UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: April 30, 2015

CARPENTER TECHNOLOGY CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-5828 |

|

23-0458500 |

|

(State of or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer I.D. No.) |

|

P.O. Box 14662

Reading, Pennsylvania |

|

|

|

19612-4662 |

|

(Address of principal executive

offices) |

|

|

|

(Zip Code) |

|

|

|

(610) 208-2000 |

|

|

|

Registrant’s telephone number, including area code |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 - Results of Operations and Financial Condition.

On April 30, 2015, Carpenter Technology Corporation issued a press release announcing fiscal 2015 third quarter results for the period ended March 31, 2015. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K and shall not be deemed to be “filed” for any purpose.

Item 9.01 - Financial Statements and Exhibits

|

(d) Exhibits |

|

|

|

|

|

|

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release regarding earnings, dated April 30, 2015 |

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CARPENTER TECHNOLOGY CORPORATION |

|

|

|

|

|

|

|

|

By |

/s/ |

Tony R. Thene |

|

|

|

|

Tony R. Thene |

|

|

|

|

Senior Vice President and Chief Financial Officer |

Date: May 1, 2015

Exhibit 99.1

|

Media Inquiries: |

|

Investor Inquiries: |

|

|

|

|

|

William J. Rudolph, Jr. |

|

Michael A. Hajost |

|

|

|

|

|

+1 610-208-3892 |

|

+1 610-208-3476 |

|

|

|

|

|

wrudolph@cartech.com |

|

mhajost@cartech.com |

CARPENTER TECHNOLOGY REPORTS THIRD QUARTER RESULTS

Reported (loss) earnings per share of ($0.03) or $0.32 excluding restructuring and special items

Net sales of $570.6 million

Adjusted EBITDA of $47.0 million

Free cash flow of $86.7 million

WYOMISSING, Pa. – April 30, 2015 – Carpenter Technology Corporation (NYSE: CRS) today announced financial results for the quarter ended March 31, 2015. Carpenter reported a net loss of $1.4 million or $0.03 per diluted share. Excluding restructuring charges and special items, earnings per share would have been $0.32 in the quarter. This compares to a reported net income of $30.6 million or $0.57 per diluted share in the same quarter last year. Last year’s third fiscal quarter included approximately $8 million ($0.10 per share) of additional weather-related costs.

Financial Highlights

|

($ in millions) |

|

Q3 |

|

Q3 |

|

Q2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

FY2015 |

|

FY2014 |

|

FY2015 |

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

570.6 |

|

$ |

566.3 |

|

$ |

548.4 |

|

|

|

|

|

|

|

|

|

|

|

Net Sales Excluding Surcharge (a) |

|

$ |

462.9 |

|

$ |

467.2 |

|

$ |

445.7 |

|

|

|

|

|

|

|

|

|

|

|

Operating Income |

|

$ |

4.8 |

|

$ |

49.5 |

|

$ |

45.0 |

|

|

|

|

|

|

|

|

|

|

|

Net (Loss) Income |

|

$ |

(1.4 |

) |

$ |

30.6 |

|

$ |

24.1 |

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow (a) |

|

$ |

86.7 |

|

$ |

(22.2 |

) |

$ |

(65.5 |

) |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (a) |

|

$ |

47.0 |

|

$ |

92.0 |

|

$ |

86.6 |

|

(a) non-GAAP financial measure explained in the attached tables

Page 1 of 8

Comment

Gregory A. Pratt, Carpenter’s chairman, president and chief executive officer, stated: “A short time ago, we issued a press release announcing actions to improve profitability, cut costs and strengthen operations. Today, as we report financial results of the third quarter of fiscal year 2015, our message remains consistent. Our operating results for this quarter reflect an improving Specialty Alloys Operations (SAO) product sales mix that was more than offset by the unfavorable impacts of operating cost increases, the current weakness in oil and gas markets, and unfavorable cost absorption as a result of reducing inventory.

“We want to reiterate our message regarding Carpenter’s many actions aimed at improving operating performance and driving long-term growth and stockholder value. First, we have consistently said the Company would begin generating positive free cash flow in the second half of fiscal year 2015, and we generated $87 million of free cash flow in the third quarter. We also stated that we are committed to reducing inventory, and our free cash flow results for the quarter reflect the impact of reducing inventory by $44 million. We said we would reduce capital spending once the Athens project was complete, and our capital expenditures for the quarter reflect our lowest quarterly capital expenditures in four years. Lastly, we said we would use the newly generated free cash flow to buy back shares under our share repurchase program. In the third quarter, we purchased $50 million of shares, in addition to the $10 million we purchased in the second quarter. Furthermore, we purchased $60 million of shares in the month of April.

“Clearly we have additional work ahead of us as we continue to initiate actions we believe are necessary to stem the tide of higher operating costs. To that end, we have initiated a

Page 2 of 8

restructuring plan that is expected to yield annual overhead savings of $30 million. We expect to realize a portion of this savings in our upcoming fourth quarter. Our Business Management Office, or BMO, is working to identify and execute opportunities to improve cost performance and profit margin, as well as to further reduce inventory. Lastly, we are making continued progress in obtaining the site and customer-specific product qualifications for our newly constructed Athens facility, in order to further actualize its capabilities.”

Net Sales and Operating Income

Net sales for the third quarter of fiscal year 2015 were $570.6 million, and net sales excluding surcharge were $462.9 million, a decrease of $4.3 million (or 1 percent) from the same quarter last year, on 11 percent lower volume.

Operating income was $4.8 million, a decrease of $44.7 million from the third quarter of the prior year. Operating income—excluding pension earnings, interest and deferrals (EID) and restructuring charges and special items—was $35.1 million, a decrease of $28.4 million (or 45 percent) from the third quarter of the prior year. These results reflect higher SAO operating costs, additional depreciation expenses of the Athens facility, the unfavorable impacts of inventory reduction initiatives, and reduced demand for oil and gas products from the PEP segment, which were all partially offset by a stronger mix of products within the SAO segment.

Page 3 of 8

Restructuring Charges and Special Items

The third quarter results include restructuring charges and special items of $0.35 per diluted share, consisting of employee termination costs, costs involved with exiting the ultra-fine grain material development program, facility closure expenses, and consulting fees related to the establishment of the Business Management Office (BMO) and strategic business review.

Cash Flow

Cash flow from operations was $120.9 million, which included a $43.8 million reduction in inventory, a $20.1 million decrease in other working capital and $1.5 million of pension contributions. This compares to a cash flow from operations of $81.0 million in the prior year’s third quarter, which included a $1.3 million increase in inventory, a $4.5 million decrease in other working capital and $1.5 million of pension contributions. Free cash flow in the third quarter of fiscal year 2015 was $86.7 million, compared to negative $22.2 million in the same quarter last year. Capital spending in the third quarter, which included $6.6 million related to the construction of the Athens facility, was $24.8 million, compared to $93.6 million in the prior year’s third quarter, which included $74.2 million related to Athens.

Total liquidity, including cash and available revolver balance, was $521 million at the end of the third quarter. This consisted of $29 million of cash and $492 million of available revolver.

Page 4 of 8

End-Use Markets

|

|

Q3 FY15

Sales*

Ex. Surcharge

(in Millions) |

Q3 FY15

vs.

Q3 FY14 |

Q3 FY15

vs.

Q2 FY15 |

|

Aerospace and Defense |

$213.9 |

+6% |

+13% |

|

Energy |

$60.8 |

-16% |

-14% |

|

Medical |

$29.0 |

+3% |

+13% |

|

Transportation |

$33.4 |

+9% |

+7% |

|

Industrial and Consumer |

$92.0 |

-6% |

-5% |

* Excludes sales through Carpenter’s Distribution businesses

Aerospace and Defense

· Strong sequential and year-over-year sales growth for engine materials as supply chain demand normalizes

· Fastener demand up year-over-year, driven primarily by high nickel content products

· Structural and distribution activity reflects increased volume and improved mix on a sequential basis, with lower volume year-over-year

Energy

· North American quarterly average directional rig count was down 25 percent sequentially and 20 percent year-over-year

· The dramatic drop in oil prices and low drilling activity caused a significant decrease in PEP sales

Page 5 of 8

· Materials for power generation applications were up sequentially but down year-over-year due to highly variable demand patterns

Medical

· SAO sales rose year-over-year due to increased demand for orthopedic implant and surgical instrument materials

· Buying patterns from OEMs have stabilized

· The pricing environment remains extremely competitive

Transportation

· Sales were up year-over-year based on strong volume growth and an improved mix of materials supporting advancements in engine technologies

· North American light vehicle sales show continued positive growth, up 6 percent year-over-year

· Low fuel prices and lower interest rates are driving sales for vehicle platforms with higher Carpenter material content

Industrial and Consumer

· Lower revenue was driven by reduced sales of commodity industrial and infrastructure materials

· Growth continues in high-end applications for consumer electronics

Conference Call and Webcast Presentation

Carpenter will host a conference call and webcast presentation today, April 30, at 10:00 a.m. ET, to discuss the financial results and operations for the fiscal third quarter of 2015. Please call 610-208-2222 for details. Access to both the call and webcast presentation will also be available at Carpenter’s website (http://www.cartech.com) and through CCBN

Page 6 of 8

(http://www.ccbn.com), and a replay of the call will soon be made available at http://www.cartech.com or at http://www.ccbn.com. Presentation materials used during this conference call will be available for viewing and download at 8:00 a.m. ET today, at http://www.cartech.com.

Non-GAAP Financial Measures

This press release includes discussions of financial measures that have not been determined in accordance with U.S. Generally Accepted Accounting Principles (GAAP). A reconciliation of the non-GAAP financial measures to their most directly comparable financial measures prepared in accordance with GAAP, accompanied by reasons why the Company believes the non-GAAP measures are important, are included in the attached schedules.

About Carpenter Technology

Carpenter produces and distributes premium alloys, including special alloys, titanium alloys and powder metals, as well as stainless steels, alloy steels and tool steels. Information about Carpenter can be found at http://www.cartech.com.

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Act of 1995. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ from those projected, anticipated or implied. The most significant of these uncertainties are described in Carpenter’s filings with the Securities and Exchange Commission, including its annual report on Form 10-K for the year ended June 30, 2014, Form 10-Q for the quarters ended September 30, 2014 and December 31, 2014 and the exhibits attached to those filings. They include but are not limited to: (1) the cyclical nature of the specialty materials business and certain end-use markets, including aerospace, defense, industrial, transportation, consumer, medical and energy, or other influences on Carpenter’s business such as new competitors, the consolidation of competitors, customers and suppliers, or the transfer of manufacturing capacity from the United States to foreign countries; (2) the ability of Carpenter to achieve cash generation, growth, earnings, profitability, cost savings and reductions, productivity improvements or process changes; (3) the ability to recoup increases in the cost of energy, raw materials, freight or other factors; (4)

Page 7 of 8

domestic and foreign excess manufacturing capacity for certain metals; (5) fluctuations in currency exchange rates; (6) the degree of success of government trade actions; (7) the valuation of the assets and liabilities in Carpenter’s pension trusts and the accounting for pension plans; (8) possible labor disputes or work stoppages; (9) the potential that our customers may substitute alternate materials or adopt different manufacturing practices that replace or limit the suitability of our products; (10) the ability to successfully acquire and integrate acquisitions; (11) the availability of credit facilities to Carpenter, its customers or other members of the supply chain; (12) the ability to obtain energy or raw materials, especially from suppliers located in countries that may be subject to unstable political or economic conditions; (13) Carpenter’s manufacturing processes are dependent upon highly specialized equipment located primarily in facilities in Reading, Latrobe and Athens for which there may be limited alternatives if there are significant equipment failures or a catastrophic event; (14) the ability to hire and retain key personnel, including members of the executive management team, management, metallurgists and other skilled personnel; (15) fluctuations in oil and gas prices and production; (16) the success of restructuring actions; and (17) share repurchases are at Carpenter’s discretion and could be affected by changes in Carpenter’s share price, operating results, capital spending, cash flows, inventory, acquisitions, investments, tax laws and general market conditions. Any of these factors could have an adverse and/or fluctuating effect on Carpenter’s results of operations. The forward-looking statements in this document are intended to be subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Carpenter undertakes no obligation to update or revise any forward-looking statements.

Page 8 of 8

PRELIMINARY

CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data)

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

March 31, |

|

March 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET SALES |

|

$ |

570.6 |

|

$ |

566.3 |

|

$ |

1,668.8 |

|

$ |

1,568.4 |

|

|

Cost of sales |

|

494.8 |

|

471.8 |

|

1,438.9 |

|

1,275.2 |

|

|

Gross profit |

|

75.8 |

|

94.5 |

|

229.9 |

|

293.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

45.7 |

|

45.0 |

|

132.7 |

|

140.4 |

|

|

Restructuring charges |

|

25.3 |

|

- |

|

25.3 |

|

- |

|

|

Operating income |

|

4.8 |

|

49.5 |

|

71.9 |

|

152.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(7.1) |

|

(2.7) |

|

(20.9) |

|

(10.8) |

|

|

Other (expense) income, net |

|

- |

|

(0.6) |

|

4.8 |

|

0.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income before income taxes |

|

(2.3) |

|

46.2 |

|

55.8 |

|

142.1 |

|

|

Income tax (benefit) expense |

|

(0.9) |

|

15.6 |

|

19.6 |

|

47.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) INCOME |

|

$ |

(1.4) |

|

$ |

30.6 |

|

$ |

36.2 |

|

$ |

94.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(LOSS) EARNINGS PER SHARE: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.03) |

|

$ |

0.57 |

|

$ |

0.68 |

|

$ |

1.77 |

|

|

Diluted |

|

$ |

(0.03) |

|

$ |

0.57 |

|

$ |

0.68 |

|

$ |

1.76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES |

|

|

|

|

|

|

|

|

|

|

OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

52.6 |

|

53.3 |

|

53.2 |

|

53.2 |

|

|

Diluted |

|

52.6 |

|

53.7 |

|

53.3 |

|

53.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per common share |

|

$ |

0.18 |

|

$ |

0.18 |

|

$ |

0.54 |

|

$ |

0.54 |

|

PRELIMINARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(Unaudited)

|

|

|

Nine Months Ended |

|

|

|

|

March 31, |

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net income |

|

$ |

36.2 |

|

$ |

94.7 |

|

|

Adjustments to reconcile net income to net cash

provided from operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

91.2 |

|

80.9 |

|

|

Non-cash restructuring and asset impairment charges |

|

6.3 |

|

- |

|

|

Deferred income taxes |

|

68.4 |

|

2.0 |

|

|

Net pension expense |

|

34.6 |

|

43.0 |

|

|

Payments from qualified pension plan associated with restructuring |

|

7.6 |

|

- |

|

|

Stock-based compensation expense |

|

6.8 |

|

9.0 |

|

|

Net loss on disposal of property and equipment |

|

0.8 |

|

0.5 |

|

|

Changes in working capital and other: |

|

|

|

|

|

|

Accounts receivable |

|

6.6 |

|

30.0 |

|

|

Inventories |

|

(18.4) |

|

(60.6) |

|

|

Other current assets |

|

(12.0) |

|

(6.4) |

|

|

Accounts payable |

|

(42.3) |

|

0.5 |

|

|

Accrued liabilities |

|

(22.7) |

|

(31.4) |

|

|

Pension plan contributions |

|

(5.5) |

|

(4.6) |

|

|

Other postretirement plan contributions |

|

(10.2) |

|

(9.8) |

|

|

Other, net |

|

1.0 |

|

(3.8) |

|

|

Net cash provided from operating activities |

|

148.4 |

|

144.0 |

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES: |

|

|

|

|

|

|

Purchases of property, equipment and software |

|

(152.3) |

|

(298.2) |

|

|

Proceeds from disposals of property and equipment |

|

0.2 |

|

0.3 |

|

|

Net cash used for investing activities |

|

(152.1) |

|

(297.9) |

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES: |

|

|

|

|

|

|

Dividends paid |

|

(28.8) |

|

(28.8) |

|

|

Purchases of treasury stock |

|

(60.3) |

|

- |

|

|

Tax benefits on share-based compensation |

|

0.6 |

|

2.2 |

|

|

Proceeds from stock options exercised |

|

2.3 |

|

6.8 |

|

|

Net cash used for financing activities |

|

(86.2) |

|

(19.8) |

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

(0.7) |

|

1.5 |

|

|

DECREASE IN CASH AND CASH EQUIVALENTS |

|

(90.6) |

|

(172.2) |

|

|

Cash and cash equivalents at beginning of period |

|

120.0 |

|

257.5 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

|

$ |

29.4 |

|

$ |

85.3 |

|

PRELIMINARY

CONSOLIDATED BALANCE SHEETS

(in millions)

(Unaudited)

|

|

|

March 31, |

|

June 30, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

29.4 |

|

$ |

120.0 |

|

|

Accounts receivable, net |

|

318.9 |

|

339.6 |

|

|

Inventories |

|

710.7 |

|

699.2 |

|

|

Deferred income taxes |

|

16.7 |

|

- |

|

|

Other current assets |

|

43.0 |

|

35.7 |

|

|

Total current assets |

|

1,118.7 |

|

1,194.5 |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

1,403.6 |

|

1,407.0 |

|

|

Goodwill |

|

257.3 |

|

257.7 |

|

|

Other intangibles, net |

|

73.5 |

|

80.6 |

|

|

Other assets |

|

114.3 |

|

117.7 |

|

|

Total assets |

|

$ |

2,967.4 |

|

$ |

3,057.5 |

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

178.3 |

|

$ |

278.1 |

|

|

Accrued liabilities |

|

144.3 |

|

148.0 |

|

|

Deferred income taxes |

|

- |

|

4.5 |

|

|

Total current liabilities |

|

322.6 |

|

430.6 |

|

|

|

|

|

|

|

|

|

Long-term debt, net of current portion |

|

609.8 |

|

604.3 |

|

|

Accrued pension liabilities |

|

228.9 |

|

203.4 |

|

|

Accrued postretirement benefits |

|

160.2 |

|

163.2 |

|

|

Deferred income taxes |

|

182.8 |

|

110.7 |

|

|

Other liabilities |

|

63.3 |

|

41.0 |

|

|

Total liabilities |

|

1,567.6 |

|

1,553.2 |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Common stock |

|

276.2 |

|

275.8 |

|

|

Capital in excess of par value |

|

265.1 |

|

263.5 |

|

|

Reinvested earnings |

|

1,319.0 |

|

1,311.6 |

|

|

Common stock in treasury, at cost |

|

(157.6) |

|

(101.4) |

|

|

Accumulated other comprehensive loss |

|

(302.9) |

|

(245.2) |

|

|

Total stockholders’ equity |

|

1,399.8 |

|

1,504.3 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

2,967.4 |

|

$ |

3,057.5 |

|

PRELIMINARY

SEGMENT FINANCIAL DATA

(in millions, except pounds sold)

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

March 31, |

|

March 31, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

Pounds sold* (000): |

|

|

|

|

|

|

|

|

|

|

Specialty Alloys Operations |

|

67,232 |

|

74,836 |

|

202,952 |

|

204,982 |

|

|

Performance Engineered Products |

|

3,806 |

|

3,108 |

|

11,064 |

|

8,458 |

|

|

Intersegment |

|

(1,986) |

|

(364) |

|

(5,506) |

|

(3,590) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated pounds sold |

|

69,052 |

|

77,580 |

|

208,510 |

|

209,850 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales: |

|

|

|

|

|

|

|

|

|

|

Specialty Alloys Operations |

|

|

|

|

|

|

|

|

|

|

Net sales excluding surcharge |

|

$ |

360.0 |

|

$ |

351.4 |

|

$ |

1,016.4 |

|

$ |

975.5 |

|

|

Surcharge |

|

109.8 |

|

100.6 |

|

327.6 |

|

279.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Specialty Alloys Operations net sales |

|

469.8 |

|

452.0 |

|

1,344.0 |

|

1,254.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance Engineered Products |

|

|

|

|

|

|

|

|

|

|

Net sales excluding surcharge |

|

120.1 |

|

129.8 |

|

383.1 |

|

360.7 |

|

|

Surcharge |

|

0.3 |

|

0.3 |

|

1.0 |

|

1.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance Engineered Products net sales |

|

120.4 |

|

130.1 |

|

384.1 |

|

362.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Intersegment |

|

|

|

|

|

|

|

|

|

|

Net sales excluding surcharge |

|

(17.2) |

|

(14.0) |

|

(50.8) |

|

(42.3) |

|

|

Surcharge |

|

(2.4) |

|

(1.8) |

|

(8.5) |

|

(6.1) |

|

|

Intersegment net sales |

|

(19.6) |

|

(15.8) |

|

(59.3) |

|

(48.4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated net sales |

|

$ |

570.6 |

|

$ |

566.3 |

|

$ |

1,668.8 |

|

$ |

1,568.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income: |

|

|

|

|

|

|

|

|

|

|

Specialty Alloys Operations |

|

$ |

37.9 |

|

$ |

51.6 |

|

$ |

106.0 |

|

$ |

169.7 |

|

|

Performance Engineered Products |

|

8.5 |

|

13.1 |

|

30.8 |

|

33.3 |

|

|

Corporate costs (including restructuring charges) |

|

(38.6) |

|

(9.5) |

|

(55.9) |

|

(33.7) |

|

|

Pension earnings, interest and deferrals |

|

(2.4) |

|

(6.0) |

|

(7.1) |

|

(15.8) |

|

|

Intersegment |

|

(0.6) |

|

0.3 |

|

(1.9) |

|

(0.7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated operating income |

|

$ |

4.8 |

|

$ |

49.5 |

|

$ |

71.9 |

|

$ |

152.8 |

|

The Company has two reportable segments, Specialty Alloys Operations (“SAO”) and Performance Engineered Products (“PEP”).

The SAO segment is comprised of Carpenter’s major premium alloy and stainless steel manufacturing operations. This includes operations performed at mills primarily in Reading and Latrobe and surrounding areas in Pennsylvania, South Carolina and Alabama.

The PEP segment is comprised of the Company’s differentiated operations. This segment includes the Dynamet titanium business, the Carpenter Powder Products business, the Amega West business, the Specialty Steel Supply business, the Latrobe Special Metals Distribution business and Aceros Fortuna based in Mexico. The businesses in the PEP segment are managed with an entrepreneurial structure to promote flexibility and agility to quickly respond to market dynamics. It is our belief this model will ultimately drive overall revenue and profit growth. The pounds sold data above for the PEP segment includes only the Dynamet and CPP businesses.

The service cost component of net pension expense, which represents the estimated cost of future pension liabilities earned associated with active employees, is included in the operating results of the business segments. The residual net pension expense, or pension earnings, interest and deferrals (pension EID), is comprised of the expected return on plan assets, interest costs on the projected benefit obligations of the plans, and amortization of actuarial gains and losses and prior service costs and is included under the heading “Pension earnings, interest and deferrals”.

* Pounds sold exclude sales associated with the distribution businesses.

PRELIMINARY

NON-GAAP FINANCIAL MEASURES

(in millions, except per share data)

(Unaudited)

|

OPERATING MARGIN EXCLUDING SURCHARGE, |

|

Three Months Ended |

|

Nine Months Ended |

|

|

PENSION EARNINGS, INTEREST AND DEFERRALS, |

|

March 31, |

|

March 31, |

|

|

RESTRUCTURING CHARGES AND SPECIAL ITEMS |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

570.6 |

|

$ |

566.3 |

|

$ |

1,668.8 |

|

$ |

1,568.4 |

|

|

Less: surcharge revenue |

|

107.7 |

|

99.1 |

|

320.1 |

|

274.5 |

|

|

Consolidated net sales excluding surcharge |

|

$ |

462.9 |

|

$ |

467.2 |

|

$ |

1,348.7 |

|

$ |

1,293.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

4.8 |

|

$ |

49.5 |

|

$ |

71.9 |

|

$ |

152.8 |

|

|

Pension earnings, interest and deferrals |

|

2.4 |

|

6.0 |

|

7.1 |

|

15.8 |

|

|

Operating income excluding pension earnings, interest and deferrals |

|

7.2 |

|

55.5 |

|

79.0 |

|

168.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges and special items: |

|

|

|

|

|

|

|

|

|

|

Restructuring charges |

|

25.3 |

|

- |

|

25.3 |

|

- |

|

|

Consulting costs |

|

2.6 |

|

- |

|

2.6 |

|

- |

|

|

Weather-related costs |

|

- |

|

8.0 |

|

- |

|

8.0 |

|

|

Operating income excluding pension earnings, interest and deferrals, restructuring charges and special items |

|

$ |

35.1 |

|

$ |

63.5 |

|

$ |

106.9 |

|

$ |

176.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating margin excluding surcharge and pension earnings, interest and deferrals |

|

1.6% |

|

11.9% |

|

5.9% |

|

13.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating margin excluding surcharge, pension earnings, interest and deferrals, restructuring charges and special items |

|

7.6% |

|

13.6% |

|

7.9% |

|

13.6% |

|

Management believes that removing the impacts of raw material surcharge from operating margin provides a more consistent basis for comparing results of operations from period to period. In addition, management believes that excluding the impact of pension earnings, interest and deferrals, which may be volatile due to changes in the financial markets, is helpful in analyzing the true operating performance of the Company.

Management believes that removing the impact of costs associated with restructuring and special items is helpful in analyzing the operating performance of the Company, as these costs are not indicative of ongoing operating performance.

|

ADJUSTED EARNINGS PER SHARE EXCLUDING

RESTRUCTURING CHARGES AND SPECIAL ITEMS |

|

(Loss)

Income

Before

Income

Taxes |

|

Income Tax

(Benefit)

Expense |

|

Net (Loss)

Income |

|

(Loss)

Earnings

Per Diluted

Share* |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, 2015, as reported |

|

$ |

(2.3) |

|

$ |

(0.9) |

|

$ |

(1.4) |

|

$ |

(0.03) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges |

|

25.3 |

|

8.7 |

|

16.6 |

|

0.32 |

|

|

Consulting costs |

|

2.6 |

|

0.9 |

|

1.7 |

|

0.03 |

|

|

Total impact of restructuring charges and special items |

|

27.9 |

|

9.6 |

|

18.3 |

|

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, 2015, as adjusted |

|

$ |

25.6 |

|

$ |

8.7 |

|

$ |

16.9 |

|

$ |

0.32 |

|

* Impact per diluted share calculated using weighted average common shares outstanding of 52.6 million.

Management believes that earnings per share adjusted to exclude the impacts of restructuring charges and special items is helpful in analyzing the operating performance of the Company, as these costs are not indicative of ongoing operating performance.

PRELIMINARY

NON-GAAP FINANCIAL MEASURES

(in millions)

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

ADJUSTED EARNINGS BEFORE INTEREST, TAXES, |

|

March 31, |

|

March 31, |

|

|

DEPRECIATION AND AMORTIZATION (EBITDA) |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(1.4 |

) |

|

$ |

30.6 |

|

$ |

36.2 |

|

|

$ |

94.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

7.1 |

|

|

2.7 |

|

20.9 |

|

|

10.8 |

|

|

Income tax (benefit) expense |

|

(0.9 |

) |

|

15.6 |

|

19.6 |

|

|

47.4 |

|

|

Depreciation and amortization |

|

30.7 |

|

|

27.5 |

|

91.2 |

|

|

80.9 |

|

|

Other expense (income), net |

|

- |

|

|

0.6 |

|

(4.8 |

) |

|

(0.1 |

) |

|

EBITDA |

|

$ |

35.5 |

|

|

$ |

77.0 |

|

$ |

163.1 |

|

|

$ |

233.7 |

|

|

Net pension expense |

|

11.5 |

|

|

15.0 |

|

34.6 |

|

|

43.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

47.0 |

|

|

$ |

92.0 |

|

$ |

197.7 |

|

|

$ |

276.7 |

|

Management believes that earnings before interest, taxes, depreciation and amortization adjusted to exclude net pension expense is helpful in analyzing the operating performance of the Company.

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

March 31, |

|

March 31, |

|

|

FREE CASH FLOW |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided from operating activities |

|

$ |

120.9 |

|

|

$ |

81.0 |

|

|

$ |

148.4 |

|

|

$ |

144.0 |

|

|

Purchases of property, equipment and software |

|

(24.8 |

) |

|

(93.6 |

) |

|

(152.3 |

) |

|

(298.2 |

) |

|

Proceeds from disposals of property and equipment |

|

0.1 |

|

|

- |

|

|

0.2 |

|

|

0.3 |

|

|

Dividends paid |

|

(9.5 |

) |

|

(9.6 |

) |

|

(28.8 |

) |

|

(28.8 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free cash flow |

|

$ |

86.7 |

|

|

$ |

(22.2 |

) |

|

$ |

(32.5 |

) |

|

$ |

(182.7 |

) |

Management believes that the free cash flow measure provides useful information to investors regarding our financial condition because it is a measure of cash generated which management evaluates for alternative uses.

PRELIMINARY

SUPPLEMENTAL SCHEDULES

(in millions)

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

March 31, |

|

March 31, |

|

|

NET SALES BY END-USE MARKET |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

End-Use Market Excluding Surcharge: |

|

|

|

|

|

|

|

|

|

|

Aerospace and defense |

|

$ |

213.9 |

|

$ |

202.5 |

|

$ |

583.7 |

|

$ |

563.2 |

|

|

Industrial and consumer |

|

92.0 |

|

98.0 |

|

287.2 |

|

272.7 |

|

|

Energy |

|

60.8 |

|

72.5 |

|

198.9 |

|

196.4 |

|

|

Transportation |

|

33.4 |

|

30.6 |

|

95.4 |

|

84.5 |

|

|

Medical |

|

29.0 |

|

28.2 |

|

81.4 |

|

75.5 |

|

|

Distribution |

|

33.8 |

|

35.4 |

|

102.1 |

|

101.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated net sales excluding surcharge |

|

462.9 |

|

467.2 |

|

1,348.7 |

|

1,293.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Surcharge revenue |

|

107.7 |

|

99.1 |

|

320.1 |

|

274.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated net sales |

|

$ |

570.6 |

|

$ |

566.3 |

|

$ |

1,668.8 |

|

$ |

1,568.4 |

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

March 31, |

|

March 31, |

|

|

NET SALES BY MAJOR PRODUCT CLASS |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales by Product Class Excluding Surcharge: |

|

|

|

|

|

|

|

|

|

|

Special alloys |

|

$ |

188.6 |

|

$ |

175.0 |

|

$ |

519.8 |

|

$ |

483.7 |

|

|

Stainless steel |

|

132.7 |

|

143.1 |

|

406.2 |

|

395.8 |

|

|

Alloy and tool steel |

|

45.0 |

|

53.3 |

|

132.0 |

|

145.8 |

|

|

Titanium products |

|

39.7 |

|

42.9 |

|

119.6 |

|

113.6 |

|

|

Powder metals |

|

15.2 |

|

11.3 |

|

46.0 |

|

33.5 |

|

|

Distribution and other |

|

41.7 |

|

41.6 |

|

125.1 |

|

121.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated net sales excluding surcharge |

|

462.9 |

|

467.2 |

|

1,348.7 |

|

1,293.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Surcharge revenue |

|

107.7 |

|

99.1 |

|

320.1 |

|

274.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated net sales |

|

$ |

570.6 |

|

$ |

566.3 |

|

$ |

1,668.8 |

|

$ |

1,568.4 |

|

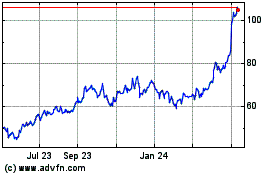

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

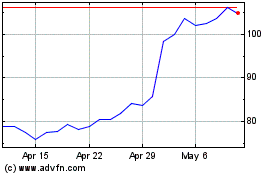

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Apr 2023 to Apr 2024