UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 4 , 2015

Carriage Services, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 1-11961 | | 76-0423828 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

3040 Post Oak Boulevard, Suite 300

Houston, Texas 77056

(Address, including zip code, of principal executive offices)

Registrant's telephone number, including area code:

(713) 332-8400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

In the press release dated August 4, 2015, Carriage Services, Inc. (“the Company”) announced and commented on its financial results for its quarter ended June 30, 2015. A copy of the press release issued by the Company is attached hereto as Exhibit 99.1 and incorporated by this reference. The information being furnished under Item 9.01 Financial Statements and Exhibits, including the press release attached hereto as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liabilities of that Section.

The Company’s press release dated August 4, 2015 contains non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with United States generally accepted accounting principles, or GAAP. Pursuant to the requirements of Regulation G, the Company has provided quantitative reconciliations within the press release of the non-GAAP financial measures to the most directly comparable GAAP financial measures.

ITEM 9.01 FINANCIAL STATMENTS AND EXHIBITS.

(d) Exhibits. The following are furnished as part of this current report on Form 8-K:

99.1 Press Release dated August 4, 2015

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Carriage Services, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| CARRIAGE SERVICES, INC. |

| | | |

Dated: August 4, 2015 | By: | | /s/ Carl B. Brink |

| | | Carl B. Brink |

| | | Principal Financial Officer and Treasurer |

INDEX TO EXHIBITS

|

| | | |

Exhibit | | Description |

| |

99.1 |

| | Press Release dated August 4, 2015. |

CARRIAGE SERVICES ANNOUNCES RECORD RESULTS FOR SECOND QUARTER 2015

AND RAISES ROLLING FOUR QUARTER OUTLOOK

HOUSTON, August 4, 2015 /PRNewswire/ -- Melvin C. Payne, Chief Executive Officer, stated, “We achieved record second quarter results with Adjusted Net Income of $6.4 million equal to Adjusted Diluted EPS of $0.34 and Adjusted Net Income Margin of 10.8% on record revenue of $59.3 million. While the second quarter revenue and earnings increases over last year were all modest in the 3% - 5% range, the large increases comprising our record high performance for the first six months continues to reflect the maturity and effectiveness of Carriage as an operating and consolidation platform that has also become a superior value creation investment platform. We are producing record amounts of Adjusted Free Cash Flow, i.e. $13.9 million for the second quarter and $25.4 million for the first six months, primarily a function of our increasing cash earning power as reflected by our historically high Adjusted Consolidated EBITDA Margin of 30.1% for the first six months of 2015. Shown below are the highlights of our three and six months performance (in millions):

Three Months ended June 30, 2015

| |

• | Total Revenue of $59.3 million, an increase of 4.9%; |

| |

• | Adjusted Consolidated EBITDA of $17.2 million, an increase of 5.4%; |

| |

• | Adjusted Consolidated EBITDA Margin increased 10 basis points to 29.0%; |

| |

• | Adjusted Diluted Earnings Per Share of $0.34, an increase of 3.0%; |

| |

• | Adjusted Net Profit Margin up 10 basis points to 10.8%; and |

| |

• | Adjusted Free Cash Flow of $13.9 million. |

Six Months ended June 30, 2015

| |

• | Total Revenue of $122.5 million, an increase of 9.2%; |

| |

• | Adjusted Consolidated EBITDA of $36.9 million, an increase of 17.3%; |

| |

• | Adjusted Consolidated EBITDA Margin up 210 basis points to 30.1%; |

| |

• | Adjusted Diluted Earnings Per Share of $0.76, an increase of 18.8%; |

| |

• | Adjusted Net Profit Margin up 130 basis points to 11.8%; and |

| |

• | Adjusted Free Cash Flow of $25.4 million, an increase of 30.9%. |

Since launching the first five year phase of our Good To Great Journey at the beginning of 2012, our goal has been to create a high performance culture driven by a strong and uniquely collaborative leadership team dynamic in our Houston home office. We initially created the Operations and Support Leadership Team (OSLT) that has since evolved into the Operations and Strategic Growth Leadership Team (OSGLT), a small group of leaders representing all major functional areas of Carriage. We have gone through several organizational structure and responsibility changes within OSGLT since January 1, 2012, each of which was designed to raise and accelerate the high and sustainable financial performance required by the Carriage Good To Great Journey. We recently completed another leadership reorganization, as our OSGLT members were reduced from fifteen active members to ten and a significant number of department or functional groups were placed under new leadership within the OSGLT. A primary by-product of these organizational changes will be much less overhead and improved execution of our three models in the future.

In May we announced that Bill Heiligbrodt will officially retire as a full time employee of Carriage on March 4, 2016, after which he will serve as a consultant for two more years to me and other members of our

Operations and Strategic Growth Leadership Team. While Bill has officially transitioned his executive officer roles to Viki Blinderman and Ben Brink as Co-CFO's, he continues to actively serve as an advisory member of our OSGLT and Board of Directors.

Our revised Strategic Acquisition Model methodologies are being actively implemented both by Dave DeCarlo’s Corporate Development Team and by the various support teams in Houston. We remain highly optimistic that our focus on the best remaining independent businesses in the best strategic markets and areas will result in long-term high single digit annual compound revenue growth with much higher rates of growth in Adjusted Diluted EPS and Free Cash Flow over time because of the highly efficient leveraging dynamics of Carriage as a deathcare operations and consolidation platform.

We have concluded that allocation of our increasing Adjusted Free Cash Flow should include repurchasing common shares when the price does not fully reflect the cash earning power and intrinsic value of our company, which we believe is currently the case. Accordingly, we recently announced that our Board approved a $25 million common share repurchase program. We will repurchase shares under this plan from time to time as long as we can buy our shares at prices under what we consider ‘fair value’, a capital allocation strategy option that was initiated in the second quarter with the repurchase of 125,000 shares for $3.1 million. We will continue to prioritize the allocation of our Adjusted Free Cash Flow toward the goal of acquiring the best remaining independent funeral and cemetery businesses in the best strategic markets in the country and on exceptional internal growth projects.

To reflect primarily the overhead benefits of recent organizational changes, we are raising our Rolling Four Quarter Outlook of Adjusted Diluted Earnings per share to $1.57 – $1.61 from $1.55 – $1.59 at the end of the first quarter,” concluded Mr. Payne.

FIELD OPERATIONS

Three Months Ended June 30, 2015 compared to Three Months Ended June 30, 2014

| |

• | Total Field Revenue increased 4.9% to $59.3 million; |

| |

• | Total Field EBITDA increased 5.3% to $23.6 million; |

| |

• | Total Field EBITDA Margin increased 10 basis points to 39.7%; |

| |

• | Total Funeral Operating Revenue increased 6.2% to $42.3 million; |

| |

• | Same Store Funeral Revenue increased 1.8% with same store volume increasing 0.1%; |

| |

• | Acquisition Funeral Revenue increased 21.9% with acquisition volume increasing 18.9%; |

| |

• | Total Funeral Field EBITDA increased 9.2% to $15.3 million; |

| |

• | Total Funeral Field EBITDA Margin increased 100 basis points to 36.2%; |

| |

• | Total Cemetery Operating Revenue increased 4.1% to $12.2 million; |

| |

• | Cemetery pre-need property sale contracts decreased 4.6% to 2,110; |

| |

• | Preneed property revenue recognized increased 0.4% and At-need revenue increased 5.6%; |

| |

• | Total Cemetery Field EBITDA increased 3.3% to $3.8 million; |

| |

• | Total Cemetery Field EBITDA Margin decreased 20 basis points to 31.4%; |

| |

• | Total Financial Revenue decreased 3.7% to $4.8 million; |

| |

• | Funeral Financial Revenue decreased 6.5% to $2.2 million; |

| |

• | Cemetery Financial Revenue decreased 1.2% to $2.6 million; |

| |

• | Total Financial EBITDA decreased 4.8% to $4.4 million; |

| |

• | Total Financial EBITDA Margin decreased 100 basis points to 92.3%. |

Six Months Ended June 30, 2015 compared to Six Months Ended June 30, 2014

| |

• | Total Field Revenue increased 9.2% to $122.5 million; |

| |

• | Total Field EBITDA increased 13.1% to $51.1 million; |

| |

• | Total Field EBITDA Margin increased 140 basis points to 41.7%; |

| |

• | Total Funeral Operating Revenue increased 10.5% to $89.9 million; |

| |

• | Same Store Funeral Revenue increased 4.2% with same store volume increasing 2.5%; |

| |

• | Acquisition Funeral Revenue increased 35.4% with acquisition volume increasing 33.5%; |

| |

• | Total Funeral Field EBITDA increased 16.4% to $34.8 million; |

| |

• | Total Funeral Field EBITDA Margin increased 200 basis points to 38.7%; |

| |

• | Total Cemetery Operating Revenue increased 8.4% to $23.3 million; |

| |

• | Cemetery pre-need property sale contracts increased 10.2% to 4,250; |

| |

• | Preneed property revenue recognized increased 11.6% and At-need revenue increased 6.0%; |

| |

• | Total Cemetery Field EBITDA increased 17.5% to $7.7 million; |

| |

• | Total Cemetery Field EBITDA Margin increased 260 basis points to 33.0%; |

| |

• | Total Financial Revenue decreased 0.1% to $9.4 million; |

| |

• | Funeral Financial Revenue decreased 1.6% to $4.8 million; |

| |

• | Cemetery Financial Revenue increased 1.6% to $4.6 million; |

| |

• | Total Financial EBITDA decreased 1.3% to $8.6 million; |

| |

• | Total Financial EBITDA Margin decreased 110 basis points to 92.4%. |

ADJUSTED FREE CASH FLOW

We produced Adjusted Free Cash Flow from operations for the three and six months ended June 30, 2015 of $13.9 million and $25.4 million, respectively, compared to Adjusted Free Cash Flow from operations of $13.9 million and $19.4 million for the corresponding periods in 2014. A reconciliation of Cash Flow Provided by Operations to Adjusted Free Cash Flow for the three and six months ended June 30, 2014 and 2015 is as follows (in millions):

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

|

| 2014 |

| | 2015 |

| | 2014 |

| | 2015 |

|

Cash flow provided by operations | $ | 14.9 |

| | $ | 15.7 |

| | $ | 13.3 |

| | $ | 28.3 |

|

Cash used for maintenance capital expenditures | (1.7 | ) | | (3.0 | ) | | (2.6 | ) | | (4.8 | ) |

Free Cash Flow | $ | 13.2 |

| | $ | 12.7 |

| | $ | 10.7 |

| | $ | 23.5 |

|

| | | | | | | |

Plus: Incremental Special Items: | | | | | | | |

Adjustment for tax benefit from Good to Great stock awards | — |

| | — |

| | 4.8 |

| | — |

|

Acquisition and divestiture expenses | 0.3 |

| | — |

| | 1.0 |

| | 0.5 |

|

Severance costs | 0.4 |

| | 0.5 |

| | 0.7 |

| | 0.6 |

|

Consulting fees | — |

| | 0.7 |

| | 0.3 |

| | 0.8 |

|

Other incentive compensation | — |

| | — |

| | 1.0 |

| | — |

|

Premium paid for the redemption of convertible junior subordinated debentures | — |

| | — |

| | 0.9 |

| | — |

|

Adjusted Free Cash Flow | $ | 13.9 |

| | $ | 13.9 |

| | $ | 19.4 |

| | $ | 25.4 |

|

ROLLING FOUR QUARTER OUTLOOK

The Rolling Four Quarter Outlook (“Outlook”) reflects management’s opinion on the performance of the portfolio of existing businesses, including performance of existing trusts, plus likely acquisitions for the Rolling Four Quarter Outlook period ending June 30, 2016. This Outlook is not intended to be management estimates or forecasts of our future performance, as we believe such precise rolling estimates will be precisely wrong all the time. Rather our intent and goal is to reflect a “roughly right range” most of the time of future Rolling Four Quarter Outlook performance as we execute our Standards Operating, Strategic Acquisition and 4E Leadership Models over time.

ROLLING FOUR QUARTER OUTLOOK – Period Ending June 30, 2016

|

| | |

| | Range (in millions, except per share amounts) |

Revenues | | $250 - $254 |

Adjusted Consolidated EBITDA | | $71 - $75 |

Adjusted Net Income | | $29 - $31 |

Adjusted Diluted Earnings Per Share(1) | | $1.57 - $1.61 |

Factors affecting our analysis include, among others, number, size and timing of closing of acquisitions, funeral contract volumes, average revenue per funeral service, cemetery interment volumes, preneed cemetery sales, capital expenditures, execution of our funeral and cemetery Standards Operating Model, Strategic Acquisition Model, Withdrawable Trust Income and changes in Federal Reserve monetary policy. Revenues, Adjusted Consolidated EBITDA, Adjusted Net Income and Adjusted Diluted Earnings Per Share for the four quarter period ending June 30, 2016 are expected to improve relative to the trailing four quarter period ending June 30, 2015 for the following reasons:

| |

• | Increases in Acquired Funeral Revenue and Acquired Funeral Field EBITDA; |

| |

• | Increases in Acquired Cemetery Revenue and Acquired Cemetery Field EBITDA; |

| |

• | Modest increases in Same Store Funeral Revenue and Same Store Funeral Field EBITDA; |

| |

• | Increases in Same Store Cemetery Revenue and Same Store Cemetery Field EBITDA; |

| |

• | Incremental increases in Financial Revenue and Financial EBITDA from trust funds; and |

| |

• | Modest decreases in Overhead as a percentage of Revenue. |

|

| |

(1) | The Rolling Four Quarter Outlook on Adjusted Diluted Earnings Per Share does not include any changes to our fully diluted share count that could occur related to a stock price increase and EPS dilution calculations related to our convertible notes and outstanding and exercisable stock options. |

TRUST FUND PERFORMANCE

For the six months ended June 30, 2015, Carriage’s discretionary trust funds gained 3.6% compared to our 70/30 index benchmark of 2.1%. The current yield on Carriage's discretionary fixed income portfolio, which comprises 65% of discretionary trust assets, is 7.3% and the estimated annual income for the discretionary portfolio is approximately $10.3 million.

Shown below are consolidated performance metrics for the combined trust fund portfolios (preneed funeral, cemetery merchandise and services and cemetery perpetual care) at key dates.

|

| | | | | | | |

Investment Performance |

| | Investment Performance(1) | | Index Performance |

| | Discretionary | Total Trust | | S&P 500 Stock Index | High Yield Index | 70/30 index Benchmark(2) |

| | | | | | | |

6 months ended 6/30/15 | | 3.6% | 3.2% | | 1.2% | 2.5% | 2.1% |

1 year ended 12/31/14 | | 8.3% | 7.9% | | 13.7% | 2.5% | 5.8% |

2 years ended 12/31/14 | | 23.8% | 22.7% | | 50.4% | 10.1% | 22.2% |

3 years ended 12/31/14 | | 48.9% | 43.7% | | 74.5% | 27.5% | 41.6% |

4 years ended 12/31/14 | | 44.6% | 41.0% | | 78.1% | 33.8% | 47.1% |

5 years ended 12/31/14 | | 74.5% | 66.6% | | 105.0% | 54.1% | 69.3% |

|

| |

(1) | Investment performance includes realized income and unrealized appreciation (depreciation). |

(2) | The 70/30 Benchmark is 70% weighted to the High Yield Index and 30% weighted to the S&P 500 Stock Index. |

|

| | | | | | | | | | | | | | |

Asset Allocation as of June 30, 2015 (in thousands) |

| | | Discretionary Trust Funds | | Total Trust Funds |

Asset Class | | | MV |

| % |

| | MV |

| % |

|

Cash | | | $ | 19,703 |

| 10 | % | | $ | 35,203 |

| 15 | % |

Equities | | | 47,146 |

| 24 | % | | 55,245 |

| 24 | % |

Fixed Income | | | 128,478 |

| 64 | % | | 140,959 |

| 59 | % |

Other/Insurance | | | 3,476 |

| 2 | % | | 3,668 |

| 2 | % |

Total Portfolios | | | $ | 198,803 |

| 100 | % | | $ | 235,075 |

| 100 | % |

CONFERENCE CALL AND INVESTOR RELATIONS CONTACT

Carriage Services has scheduled a conference call for tomorrow, August 5, 2015 at 9:30 a.m. central time. To participate in the call, please dial 866-516-3867 (ID-76057989) and ask for the Carriage Services conference call. A replay of the conference call will be available through August 9, 2015 and may be accessed by dialing 855-859-2056 (ID-76057989). The conference call will also be available at www.carriageservices.com. For any investor relations questions, please contact Ben Brink at 713-332-8441.

|

| | | | | | | | | | | | | | | | | |

CARRIAGE SERVICES, INC. |

OPERATING AND FINANCIAL TREND REPORT |

FROM CONTINUING OPERATIONS (IN THOUSANDS - EXCEPT PER SHARE AMOUNTS) |

| | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2014 | 2015 | % Change | | 2014 | 2015 | % Change |

| | | | | | | |

Same Store Contracts | | | | | | | |

Atneed Contracts | 4,892 |

| 4,911 |

| 0.4 | % | | 10,228 |

| 10,455 |

| 2.2 | % |

Preneed Contracts | 1,227 |

| 1,217 |

| -0.8 | % | | 2,540 |

| 2,630 |

| 3.5 | % |

Total Same Store Funeral Contracts | 6,119 |

| 6,128 |

| 0.1 | % | | 12,768 |

| 13,085 |

| 2.5 | % |

Acquisition Contracts | | | | | | | |

Atneed Contracts | 1,248 |

| 1,442 |

| 15.5 | % | | 2,366 |

| 3,085 |

| 30.4 | % |

Preneed Contracts | 230 |

| 315 |

| 37.0 | % | | 438 |

| 658 |

| 50.2 | % |

Total Acquisition Funeral Contracts | 1,478 |

| 1,757 |

| 18.9 | % | | 2,804 |

| 3,743 |

| 33.5 | % |

Total Funeral Contracts | 7,597 |

| 7,885 |

| 3.8 | % | | 15,572 |

| 16,828 |

| 8.1 | % |

| | | | | | | |

Funeral Operating Revenue | | | | | | | |

Same Store Revenue | $ | 31,199 |

| $ | 31,769 |

| 1.8 | % | | $ | 64,863 |

| $ | 67,604 |

| 4.2 | % |

Acquisition Revenue | 8,621 |

| 10,513 |

| 21.9 | % | | 16,442 |

| 22,262 |

| 35.4 | % |

Total Funeral Operating Revenue | $ | 39,820 |

| $ | 42,282 |

| 6.2 | % | | $ | 81,305 |

| $ | 89,866 |

| 10.5 | % |

| | | | | | | |

Cemetery Operating Revenue | | | | | | | |

Same Store Revenue | $ | 11,382 |

| $ | 11,266 |

| -1.0 | % | | $ | 21,094 |

| $ | 21,534 |

| 2.1 | % |

Acquisition Revenue | 334 |

| 930 |

| 178.4 | % | | 389 |

| 1,752 |

| 350.4 | % |

Total Cemetery Operating Revenue | $ | 11,716 |

| $ | 12,196 |

| 4.1 | % | | $ | 21,483 |

| $ | 23,286 |

| 8.4 | % |

| | | | | | | |

Financial Revenue | | | | | | | |

Preneed Funeral Commission Income | $ | 563 |

| $ | 370 |

| -34.3 | % | | $ | 1,127 |

| $ | 725 |

| -35.7 | % |

Preneed Funeral Trust Earnings | 1,809 |

| 1,849 |

| 2.2 | % | | 3,725 |

| 4,047 |

| 8.6 | % |

Cemetery Trust Earnings | 2,276 |

| 2,176 |

| -4.4 | % | | 3,860 |

| 3,817 |

| -1.1 | % |

Preneed Cemetery Finance Charges | 320 |

| 388 |

| 21.3 | % | | 657 |

| 773 |

| 17.7 | % |

Total Financial Revenue | $ | 4,968 |

| $ | 4,783 |

| -3.7 | % | | $ | 9,369 |

| $ | 9,362 |

| -0.1 | % |

Total Revenue | $ | 56,504 |

| $ | 59,261 |

| 4.9 | % | | $ | 112,157 |

| $ | 122,514 |

| 9.2 | % |

| | | | | | | |

Field EBITDA | | | | | | | |

Same Store Funeral Field EBITDA | $ | 10,878 |

| $ | 11,415 |

| 4.9 | % | | $ | 23,768 |

| $ | 25,953 |

| 9.2 | % |

Same Store Funeral Field EBITDA Margin | 34.9 | % | 35.9 | % | 100 bp |

| | 36.6 | % | 38.4 | % | 180 bp |

|

Acquisition Funeral Field EBITDA | 3,142 |

| 3,898 |

| 24.1 | % | | 6,108 |

| 8,811 |

| 44.3 | % |

Acquisition Funeral Field EBITDA Margin | 36.4 | % | 37.1 | % | 70 bp |

| | 37.1 | % | 39.6 | % | 250 bp |

|

Total Funeral Field EBITDA | $ | 14,020 |

| $ | 15,313 |

| 9.2 | % | | $ | 29,876 |

| $ | 34,764 |

| 16.4 | % |

Total Funeral Field EBITDA Margin | 35.2 | % | 36.2 | % | 100 bp |

| | 36.7 | % | 38.7 | % | 200 bp |

|

| | | | | | | |

Same Store Cemetery Field EBITDA | $ | 3,568 |

| $ | 3,537 |

| -0.9 | % | | $ | 6,408 |

| $ | 7,087 |

| 10.6 | % |

Same Store Cemetery Field EBITDA Margin | 31.3 | % | 31.4 | % | 10 bp |

| | 30.4 | % | 32.9 | % | 250 bp |

|

Acquisition Cemetery Field EBITDA | 134 |

| 288 |

| 114.9 | % | | 125 |

| 588 |

| 370.4 | % |

Acquisition Cemetery Field EBITDA Margin | 40.1 | % | 31.0 | % | -910 bp |

| | 32.1 | % | 33.6 | % | 150 bp |

|

Total Cemetery Field EBITDA | $ | 3,702 |

| $ | 3,825 |

| 3.3 | % | | $ | 6,533 |

| $ | 7,675 |

| 17.5 | % |

Total Cemetery Field EBITDA Margin | 31.6 | % | 31.4 | % | -20 bp |

| | 30.4 | % | 33.0 | % | 260 bp |

|

| | | | | | | |

Funeral Financial EBITDA | $ | 2,079 |

| $ | 1,925 |

| -7.4 | % | | $ | 4,305 |

| $ | 4,196 |

| -2.5 | % |

Cemetery Financial EBITDA | 2,556 |

| 2,489 |

| -2.6 | % | | 4,454 |

| 4,453 |

| — | % |

Total Financial EBITDA | $ | 4,635 |

| $ | 4,414 |

| -4.8 | % | | $ | 8,759 |

| $ | 8,649 |

| -1.3 | % |

Total Financial EBITDA Margin | 93.3 | % | 92.3 | % | -100 bp |

| | 93.5 | % | 92.4 | % | -110 bp |

|

| | | | | | | |

Total Field EBITDA | $ | 22,357 |

| $ | 23,552 |

| 5.3 | % | | $ | 45,168 |

| $ | 51,088 |

| 13.1 | % |

Total Field EBITDA Margin | 39.6 | % | 39.7 | % | 10 bp |

| | 40.3 | % | 41.7 | % | 140 bp |

|

| | | | | | | |

|

| | | | | | | | | | | | | | | | | |

OPERATING AND FINANCIAL TREND REPORT |

FROM CONTINUING OPERATIONS (IN THOUSANDS - EXCEPT PER SHARE AMOUNTS) |

| | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2014 | 2015 | % Change | | 2014 | 2015 | % Change |

| | | | | | | |

Overhead | | | | | | | |

Total Variable Overhead | $ | 1,411 |

| $ | 1,766 |

| 25.2 | % | | $ | 5,274 |

| $ | 4,196 |

| -20.4 | % |

Total Regional Fixed Overhead | 781 |

| 884 |

| 13.2 | % | | 1,567 |

| 1,707 |

| 8.9 | % |

Total Corporate Fixed Overhead | 5,085 |

| 5,260 |

| 3.4 | % | | 10,659 |

| 10,613 |

| -0.4 | % |

Total Overhead | $ | 7,277 |

| $ | 7,910 |

| 8.7 | % | | $ | 17,500 |

| $ | 16,516 |

| -5.6 | % |

Overhead as a percent of sales | 12.9 | % | 13.3 | % | 40 bp |

| | 15.6 | % | 13.5 | % | -210 bp |

|

| | | | | | | |

Consolidated EBITDA | $ | 15,080 |

| $ | 15,642 |

| 3.7 | % | | $ | 27,668 |

| $ | 34,572 |

| 25.0 | % |

Consolidated EBITDA Margin | 26.7 | % | 26.4 | % | -30 bp |

| | 24.7 | % | 28.2 | % | 350 bp |

|

| | | | | | | |

Other Expenses and Interest | | | | | | | |

Depreciation & Amortization | $ | 3,029 |

| $ | 3,365 |

| 11.1 | % | | $ | 5,785 |

| $ | 6,687 |

| 15.6 | % |

Non-Cash Stock Compensation | 1,263 |

| 1,287 |

| 1.9 | % | | 1,993 |

| 2,376 |

| 19.2 | % |

Interest Expense | 2,691 |

| 2,492 |

| -7.4 | % | | 5,536 |

| 5,042 |

| -8.9 | % |

Accretion of Discount on Convertible Subordinated Notes | 694 |

| 851 |

| 22.6 | % | | 865 |

| 1,678 |

| 94.0 | % |

Loss on Early Extinguishment of Debt | 1,042 |

| — |

| -100.0 | % | | 1,042 |

| — |

| -100.0 | % |

Loss on Redemption of Convertible Junior Subordinated Debentures | — |

| — |

|

| | 3,779 |

| — |

| -100.0 | % |

Other, Net | (5 | ) | (13 | ) | 160.0 | % | | (373 | ) | 106 |

| -128.4 | % |

Pretax Income | $ | 6,366 |

| $ | 7,660 |

| 20.3 | % | | $ | 9,041 |

| $ | 18,683 |

| 106.6 | % |

Net Tax Provision | 2,483 |

| 3,103 |

| 25.0 | % | | 3,526 |

| 7,708 |

| 118.6 | % |

GAAP Net Income | $ | 3,883 |

| $ | 4,557 |

| 17.4 | % | | $ | 5,515 |

| $ | 10,975 |

| 99.0 | % |

| | | | | | | |

Special Items, Net of tax except for ** | | | | | | | |

Withdrawable Trust Income | $ | 366 |

| $ | 230 |

| | | $ | 515 |

| $ | 230 |

| |

Acquisition and Divestiture Expenses | 168 |

| 19 |

| | | 659 |

| 354 |

| |

Severance Costs | 268 |

| 323 |

| | | 477 |

| 407 |

| |

Consulting Fees | 6 |

| 445 |

| | | 165 |

| 521 |

| |

Other Incentive Compensation | — |

| — |

| | | 660 |

| — |

| |

Accretion of Discount on Convertible Subordinated Notes ** | 694 |

| 851 |

| | | 865 |

| 1,678 |

| |

Costs Related to Credit Facility | 688 |

| — |

| | | 688 |

| — |

| |

Loss on Redemption of Convertible Junior Subordinated Debentures | — |

| — |

| | | 2,493 |

| — |

| |

Gain on Asset Purchase | — |

| — |

| | | (746 | ) | — |

| |

Other Special Items | — |

| — |

| | | 503 |

| 98 |

| |

Tax Adjustment from Prior Period ** | — |

| — |

| | | — |

| 141 |

| |

Sum of Special Items, Net of tax | $ | 2,190 |

| $ | 1,868 |

| -14.7 | % | | $ | 6,279 |

| $ | 3,429 |

| -45.4 | % |

| | | | | | | |

Adjusted Net Income | $ | 6,073 |

| $ | 6,425 |

| 5.8 | % | | $ | 11,794 |

| $ | 14,404 |

| 22.1 | % |

Adjusted Net Profit Margin | 10.7 | % | 10.8 | % | 10 bp |

| | 10.5 | % | 11.8 | % | 130 bp |

|

| | | | | | | |

Adjusted Basic Earnings Per Share | $ | 0.33 |

| $ | 0.35 |

| 6.1 | % | | $ | 0.64 |

| $ | 0.78 |

| 21.9 | % |

Adjusted Diluted Earnings Per Share | $ | 0.33 |

| $ | 0.34 |

| 3.0 | % | | $ | 0.64 |

| $ | 0.76 |

| 18.8 | % |

| | | | | | | |

GAAP Basic Earnings Per Share | $ | 0.21 |

| $ | 0.25 |

| 19.0 | % | | $ | 0.30 |

| $ | 0.59 |

| 96.7 | % |

GAAP Diluted Earnings Per Share | $ | 0.21 |

| $ | 0.24 |

| 14.3 | % | | $ | 0.30 |

| $ | 0.57 |

| 90.0 | % |

| | | | | | | |

Weighted Average Basic Shares Outstanding | 18,123 |

| 18,268 |

| | | 18,054 |

| 18,238 |

| |

Weighted Average Diluted Shares Outstanding | 18,247 |

| 18,880 |

| | | 18,195 |

| 18,844 |

| |

| | | | | | | |

Reconciliation to Adjusted Consolidated EBITDA | | | | | | | |

Consolidated EBITDA | $ | 15,080 |

| $ | 15,642 |

| 3.7 | % | | $ | 27,668 |

| $ | 34,572 |

| 25.0 | % |

Withdrawable Trust Income | 554 |

| 348 |

| | | 779 |

| 348 |

| |

Acquisition and Divestiture Expenses | 255 |

| 29 |

| | | 999 |

| 537 |

| |

Severance Costs | 406 |

| 489 |

| | | 723 |

| 616 |

| |

Consulting Fees | 9 |

| 673 |

| | | 250 |

| 788 |

| |

Other Incentive Compensation | — |

| — |

| | | 1,000 |

| — |

| |

Adjusted Consolidated EBITDA | $ | 16,304 |

| $ | 17,181 |

| 5.4 | % | | $ | 31,419 |

| $ | 36,861 |

| 17.3 | % |

Adjusted Consolidated EBITDA Margin | 28.9 | % | 29.0 | % | 10 bp |

| | 28.0 | % | 30.1 | % | 210 bp |

|

CARRIAGE SERVICES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

|

| | | | | | | |

| | | (unaudited) |

| December 31, 2014 | | June 30, 2015 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 413 |

| | $ | 558 |

|

Accounts receivable, net | 19,264 |

| | 16,909 |

|

Inventories | 5,294 |

| | 5,502 |

|

Prepaid expenses | 4,590 |

| | 3,451 |

|

Other current assets | 7,144 |

| | 2,539 |

|

Total current assets | 36,705 |

| | 28,959 |

|

Preneed cemetery trust investments | 71,972 |

| | 71,894 |

|

Preneed funeral trust investments | 97,607 |

| | 96,002 |

|

Preneed receivables, net | 26,284 |

| | 26,448 |

|

Receivables from preneed trusts, net | 12,809 |

| | 12,939 |

|

Property, plant and equipment, net | 186,211 |

| | 205,332 |

|

Cemetery property, net | 75,564 |

| | 75,516 |

|

Goodwill | 257,442 |

| | 261,291 |

|

Deferred charges and other non-current assets | 14,264 |

| | 14,899 |

|

Cemetery perpetual care trust investments | 48,670 |

| | 48,620 |

|

Total assets | $ | 827,528 |

| | $ | 841,900 |

|

| | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Current portion of long-term debt and capital lease obligations | $ | 9,838 |

| | $ | 10,705 |

|

Accounts payable | 6,472 |

| | 6,639 |

|

Other liabilities | 1,437 |

| | 3,698 |

|

Accrued liabilities | 15,203 |

| | 12,942 |

|

Total current liabilities | 32,950 |

| | 33,984 |

|

Long-term debt, net of current portion | 111,887 |

| | 110,571 |

|

Revolving credit facility | 40,500 |

| | 46,400 |

|

Convertible subordinated notes due 2021 | 114,542 |

| | 116,220 |

|

Obligations under capital leases, net of current portion | 3,098 |

| | 2,989 |

|

Deferred preneed cemetery revenue | 56,875 |

| | 56,298 |

|

Deferred preneed funeral revenue | 31,265 |

| | 31,028 |

|

Deferred tax liability | 36,414 |

| | 36,353 |

|

Other long-term liabilities | 2,401 |

| | 3,601 |

|

Deferred preneed cemetery receipts held in trust | 71,972 |

| | 71,894 |

|

Deferred preneed funeral receipts held in trust | 97,607 |

| | 96,002 |

|

Care trusts’ corpus | 48,142 |

| | 48,154 |

|

Total liabilities | 647,653 |

| | 653,494 |

|

Commitments and contingencies: | | | |

Stockholders’ equity: | | | |

Common stock, $.01 par value; 80,000,000 shares authorized; 22,434,000 and 22,449,000 shares issued at December 31, 2014 and June 30, 2015 | 224 |

| | 224 |

|

Additional paid-in capital | 212,386 |

| | 213,024 |

|

Accumulated deficit | (17,468 | ) | | (6,493 | ) |

Treasury stock, at cost; 3,922,000 and 4,047,000 shares at December 31, 2014 and June 30, 2015 | (15,267 | ) | | (18,349 | ) |

Total stockholders’ equity | 179,875 |

| | 188,406 |

|

Total liabilities and stockholders’ equity | $ | 827,528 |

| | $ | 841,900 |

|

CARRIAGE SERVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except per share data)

|

| | | | | | | | | | | | | | | |

| For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| 2014 |

| | 2015 |

| | 2014 |

| | 2015 |

|

| | | | | | | |

Revenues | $ | 56,504 |

| | $ | 59,261 |

| | $ | 112,157 |

| | $ | 122,514 |

|

Field costs and expenses | 38,515 |

| | 41,013 |

| | 76,152 |

| | 82,057 |

|

Gross profit | $ | 17,989 |

| | $ | 18,248 |

| | $ | 36,005 |

| | $ | 40,457 |

|

General and administrative expenses | 7,201 |

| | 7,258 |

| | 16,877 |

| | 14,948 |

|

Operating income | $ | 10,788 |

| | $ | 10,990 |

| | $ | 19,128 |

| | $ | 25,509 |

|

Interest expense, net | (2,686 | ) | | (2,479 | ) | | (5,531 | ) | | (5,148 | ) |

Accretion of discount on convertible subordinated notes | (694 | ) | | (851 | ) | | (865 | ) | | (1,678 | ) |

Loss on early extinguishment of debt | (1,042 | ) | | — |

| | (1,042 | ) | | — |

|

Loss on redemption of convertible junior subordinated debentures | — |

| | — |

| | (3,779 | ) | | — |

|

Other income | — |

| | — |

| | 1,130 |

| | — |

|

Income from continuing operations before income taxes | $ | 6,366 |

| | $ | 7,660 |

| | $ | 9,041 |

| | $ | 18,683 |

|

Provision for income taxes | (2,483 | ) | | (3,103 | ) | | (3,526 | ) | | (7,708 | ) |

Net income from continuing operations | 3,883 |

| | 4,557 |

| | 5,515 |

| | 10,975 |

|

Loss from discontinued operations, net of tax | (637 | ) | | — |

| | (51 | ) | | — |

|

Net income available to common stockholders | $ | 3,246 |

| | $ | 4,557 |

| | $ | 5,464 |

| | $ | 10,975 |

|

| | | | | | | |

Basic earnings (loss) per common share: | | | | | | | |

Continuing operations | $ | 0.21 |

| | $ | 0.25 |

| | $ | 0.30 |

| | $ | 0.59 |

|

Discontinued operations | (0.03 | ) | | — |

| | — |

| | — |

|

Basic earnings per common share | $ | 0.18 |

| | $ | 0.25 |

| | $ | 0.30 |

| | $ | 0.59 |

|

| | | | | | | |

Diluted earnings (loss) per common share: | | | | | | | |

Continuing operations | $ | 0.21 |

| | $ | 0.24 |

| | $ | 0.30 |

| | $ | 0.57 |

|

Discontinued operations | (0.04 | ) | | — |

| | (0.01 | ) | | — |

|

Diluted earnings per common share | $ | 0.17 |

| | $ | 0.24 |

| | $ | 0.29 |

| | $ | 0.57 |

|

| | | | | | | |

Dividends declared per common share | $ | 0.025 |

| | $ | 0.025 |

| | $ | 0.050 |

| | $ | 0.050 |

|

| | | | | | | |

Weighted average number of common and common equivalent shares outstanding: | | | | | | | |

Basic | 18,123 |

| | 18,268 |

| | 18,054 |

| | 18,238 |

|

Diluted | 18,247 |

| | 18,880 |

| | 18,195 |

| | 18,844 |

|

CARRIAGE SERVICES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited and in thousands)

|

| | | | | | | |

| For the Six Months Ended June 30, |

| 2014 | | 2015 |

Cash flows from operating activities: | | | |

Net income | $ | 5,464 |

| | $ | 10,975 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Gain on sale of businesses and purchase of other assets | (2,039 | ) | | — |

|

Impairment of goodwill | 1,180 |

| | — |

|

Loss on early extinguishment of debt | 1,042 |

| | — |

|

Depreciation and amortization | 5,801 |

| | 6,687 |

|

Amortization of deferred financing costs | 456 |

| | 460 |

|

Accretion of discount on convertible subordinated notes | 865 |

| | 1,678 |

|

Provision for losses on accounts receivable | 1,338 |

| | 833 |

|

Stock-based compensation expense | 2,782 |

| | 2,376 |

|

Deferred income tax (benefit) expense | (1,884 | ) | | 1,452 |

|

Loss on redemption of convertible junior subordinated debentures | 2,932 |

| | — |

|

Other | (8 | ) | | — |

|

Changes in operating assets and liabilities that provided (required) cash: | | | |

Accounts and preneed receivables | (1,783 | ) | | 1,358 |

|

Inventories and other current assets | 818 |

| | 4,062 |

|

Deferred charges and other | (174 | ) | | 117 |

|

Preneed funeral and cemetery trust investments | (10,057 | ) | | 1,603 |

|

Accounts payable | (871 | ) | | 167 |

|

Accrued and other liabilities | (2,117 | ) | | (953 | ) |

Deferred preneed funeral and cemetery revenue | 345 |

| | (814 | ) |

Deferred preneed funeral and cemetery receipts held in trust | 9,229 |

| | (1,671 | ) |

Net cash provided by operating activities | 13,319 |

| | 28,330 |

|

| | | |

Cash flows from investing activities: | | | |

Acquisitions and land for new construction | (54,850 | ) | | (4,250 | ) |

Purchase of land and buildings previously leased | (4,100 | ) | | (6,080 | ) |

Net proceeds from the sale of businesses and other assets | 200 |

| | — |

|

Capital expenditures | (5,593 | ) | | (15,285 | ) |

Net cash used in investing activities | (64,343 | ) | | (25,615 | ) |

| | | |

Cash flows from financing activities: | | | |

Net borrowings on the revolving credit facility | 5,500 |

| | 5,900 |

|

Net borrowings (payments) on the term loan | 8,000 |

| | (4,688 | ) |

Proceeds from the issuance of convertible subordinated notes | 143,750 |

| | — |

|

Payment of debt issuance costs related to the convertible subordinated notes | (4,650 | ) | | — |

|

Payments on other long-term debt and obligations under capital leases | (542 | ) | | (401 | ) |

Redemption of convertible junior subordinated debentures | (89,748 | ) | | — |

|

Payments for performance-based stock awards | (16,150 | ) | | — |

|

Proceeds from the exercise of stock options and employee stock purchase plan contributions | 863 |

| | 410 |

|

Dividends on common stock | (917 | ) | | (925 | ) |

Payment of loan origination costs related to the credit facility | (797 | ) | | (13 | ) |

Purchases of treasury stock | — |

| | (3,082 | ) |

Excess tax benefit of equity compensation | 5,069 |

| | 229 |

|

Net cash provided by (used in) financing activities | 50,378 |

| | (2,570 | ) |

| | | |

Net (decrease) increase in cash and cash equivalents | (646 | ) | | 145 |

|

Cash and cash equivalents at beginning of period | 1,377 |

| | 413 |

|

Cash and cash equivalents at end of period | $ | 731 |

| | $ | 558 |

|

CARRIAGE SERVICES, INC.

CALCULATION OF EARNINGS PER SHARE

(UNAUDITED)

(in thousands, except per share data)

|

| | | | | | | | | | | | | | | |

| For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| 2014 |

| | 2015 |

| | 2014 |

| | 2015 |

|

Numerator for basic and diluted earnings per share: | | | | | | | |

Numerator from continuing operations | | | | | | | |

Income from continuing operations | $ | 3,883 |

| | $ | 4,557 |

| | $ | 5,515 |

| | $ | 10,975 |

|

Less: Earnings allocated to unvested restricted stock | (76 | ) | | (53 | ) | | (115 | ) | | (146 | ) |

Income attributable to continuing operations | $ | 3,807 |

| | $ | 4,504 |

| | $ | 5,400 |

| | $ | 10,829 |

|

| | | | | | | |

Numerator from discontinued operations | | | | | | | |

Loss from discontinued operations | $ | (637 | ) | | $ | — |

| | $ | (51 | ) | | $ | — |

|

Less: Earnings allocated to unvested restricted stock | 13 |

| | — |

| | 1 |

| | — |

|

Loss attributable to discontinued operations | $ | (624 | ) | | $ | — |

| | $ | (50 | ) | | $ | — |

|

| | | | | | | |

| | | | | | | |

Denominator | | | | | | | |

Denominator for basic earnings per common share - weighted average shares outstanding | 18,123 |

| | 18,268 |

| | 18,054 |

| | 18,238 |

|

Effect of dilutive securities: | | | | | | | |

Stock options | 124 |

| | 261 |

| | 141 |

| | 255 |

|

Convertible subordinated notes | — |

| | 351 |

| | — |

| | 351 |

|

Denominator for diluted earnings per common share - weighted average shares outstanding | 18,247 |

| | 18,880 |

| | 18,195 |

| | 18,844 |

|

| | | | | | | |

Basic earnings (loss) per common share: | | | | | | | |

Continuing operations | $ | 0.21 |

| | $ | 0.25 |

| | $ | 0.30 |

| | $ | 0.59 |

|

Discontinued operations | (0.03 | ) | | — |

| | — |

| | — |

|

Basic earnings per common share | $ | 0.18 |

| | $ | 0.25 |

| | $ | 0.30 |

| | $ | 0.59 |

|

| | | | | | | |

Diluted earnings (loss) per common share: | | | | | | | |

Continuing operations | $ | 0.21 |

| | $ | 0.24 |

| | $ | 0.30 |

| | $ | 0.57 |

|

Discontinued operations | (0.04 | ) | | — |

| | (0.01 | ) | | — |

|

Diluted earnings per common share | $ | 0.17 |

| | $ | 0.24 |

| | $ | 0.29 |

| | $ | 0.57 |

|

NON-GAAP FINANCIAL MEASURES

This press release uses Non-GAAP financial measures to present the financial performance of the Company. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported operating results or cash flow from operations or any other measure of performance as determined in accordance with GAAP. We believe the Non-GAAP results are useful to investors because such results help investors compare our results to previous periods and provide insights into underlying trends in our business. The Company’s GAAP financial statements accompany this release. Reconciliations of the Non-GAAP financial measures to GAAP measures are provided in this press release.

The Non-GAAP financial measures include “Adjusted Net Income”, “Adjusted Basic Earnings Per Share”, “Adjusted Diluted Earnings Per Share”, “Consolidated EBITDA”, “Adjusted Consolidated EBITDA”, “Adjusted Free Cash Flow”, “Funeral, Cemetery and Financial EBITDA”, “Total Field EBITDA” and “Special Items” in this press release. These financial measurements are defined as similar GAAP items adjusted for Special Items and are reconciled to GAAP in this press release. In addition, the Company’s presentation of these measures may not be comparable to similarly titled measures in other companies’ reports. The definitions used by the Company for our internal management purposes and in this press release are as follows:

| |

• | Adjusted Net Income is defined as net income from continuing operations plus adjustments for special items and other non-recurring expenses or credits. |

| |

• | Consolidated EBITDA is defined as net income from continuing operations before income taxes, interest expenses, non-cash stock compensation, depreciation and amortization, and interest income and other, net. |

| |

• | Adjusted Consolidated EBITDA is defined as Consolidated EBITDA plus adjustments for special items and non-recurring expenses or credits. |

| |

• | Adjusted Free Cash Flow is defined as net cash provided by operations, adjusted by special items as deemed necessary, less cash for maintenance capital expenditures. |

| |

• | Funeral Field EBITDA is defined as Funeral Gross Profit less depreciation and amortization, regional and unallocated overhead expenses and net financial income. |

| |

• | Cemetery Field EBITDA is defined as Cemetery Gross Profit less depreciation and amortization, regional and unallocated overhead expenses and net financial income. |

| |

• | Financial EBITDA is defined as Financial Revenue less Financial Expenses. |

| |

• | Total Field EBITDA is defined as Gross Profit less depreciation and amortization and regional and unallocated overhead expenses. |

| |

• | Special Items is defined as charges or credits that are deemed as Non-GAAP items such as withdrawable trust income, acquisition and divestiture expenses, severance costs, loss on early retirement of debt and other costs, discrete tax items and other non-recurring amounts. Special items are taxed at the federal statutory rate of 34 percent for the three and six months ended June 30, 2014 and 2015, except for the accretion of the discount on Convertible Notes as this is a non-tax deductible item and the tax adjustment from prior period. |

| |

• | Adjusted Basic Earnings Per Share is defined as GAAP Basic Earnings Per Share, adjusted for special items. |

| |

• | Adjusted Diluted Earnings Per Share is defined as GAAP Diluted Earnings Per Share, adjusted for special items. |

Certain state regulations allow the withdrawal of financial income from preneed cemetery merchandise and services trust funds when realized in the trust. Under current generally accepted accounting principles, trust income is only recognized in the Company’s financial statements at a later time when the related merchandise and services sold on the preneed contract is delivered at the time of death. Carriage has provided financial income from the trusts, termed “Withdrawable Trust Income” and reported on a Non-GAAP proforma basis within Special Items in the accompanying Operating and Financial Trend Report (a Non-GAAP Unaudited Income Statement), to reflect the current cash results. Management believes that the Withdrawable Trust Income provides useful information to investors because it presents income and cash flow when earned by the trusts.

Reconciliation of Non-GAAP Financial Measures:

This press release includes the use of certain financial measures that are not GAAP measures. The Non-GAAP financial measures are presented for additional information and are reconciled to their most comparable GAAP measures below.

Reconciliation of Net Income from continuing operations to Adjusted Net Income for the three and six months ended June 30, 2014 and 2015 (in thousands):

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

|

| 2014 |

| | 2015 |

| | 2014 |

| | 2015 |

|

Net Income from continuing operations | $ | 3,883 |

| | $ | 4,557 |

| | $ | 5,515 |

| | $ | 10,975 |

|

Special items, net of tax except for ** | | | | | | | |

Withdrawable Trust Income | $ | 366 |

| | $ | 230 |

| | $ | 515 |

| | $ | 230 |

|

Acquisition and Divestiture Expenses | 168 |

| | 19 |

| | 659 |

| | 354 |

|

Severance Costs | 268 |

| | 323 |

| | 477 |

| | 407 |

|

Consulting Fees | 6 |

| | 445 |

| | 165 |

| | 521 |

|

Other Incentive Compensation | — |

| | — |

| | 660 |

| | — |

|

Accretion of Discount on Convertible Subordinated Notes ** | 694 |

| | 851 |

| | 865 |

| | 1,678 |

|

Costs Related to the Credit Facility | 688 |

| | — |

| | 688 |

| | — |

|

Loss on Redemption of Convertible Junior Subordinated Debentures | — |

| | — |

| | 2,493 |

| | — |

|

Gain on Asset Purchase | — |

| | — |

| | (746 | ) | | — |

|

Other Special Items | — |

| | — |

| | 503 |

| | 98 |

|

Tax Adjustment from Prior Period ** | — |

| | — |

| | — |

| | 141 |

|

Total Special items affecting net income | $ | 2,190 |

| | $ | 1,868 |

| | $ | 6,279 |

| | $ | 3,429 |

|

Adjusted Net Income | $ | 6,073 |

| | $ | 6,425 |

| | $ | 11,794 |

| | $ | 14,404 |

|

Reconciliation of Net Income from continuing operations to Consolidated EBITDA and Adjusted Consolidated EBITDA for the three and six months ended June 30, 2014 and 2015 (in thousands):

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| |

| 2014 |

| | 2015 |

| | 2014 |

| | 2015 |

|

Net income from continuing operations | $ | 3,883 |

| | $ | 4,557 |

| | $ | 5,515 |

| | $ | 10,975 |

|

Net provision for income taxes | 2,483 |

| | 3,103 |

| | 3,526 |

| | 7,708 |

|

Pre-tax earnings from continuing operations | $ | 6,366 |

| | $ | 7,660 |

| | $ | 9,041 |

| | $ | 18,683 |

|

Depreciation & amortization | 3,029 |

| | 3,365 |

| | 5,785 |

| | 6,687 |

|

Non-cash stock compensation | 1,263 |

| | 1,287 |

| | 1,993 |

| | 2,376 |

|

Interest expense | 2,691 |

| | 2,492 |

| | 5,536 |

| | 5,042 |

|

Accretion of discount on convertible subordinated notes | 694 |

| | 851 |

| | 865 |

| | 1,678 |

|

Loss on early extinguishment of debt | 1,042 |

| | — |

| | 1,042 |

| | — |

|

Loss on redemption of convertible junior subordinated debentures | — |

| | — |

| | 3,779 |

| | — |

|

Other, net | (5 | ) | | (13 | ) | | (373 | ) | | 106 |

|

Consolidated EBITDA | $ | 15,080 |

| | $ | 15,642 |

| | $ | 27,668 |

| | $ | 34,572 |

|

Adjusted For: | | | | | | | |

Withdrawable Trust Income | $ | 554 |

| | $ | 348 |

| | $ | 779 |

| | $ | 348 |

|

Acquisition and Divestiture Expenses | 255 |

| | 29 |

| | 999 |

| | 537 |

|

Severance Costs | 406 |

| | 489 |

| | 723 |

| | 616 |

|

Consulting Fees | 9 |

| | 673 |

| | 250 |

| | 788 |

|

Other Incentive Compensation | — |

| | — |

| | 1,000 |

| | — |

|

Adjusted Consolidated EBITDA | $ | 16,304 |

| | $ | 17,181 |

| | $ | 31,419 |

| | $ | 36,861 |

|

Revenue | $ | 56,504 |

| | $ | 59,261 |

| | $ | 112,157 |

| | $ | 122,514 |

|

| | | | | | | |

Adjusted Consolidated EBITDA Margin | 28.9 | % | | 29.0 | % | | 28.0 | % | | 30.1 | % |

Reconciliation of funeral and cemetery income before income taxes to Field EBITDA for the three and six months ended June 30, 2014 and 2015 (in thousands):

|

| | | | | | | | | | | | | | | |

Funeral Field EBITDA | Three Months Ended

June 30, | | Six Months Ended

June 30, |

|

| 2014 |

| | 2015 |

| | 2014 |

| | 2015 |

|

Gross Profit (GAAP) | $ | 13,214 |

| | $ | 13,644 |

| | $ | 27,735 |

| | $ | 31,640 |

|

Depreciation & amortization | 1,683 |

| | 1,876 |

| | 3,297 |

| | 3,665 |

|

Regional & unallocated costs | 1,202 |

| | 1,718 |

| | 3,149 |

| | 3,655 |

|

Net financial income | (2,079 | ) | | (1,925 | ) | | (4,305 | ) | | (4,196 | ) |

Funeral Field EBITDA | $ | 14,020 |

| | $ | 15,313 |

| | $ | 29,876 |

| | $ | 34,764 |

|

|

| | | | | | | | | | | | | | | |

Cemetery Field EBITDA | Three Months Ended

June 30, | | Six Months Ended

June 30, |

|

| 2014 |

| | 2015 |

| | 2014 |

| | 2015 |

|

Gross Profit (GAAP) | $ | 4,775 |

| | $ | 4,604 |

| | $ | 8,270 |

| | $ | 8,817 |

|

Depreciation & amortization | 992 |

| | 1,117 |

| | 1,793 |

| | 2,130 |

|

Regional & unallocated costs | 491 |

| | 593 |

| | 924 |

| | 1,181 |

|

Net financial income | (2,556 | ) | | (2,489 | ) | | (4,454 | ) | | (4,453 | ) |

Cemetery Field EBITDA | $ | 3,702 |

| | $ | 3,825 |

| | $ | 6,533 |

| | $ | 7,675 |

|

|

| | | | | | | | | | | | | | | |

Total Field EBITDA | Three Months Ended

June 30, | | Six Months Ended

June 30, |

|

| 2014 |

| | 2015 |

| | 2014 |

| | 2015 |

|

Funeral Field EBITDA | $ | 14,020 |

| | $ | 15,313 |

| | $ | 29,876 |

| | $ | 34,764 |

|

Cemetery Field EBITDA | 3,702 |

| | 3,825 |

| | 6,533 |

| | 7,675 |

|

Funeral Financial EBITDA | 2,079 |

| | 1,925 |

| | 4,305 |

| | 4,196 |

|

Cemetery Financial EBITDA | 2,556 |

| | 2,489 |

| | 4,454 |

| | 4,453 |

|

Total Field EBITDA | $ | 22,357 |

| | $ | 23,552 |

| | $ | 45,168 |

| | $ | 51,088 |

|

Reconciliation of GAAP basic earnings per share to Adjusted basic earnings per share for the three and six months ended June 30, 2014 and 2015:

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

|

| 2014 |

| | 2015 |

| | 2014 |

| | 2015 |

|

GAAP basic earnings per share from continuing operations | $ | 0.21 |

| | $ | 0.25 |

| | $ | 0.30 |

| | $ | 0.59 |

|

Special items affecting net income | 0.12 |

| | 0.10 |

| | 0.34 |

| | 0.19 |

|

Adjusted basic earnings per share | $ | 0.33 |

| | $ | 0.35 |

| | $ | 0.64 |

| | $ | 0.78 |

|

Reconciliation of GAAP diluted earnings per share to Adjusted diluted earnings per share for the three and six months ended June 30, 2014 and 2015:

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

|

| 2014 |

| | 2015 |

| | 2014 |

| | 2015 |

|

GAAP diluted earnings per share from continuing operations | $ | 0.21 |

| | $ | 0.24 |

| | $ | 0.30 |

| | $ | 0.57 |

|

Special items affecting net income | 0.12 |

| | 0.10 |

| | 0.34 |

| | 0.19 |

|

Adjusted diluted earnings per share | $ | 0.33 |

| | $ | 0.34 |

| | $ | 0.64 |

| | $ | 0.76 |

|

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

Certain statements made herein or elsewhere by, or on behalf of, the Company that are not historical facts are intended to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In addition to historical information, this Press Release contains certain statements and information that may constitute forward-looking statements within the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include statements regarding the consummation of the SCI acquisition, any projections of earnings, revenues, asset sales, cash flow, debt levels or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing and are based on our current expectations and beliefs concerning future developments and their potential effect on us. The words “may”, “will”, “estimate”, “intend”, “believe”, “expect”, “project”, “forecast”, “foresee”, “should”, “would”, “could”, “plan”, “anticipate” and other similar words or expressions are intended to identify forward-looking statements, which are generally not historical in nature. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, those summarized below:

| |

• | the execution of our Standards Operating, 4E leadership and Standard Acquisition Models; |

| |

• | changes in the number of deaths in our markets; |

| |

• | changes in consumer preferences; |

| |

• | ability to find and retain skilled personnel; |

| |

• | the effects of competition; |

| |

• | the investment performance of our funeral and cemetery trust funds; |

| |

• | fluctuations in interest rates; |

| |

• | our ability to obtain debt or equity financing on satisfactory terms to fund additional acquisitions, expansion projects, working capital requirements and the repayment or refinancing of indebtedness; |

| |

• | death benefits related to preneed funeral contracts funded through life insurance contracts; |

| |

• | our ability to generate preneed sales; |

| |

• | the financial condition of third-party insurance companies that fund our preneed funeral contracts; |

| |

• | increased or unanticipated costs, such as insurance or taxes; |

| |

• | effects of the application of applicable laws and regulations, including changes in such regulations or the interpretation thereof; |

| |

• | consolidation of the deathcare industry; and |

| |

• | other factors and uncertainties inherent in the deathcare industry. |

For additional information regarding known material factors that could cause our actual results to differ from our projected results, please see “Risk Factors” in our most recent Annual Report on Form 10-K. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. A copy of the Company’s Form 10-K, other Carriage Services information and news releases are available at www.carriageservices.com.

This press release includes the use of certain financial measures that are not GAAP measures. The Non-GAAP financial measures are presented for additional information and are reconciled to their most comparable GAAP measures in the tables presented above.

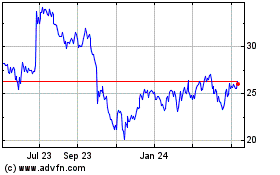

Carriage Services (NYSE:CSV)

Historical Stock Chart

From Mar 2024 to Apr 2024

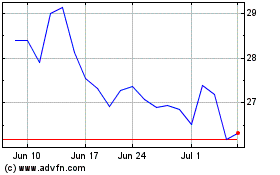

Carriage Services (NYSE:CSV)

Historical Stock Chart

From Apr 2023 to Apr 2024