UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

Carter’s, Inc.

(Exact name of the registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-31829 |

|

13-3912933 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No) |

|

|

|

| Phipps Tower

3438 Peachtree Road NE, Suite 1800, Atlanta, Georgia |

|

30326 |

| (Address of principal executive offices) |

|

(Zip code) |

|

|

|

| Michael C. Wu

Senior Vice President, General Counsel, and Secretary |

|

678-791-1000 |

(Name and telephone number, including area code, of the

person to contact in connection with this report.)

Check the appropriate box to

indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

| x |

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

Section 1 – Conflict Minerals Disclosure

Item 1.01 and 1.02 Conflict Minerals Disclosure and Report; Exhibit

In accordance with Rule 13p-1 promulgated under the Securities Exchange Act of 1934, as amended, the Conflicts Mineral Report for the calendar year ended

December 31, 2014 filed herewith as Exhibit 1.01 is at Carter’s Inc.’s (the “Company”) website: http://www.carters.com, in the Social Responsibility section of the website.

Certain of the Company’s operations contract to manufacture products in which tin, tantalum, tungsten, and/or gold (“Conflict Minerals”) may be

necessary to the functionality or production of those products. The Company, as a retailer, does not manufacture any of the products that it sells through its operations.

After exercising reasonable due diligence as required by Rule 13p-1 and Form SD, the Company is unable to determine with certainty whether or not any of the

Conflict Minerals necessary to the functionality or production of Covered Products (as defined in the Conflict Minerals Report) are “DRC conflict free” as defined in paragraph (d)(4) of the instructions to Item 1.01. Accordingly, the

Company declares itself to be “DRC conflict undeterminable” as defined by paragraph (d)(5) of the instructions to Item 1.01 for all products contracted to be manufactured for the Company. As part of our review, we were unable to

determine whether any of the Conflict Minerals identified came from recycled or scrap sources.

This Form SD and the Conflict Minerals Report filed as

Exhibit 1.01 contain forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 relating to the Company’s future performance, including, without limitation, statements

with respect to the Company’s anticipated financial results for the second quarter of fiscal 2015 and fiscal year 2015, or any other future period, assessment of the Company’s performance and financial position, and drivers of the

Company’s sales and earnings growth. Such statements are based on current expectations only, and are subject to certain risks, uncertainties, and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, or projected. Factors that could cause actual results to materially differ include the risks of: losing one or more major customers, vendors, or

licensees or financial difficulties for one or more of our major customers, vendors, or licensees; the Company’s products not being accepted in the marketplace; changes in consumer preference and fashion trends; negative publicity; the Company

failing to protect its intellectual property; incurring costs in connection with cooperating with regulatory investigations and proceedings; the breach of the Company’s consumer databases, systems or processes; deflationary pricing pressures;

decreases in the overall level of consumer spending; disruptions resulting from the Company’s dependence on foreign supply sources; foreign currency risks due to the Company’s operations outside of the United States; the Company’s use

of a small number of vendors over whom it has little control; the Company’s foreign supply sources not meeting the Company’s quality standards or regulatory requirements; disruptions in the Company’s supply chain, including

distribution centers or in-sourcing capabilities or otherwise, and the risk of slow-downs, disruptions or strikes in the event that the new tentative agreement between the Pacific Maritime Association, which represents the operator of the port

through which we source substantially all of our products, and the International Longshore and Warehouse Union is not finalized and approved in a timely manner; product recalls; the loss of the Company’s principal product sourcing agent;

increased competition in the baby and young children’s apparel market; the Company being unable to identify new retail store locations or negotiate appropriate lease terms for the retail stores; the Company’s failure to successfully manage

its eCommerce business; the Company not adequately forecasting demand, which could, among other things, create significant levels of excess inventory; failure to achieve sales growth plans, cost savings, and other assumptions that support the

carrying value of the Company’s intangible assets; increased leverage, not being able to repay its indebtedness and being subject to restrictions on operations by the Company’s debt agreements; not attracting and retaining key individuals

within the organization; failure to properly manage strategic projects; failure to implement needed upgrades to the Company’s information technology systems; disruptions of distribution functions in its Braselton, Georgia facility; being

unsuccessful in expanding into international markets and failing to successfully manage legal, regulatory, political, and economic risks of international operations, including maintaining compliance with worldwide anti-bribery laws; fluctuations in

the Company’s tax obligations and effective tax rate; incurring substantial costs as a result of various claims or pending or threatened lawsuits; and the failure to declare future quarterly dividends. Many of these risks are further described

in the most recently filed Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission under the headings “Risk Factors” and “Forward-Looking Statements.” The Company undertakes no obligation to

publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Section 2

– Exhibits

Exhibits filed as part of this report:

Exhibit 1.01 – Conflict Minerals Report required by Items 1.01 and 1.02 of this Form.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly

authorized undersigned.

|

|

|

|

|

| Carter’s, Inc. |

|

June 1, 2015 |

|

|

|

| By: |

|

/s/ Michael C. Wu |

|

|

| Name: |

|

Michael C. Wu |

|

|

| Title: |

|

Senior Vice President, General Counsel, and Secretary |

|

|

2

Exhibit 1.01

Conflict Minerals Report of Carter’s, Inc.

In accord with Rule 13p-1 under the Securities Exchange Act of 1934

This Conflict Minerals Report (the “Report”) of Carter’s Inc. (the “Company”) has been prepared pursuant to Rule 13p-1 and Form SD

(the “Rules”) promulgated under the Securities Exchange Act of 1934 for the reporting period January 1, 2014 through December 31, 2014 (“2014 Calendar Year”).

The Company is the largest branded marketer in the United States and Canada of apparel and related products exclusively for babies and young children. The

Company owns the Carter’s and OshKosh B’gosh brands, two of the most recognized brands in the marketplace. These brands are sold in leading department stores, national chains, and specialty retailers both domestically and

internationally. They are also sold through more than 800 Company-operated stores in the United States and Canada and on-line at www.carters.com, www.oshkoshbgosh.com, and www.cartersoshkosh.ca.

The Rules require disclosure of certain information when a company manufactures or contracts to manufacture products and the minerals specified in the Rules

are necessary to the functionality or production of those products. The minerals covered by the Rules are gold, columboite-tantalite (coltan), cassiterite, and wolframite, including their derivatives consisting of tin, tungsten, and tantalum

(collectively, “Conflict Minerals”) and the countries covered by this Report (collectively, the “Covered Countries”) are the Democratic Republic of the Congo and all adjoining countries (consisting of Angola, the Republic of the

Congo, Central African Republic, South Sudan, Uganda, Rwanda, Burundi, Tanzania, and Zambia).

As described in this Report, certain of the Company’s

operations contract to manufacture products in which Conflict Minerals may be necessary to the functionality or production of those products. The Company is a retailer and does not manufacture any of the products that it sells through its

operations.

This Report is not audited, nor is an independent private sector audit required for this Report under the Rules and guidance from the

Securities and Exchange Commission (the “SEC”).

Description of Products Covered By this Report

This report relates to Company products (the “Covered Products”):

| • |

|

for which Conflict Minerals may be necessary to the functionality or production of the products; |

| • |

|

that were contracted to be manufactured by the Company; and |

| • |

|

for which the manufacture was completed during the 2014 Calendar Year. |

Covered Products include the following

categories of the Company’s products:

Apparel (products made with metallized yarns) or apparel products with trim, including, but not limited to,

zippers, clasps, buttons, buckles, rivets, snaps, hooks, eyes, and other fasteners.

Reasonable Country of Origin Inquiry Description

In accordance with the Rules, the Company has conducted a good faith reasonable country of origin inquiry (“RCOI”) regarding the use of the Conflict

Minerals which was reasonably designed to determine whether any of the Conflict Minerals originated in the Covered Countries and whether any of the Conflict Minerals may be from recycled or scrap sources. The Company also exercised due diligence on

the source and chain of custody of the Conflict Minerals.

1

To implement the RCOI, the Company’s Tier 1 and Tier 2 suppliers (Tier 1 suppliers are direct suppliers to

the Company and Tier 2 suppliers have been sub-contracted by Tier 1 suppliers) were engaged to collect information regarding the presence and sourcing of Conflict Minerals used in the products supplied to the Company. Information was collected and

stored using an online platform provided by a third-party vendor, Source Intelligence, Inc. (“Source Intelligence”).

To begin the engagement

process, an introductory email was sent to our Tier 1 and Tier 2 suppliers describing the compliance requirements and requesting conflict minerals information. Following the initial introductions to the program and information request, several

reminder emails were sent to each non-responsive supplier requesting survey completion. Suppliers who remained non-responsive to email reminders were contacted by telephone to determine the reason for the delay and to provide further assistance for

completing the request. An additional escalation process was initiated by the Company and Source Intelligence for suppliers who continued to be non-responsive after the telephone contacts described above were made.

Each supplier was asked whether the Conflict Minerals used in its products are sourced from Covered Countries and whether they were sourced from recycled or

scrap sources. The information request included the use of the Electronic Industry Citizenship Coalition (“EICC”) and Global e-Sustainability Initiative (“GeSI”) Conflict Minerals Reporting Template (“CMRT”) for data

collection.

Supplier responses were evaluated for plausibility, consistency, and gaps. Additional supplier contacts were conducted to address issues

including, incomplete data on CMRT reporting templates, responses that did not identify smelters or refiners for listed metals, and organizations that were identified as smelters or refiners but not verified as such through further analysis and

research.

A total of 373 suppliers were identified as in-scope for conflict mineral regulatory purposes and contacted as part of the RCOI process. The

survey response rate among these suppliers was 93%. Of these responding suppliers, 12% responded “yes” as to having one or more of the Conflict Minerals as necessary to the functionality or production of the Covered Products.

Based on the results of our RCOI, which indicated that one or more of the Covered Products contained Conflict Minerals that may have originated in a Covered

Country, we exercised continued due diligence on the source and chain of custody of those conflict minerals, as further described below.

Due Diligence

A) Design of Due Diligence Framework

The

Company’s due diligence process is materially based on the Organization for Economic Cooperation and Development’s Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas and

accompanying supplements on gold, tin, tantalum, and tungsten (“OECD Guidance”).

The OECD Guidance identifies five due diligence steps:

Step 1: Establish Strong Company Management Systems

Step 2:

Identify and Assess Risks in the Supply Chain

Step 3: Design and Implement a Strategy to Respond to Identified Risks

Step 4: Carry out Independent Third-Party Audit of Smelter/Refiner’s Due Diligence

Step 5: Report Annually on Supply Chain Due Diligence

2

The Company has adopted a policy relating to Conflict Minerals which incorporates the standards set forth in the

OECD Guidance and is available at http://www.carters.com in the Social Responsibility section of the website.

It is important to note that

the OECD Guidance was written for both upstream and downstream companies in the supply chain. The Company’s supply chain with respect to the Covered Products is complex and, as a retailer, includes many third parties between the ultimate

manufacturer of the Covered Products and the original sources of the Conflict Minerals. The Company does not purchase any of the Conflict Minerals from mines, smelters or refiners, nor does it manufacture any of the Covered Products. As a result,

the Company must rely on its suppliers to provide information regarding the origin of the Conflict Minerals that are included in the Covered Products. Furthermore, the Company believes that the smelters and refiners of the Conflict Minerals are best

situated to identify the sources of Conflict Minerals and, consistent with that belief, the Company has taken steps to try to identify the applicable smelters and refiners (“SORs”) of Conflict Minerals in its supply chain. Because the

Company is a retailer and therefore a downstream company in the supply chain, its due diligence practices were tailored according to its size, ability to impact the mineral supply chain, and industry guidance for the specialty apparel industry.

B) Description of Due Diligence Measures Performed

The

Company’s due diligence review consisted of the following activities undertaken by it in order to meet its obligations under the Rules:

|

|

|

|

|

| Step |

|

OECD Guidance |

|

Due diligence activities performed materially based on guidance |

| 1 |

|

Establish Strong Company Management Systems |

|

• Adopted and published a Conflict Minerals Policy,

which is available at http://www.carters.com in the Social Responsibility section of the website.

• Developed a comprehensive Conflict Minerals Program/Framework

outlining management’s compliance initiatives with respect to the Rules.

• Engaged Source Intelligence, a compliance solution provider, to lead

information collection/inquiry efforts with the Company’s suppliers (373 suppliers identified as in-scope); received a 93% response rate, or 347 responses.

• Engaged both Tier 1 and Tier 2 suppliers as part of the Company’s

due diligence process. |

|

|

|

| 2 |

|

Identify and Assess Risks in the Supply Chain |

|

• Identified SORs in the supply chain, through

in-scope supplier inquiries, to conduct an RCOI.

• Evaluated supplier responses related to the stated origin of

materials, as well as the products specified to contain/not contain Conflict Minerals for plausibility, consistency, and gaps. |

|

|

|

| 3 |

|

Design and Implement a Strategy to Respond to Identified Risks |

|

• Implemented cautionary flags for supplier

responses prompting additional investigation and action.

• Incorporated relevant elements of compliance with the Rules into our

master supplier agreement template.

• Outlined a plan to incorporate any new suppliers into our existing due

diligence efforts. |

3

|

|

|

|

|

|

|

|

| 4 |

|

Carry out Independent Third-Party Audit of

SORs Due Diligence |

|

• Utilized Source Intelligence’s online

platform to identify each supplier’s SORs for raw materials, and verified each supplier’s SORs against independently published lists of Conflict-Free Smelter Programs (i.e., the EICC and GeSI).

• This step does not require or define audit protocols for downstream

companies; however downstream companies can support these audits by supporting or joining industry organizations. |

|

|

|

| 5 |

|

Report Annually on Supply Chain Due

Diligence |

|

• Filed Form SD and Conflict Minerals Report with

the SEC (and posted the Conflict Minerals Report to the Company website) on June 1, 2015. |

C) Due Diligence Determination

Having completed the due diligence exercise in good faith, the Company, as further discussed below, is unable to determine with certainty whether or not the

Conflict Minerals necessary to the functionality or production of Covered Products “DRC conflict free” as defined in paragraph (d)(4) of the instructions to Item 1.01 of Form SD. In these circumstances, an independent private sector

audit is not required. The Company did not have any direct engagement with, or conduct any on-site visits of, any mines, smelters, or refiners and has not developed any action plans with respect to any mines, smelters, or refiners.

Smelters or Refiners and Country of Origin of Conflict Minerals

The Company requested that its suppliers use the CMRT to identify the SORs used to produce any Conflict Minerals in their products and to identify the country

of origin of the Conflict Minerals. As noted above, a total of 373 suppliers were identified as in-scope for conflict mineral regulatory purposes and contacted as part of the RCOI process. The survey response rate among these suppliers was 93%. Of

these responding suppliers, 12% responded yes as to having one or more of the Conflict Minerals as necessary to the functionality or production of the Covered Products.

For those SORs that are known or thought to be sourcing from a Covered Country, additional investigation was conducted by Source Intelligence to determine the

source and chain of custody of the Conflict Minerals. Source Intelligence relies on the following internationally accepted audit standards to determine which SORs are considered to be “DRC conflict free:” the Conflict-Free Sourcing

Initiative’s (“CFSI”) Conflict-Free Smelter Program, the London Bullion Market Association Good Delivery Program, and the Responsible Jewelry Council Chain of Custody Certification. If the SOR is not certified by these internationally

recognized standards, Source Intelligence attempts to contact the SOR to gain more information about their sourcing practices, including countries of origin and transfer, as well as whether there are any internal due diligence procedures in place or

other processes the SOR takes to track the chain of custody of its mineral ores. Source Intelligence considers whether the SOR has a documented, effective and communicated conflict free sourcing policy, and an accounting system to support a mass

balance of materials

4

processed and traceability documentation. Internet research is also performed to determine whether there are any outside sources of information regarding the SOR’s sourcing practices. As

many as three contact attempts are made by Source Intelligence to these SORs to gather information on mine country of origin and sourcing practices.

Based on these responses, the Company was able to verify the following list of SORs that were used to produce Conflict Minerals in our suppliers’

products. It should be noted that in many cases, the summarized SOR information provided to the Company by its suppliers was produced at a company or divisional level based on all of their products as a whole, rather than being limited to the

specific products supplied to Carter’s. As a result, the Company was unable to determine whether all of the SORs listed below were actually in our supply chain during the Reporting Period and therefore is unable to determine with certainty

whether or not the Conflict Minerals necessary to the functionality or production of Covered Products is “DRC conflict free” as defined in paragraph (d)(4) of the instructions to Item 1.01 of Form SD. Additionally, as part of its

review, the Company has no evidence that any the Conflict Minerals identified came from recycled or scrap sources.

Gold

Asahi Pretec Corporation*

Chimet S.p.A.*

Nadir Metal Rafineri San. Ve Tic A.Ş.*

Heraeus Precious

Metals GmbH & Co. KG*

Istanbul Gold Refinery*

LS-NIKKO Copper Inc.*

Metalor Technologies SA*

Metalor USA Refining Corporation*

Mitsubishi Materials

Corporation*

Ohio Precious Metals, LLC*

Royal Canadian

Mint*

Shandong Zhaojin Gold & Silver Refinery*

Tanaka Kikinzoku Kogyo K.K.*

The Refinery of Shandong Gold

Mining Co. Ltd.*

Umicore Brasil Ltda*

Tin

Alpha*

CNMC (Guangxi) PGMA Co. Ltd.

Cooper Santa*

CV United Smelting*

Empresa Metallurgica Vinto*

Geijiu Non-Ferrous Metal Processing

Co.*

Malaysia Smelting Corporation (MSC)*

Melt Metais e

Ligas S/A*

Metallo Chimique*

Mineração Taboca

S.A.*

Minsur*

Operaciones Metalurgical S.A.*

PT Koba Tin

PT Tambang Timah*

PT Timah (Persero), Tbk*

Thaisarco*

Yunnan Tin Company Limited*

5

Tungsten

None

Tantalum

None

| * |

Denotes SORs that have received a “conflict free” designation from an independent third party audit program as of June 1, 2015. |

The Company believes the countries of origin for the conflict minerals produced by these SORs include: Argentina, Australia, Bolivia, Brazil, Canada, Chile,

China, the DRC, Guinea, Guyana, India, Indonesia, Italy, Japan, Kazakhstan, Malaysia, Mexico, Myanmar, Niger, Nigeria, Papua New Guinea, Peru, Philippines, Portugal, Russia, Rwanda, Saudi Arabia, Singapore, South Africa, South Korea, Spain,

Suriname, Sweden, Thailand, Turkey, the United Kingdom, the United States of America, and Uzbekistan.

Steps to be taken to Mitigate Risk

The Company will endeavor to continuously improve upon its supply chain due diligence efforts via the following measures:

| • |

|

Continue to assess the presence of Conflict Minerals in its supply chain; |

| • |

|

Clearly communicate expectations with regard to supplier performance, transparency and sourcing; |

| • |

|

Continue to compare RCOI results to information collected via independent conflict free smelter validation programs such as the CFSI’s Conflict-Free Smelter Program; and |

| • |

|

Contact smelters identified as a result of the RCOI process and request their participation in obtaining a “conflict free” designation from an industry program such as the CFSI’s Conflict-Free Smelter

Program. |

6

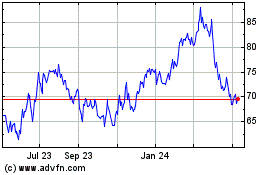

Carters (NYSE:CRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

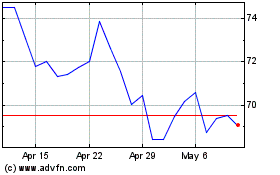

Carters (NYSE:CRI)

Historical Stock Chart

From Apr 2023 to Apr 2024