain officers as defendants and includes allegations of securities fraud relating to public disclosures made by the Company concerning the PBM business and allegations of insider trading. In addition, a shareholder derivative lawsuit was filed by Mark Wuotila in December 2009 in the same court against the directors and certain officers of the Company. This lawsuit, which has remained stayed pending developments in the related securities class action, includes allegations of, among other things, securities fraud, insider trading and breach of fiduciary duties and further alleges that the Company was damaged by the purchase of stock at allegedly inflated prices under its share repurchase program. In January 2011, both lawsuits were transferred to the United States District Court for the District of New Hampshire. The parties are conducting discovery in the class action, and the derivative action is stayed pending further developments in the class action. |

| |

• | In March 2010, the Company learned that various State Attorneys General offices and certain other government agencies were conducting a multi-state investigation of certain of the Company’s business practices similar to those being investigated at that time by the U.S. Federal Trade Commission (“FTC”). Twenty-eight states, the District of Columbia and the County of Los Angeles are known to be participating in this investigation. The prior FTC investigation, which commenced in August 2009, was officially concluded in May 2012 when the consent order entered into between the FTC and the Company became final. The Company has cooperated with the multi-state investigation. |

| |

• | In March 2010, the Company received a subpoena from the OIG requesting information about programs under which the Company has offered customers remuneration conditioned upon the transfer of prescriptions for drugs or medications to the Company’s pharmacies in the form of gift cards, cash, non-prescription merchandise or discounts or coupons for non-prescription merchandise. The subpoena relates to an investigation of possible false or otherwise improper claims for payment under the Medicare and Medicaid programs. The Company has provided documents and other information in response to this request for information. |

| |

• | In January 2012, the United States District Court for the Eastern District of Pennsylvania unsealed a first amended qui tam complaint filed in August 2011 by an individual relator, Anthony Spay, who is described in the complaint as having once been employed by a firm providing pharmacy prescription benefit audit and recovery services. The complaint seeks monetary damages and alleges that Caremark’s processing of Medicare claims on behalf of one of its clients violated the federal False Claims Act. The United States declined to intervene in the lawsuit. The case is proceeding. |

| |

• | In November 2014, the U.S. District Court in the District of Massachusetts unsealed a qui tam lawsuit brought against the Company by a pharmacy auditor and a CVS pharmacist. The lawsuit, which was initially filed under seal in 2011, alleges that the Company violated the federal False Claims Act, as well as the false claims acts of several states, by overcharging state and federal governments in connection with prescription drugs available through the Company’s Health Savings Pass program, a membership-based program that allows enrolled customers special pricing for typical 90-day supplies of various generic prescription drugs. The federal government, which issued a January 2012 OIG subpoena concerning the Health Savings Pass program, has declined to intervene in the case. The Company has filed a motion to dismiss the declined qui tam complaint. Separately, the Attorney General of the State of Texas has issued civil investigative demands and other requests in February 2012 and May 2014, and has continued its investigation concerning the Health Savings Pass program and claims for reimbursement from the Texas Medicaid program. |

| |

• | On October 12, 2012, the Drug Enforcement Agency (“DEA”) Administrator published its Final Decision and Order revoking the DEA license registrations for dispensing controlled substances at two of our retail pharmacy stores in Sanford, Florida. The license revocations for the two stores formally became effective on November 13, 2012. The Company has entered into discussions with the U.S. Attorney’s Office for the Middle District of Florida concerning civil penalties for violations of the Controlled Substances Act arising from the circumstances underlying the action taken against the two Sanford, Florida stores. The Company is also undergoing several audits by the DEA and is in discussions with the DEA and the U.S. Attorney’s Office in several locations. Whether agreements can be reached and on what terms is uncertain. |

| |

• | In November 2012, the Company received a subpoena from the OIG requesting information concerning automatic refill programs used by pharmacies to refill prescriptions for customers. The Company has been cooperating and providing documents and other information in response to this request for information. |

| |

• | In January 2014, the U.S. District Court in the Southern District of New York unsealed a qui tam action in which the Company is a defendant. The suit originally was filed under seal in 2011 by relator David Kester, a former employee of Novartis Pharmaceuticals Corp. (“Novartis”). The suit alleges that Novartis, the Company, and other specialty pharmacies violated the federal False Claims Act, as well as the false claims acts of several states, by using pharmacists, nurses and other staff to recommend and increase the sales and market share for certain Novartis specialty drugs in exchange for patient referrals, rebates and discounts provided by Novartis. The federal government has intervened in the case as to some allegations against Novartis but has declined to intervene as to any of the allegations against the Company. The relator has continued to litigate the declined action against the Company and other specialty pharmacies. |

| |

• | In March 2014, the Company received a subpoena from the United States Attorney’s Office for the District of Rhode Island, requesting documents and information concerning bona fide service fees and rebates received from certain pharmaceutical manufacturers in connection with certain drugs utilized under Part D of the Medicare Program. The Company has been cooperating with the government and collecting documents in response to the subpoena. |

The Company is also a party to other legal proceedings, government investigations, inquiries and audits arising in the normal course of its business, none of which is expected to be material to the Company. The Company can give no assurance, however, that its business, financial condition and results of operations will not be materially adversely affected, or that the Company will not be required to materially change its business practices, based on: (i) future enactment of new health care or other laws or regulations; (ii) the interpretation or application of existing laws or regulations as they may relate to the Company’s business, the pharmacy services, retail pharmacy or retail clinic industries or to the health care industry generally; (iii) pending or future federal or state governmental investigations of the Company’s business or the pharmacy services, retail pharmacy or retail clinic industry or of the health care industry generally; (iv) pending or future government enforcement actions against the Company; (v) adverse developments in any pending qui tam lawsuit against the Company, whether sealed or unsealed, or in any future qui tam lawsuit that may be filed against the Company; or (vi) adverse developments in pending or future legal proceedings against the Company or affecting the pharmacy services, retail pharmacy or retail clinic industry or the health care industry generally.

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders

CVS Health Corporation:

We have reviewed the condensed consolidated balance sheet of CVS Health Corporation (the Company) as of March 31, 2015, and the related condensed consolidated statements of income, comprehensive income and cash flows for the three-month periods ended March 31, 2015 and 2014. These financial statements are the responsibility of the Company’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the condensed consolidated financial statements referred to above for them to be in conformity with U.S. generally accepted accounting principles.

As discussed in Note 2 to the condensed consolidated financial statements, the Company has elected changes in its methods of accounting for front store inventories in the Retail Pharmacy Segment effective January 1, 2015.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of CVS Health Corporation as of December 31, 2014, and the related consolidated statements of income, comprehensive income, shareholders’ equity, and cash flows for the year then ended not presented herein, and in our report dated February 10, 2015, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of December 31, 2014, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

|

| |

| /s/ Ernst & Young LLP |

| |

May 1, 2015 | |

Boston, Massachusetts | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview of Our Business

CVS Health Corporation, together with its subsidiaries (collectively “CVS Health,” the “Company,” “we,” “our” or “us”), is a pharmacy innovation company helping people on their path to better health. At the forefront of a changing health care landscape, the Company has an unmatched suite of capabilities and the expertise needed to drive innovations that will help shape the future of health.

We are currently the only integrated pharmacy health care company with the ability to impact consumers, payors, and providers with innovative, channel-agnostic solutions. We have a deep understanding of their diverse needs through our unique integrated model, and we are bringing them innovative solutions that help increase access to quality care, deliver better health outcomes, and lower overall health care costs.

Through our more than 7,800 retail drugstores, nearly 1,000 walk-in health care clinics, a leading pharmacy benefits manager with more than 70 million plan members, and expanding specialty pharmacy services, we enable people, businesses, and communities to manage health in more effective ways. We are delivering break-through products and services, from advising patients on their medications at our CVS/pharmacy® locations, to introducing unique programs to help control costs for our clients at CVS/caremarkTM, to innovating how care is delivered to our patients with complex conditions through CVS/specialtyTM, or by expanding access to high-quality, low-cost care at CVS/minuteclinicTM.

We currently have three reportable segments: Pharmacy Services, Retail Pharmacy and Corporate.

Pharmacy Services Segment

Our Pharmacy Services Segment generates revenue from a full range of pharmacy benefit management (“PBM”) services, including plan design and administration, formulary management, Medicare Part D services, mail order, specialty pharmacy and infusion services, retail pharmacy network management services, prescription management systems, clinical services, disease management services and medical spend management. Our clients are primarily employers, insurance companies, unions, government employee groups, health plans, Managed Medicaid plans and other sponsors of health benefit plans, and individuals throughout the United States. A portion of covered lives primarily within the Managed Medicaid, health plan and employer markets have access to our services through public and private exchanges. As a pharmacy benefits manager, we manage the dispensing of pharmaceuticals through our mail order pharmacies, specialty pharmacies and national network of more than 68,000 retail pharmacies, consisting of approximately 41,000 chain pharmacies (which includes our CVS/pharmacy stores) and 27,000 independent pharmacies, to eligible members in the benefit plans maintained by our clients and utilize our information systems to perform, among other things, safety checks, drug interaction screenings and brand to generic substitutions.

Our specialty pharmacies support individuals that require complex and expensive drug therapies. Our specialty pharmacy business includes mail order and retail specialty pharmacies that operate under the CVS CaremarkTM, CarePlus CVS/pharmacy® and Navarro Health Services® names. The Pharmacy Services Segment also provides health management programs, which include integrated disease management program for 17 conditions, through our Accordant® rare disease management offering. In addition, through our SilverScript Insurance Company subsidiary, we are a national provider of drug benefits to eligible beneficiaries under the federal government’s Medicare Part D program. The Pharmacy Services Segment operates under the CVS/caremarkTM Pharmacy Services, Caremark®, CVS CaremarkTM, CVS/caremarkTM, CarePlus CVS/pharmacy®, RxAmerica®, Accordant®, SilverScript®, Coram®, CVS/specialtyTM, NovoLogix® and Navarro® Health Services names. As of March 31, 2015, the Pharmacy Services Segment operated 24 retail specialty pharmacy stores, 11 specialty mail order pharmacies, four mail service dispensing pharmacies, and 86 branches for infusion and enteral services, including approximately 70 ambulatory infusion suites and six centers of excellence, located in 40 states, Puerto Rico and the District of Columbia.

Retail Pharmacy Segment

Our Retail Pharmacy Segment sells prescription drugs and a wide assortment of general merchandise, including over-the-counter drugs, beauty products and cosmetics, personal care products, convenience foods, photo finishing, seasonal merchandise and greeting cards through our CVS/pharmacy®, CVS®, Longs Drugs®, Navarro Discount Pharmacy® and Drogaria

OnofreTM retail stores and online through CVS.com®, Navarro.comTM and Onofre.com.brTM. Our Retail Pharmacy Segment derives the majority of its revenues through the sale of prescription drugs, which are dispensed by our 24,000 retail pharmacists. Our Retail Pharmacy Segment also provides health care services through our CVS/minuteclinic offering. MinuteClinics are staffed by nurse practitioners and physician assistants who utilize nationally recognized protocols to diagnose and treat minor health conditions, perform health screenings, monitor chronic conditions, and deliver vaccinations. As of March 31, 2015, our Retail Pharmacy Segment included 7,850 retail drugstores (of which 7,794 operated a pharmacy) located in 44 states, the District of Columbia, Puerto Rico and Brazil operating primarily under the CVS/pharmacy®, CVS®, Longs Drugs®, Navarro Discount Pharmacy® or Drogaria OnofreTM names, 17 onsite pharmacies, 986 retail health care clinics operating under the MinuteClinic® name (of which 978 were located in CVS/pharmacy stores), and our online retail websites, CVS.com, Navarro.com and Onofre.com.br.

Corporate Segment

The Corporate Segment provides management and administrative services to support the Company. The Corporate Segment consists of certain aspects of our executive management, corporate relations, legal, compliance, human resources, corporate information technology and finance departments.

Results of Operations

The following discussion explains the material changes in our results of operations for the three months ended March 31, 2015 and 2014, and the significant developments affecting our financial condition since December 31, 2014. We strongly recommend that you read our audited consolidated financial statements and notes thereto and Management’s Discussion and Analysis of Financial Condition and Results of Operations included as Exhibit 13 to our 2014 Form 10-K along with this report.

Summary of the Condensed Consolidated Financial Results:

|

| | | | | | | |

| Three Months Ended March 31, |

In millions | 2015 | | 2014 |

| | | |

Net revenues | $ | 36,332 |

| | $ | 32,689 |

|

Cost of revenues | 30,168 |

| | 26,747 |

|

Gross profit | 6,164 |

| | 5,942 |

|

Operating expenses | 4,032 |

| | 3,918 |

|

Operating profit | 2,132 |

| | 2,024 |

|

Interest expense, net | 134 |

| | 158 |

|

Income before income tax provision | 1,998 |

| | 1,866 |

|

Income tax provision | 777 |

| | 737 |

|

Net income | $ | 1,221 |

| | $ | 1,129 |

|

Net Revenues

Net revenues increased approximately $3.6 billion, or 11.1%, in the three months ended March 31, 2015, as compared to the prior year. The increase in the Pharmacy Services Segment was primarily driven by growth in specialty pharmacy and increased volume in pharmacy network claims. The increase in the Retail Pharmacy Segment was primarily due to an increase in pharmacy same store sales and revenue from new stores. Net revenues in both periods were negatively impacted by increased generic dispensing rates for both the Pharmacy Services and Retail Pharmacy segments. However, the year-over-year increase in generic dispensing rates was not as significant in the three months ended March 31, 2015 compared to the prior year. Generic prescription drugs typically have a lower selling price than brand name prescription drugs.

Please see the section entitled “Segment Analysis” below for additional information regarding net revenues.

Gross Profit

Gross profit dollars increased $222 million, or 3.7%, in the three months ended March 31, 2015, as compared to the prior year. Gross profit as a percentage of net revenues decreased approximately 120 basis points to 17.0% in the three months ended

March 31, 2015, as compared to the prior year. The decrease was driven by a change in the mix of business with the Pharmacy Services Segment growing faster than the Retail Pharmacy Segment, as well as modest declines in gross margin in both segments. Gross profit dollars for the three months ended March 31, 2015 were positively impacted by an increase in generic dispensing rates compared to the prior year.

Please see the section entitled “Segment Analysis” below for additional information regarding gross profit.

Operating Expenses

Operating expenses increased $114 million, or 2.9%, in the three months ended March 31, 2015, as compared to the prior year. Operating expenses as a percentage of net revenues decreased approximately 90 basis points to 11.1% for the three months ended March 31, 2015, as compared to 12.0% in the prior year. The increase in operating expense dollars in the three months ended March 31, 2015, was primarily due to incremental store operating costs associated with operating more stores in our Retail Pharmacy Segment. The decrease in operating expenses as a percentage of net revenues was primarily due to expense leverage from sales growth in both operating segments and disciplined expense control.

Please see the section entitled “Segment Analysis” below for additional information regarding operating expenses.

Interest Expense, net

Interest expense, net, decreased $24 million in the three months ended March 31, 2015, as compared to the prior year. This decrease is primarily due to lower average interest rates on our outstanding debt during the three months ended March 31, 2015.

For additional information on our financing activities, please see the “Liquidity and Capital Resources” section later in Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Income Tax Provision

Our effective income tax rate was 38.9% for the three months ended March 31, 2015, compared to 39.5% for the three months ended March 31, 2014. The difference in the effective income tax rate for the three months ended March 31, 2015, was primarily due to certain permanent and discrete items.

Segment Analysis

We evaluate the performance of our Pharmacy Services and Retail Pharmacy segments based on net revenue, gross profit and operating profit before the effect of nonrecurring charges and gains and certain intersegment activities. We evaluate the performance of our Corporate Segment based on operating expenses before the effect of nonrecurring charges and gains and certain intersegment activities. The following is a reconciliation of our segments to the condensed consolidated financial statements:

|

| | | | | | | | | | | | | | | | | | | |

In millions | Pharmacy Services Segment(1) | | Retail Pharmacy Segment | | Corporate Segment | | Intersegment Eliminations (2) | | Consolidated Totals |

Three Months Ended | | | | | | | | | |

March 31, 2015: | | | | | | | | | |

Net revenues | $ | 23,879 |

| | $ | 16,951 |

| | $ | — |

| | $ | (4,498 | ) | | $ | 36,332 |

|

Gross profit | 1,026 |

| | 5,295 |

| | — |

| | (157 | ) | | 6,164 |

|

Operating profit (loss) | 734 |

| | 1,727 |

| | (189 | ) | | (140 | ) | | 2,132 |

|

March 31, 2014: | |

| | |

| | |

| | |

| | |

|

Net revenues | 20,195 |

| | 16,480 |

| | — |

| | (3,986 | ) | | 32,689 |

|

Gross profit | 934 |

| | 5,184 |

| | — |

| | (176 | ) | | 5,942 |

|

Operating profit (loss) | 640 |

| | 1,750 |

| | (190 | ) | | (176 | ) | | 2,024 |

|

| |

(1) | Net revenues of the Pharmacy Services Segment include approximately $2.5 billion and $2.2 billion of retail co-payments for the three months ended March 31, 2015 and 2014, respectively. |

| |

(2) | Intersegment eliminations relate to two types of transaction: (i) Intersegment revenues that occur when Pharmacy Services Segment customers use Retail Pharmacy Segment stores to purchase covered products. When this occurs, both the Pharmacy Services and Retail Pharmacy segments record the revenue on a stand-alone basis, and (ii) Intersegment revenues, gross profit and operating profit that occur when Pharmacy Services Segment customers, through the Company's intersegment activities (such as the Maintenance Choice® program), elect to pick-up their maintenance prescriptions at Retail Pharmacy Segment stores instead of receiving them through the mail. When this occurs, both the Pharmacy Services and Retail Pharmacy segments record the revenue, gross profit and operating profit on a standalone basis. The following amounts are eliminated in consolidation in connection with the intersegment activity described in item (ii) above: net revenues of $1.2 billion and $1.1 billion for the three months ended March 31, 2015 and 2014, respectively; gross profit of $157 million and $176 million for the three months ended March 31, 2015 and 2014, respectively; and operating profit of $140 million and $176 million for the three months ended March 31, 2015 and 2014, respectively. |

Pharmacy Services Segment

The following table summarizes our Pharmacy Services Segment’s performance for the respective periods:

|

| | | | | | | |

| Three Months Ended

March 31, |

In millions | 2015 | | 2014 |

| | | |

Net revenues | $ | 23,879 |

| | $ | 20,195 |

|

Gross profit | 1,026 |

| | 934 |

|

Gross profit % of net revenues | 4.3 | % | | 4.6 | % |

Operating expenses | 292 |

| | 294 |

|

Operating expense % of net revenues | 1.2 | % | | 1.5 | % |

Operating profit | 734 |

| | 640 |

|

Operating profit % of net revenues | 3.1 | % | | 3.2 | % |

Net revenues(1): | |

| | |

|

Mail choice(2) | $ | 8,750 |

| | $ | 6,834 |

|

Pharmacy network(3) | 15,059 |

| | 13,302 |

|

Other | 70 |

| | 59 |

|

Pharmacy claims processed(1): | |

| | |

|

Total | 251.1 |

| | 227.8 |

|

Mail choice(2) | 20.3 |

| | 19.8 |

|

Pharmacy network(3) | 230.8 |

| | 208.0 |

|

Generic dispensing rate(1): | | | |

|

Total | 83.5 | % | | 82.0 | % |

Mail choice(2) | 76.1 | % | | 73.9 | % |

Pharmacy network(3) | 84.1 | % | | 82.8 | % |

Mail choice penetration rate | 19.8 | % | | 21.2 | % |

(1) Pharmacy network net revenues, claims processed and generic dispensing rates do not include Maintenance Choice, which are included within the mail choice category.

(2) Mail choice is defined as claims filled at a Pharmacy Services mail facility, which includes specialty claims, as well as 90-day claims filled at retail pharmacies under the Maintenance Choice program.

(3) Pharmacy network is defined as claims filled at retail pharmacies, including our retail drugstores, but excluding Maintenance Choice activity.

Net Revenues

Net revenues in our Pharmacy Services Segment increased $3.7 billion, or 18.2%, to $23.9 billion in the three months ended March 31, 2015, as compared to the prior year. The increase is primarily due to growth in specialty pharmacy, driven by increased volume, new products, inflation and the implementation of Specialty Connect®, as well as increased pharmacy network claims. As you review our Pharmacy Services Segment’s performance in this area, we believe you should consider the following important information that impacted the three months ended March 31, 2015:

| |

• | Our mail choice claims processed increased 2.7% to 20.3 million claims in the three months ended March 31, 2015, compared to 19.8 million claims in the prior year. The increase in mail choice claims was driven by specialty claim volume and increased claims associated with the continuing adoption of our Maintenance Choice offerings. |

| |

• | Our average revenue per mail choice claim increased by 24.7%, compared to the prior year. This increase was primarily due to growth in specialty pharmacy. |

| |

• | Our pharmacy network claims processed increased 11.0% to 230.8 million claims in the three months ended March 31, 2015, compared to 208.0 million claims in the prior year. The increase in the pharmacy network claim volume was primarily due to net new business, as well as growth in Managed Medicaid and public exchanges. |

| |

• | Our average revenue per pharmacy network claim processed increased 2.0%, as compared to the prior year. This increase was primarily due to drug inflation and changes in the drug mix, partially offset by increases in the generic dispensing rate. |

| |

• | Our mail choice generic dispensing rate increased to 76.1% in the three months ended March 31, 2015, compared to 73.9% in the prior year. Our pharmacy network generic dispensing rate increased to 84.1%, compared to 82.8% in the prior year. These continued increases in mail choice and pharmacy network generic dispensing rates were primarily due to the impact of new generic drug introductions, and our continuous efforts to encourage plan members to use generic drugs when they are available. We believe our generic dispensing rates will continue to increase in future periods, albeit at a slower pace. This increase will be affected by, among other things, the number of new generic drug introductions and our success at encouraging plan members to utilize generic drugs when they are available and clinically appropriate. |

Gross Profit

Gross profit in our Pharmacy Services Segment includes net revenues less cost of revenues. Cost of revenues includes (i) the cost of pharmaceuticals dispensed, either directly through our mail service, specialty mail and specialty retail pharmacies or indirectly through our retail pharmacy networks, (ii) shipping and handling costs and (iii) the operating costs of our mail service dispensing pharmacies, customer service operations and related information technology support.

Gross profit increased $92 million, or 9.8%, to approximately $1.0 billion in the three months ended March 31, 2015, as compared to the prior year. Gross profit as a percentage of net revenues decreased to 4.3% in the three months ended March 31, 2015, compared to 4.6% in the prior year. The increase in gross profit dollars was primarily due to volume increases, higher generic dispensing, as well as favorable purchasing and rebate economics, partially offset by price compression. The decrease in gross profit as a percentage of net revenues was primarily due to price compression, partially offset by favorable generic dispensing, as well as favorable purchasing and rebate economics.

As you review our Pharmacy Services Segment’s performance in this area, we believe you should consider the following important information that had an impact on the three months ended March 31, 2015:

| |

• | Our gross profit dollars and gross profit as a percentage of net revenues continued to be impacted by our efforts to (i) retain existing clients, (ii) obtain new business and (iii) maintain or improve the rebates and/or discounts we received from manufacturers, wholesalers and retail pharmacies. In particular, competitive pressures in the PBM industry have caused us and other PBMs to continue to share a larger portion of rebates and/or discounts received from pharmaceutical manufacturers with clients. In addition, market dynamics and regulatory changes have impacted our ability to offer plan sponsors pricing that includes retail network “differential” or “spread”. We expect these trends to continue. The “differential” or “spread” is any difference between the drug price charged to plan sponsors, including Medicare Part D plan sponsors, by a PBM and the price paid for the drug by the PBM to the dispensing provider. The increased use of generic drugs has positively impacted our gross profit margins but has resulted in third party payors augmenting their efforts to reduce reimbursement payments for prescriptions. This trend, which we expect to continue, reduces the benefit we realize from brand to generic product conversions. |

| |

• | Our gross profit as a percentage of revenues benefited from the increase in our total generic dispensing rate, which increased to 83.5% in the three months ended March 31, 2015, compared to our generic dispensing rate of 82.0% in the prior year. This increase was primarily due to new generic drug introductions and our continual efforts to encourage plan members to use clinically appropriate generic drugs when they are available. We expect the trend in generic introductions to continue, albeit at a slower pace. |

Operating Expenses

Operating expenses in our Pharmacy Services Segment include selling, general and administrative expenses; depreciation and amortization related to selling, general and administrative activities; and expenses related to specialty retail pharmacies, which includes store and administrative payroll, employee benefits and occupancy costs.

Operating expenses decreased $2 million to $292 million, or 1.2% as a percentage of net revenues, in the three months ended March 31, 2015, compared to $294 million, or 1.5% as a percentage of net revenues, in the prior year. The improvement in operating expenses as a percentage of net revenues for the three months ended March 31, 2015 was primarily driven by expense leverage from our revenue growth.

Retail Pharmacy Segment

The following table summarizes our Retail Pharmacy Segment’s performance for the respective periods:

|

| | | | | | | |

| Three Months Ended March 31, |

In millions | 2015 | | 2014 |

| | | |

Net revenues | $ | 16,951 |

| | $ | 16,480 |

|

Gross profit | 5,295 |

| | 5,184 |

|

Gross profit % of net revenues | 31.2 | % | | 31.5 | % |

Operating expenses | 3,568 |

| | 3,434 |

|

Operating expense % of net revenues | 21.0 | % | | 20.8 | % |

Operating profit | 1,727 |

| | 1,750 |

|

Operating profit % of net revenues | 10.2 | % | | 10.6 | % |

Retail prescriptions filled (90 Day = 3 Rx) (1) | 241.3 |

| | 227.1 |

|

Net revenue increase: | |

| | |

|

Total | 2.9 | % | | 2.7 | % |

Pharmacy | 5.3 | % | | 5.1 | % |

Front store | (3.6 | )% | | (2.4 | )% |

Total prescription volume (90 Day = 3 Rx) (1) | 6.3 | % | | 2.7 | % |

Same store increase (decrease)(2): | |

| | |

|

Total sales | 1.2 | % | | 1.4 | % |

Pharmacy sales | 4.2 | % | | 3.8 | % |

Front store sales(3) | (6.1 | )% | | (3.8 | )% |

Prescription volume (90 Day = 3 Rx) (1) | 5.1 | % | | 2.1 | % |

Generic dispensing rate | 84.4 | % | | 82.9 | % |

Pharmacy % of total revenues | 71.7 | % | | 70.5 | % |

Third party % of pharmacy revenue | 98.5 | % | | 98.3 | % |

| |

(1) | Includes the adjustment to convert 90-day, non-specialty prescriptions to the equivalent of three 30-day prescriptions. This adjustment reflects the fact that these prescriptions include approximately three times the amount of product days supplied compared to a normal prescription. |

| |

(2) | Same store sales exclude revenues from MinuteClinic and stores in Brazil. |

| |

(3) | On a comparable basis, front store same store sales would have been approximately 800 basis points higher for the three months ended March 31, 2015 if tobacco and the estimated associated basket sales were excluded from the three months ended March 31, 2014. |

As of March 31, 2015, we operated 7,850 retail drugstores, compared to 7,675 retail drugstores as of March 31, 2014.

Net Revenues