Carpenter Technology Announces Retirement Plan Changes

September 14 2016 - 8:00AM

Will freeze General Retirement Plan

effective December 31, 2016

Carpenter Technology Corporation (NYSE:CRS) (the “Company”) today

announced changes to retirement plans it offers to certain

employees. The Company will freeze benefits accrued to eligible

participants of the General Retirement Plan (“GRP”) effective

December 31, 2016. The GRP is a defined benefit pension plan that

currently includes approximately 1,900 domestic current salaried

and hourly employees. The affected employees will be transitioned

to the Company’s 401(k) plan that has been in effect for eligible

employees since 2012, when the GRP was closed to new entrants.

The Company also announced plans to voluntarily contribute $100

million to the GRP within the next 60 days, which will further

bolster the funded position of the plan.

As a result of these changes, the Company expects an

approximately $40-45 million reduction in its annual net pension

expense inclusive of estimated incremental defined contribution

plan costs. The savings estimates are based on assumptions used in

the Company’s June 30, 2016 valuation and are subject to change as

the Company completes a re-measurement of the plan’s assets and

liabilities as of September 30, 2016. The Company also expects to

record certain non-cash charges related to the change of an amount

less than $1 million.

“During the past year, we launched numerous initiatives to

aggressively manage our business and promote sustainability in the

face of ongoing marketplace volatility across select end-use

markets. To further strengthen our long-term financial

condition and remain competitive in today’s marketplace, we are

modifying our approach to how we partner with employees to help

them prepare for retirement,” said Tony Thene, Carpenter's

President and CEO. “Our decision to transition from a

traditional defined benefit pension plan to a more typical defined

contribution plan reflects our goal to provide our employees a

competitive retirement plan option while aligning the majority of

our workforce under a common retirement plan. At the same

time, our $100 million voluntary contribution to the GRP underlines

our commitment to supporting our many loyal employees who have

contributed to Carpenter’s success and leadership position.”

In connection with these actions, the Company has updated its

forward looking guidance for fiscal year 2017 related to net

pension expense and pension contributions. The Company now expects

net pension expense for fiscal year 2017 to be approximately $39

million to $44 million and expects to make a discretionary pension

contribution of $100 million during fiscal year 2017. The reduction

in net pension expense excludes the expected incremental defined

contribution plan costs of approximately $5 million in the second

half of fiscal year 2017.

About Carpenter Technology

Carpenter Technology Corporation is a leading producer and

distributor of premium specialty alloys, including titanium alloys,

powder metals, stainless steels, alloy steels and tool

steels. Carpenter’s high-performance materials and advanced

process solutions are an integral part of critical applications

used within the aerospace, transportation, medical and energy

markets, among other markets. Building on its history of

innovation, Carpenter’s superalloy powder technologies support a

range of next-generation products and manufacturing techniques,

including additive manufacturing or 3D Printing. Information

about Carpenter can be found at www.cartech.com.

Forward-Looking Statements

This presentation contains forward-looking statements within the

meaning of the Private Securities Litigation Act of 1995. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ from those projected,

anticipated or implied. The most significant of these uncertainties

are described in Carpenter’s filings with the Securities and

Exchange Commission, including its annual report on Form 10-K for

the year ended June 30, 2016 and the exhibits attached to that

filing. They include but are not limited to: (1) the cyclical

nature of the specialty materials business and certain end-use

markets, including aerospace, defense, industrial, transportation,

consumer, medical and energy, or other influences on Carpenter’s

business such as new competitors, the consolidation of competitors,

customers and suppliers, or the transfer of manufacturing capacity

from the United States to foreign countries; (2) the ability of

Carpenter to achieve cash generation, growth, earnings,

profitability, cost savings and reductions, productivity

improvements or process changes; (3) the ability to recoup

increases in the cost of energy, raw materials, freight or other

factors; (4) domestic and foreign excess manufacturing capacity for

certain metals; (5) fluctuations in currency exchange rates; (6)

the degree of success of government trade actions; (7) the

valuation of the assets and liabilities in Carpenter’s pension

trusts and the accounting for pension plans; (8) possible labor

disputes or work stoppages; (9) the potential that our customers

may substitute alternate materials or adopt different manufacturing

practices that replace or limit the suitability of our products;

(10) the ability to successfully acquire and integrate

acquisitions; (11) the availability of credit facilities to

Carpenter, its customers or other members of the supply chain; (12)

the ability to obtain energy or raw materials, especially from

suppliers located in countries that may be subject to unstable

political or economic conditions; (13) Carpenter’s manufacturing

processes are dependent upon highly specialized equipment located

primarily in facilities in Reading and Latrobe, Pennsylvania and

Athens, Alabama for which there may be limited alternatives if

there are significant equipment failures or a catastrophic event;

(14) the ability to hire and retain key personnel, including

members of the executive management team, management, metallurgists

and other skilled personnel; (15) fluctuations in oil and gas

prices and production; and (16) the success of actions taken to

reduce costs associated with retirement and pension plans. Any of

these factors could have an adverse and/or fluctuating effect on

Carpenter’s results of operations. The forward-looking statements

in this document are intended to be subject to the safe harbor

protection provided by Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Carpenter undertakes no obligation to update or revise

any forward-looking statements.

Media Inquiries:

William J. Rudolph, Jr.

+1 610-208-3892

wrudolph@cartech.com

Investor Inquiries:

Brad Edwards

Brainerd Communicators

+1 212-986-6667

edwards@braincomm.com

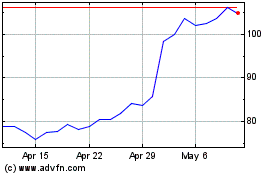

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

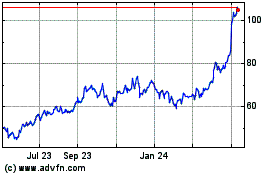

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Apr 2023 to Apr 2024