Table of Contents

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange

Act of 1934 (Amendment No. )

| Filed by the Registrant

[X] |

|

| Filed by a Party other than

the Registrant [ ] |

|

|

| |

|

|

| Check the appropriate

box: |

|

|

| [ ] |

|

Preliminary Proxy

Statement |

[ ]

|

Soliciting Material Under Rule

14a-12 |

| [ ] |

|

Confidential, For Use of

the

Commission Only (as permitted

by Rule 14a-6(e)(2)) |

|

|

| [X] |

|

Definitive Proxy

Statement |

|

| [ ] |

|

Definitive Additional

Materials |

|

| |

CVS Health Corporation |

|

| |

(Name of Registrant as

Specified In Its Charter) |

|

|

|

|

| |

|

|

| |

(Name

of Person(s) Filing Proxy Statement, if Other Than the

Registrant) |

|

| Payment of Filing Fee (Check

the appropriate box): |

| [X] |

|

No fee required. |

|

[

] |

|

Fee computed on

table below per Exchange Act Rules 14a-6(i)(4) and

0-11. |

| |

|

1) |

|

Title of each class of

securities to which transaction applies: |

| |

|

|

|

|

|

|

2) |

|

Aggregate number of

securities to which transaction applies: |

|

|

|

|

|

|

|

3) |

|

Per unit price or

other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and

state how it was determined): |

|

|

|

|

|

|

|

4) |

|

Proposed maximum

aggregate value of transaction: |

|

|

|

|

|

|

|

5) |

|

Total fee

paid: |

|

|

|

|

|

|

[

] |

|

Fee paid previously

with preliminary materials: |

|

[

] |

|

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration

statement number, or the form or schedule and the date of its

filing. |

| |

|

1) |

|

Amount previously

paid: |

| |

|

|

|

|

|

|

2) |

|

Form, Schedule or Registration

Statement No.: |

| |

|

|

|

|

|

|

3) |

|

Filing Party: |

| |

|

|

|

|

|

|

4) |

|

Date Filed: |

|

|

|

|

|

Table of Contents

|

|

|

Notice

of

Annual Meeting

of

Stockholders |

|

|

|

May 7, 2015;

9:00 a.m. |

|

|

|

CVS Health

Corporation

Customer Support Center

One CVS Drive

Woonsocket,

Rhode Island 02895 |

Table of Contents

MESSAGE FROM OUR

CHAIRMAN AND

OUR

CHIEF EXECUTIVE

OFFICER

Dear

Fellow Stockholders:

|

|

|

|

By

any measure, 2014 was a milestone year for CVS Health. We met or exceeded

all of our key financial targets and maintained our focus on the three

pillars that we consider essential to maximizing stockholder value:

driving productive, long-term growth; generating significant free cash

flow; and optimizing capital allocation. We delivered solid year-over-year

growth in revenues, operating profit, earnings per share, and cash flow,

and once again returned more than $5 billion to stockholders through

dividends and share repurchases.

This

strong performance resulted in total shareholder returns of 36.6 percent

in 2014, outperforming the S&P 500 Index and the Dow Jones Industrial

Average, which returned 13.7 percent and 10.0 percent, respectively. In

fact, we outperformed these indices on a three-, five-, and 10-year basis

as well.

In

2014, we became the first national pharmacy chain to eliminate the sale of

tobacco products. This strategic action eliminated approximately $2

billion in tobacco and associated revenues on an annual basis; yet we

believe it will help drive our long-term growth as it better aligns the

company with patients, payors, and providers as they search for ways to

improve health outcomes and control costs. Importantly, at the same time

we changed our corporate name to CVS Health. Our company is at the

forefront of an evolving health care landscape and our new name reflects

our broader health care commitment and underscores our purpose of helping

people on their path to better health.

Last

year also saw the launch of our new corporate social responsibility

roadmap, Prescription for a Better World. Through this roadmap, we are

focused on three key areas: building healthier communities, protecting the

planet, and creating economic opportunities. We believe these areas are

essential ingredients for a better world and we can help support them by

leveraging the scale, expertise, and innovative spirit of CVS

Health.

In

addition to engaging with our communities, we seek to proactively engage

with our stockholders to ensure that we understand your needs. We believe

accountability to our stockholders is a mark of good governance, and we

pride ourselves in strong corporate governance practices. As you will see,

we have made substantial changes to the format of our proxy statement this

year based on conversations we have had with many of you throughout the

year. We hope that you will find our new presentation helpful and more

user-friendly, and we certainly welcome your feedback.

Our

2015 Annual Meeting of Stockholders will be held on Thursday, May 7, 2015,

at 9:00 a.m., at the CVS Health Customer Support Center located at One CVS

Drive in Woonsocket, Rhode Island. We invite you to attend, and ask you to

please vote at your earliest convenience whether or not you plan to

attend. Your vote is important.

With our strong position in this

evolving health care marketplace, we see a bright future for CVS Health

and our stockholders. Thank you for your confidence and your continued

support. |

|

Larry J.

Merlo David W. Dorman

|

|

|

|

|

|

Sincerely, |

|

|

|

|

|

|

|

|

David W.

Dorman

Chairman of the Board

|

Larry J.

Merlo

President and Chief Executive

Officer |

|

|

www.cvshealthannualmeeting.com 1

Table of Contents

NOTICE

OF

ANNUAL

MEETING

OF STOCKHOLDERS

| Date and

Time |

|

May 7, 2015, 9:00 A.M.

EDT |

| |

|

|

| Place |

|

CVS Health

Corporation |

| |

|

Customer Support

Center |

|

|

One CVS Drive |

|

|

Woonsocket, Rhode Island

02895 |

|

|

|

Items to be

Voted |

|

●Elect 11 directors named in this proxy

statement;

●Ratify the appointment of Ernst & Young LLP as

the Company’s independent registered public accounting firm for fiscal

2015;

●Act, by non-binding vote, to approve the Company’s

executive compensation as disclosed in this proxy

statement;

●Approve the performance criteria in the Company’s

2010 Incentive Compensation Plan;

●Act on one stockholder proposal to be presented; and

●Conduct any other business properly brought before

the Meeting. |

|

|

|

Eligibility

to Vote |

|

Stockholders of

record at the close of business on March 12, 2015 may vote at the

Meeting. |

|

By Order of the Board of

Directors,

Colleen M.

McIntosh

Senior Vice President

& Corporate Secretary

|

Your vote is important.

Whether or not you plan to attend the

Annual Meeting, please vote your shares. In addition to voting in person or by

mail, stockholders of record have the option of voting by telephone or via the

Internet. If your shares are held in the name of a bank, broker or other holder

of record (i.e., in “street name”), please read your voting instructions to see

which of these options are available to you. Even if you are attending the

Annual Meeting in person, we encourage you to vote in advance by mail, phone or

Internet.

We began mailing this proxy statement

and the enclosed proxy card on or about March 27, 2015 to all stockholders

entitled to vote. Our 2014 Annual Report, which includes our financial

statements, is being sent with this proxy statement.

|

Important Notice Regarding the

Availability of Proxy Materials for the Annual Meeting to Be Held on May

7, 2015.

The proxy statement and annual

report to security holders are available at www.cvshealthannualmeeting.com

and at www.proxyvote.com/cvs. |

2 CVS Health Notice of Annual Meeting of Stockholders

Table of Contents

|

TABLE OF CONTENTS |

www.cvshealthannualmeeting.com 3

Table of Contents

TABLE OF CONTENTS

4 CVS Health Notice of Annual Meeting of Stockholders

Table of Contents

|

PROXY STATEMENT

HIGHLIGHTS |

This

summary highlights selected information in this Proxy Statement – please review

the entire document before voting.

MEETING INFORMATION

| Date |

Time |

Location |

Admission |

|

May 7, 2015 |

9:00 a.m. EDT |

CVS Health Corporation

Customer Support Center

One CVS

Drive

Woonsocket, RI 02895 |

See page 67 for

instructions |

|

|

All of our Annual

Meeting materials are available in one place at

www.cvshealthannualmeeting.com There, you can download electronic

copies of our Annual Report and Proxy Statement, and use the link to

vote. |

VOTING ITEMS

| Item |

Board

Recommendation |

Reason(s) for Board

Recommendation |

Further

Information

(page) |

|

1 – Election of 11 directors named in this

proxy statement |

FOR each

director

nominee |

Our nominees are

seasoned leaders who bring a mix of skills and qualifications to the

Board |

11 |

|

2 – Ratify the

appointment of Ernst & Young LLP as the Company’s independent

registered public accounting firm for fiscal 2015 |

FOR |

Based on its recent

evaluation, our Audit Committee believes that the retention of Ernst &

Young LLP is in the best interests of the Company and its

stockholders |

32 |

|

3 – Approve, on a non-binding basis, the Company’s executive compensation as

disclosed in this proxy statement |

FOR |

Our executive

compensation program reflects our unwavering commitment to paying for

performance and reflects feedback

received from stockholder outreach |

33 |

|

4 – Approve the

performance criteria in the Company’s 2010 Incentive Compensation

Plan |

FOR |

Awards under the Plan

enable us to attract and retain key employees and to align their interests

with those of our stockholders |

35 |

|

5 – Stockholder

proposal regarding congruency of corporate values and political

contributions |

AGAINST |

See the Board’s

statement of opposition |

65 |

HOW TO VOTE

Your vote is

important to the future of CVS Health. You are eligible to vote if you were a

stockholder of record at the close of business on March 12, 2015. Even if you

plan to attend the meeting, please vote as soon as possible using one of the

following methods. In all cases, you should have your proxy card in

hand:

| Use the Internet |

Use a Mobile

Device |

Call

Toll-Free |

Mail Your Proxy

Card |

|

|

|

|

|

www.proxyvote.com |

Scan this QR

Code |

1-800- 690-6903 |

Follow the instructions on your

voting form |

www.cvshealthannualmeeting.com 5

Table of Contents

PROXY STATEMENT HIGHLIGHTS

THE CVS HEALTH BOARD

You are

asked to vote on the election of the following eleven director nominees to serve

on the Board of CVS Health. Directors are elected by a majority of votes

cast.

|

|

Director

Since |

|

Other

Public

Company

Boards |

CVS Health

Committees |

| Name, Primary

Occupation |

Age |

Independent |

A |

MP&D |

N&CG |

E |

|

Richard M.

Bracken

Chairman and CEO of HCA

Holdings,

Inc. (Retired) |

62 |

2015 |

YES |

None |

• |

|

|

|

|

C. David Brown

II

Chairman of Broad and Cassel |

63 |

2007 |

YES |

1 |

|

• |

• |

• |

|

Alecia A. DeCoudreaux

President of Mills College |

60 |

2015 |

YES |

None |

|

|

|

|

|

Nancy-Ann M.

DeParle

Co-Founding Partner of

Consonance

Capital

Partners, LLC |

58 |

2013 |

YES |

1 |

• |

|

|

|

|

David W. Dorman

Chairman of the Board of

CVS

Health Corporation,

Founding Partner of

Centerview

Capital Technology

Fund |

61 |

2006 |

YES |

3 |

|

• |

• |

• |

|

Anne M.

Finucane

Global Chief Strategy

and

Marketing Officer of Bank

of

America Corporation |

62 |

2011 |

YES |

None |

|

|

• |

|

|

Larry J. Merlo

President and CEO of

CVS Health

Corporation |

59 |

2010 |

NO |

None |

|

|

|

• |

|

Jean-Pierre Millon

President and CEO of PCS

Health

Systems, Inc. (Retired) |

64 |

2007 |

YES |

None |

• |

|

|

|

|

Richard J.

Swift

Chairman of the Board,

President

and CEO of Foster

Wheeler Ltd.

(Retired) |

70 |

2006 |

YES |

4 |

• |

|

|

• |

|

William C. Weldon

Chairman of the Board and CEO

of

Johnson & Johnson

(Retired) |

66 |

2013 |

YES |

3 |

|

• |

• |

|

|

Tony L.

White

Chairman of the Board,

President

and CEO of Applied

Biosystems, Inc.

(Retired) |

68 |

2011 |

YES |

2 |

• |

• |

|

|

| A: |

Audit |

| MP&D: |

Management

Planning & Development |

| N&CG: |

Nominating &

Corporate Governance |

| E: |

Executive |

6 CVS Health Notice of Annual Meeting of Stockholders

Table of Contents

PROXY STATEMENT HIGHLIGHTS

| Board

Developments and Highlights |

| The CVS Health Board continues to evaluate

our governance arrangements to ensure that the right mix of individuals

are present in our boardroom, to best serve the stockholders we represent

by ensuring effective oversight of our strategy and

management. |

|

|

|

|

Further

Information |

2014-2015 Board

Developments |

|

●Addition of two new directors; Richard

M. Bracken and Alecia A. DeCoudreaux

●Increase in the number of CVS Health

directors from 9 to 11 |

|

page 11 |

Board

Communication

|

|

●Our Board supports our stockholder

outreach program and has responded to stockholder input with changes in

our compensation program and other areas |

|

pages 17, 40 |

|

●CVS Health directors welcome communications from our

stockholders and other interested parties |

|

page

18 |

Director

Alignment

with Stockholder

Interests

|

|

●75% of our directors’ annual retainer

mix is paid in shares of CVS Health common stock |

|

page 26 |

|

●Directors must own at least 10,000

shares of CVS Health stock

●90% meeting

attendance |

|

page 29

page

17 |

| Director

Independence |

|

Director Tenure |

| 10 CVS Health directors, including our Chairman, are

independent of management. |

|

Our director nominees bring a balance of experience and

fresh perspective to our boardroom. The average tenure of CVS Health

directors is under five years. |

| Director Skills and

Experience |

| Our director nominees possess

relevant experience, skills and qualifications that contribute to a

well-functioning Board to effectively oversee the Company’s strategy and

management. Areas of director expertise

include: |

|

|

For more information

about our director nominees, please refer to page 11 of this proxy

statement. |

www.cvshealthannualmeeting.com 7

Table of Contents

PROXY STATEMENT HIGHLIGHTS

CORPORATE

GOVERNANCE

The Board of CVS Health is committed to

maintaining the highest standards of corporate governance, and has established a

strong and effective framework by which the Company is governed and reviewed.

Highlights include:

|

|

|

|

Further

Information |

2014-2015 Corporate

Governance

Developments |

|

●In response to 2014 stockholder

outreach, we redesigned our executive compensation peer group and the presentation

of our disclosure |

|

pages 40, 45 |

| Stockholder Rights |

|

●Annual election of all directors,

annual “Say on Pay” vote |

|

pages 11, 33 |

|

|

●Stockholder outreach

program |

|

pages

17, 40 |

|

|

●Majority voting in director

elections |

|

page

19 |

|

|

●Right to act by written consent and to

call special

meetings |

|

page

17 |

| Committees |

|

●We have four Board Committees: Audit, Management

Planning and Development, Nominating and Corporate Governance and

Executive |

|

page 21 |

|

|

●All members of Audit, Management Planning and

Development and Nominating and Corporate Governance are independent of

management |

|

pages 22-24 |

| Board Oversight of Risk |

|

●Full Board and individual Committee

focus on understanding Company risks |

|

page 18 |

|

|

●Annually, the Audit Committee reviews

our policies and practices with respect to risk assessment and risk

management, including discussing with management our major risks and the

steps that have been taken to monitor and mitigate such

risks |

|

pages 18,22 |

|

|

●Our independent Chairman and our CEO

are focused on the Company’s risk management efforts and ensure that risk

matters are appropriately brought to the Board and/or its Committees for

review |

|

page

18 |

|

|

For more information on

corporate governance at CVS Health, please refer to page 17 of this proxy

statement and to our website at

http://investors.cvshealth.com/corporate-governance. |

8 CVS Health Notice of Annual Meeting of Stockholders

Table of Contents

PROXY STATEMENT HIGHLIGHTS

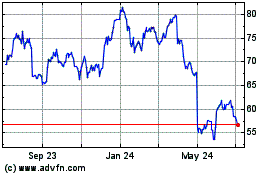

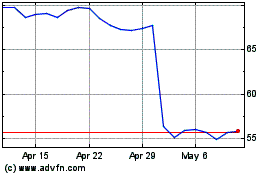

PERFORMANCE HIGHLIGHTS

For CVS Health, 2014 was a very good

year. Here are some highlights:

|

Net Revenues ($

billions) |

|

Operating Profit ($ billions) |

|

Diluted Earnings Per Share from

Continuing Operations ($) |

|

|

1 year growth of 9.9% |

|

1 year growth of 9.5% |

|

1 year growth of 5.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

Total Shareholder

Return (TSR)

(%) |

|

Annual Cash Dividends

($ per

share) |

|

|

Outperformed

S&P 500 |

|

1 year increase

of 22.2% |

|

|

|

|

|

|

|

For more

information on our financial performance, please refer to page 37 of this

proxy statement and to our Annual Report available at

www.cvshealthannualmeeting.com. |

COMPENSATION HIGHLIGHTS

| Leading Practices

in Compensation Programs |

Our pay

practices align with our core compensation principles and facilitate our

implementation of those principles. They also demonstrate our commitment to

sound compensation and governance practices.

Our executive compensation

program

motivates executive

officers to take personal

responsibility for

the

performance of CVS Health |

|

✓ |

Core Executive Compensation

Principles Designed to Deliver Growth |

|

✓ |

Performance Measures Aligned with

Stockholder Interests |

|

✓ |

Majority of the Total

Compensation Opportunity is Performance-Based |

|

✓ |

LTI Plan Share Award

Retention |

|

✓ |

Stock Ownership Guidelines

|

|

We apply leading

executive

compensation practices |

|

✕ |

No Excise Tax

Gross-Ups |

|

✕ |

No Option

Repricing |

|

✕ |

No Recycling of

Shares |

|

✓ |

Recoupment Policy

|

|

✓ |

Broad Anti-Pledging and Hedging

Policies |

|

✓ |

Executive Severance

Policy |

|

✓ |

Limited Perquisites and Personal

Benefits |

|

✓ |

Closed SERP to New

Participants |

|

✓ |

Double Trigger Vesting of Equity

Awards |

www.cvshealthannualmeeting.com 9

Table of Contents

PROXY STATEMENT

HIGHLIGHTS

| Stockholder

Outreach - Compensation Actions |

Prior to 2014, we experienced very high

and increasing levels of stockholder support for our executive compensation

program. Specifically, in 2011 we received 92.1% support, in 2012 support was

95.4% and in 2013 it was 96.0%. In 2014, the level of support declined to 70.6%. As a result, we engaged in a robust stockholder outreach program and reviewed

our policies and programs against published guidelines of stockholders and

advisory firms, to help us understand and address any concerns stockholders

might have.

| What we heard |

|

What we have done in

response |

|

Intended outcome |

|

When effective |

|

It is hard to find important

information in your proxy statement |

|

Revised the presentation and content

of our proxy statement |

|

Ensure that key messages are more

easily identified |

|

Current proxy

statement |

|

You grossed up income tax payments

when you terminated your Death Benefit Only Plan in 2013 |

|

The tax payments were related to

that one-time event that will not occur again; excise tax gross ups are

prohibited |

|

Terminating the Death Benefit Only

Plan resulted in immediate and ongoing net savings to the Company; in the

future, we will carefully consider investor views on tax payments

in establishing and terminating programs |

|

One-time event in 2013; excise

tax gross ups were eliminated by the Company in 2010, and removed from

pre-existing executive contracts in 2012 |

|

Your peer group

includes telecommunications and other companies that don’t seem to align

with what you do |

|

Modified our peer

group |

|

Present a closer connection to our retail and health care businesses |

|

2015 |

|

Although you haven’t repriced

options in the past, your policy on stock option grants permits re-pricing

of options |

|

Amended our policy on stock option

grants to specifically prohibit re-pricing without stockholder

approval |

|

Explicitly prohibit re-pricing of

stock options |

|

2014 |

The following shows the breakdown of

reported 2014 compensation for our CEO and our other named executive

officers.

|

For more

information on our executive compensation practices, please refer to

Compensation Discussion and Analysis, beginning on page 37 of this proxy

statement. |

10 CVS Health Notice of Annual Meeting of Stockholders

Table of Contents

|

ITEM 1: ELECTION OF

DIRECTORS |

Our Board of Directors has nominated 11

directors for election at the Annual Meeting. Each nominee is currently serving

as one of our directors. If you re-elect them, they will hold office until the

next annual meeting or until their successors have been elected and qualified.

In recognition of the fact that the

selection of qualified directors is complex and crucial to the long-term success

of the Company, the Nominating and Corporate Governance Committee (the

“Committee”) has established guidelines for the identification and evaluation of

candidates for membership on the Company’s Board of Directors. Those guidelines

are included in this proxy statement on page 23. When considering current

directors for re-nomination to the Board, the Committee takes into account the

performance of each director, which is part of the Committee’s annual Board

evaluation process. That process consists of individual interviews of each

director by our General Counsel, followed by a report summarizing his findings.

The Committee then recommends actions for the

Board to consider and adopt as it sees fit. The Committee also reviews the

composition of the Board in light of the current challenges and needs of the

Board and the Company, and determines whether it may be appropriate to add or

remove individuals after considering, among other things, the need for audit

committee expertise and issues of independence, diversity, judgment, character,

reputation, age, skills, background and experience. The Committee believes that

the Board, as currently constituted, is well-balanced and that it fully and

effectively addresses the Company’s needs. All of our nominees are seasoned

leaders, the majority of whom are or were chief executive officers or other

senior executives, who bring to the Board skills and qualifications gained

during their tenure at a vast array of public companies, private companies,

non-profits and other organizations. We have indicated below for each nominee

certain of the experience, qualifications, attributes or skills that led the

Committee and the Board to conclude that the nominee should continue to serve as

a director.

BIOGRAPHIES OF OUR BOARD

NOMINEES

|

|

RICHARD M. BRACKEN Age 62 |

|

Director since

January

2015 |

|

|

|

|

|

|

|

Chairman and CEO

of HCA, Inc. and HCA Holdings, Inc. (Retired) |

|

|

|

|

|

|

|

INDEPENDENT DIRECTOR |

|

DIRECTOR QUALIFICATION HIGHLIGHTS |

|

|

CVS Health Board

Committees Audit

Other

Public Boards None |

|

✓ |

Leadership – Former

CEO |

|

|

|

✓ |

Business

Operations; Consumer Products or Services |

|

|

|

✓ |

Finance |

|

|

|

✓ |

Health

Care/Regulated Industry |

|

|

|

✓ |

Risk

Management |

|

|

|

✓ |

Corporate

Governance |

|

Biography

Mr. Bracken is the former Chairman and

Chief Executive Officer of HCA, Inc. and HCA Holdings, Inc. (collectively,

“HCA”), one of the nation’s leading providers of health care services. HCA’s

facilities include approximately 165 hospitals and 115 freestanding surgery

centers in 20 states and England. Mr. Bracken served in a number of executive

roles in his 33 year career at HCA, including President of HCA’s Pacific

Division in 1995, Western Group President in 1997, Chief Operating Officer of HCA in July 2001, and President and

Chief Operating Officer in January 2002. He was elected to the HCA Board of

Directors in November 2002, became President and Chief Executive Officer in

January 2009, and Chairman and Chief Executive Officer in December, 2009. He

retired as CEO in December 2013, and as Chairman in December 2014.

Skills and Qualifications of

Particular Relevance to CVS Health

Mr. Bracken’s experience in leading a

large, publicly traded health care company lends expertise and perspective

greatly valued by the Board. In addition, his experience operating in the

highly-regulated health care industry with significant experience in enterprise

clinical quality is also greatly valued by the Board.

www.cvshealthannualmeeting.com 11

Table of Contents

ITEM 1: ELECTION OF

DIRECTORS

|

|

C. DAVID BROWN

II Age 63 |

|

Director since

March 2007 |

|

|

|

|

|

|

|

Chairman of

Broad and Cassel |

|

|

|

|

|

|

|

INDEPENDENT DIRECTOR |

|

DIRECTOR QUALIFICATION HIGHLIGHTS |

|

|

CVS Health Board

Committees Management

Planning and Development (Chair),

Nominating and

Corporate Governance, Executive

Other Public Boards Rayonier Advanced

Materials Inc. |

|

✓ |

Real

Estate |

|

|

|

✓ |

Business

Development and Corporate Transactions |

|

|

|

✓ |

Finance |

|

|

|

✓ |

Legal and

Regulatory Compliance |

|

|

|

✓ |

Risk

Management |

|

|

|

✓ |

Public Company

Board Service |

|

Biography

Mr. Brown has been Chairman of Broad

and Cassel, a Florida law firm, since March 2000. From 1989 until March 2000, he

was Managing Partner of the Orlando office of the firm. He is also the lead

director of Rayonier Advanced Materials Inc. (“RYAM”), a leading specialty

cellulose production company. Mr. Brown previously served on the board of

directors and as lead director of Rayonier Inc., a real estate development and

timberland management company, prior to the spin-off of RYAM in June 2014.

Mr. Brown also previously served on the

board of Caremark Rx, Inc. (“Caremark”) from March 2001 until the closing of the

merger transaction involving CVS Health and Caremark, when he became a director

of CVS Health. Mr. Brown has significant health care experience, including

through his oversight of UF Health while serving as Chairman of the Board of

Trustees for the University of Florida and as a member of the Board of Directors

and Executive Committee of Orlando Health, a not-for-profit health care

network.

Skills and Qualifications of

Particular Relevance to CVS Health

Mr. Brown’s legal expertise and health

care experience are valued by the Board, as is his ability to analyze and

interpret complex issues and facilitating Board engagement. The Board believes

that Mr. Brown’s experience adds knowledge and leadership depth to the

Board.

|

|

ALECIA A.

DECOUDREAUX Age 60 |

|

Director since

March 2015 |

|

|

|

|

|

|

|

President of

Mills College |

|

|

|

|

|

|

|

INDEPENDENT DIRECTOR |

|

DIRECTOR QUALIFICATION HIGHLIGHTS |

|

|

CVS Health Board

Committees None

Other

Public Boards None |

|

✓ |

Business

Development and Corporate Transactions |

|

|

|

✓ |

Legal and

Regulatory Compliance |

|

|

|

✓ |

Health

Care/Regulated Industry |

|

|

|

✓ |

Corporate

Governance |

|

|

|

✓ |

Public Policy and

Government Affairs |

|

Biography

Ms. DeCoudreaux has been President of

Mills College, a liberal arts college for women with graduate programs for women

and men, since July 2011. Previously, Ms. DeCoudreaux served in a number of

leadership roles at Eli Lilly and Company (“Eli Lilly”), a global pharmaceutical

manufacturer, including as vice president and deputy general counsel, specialty

legal team, from 2010-2011, vice president and general counsel, Lilly USA, from

2005-2009, and secretary and deputy general counsel of Eli Lilly from 1999-2005. During her 30-year career with Eli Lilly Ms.

DeCoudreaux also previously served as an executive director of Lilly Research

Laboratories, director of federal government relations, director of state

government relations and director of community relations. In addition, Ms.

DeCoudreaux has served on a number of charitable, educational, for profit and

nonprofit boards, including as both a trustee and board chair at Wellesley

College.

Skills and Qualifications of

Particular Relevance to CVS Health

Ms. DeCoudreaux has more than 30 years

of experience in the pharmaceutical industry, and her experience as an attorney

in that field and in the area of corporate governance, makes her an excellent

addition to our Board.

12 CVS Health

Notice of Annual Meeting of Stockholders

Table of Contents

ITEM 1: ELECTION OF

DIRECTORS

|

|

NANCY-ANN M.

DEPARLE Age 58 |

|

Director since

September

2013 |

|

|

|

|

|

|

|

Co-Founding

Partner of Consonance Capital Partners, LLC |

|

|

|

|

|

|

|

INDEPENDENT DIRECTOR |

|

DIRECTOR QUALIFICATION HIGHLIGHTS |

|

|

CVS Health Board

Committees Audit

Other

Public Boards HCA

Holdings, Inc. |

|

✓ |

Business

Development and Corporate Transactions |

|

|

|

✓ |

Finance |

|

|

|

✓ |

Legal and

Regulatory Compliance |

|

|

|

✓ |

Health Care

Industry |

|

|

|

✓ |

Public Policy and

Government Affairs |

|

|

|

✓ |

Public Company

Board Service |

|

Biography

Ms. DeParle has been a Co-Founding

Partner of Consonance Capital Partners, LLC, a private equity firm focused on

investing in small and mid-size health care companies, since August 2013. From

March 2009 to January 2013, Ms. DeParle served in the White House, first as

Counselor to the President and Director of the White House Office of Health

Reform, and later as Assistant to the President and Deputy Chief of Staff for

Policy. In addition, from 1993 to 2000, Ms. DeParle served as the Associate

Director for Health and Personnel for the White House Office of Management

and Budget, and later as the Administrator of the

Centers for Medicare and Medicaid Services (then known as the Health Care

Financing Administration). From 2001 to March 2009, Ms. DeParle served as a

Senior Advisor with JPMorgan Partners and as a Managing Director of its

successor entity, CCMP Capital, L.L.C., focusing on private equity investments

in health care companies. Ms. DeParle is also a director of HCA Holdings, Inc.,

a health care services company that owns, manages or operates hospitals and

various other health care facilities.

Skills and Qualifications of

Particular Relevance to CVS Health

Ms. DeParle has more than 25 years of

experience in the health care arena, and is widely considered to be one of the

nation’s leading experts in health care policy, management and financing, which

makes her an excellent fit for our Board.

|

|

DAVID W.

DORMAN Age 61 |

|

Director since

March 2006 |

|

|

|

|

|

|

|

Chairman of the

Board of CVS Health Corporation, Founding Partner of Centerview Capital

Technology Fund |

|

|

|

|

|

|

|

INDEPENDENT DIRECTOR |

|

DIRECTOR QUALIFICATION HIGHLIGHTS |

|

|

CVS Health Board

Committees Management

Planning and Development, Nominating and

Corporate

Governance (Chair), Executive

Other Public Boards Motorola Solutions, Inc.,

Yum! Brands, Inc., eBay,

Inc. |

|

✓ |

Leadership – Former

CEO |

|

|

|

✓ |

Finance |

|

|

|

✓ |

International Business

Operations; Consumer Products or Services |

|

|

|

✓ |

Technology and

Innovation |

|

|

|

✓ |

Risk

Management |

|

|

|

✓ |

Corporate

Governance |

|

|

|

✓ |

Public Company

Board Service |

|

Biography

Mr. Dorman has been the Chairman of the

Board of CVS Health Corporation since May 2011. He has also served as Lead

Director of Motorola Solutions, Inc. (formerly Motorola, Inc.), a communications

products company, since May 2011, and was Non-Executive Chairman of the Board of

Motorola from May 2008 through May 2011. He has also been a Founding Partner of

Centerview Capital Technology Fund, a private investment firm, since July 2013.

From October 2006 through April 2008, he was a Managing Director and Senior

Advisor with Warburg Pincus LLC, a global private

equity firm. From November 2005 until January 2006, Mr. Dorman served as

President and a director of AT&T Inc., a telecommunications company

(formerly known as SBC Communications). From November 2002 until November 2005,

Mr. Dorman was Chairman of the Board and Chief Executive Officer of AT&T

Corporation. Mr. Dorman is also a director of Yum! Brands, Inc., a quick service

restaurant company, and eBay, Inc., a global technology company.

Skills and Qualifications of

Particular Relevance to CVS Health

Mr. Dorman’s experience in leading

large companies, beginning with Sprint and later Pacific Bell and AT&T,

lends a perspective and skill set that is greatly valued by the Board. His

business background of growing companies is in line with and useful to our

business strategy. The Board believes that Mr. Dorman’s experience leading the

boards of AT&T and Motorola make him well-suited to be the Company’s

Chairman.

www.cvshealthannualmeeting.com 13

Table of Contents

ITEM 1: ELECTION OF

DIRECTORS

|

|

ANNE M.

FINUCANE Age 62 |

|

Director since

January

2011 |

|

|

|

|

|

|

|

Global Chief Strategy and

Marketing Officer of Bank of America Corporation, Northeast Market

President |

|

|

|

|

|

|

|

INDEPENDENT DIRECTOR |

|

DIRECTOR QUALIFICATION HIGHLIGHTS |

|

|

CVS Health Board

Committees Nominating

and

Corporate Governance

Other Public Boards None |

|

✓ |

Consumer Products

or Services |

|

|

|

✓ |

Corporate Strategy

Development and Oversight |

|

|

|

✓ |

Marketing, Brand

Management |

|

|

|

✓ |

Public

Policy |

|

|

|

✓ |

Public

Relations |

|

|

|

✓ |

Regulated

Industry |

|

Biography

Ms. Finucane has been the Global Chief

Strategy and Marketing Officer for Bank of America Corporation (“BOA”), an

international financial services company, since 2006 and has been Northeast

Market President for BOA since 2004. During her eighteen-plus years as a senior

leader at BOA and its legacy firms, Ms. Finucane has served as senior advisor to

four chief executive officers and the Board of

Directors, with a focus on corporate strategy and public policy creation and

implementation. Ms. Finucane also oversees all marketing, public policy,

government affairs, consumer policy and corporate social

responsibility for BOA. She is chair of BOA’s Corporate Social Responsibility

Committee.

Skills and Qualifications of

Particular Relevance to CVS Health

Ms. Finucane’s experience in the

financial services industry, consumer policy, marketing and government affairs

provides the Board with valuable insight in those key areas.

|

|

LARRY J.

MERLO Age 59 |

|

Director since

May 2010 |

|

|

|

|

|

|

|

President and

Chief Executive Officer of CVS Health Corporation |

|

|

|

|

|

|

|

NON-INDEPENDENT DIRECTOR |

|

DIRECTOR QUALIFICATION HIGHLIGHTS |

|

|

CVS Health Board

Committees Executive

Other

Public Boards None |

|

✓ |

Leadership –

Current CEO |

|

|

|

✓ |

Business

Operations; Consumer Products or Services |

|

|

|

✓ |

Health

Care/Regulated Industry |

|

|

|

✓ |

Public

Policy |

|

|

|

✓ |

Retail, Retail

Pharmacy and Pharmacy Benefit Management |

|

Biography

Mr. Merlo has been Chief Executive

Officer of CVS Health Corporation (formerly CVS Caremark Corporation) since

March 2011 and President of CVS Health Corporation since May 2010. Mr. Merlo

formerly served as Chief Operating Officer of CVS Health Corporation from May

2010 through March 2011 and was President of

CVS/pharmacy – Retail from January 2007 through May 2010; Executive Vice

President – Stores of CVS Health Corporation from April 2000 to January 2007;

and Executive Vice President – Stores of CVS Pharmacy, Inc. from March 1998 to

January 2007.

Skills and Qualifications of

Particular Relevance to CVS Health

Mr. Merlo has been with CVS Health and

its subsidiaries for more than 30 years, and provides the Board with invaluable

experience and insight into the retail drugstore and health care

industries.

14 CVS Health Notice of Annual Meeting of Stockholders

Table of Contents

ITEM 1: ELECTION OF

DIRECTORS

|

|

JEAN-PIERRE

MILLON Age 64 |

|

Director since

March 2007 |

|

|

|

|

|

|

|

President and

Chief Executive Officer of PCS Health Systems, Inc.

(Retired) |

|

|

|

|

|

|

|

INDEPENDENT DIRECTOR |

|

DIRECTOR

QUALIFICATION HIGHLIGHTS |

|

|

CVS Health Board

Committees Audit

Other

Public Boards None |

|

✓ |

Leadership – Former

CEO |

|

|

|

✓ |

Finance |

|

|

|

✓ |

Corporate Strategy

Development and Oversight |

|

|

|

✓ |

Health

Care/Regulated Industry |

|

|

|

✓ |

International

Business Operations |

|

|

|

✓ |

Pharmacy Benefit

Management |

|

|

|

✓ |

Public Company

Board Service |

|

Biography

Mr. Millon is the retired former

President and Chief Executive Officer of PCS Health Systems, Inc. (“PCS”). Mr.

Millon joined PCS in 1995, where he served as President and Chief Executive

Officer from June 1996 until his retirement in September 2000. Prior to that,

Mr. Millon served as an Executive and held several global leadership positions

with Eli Lilly and Company. Mr. Millon previously served on the board of

Caremark from March 2004, upon Caremark’s acquisition of AdvancePCS, and as a

director of AdvancePCS (which resulted from the merger of PCS and Advance Paradigm, Inc.) beginning in October 2000. He

became a director of CVS Health upon the closing of the merger transaction

involving CVS Health and Caremark. Mr. Millon has over 10 years of financial

management experience and fifteen years of general functional management

experience, including strategic planning experience specific to pharmacy benefit

management companies as the former head of PCS. He also has extensive venture

capital and public and private company board experience, and presently serves on

the CEO advisory board of a private equity fund.

Skills and

Qualifications of Particular Relevance to CVS Health

Mr. Millon’s extensive background

and experience in the pharmacy benefit management, pharmaceutical and life

sciences businesses, combined with his financial expertise, provide the Board

with additional perspective across the enterprise.

|

|

RICHARD J.

SWIFT Age 70 |

|

Director since

September

2006 |

|

|

|

|

|

|

|

Chairman of the

Board, President and Chief Executive Officer of Foster Wheeler Ltd.

(Retired) |

|

|

|

|

|

|

|

INDEPENDENT

DIRECTOR |

|

DIRECTOR

QUALIFICATION HIGHLIGHTS |

|

|

CVS Health Board

Committees Audit (Chair),

Executive

Other Public

Boards Ingersoll-Rand

PLC, Kaman Corporation, Hubbell Incorporated, Public Service Enterprise

Group Incorporated |

|

✓ |

Leadership – Former

CEO |

|

|

|

✓ |

Finance |

|

|

|

✓ |

International

Business Operations |

|

|

|

✓ |

Risk

Management |

|

|

|

✓ |

Corporate

Governance |

|

|

|

✓ |

Public Company

Board Service |

|

Biography

Mr. Swift is the former Chairman

of the Board, President and Chief Executive Officer of Foster Wheeler Ltd., an

international engineering and construction firm, having served in those

positions from April 1994 until his retirement in October 2001. Mr. Swift also

served as a member and as Chairman of the Financial Accounting Standards

Advisory Council (“FASAC”) from 2002 until his retirement from FASAC in December 2006. Mr. Swift is also lead director

of Public Service Enterprise Group Incorporated, an energy company, and a

director of Ingersoll-Rand PLC, a diversified industrial company, Kaman

Corporation, a diversified manufacturer and distributor, and Hubbell

Incorporated, an electrical and electronic products company.

Skills and

Qualifications of Particular Relevance to CVS Health

The Board greatly values Mr.

Swift’s financial expertise, including his experience at FASAC and with various

public company boards and audit committees for over 30 years of combined

service. Mr. Swift is an audit committee financial expert and his accounting and

financial skills are important to the oversight of our financial reporting,

enterprise and operational risk management.

www.cvshealthannualmeeting.com 15

Table of Contents

ITEM 1: ELECTION OF

DIRECTORS

|

|

WILLIAM C.

WELDON Age 66 |

|

Director since

March 2013 |

|

|

|

|

|

|

|

Chairman of the

Board and Chief Executive Officer of Johnson & Johnson

(Retired) |

|

|

|

|

|

|

|

INDEPENDENT

DIRECTOR |

|

DIRECTOR QUALIFICATION HIGHLIGHTS |

|

|

CVS Health Board

Committees Management

Planning and Development, Nominating and Corporate

Governance

Other Public

Boards JPMorgan Chase

& Co., Exxon Mobil Corporation, Chubb Corporation |

|

✓ |

Leadership – Former

CEO |

|

|

|

✓ |

Health

Care/Regulated Industry |

|

|

|

✓ |

International

Business Operations; Consumer |

|

|

|

|

Products or

Services |

|

|

|

✓ |

Risk

Management |

|

|

|

✓ |

Corporate

Governance |

|

|

|

✓ |

Public Company

Board Service |

|

Biography

Mr. Weldon is the former Chairman

of the Board and Chief Executive Officer of Johnson & Johnson, a global

developer and manufacturer of health care products, having served in those

positions from 2002 until his retirement as Chief Executive Officer in April

2012 and his retirement from the board in December 2012. Mr. Weldon previously

served in a variety of senior executive positions during his 41-year career with

Johnson & Johnson. Mr. Weldon is also a director of JPMorgan Chase &

Co., a financial services company, Exxon Mobil Corporation, an international oil

and gas company, and Chubb Corporation, an international insurance

company.

Skills and

Qualifications of Particular Relevance to CVS Health

Mr. Weldon’s experience in

managing a complex global health care company and his deep knowledge of the

worldwide health care market across multiple sectors makes him extremely well

suited to serve on our Board. His background in international business

management and operating in the highly-regulated health care industry is also

greatly valued by the Board.

|

|

TONY L.

WHITE Age 68 |

|

Director since

March 2011 |

|

|

|

|

|

|

|

Chairman of the

Board, President and Chief Executive Officer of Applied Biosystems, Inc.

(Retired) |

|

|

|

|

|

|

|

INDEPENDENT DIRECTOR |

|

DIRECTOR QUALIFICATION HIGHLIGHTS |

|

|

CVS Health Board

Committees Audit,

Management Planning and Development

Other Public Boards Ingersoll-Rand PLC, C.R. Bard, Inc. |

|

✓ |

Leadership – Former

CEO |

|

|

|

✓ |

Finance |

|

|

|

✓ |

Health

Care/Regulated Industry |

|

|

|

✓ |

Technology and

Innovation |

|

|

|

✓ |

Risk

Management |

|

|

|

✓ |

Corporate

Governance |

|

|

|

✓ |

Public Company

Board Service |

|

Biography

Mr. White is the former Chairman

of the Board, President and Chief Executive Officer of Applied Biosystems, Inc.

(formerly Applera Corporation), a developer, manufacturer and marketer of life

science systems and genomic information products, having served in those

positions from September 1995 until his retirement in November 2008. Mr. White

is also a director of Ingersoll-Rand PLC, a diversified industrial company, and

C.R. Bard, Inc., a company that designs, manufacturers, packages, distributes

and sells medical, surgical, diagnostic and patient care devices.

Skills and

Qualifications of Particular Relevance to CVS Health

Mr. White’s wealth of management

experience in the life sciences and health care industries, including over 13

years as Chairman and CEO of an advanced-technology life sciences company and 26

years in various management positions at Baxter International, Inc., a provider

of medical products and services, makes him well qualified to serve as a

director of CVS Health.

| The Board

of Directors unanimously recommends a vote FOR the election of all

nominees. |

16 CVS Health Notice of Annual Meeting of Stockholders

Table of Contents

|

|

CORPORATE GOVERNANCE AND RELATED

MATTERS |

THE BOARD’S ROLE AND ACTIVITIES IN 2014

CVS Health’s Board of Directors

(the “Board”) acts as the ultimate decision-making body of the Company and

advises and oversees management, who are responsible for the day-to-day

operations and management of the Company. In carrying out its responsibilities,

the Board reviews and assesses CVS Health’s long-term strategy and its

strategic, competitive and financial performance.

During 2014, there were eight

meetings of the Board. Directors are expected to make every effort to attend the

Annual Meeting, all Board meetings and the meetings of the Committees on which

they serve. All of our directors at the time of our 2014 Annual

Meeting of Stockholders attended that Annual Meeting. In 2014, each director

attended over 90% of the meetings of the Board and the Committees of which he or

she was a member.

One Board meeting was our annual

meeting of independent directors. The independent directors also regularly hold

executive sessions during regularly scheduled Board meetings in which our

management does not participate.

During 2014, the Board was

instrumental in our decision to become the first national pharmacy chain to

eliminate the sale of tobacco products, as well as our subsequent name change.

The Board also voted to return more than $5 billion to our stockholders, through

a combination of cash dividends and stock repurchases. The Board continued its

focus on our strategic growth initiatives, which have both short- and long-term

aspects and are aimed at guiding CVS Health through the changing health care

landscape.

STOCKHOLDER OUTREACH

Because the Company values each of

its stockholders and their opinions, we have regularly interacted with

our stockholders on a variety of matters. In 2014, at the direction of the

Board, the Company engaged in a robust stockholder outreach effort to best

understand and address any concerns stockholders might have. Details regarding

our outreach effort and the compensation-related actions taken are found on page

40 of this proxy statement. The redesign of this proxy statement, aimed at

making it more reader friendly and easier to understand, grew out of our

outreach effort.

In addition to

compensation-related matters, a number of corporate governance matters were

discussed with our stockholders during the outreach process, including director

tenure, skill sets and diversity. Stockholders were supportive of the Board’s current tenure mix and appreciated

the Company’s continued attention to the breadth, depth and diversity of its

Board of Directors. In furtherance of those qualities, we are pleased to

highlight the addition to our Board of Richard M. Bracken in January 2015 and

Alecia A. DeCoudreaux in March 2015.

We believe that taking the

responsive actions summarized above will continue to strengthen our

relationships with our stockholders and provide positive improvements in the

areas identified.

STOCKHOLDER RIGHTS

Under our Amended and Restated

Certificate of Incorporation (the “Charter”) and our Amended and Restated

By-laws (the “By-laws”), our stockholders have the right to call a special

meeting of stockholders and to act by written consent that is less than

unanimous. Holders of at least 25% of our common stock can call a special meeting or request an action by written

consent by following the procedures described in our Charter and By-laws. Our

Charter and By-laws are available to stockholders at no charge upon request to

our Corporate Secretary.

CORPORATE GOVERNANCE GUIDELINES

The Board has adopted Corporate

Governance Guidelines, which are available on our investor relations website at

http://investors.cvshealth.com and are also available to stockholders at no

charge upon request to our Corporate Secretary. These Guidelines meet the listing standards adopted by the New York Stock

Exchange (“NYSE”), on which our common stock is listed.

www.cvshealthannualmeeting.com 17

Table of Contents

CORPORATE GOVERNANCE AND RELATED

MATTERS

THE BOARD’S LEADERSHIP STRUCTURE

David W. Dorman is our independent

Chairman of the Board. The independent Chairman presides at all meetings of the

Board, and works with our Chief Executive Officer (“CEO”) to set Board meeting

agendas and the schedule of Board meetings. In addition, the independent

Chairman has the following duties and responsibilities: the authority to call,

and to lead, independent director sessions; the ability to retain independent

legal, accounting or other advisors in connection with these sessions; facilitation of communication and service

as a liaison between the CEO and the other independent directors; and the duty

to advise the CEO of the informational needs of the Board. The Board believes

that Board independence and oversight of management will be effectively

maintained through the independent Chairman, the Board’s composition and its

Committee system.

CONTACT WITH THE BOARD, THE CHAIRMAN AND OTHER INDEPENDENT

DIRECTORS

Stockholders and other parties

interested in communicating directly with the Board, the independent Chairman of

the Board or with the independent directors as a group may do so by writing to

them care of CVS Health Corporation, One CVS Drive, MC 1160, Woonsocket, RI

02895. The Nominating and Corporate Governance Committee has approved a process

for handling letters received by the Company and addressed to the Board, the

independent Chairman of the Board or to

independent members of the Board. Under that process, our Corporate Secretary

reviews all such correspondence and regularly forwards to the Board copies of

all correspondence that, in her opinion, deals with the functions of the Board

or its Committees or that she otherwise determines requires their attention.

THE BOARD’S ROLE IN RISK OVERSIGHT

The Board’s role in risk oversight

involves both the full Board and its Committees. The Audit Committee is charged

with the primary role in carrying out risk oversight responsibilities on behalf

of the Board. Pursuant to its charter, the Audit Committee annually reviews our

policies and practices with respect to risk assessment and risk management,

including discussing with management the Company’s major risk exposures and the

steps that have been taken to monitor and mitigate such exposures. As part of

CVS Health’s ongoing Enterprise Risk Management process, each of our major

business units is responsible for identifying risks that could affect

achievement of business goals and strategies, assessing the likelihood and

potential impact of significant risks, prioritizing risks and actions to be

taken in mitigation and/or response, and reporting to management’s Executive

Risk Steering Committee on actions to monitor, manage and mitigate significant

risks. Additionally, the Chief Financial Officer (“CFO”), Chief Compliance

Officer and General Counsel periodically report on the Company’s risk management

policies and practices to relevant Board Committees and to the full Board. The

Audit Committee reviews CVS Health’s major financial risk exposures as well as

major operational, compliance, reputational

and strategic risks, including developing steps to monitor, manage and mitigate

those risks. In addition, each of the other Board Committees is responsible for

oversight of risk management practices for categories of risks relevant to their

functions. For example, the Management Planning and Development Committee has

oversight responsibility for our overall compensation structure, including

review of its compensation practices, with a view to assessing associated risk.

The Board is regularly updated on specific risks in the course of its review of

corporate strategy, business plans and reports to the Board by its respective

Committees.

The Board considers its role in

risk oversight when evaluating our Corporate Governance Guidelines and its

leadership structure. Both the Corporate Governance Guidelines and the Board’s

leadership structure facilitate the Board’s oversight of risk and communication

with management. Our independent Chairman and our CEO are focused on CVS

Health’s risk management efforts and ensure that risk matters are appropriately

brought to the Board and/or its Committees for their review.

18 CVS Health Notice of Annual Meeting of Stockholders

Table of Contents

CORPORATE GOVERNANCE AND RELATED

MATTERS

SELECTING OUR DIRECTORS

| Director

Independence |

|

Director

Tenure |

| 10 CVS Health directors, including

our Chairman, are independent of management. |

|

Our director nominees bring a balance

of experience and fresh perspective to our boardroom. The average tenure

of CVS Health directors is under five

years. |

Director Diversity

DIRECTOR NOMINATIONS

Under our Corporate Governance

Guidelines, the Nominating and Corporate Governance Committee recommends to the

Board criteria for Board membership and recommends individuals for membership on

our Board of Directors. Director Qualification Criteria used by the Committee in

nominating directors are found in the Committee’s charter and are presented on

page 23 of this proxy statement. Although there is no specific policy on diversity, the

Committee values diversity, which it broadly views in terms of, among other

things, gender, race, background and experience, as a factor in selecting

members to serve on the Board. In addition, to ensure that it has access to a

broad range of qualified, experienced and diverse candidates, the Nominating and

Corporate Governance Committee uses the services of an independent search firm

to help identify and assist in the evaluation of candidates.

The Nominating and Corporate Governance

Committee will consider any director candidates recommended by stockholders who

submit a written request to our Corporate Secretary. All candidates should meet

the Director Qualification Criteria. The Committee evaluates all director

candidates and nominees in the same manner regardless of the source. If a

stockholder would like to nominate a person for election or re-election to the

Board, he or she must provide notice to the Company as provided in our bylaws.

Such notice must be addressed to the Corporate Secretary and must arrive at CVS

Health in a timely manner, between 90 and 120 days prior to the anniversary of

our last annual meeting of stockholders. The notice must include (1) the name

and address, as they appear in our books, of the stockholder giving the notice,

(2) the class and number of our shares

that are beneficially owned by the

stockholder (including information concerning derivative ownership and other arrangements concerning our stock as described in our

by-laws), (3) a written consent indicating that the candidate is willing to be

named in the proxy statement as a nominee and to serve as a director if elected,

and (4) any other information that the U.S. Securities and Exchange Commission

(“SEC”) would require to be included in a proxy statement when a stockholder

submits a proposal. See “Other Matters – Stockholder Proposals and Other

Business for our Annual Meeting in 2016” for additional information related to

our 2016 Annual Meeting.

In accordance with our by-laws, each

nominee who is a current director has submitted an irrevocable resignation,

which resignation becomes effective upon (1) that person not receiving a

majority of the votes cast in an uncontested election, and (2) acceptance by the

Board of that resignation in accordance with the policies and procedures adopted

by the Board for that purpose. The Board, acting on the recommendation of the

Nominating and Corporate Governance Committee, will no later than at its first

regularly scheduled meeting following certification of the stockholder vote,

determine whether to accept the resignation of the unsuccessful incumbent.

Absent a determination by the Board that a compelling reason exists for

concluding that it is in the best interests of the Company for an unsuccessful

incumbent to remain as a director, the Board will accept that person’s

resignation.

The retirement age for CVS Health

directors is 72. Our Corporate Governance Guidelines provide that no director

who is or would be over the age of 72 at the expiration of his or her current

term may be nominated to a new term, unless the Board waives the retirement age

for a specific director in exceptional circumstances.

www.cvshealthannualmeeting.com 19

Table of Contents

CORPORATE GOVERNANCE AND RELATED

MATTERS

INDEPENDENCE DETERMINATIONS FOR DIRECTORS

Under our Corporate Governance

Guidelines, a substantial majority of our Board must be comprised of directors

who meet the director independence requirements set forth in the Corporate

Governance Rules of the NYSE applicable to listed companies. Under the NYSE

Corporate Governance Rules, no director qualifies as “independent” unless the

Board affirmatively determines that the director has no material

relationship with the Company (either directly or as a partner, stockholder or

officer of an organization that has a relationship with the Company). The Board

has adopted categorical standards to assist it in making determinations of

independence.

| CVS Health’s

Categorical Standards to Assist in Independence

Determinations |

Our Board has

adopted the following categorical standards to assist in making director

independence determinations. Any relationship or set of facts that falls within

the following standards or relationships will not, in itself, preclude a

determination of independence:

| (1) |

Charitable donations or

pledges. |

Charitable donations made to a

tax-exempt organization of which a director (or a member of his or her

immediate family) is an executive officer or otherwise made at the behest

of the director where the amounts donated for any calendar year do not

exceed the greater of $120,000 or 2% of the consolidated gross revenues of

the organization. |

| (2) |

Commercial banking or investment banking

relationships. |

A situation in which a director

or an immediate family member of a director is an employee of a commercial

or investment bank that has relationships or dealings with or provides

services to CVS Health that do not cross the bright-line tests referred to

in paragraph (4) below. |

| (3) |

Ordinary course commercial relationships. |

A situation in which a director

(or a member of his or her immediate family) is a director, officer,

employee or significant stockholder of an entity with which CVS Health has

ordinary course business dealings that do not cross the bright-line tests

referred to in paragraph (4) below and where the director (or immediate

family member) is not directly responsible for or involved in the entity’s

business dealings with CVS Health. |

| (4) |

NYSE Listed-Company Bright-Line

Tests. |

Any relationship or set of facts

that falls within the standards permitted by the bright-line tests set

forth in Section 303A.02(b)(i)-(v) of the NYSE’s Listed Company Manual,

which are summarized below. |

| NYSE Bright-Line

Tests For Director Independence |

The following

summarizes the standards set forth in Section 303A.02(b)(i)-(v) of the NYSE’s

Listed Company Manual (excluding, for sake of brevity, the related Commentary):

| (1) |

Employees, or family members

who are employees |

A director who is an employee, or

whose immediate family member is an executive officer, of the company is

not independent until three years after the end of such employment

relationship. |

| (2) |

Compensated professional services |

A director who receives, or whose

immediate family member receives, more than $120,000 in any 12-month

period in direct compensation from the listed company, other than director

and committee fees and pension or other forms of deferred compensation for

prior service (provided such compensation is not contingent in any way on

continued service), is not independent until three years after he or she

ceases to receive more than $120,000 in such compensation in any 12-month

period. |

| (3) |

Audit relationships |

A director who is, or whose

immediate family member is, a current partner of a firm that is the

company’s internal or external auditor, or a director who is a current

employee of such a firm, or if a director’s immediate family member is a

current employee of such firm and participates in the firm’s audit,

assurance or tax compliance practice, or a director who was, or whose

immediate family member was, within the last three years (but is no

longer) a partner or employee of such firm and personally worked on the

listed company’s audit within that time. |

| (4) |

Executive officer – compensation committee

relationships |

A director who is, or whose

immediate family member is, or in the last three years has been, employed

as an executive officer of another company where any of the listed

company’s executives at the same time serve or served on that company’s

compensation committee. |

| (5) |

Significant commercial

relationships |

A director who is an executive

officer or an employee, or whose immediate family member is an executive

officer, of a company that makes payments to, or receives payments from,

the listed company for property or services in an amount which, in any

single fiscal year, exceeds the greater of $1 million, or 2% of such other

company’s consolidated gross revenues, is not “independent” until three

years after falling below such

threshold. |

20 CVS Health Notice of Annual Meeting of Stockholders

Table of Contents

CORPORATE GOVERNANCE AND RELATED

MATTERS

The Nominating and Corporate Governance

Committee of the Board undertook its annual review of director independence in

March 2015 and recommended that the Board determine that each of Richard M.

Bracken, C. David Brown II, Alecia A. DeCoudreaux, Nancy-Ann M. DeParle, David

W. Dorman, Anne M. Finucane, Jean-Pierre Millon, Richard J. Swift, William C.

Weldon and Tony L. White, is independent. Mr. Merlo is not an independent

director because of his employment as President and CEO of the Company.

In the course of its review as to the

independence of each director, the Committee considered transactions and

relationships, if any, between each director or any member of his or her

immediate family, on the one hand, and CVS Health and its subsidiaries, on the

other. In that regard, as to Mr. Bracken’s independence, the Committee, in making its recommendation, and the Board, in making its

determination, considered that Mr. Bracken is the former Chairman and CEO of an

entity with which the Company has ordinary course, arm’s length business

dealings, and that Mr. Bracken was not involved in the entity’s dealings with

the Company. The Committee and Board also considered that Mr. Weldon’s son is a

former executive officer of an entity with which CVS Health has ordinary course,

arm’s-length business dealings, and that neither Mr. Weldon nor his son was

involved in the entity’s business dealings with the Company. See “Certain

Transactions with Directors and Officers”, below. After considering all relevant

facts and circumstances, the Committee recommended, and the Board determined,

that each of Mr. Bracken and Mr. Weldon is independent.

COMMITTEES OF THE BOARD

The Board has established four standing

committees. The table below provides membership and meeting information for each

of the committees during 2014. Mr. Bracken and Ms. DeCoudreaux joined our Board

in 2015.

| Name |

|

Audit

Committee |

|

Management

Planning

&

Development

Committee |

|

Nominating

&

Corporate

Governance

Committee |

|

Executive

Committee |

| C.

David Brown II |

|

|

|

● |

|

● |

|

● |

| Nancy-Ann M.

DeParle |

|

● |

|

|

|

|

|

|

| David W. Dorman |

|

|

|

● |

|

● |

|

● |

| Anne M. Finucane |

|

|

|

|

|

● |

|

|

| Larry J. Merlo |

|

|

|

|

|

|

|

● |

| Jean-Pierre

Millon |

|

●† |

|

|

|

|

|

|

| Richard J. Swift |

|

●† |

|

|

|

|

|

● |

| William C.

Weldon |

|

|

|

● |

|

● |

|

|

| Tony L. White |

|

●† |

|

● |

|

|

|

|

| 2014 Meetings |

|

8 |

|

5 |

|

5 |

|

1 |

| ● |

Committee Chair |

| † |

Audit Committee Financial

Expert |

www.cvshealthannualmeeting.com 21

Table of Contents

CORPORATE GOVERNANCE AND RELATED

MATTERS

| AUDIT

COMMITTEE |

|

Committee Members

in 2014

(all independent)

Nancy-Ann M. DeParle

Jean-Pierre Millon*