UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2015

Carter’s, Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-31829 |

|

13-3912933 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

Phipps Tower,

3438 Peachtree Road NE, Suite 1800

Atlanta, Georgia 30326

(Address of principal executive offices, including zip code)

(678) 791-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.07 |

Submission of Matters to a Vote of Security Holders. |

Carter’s, Inc. (the “Company”) held

its Annual Meeting of Shareholders on May 7, 2015 (the “Annual Meeting”). Set forth below are the final voting results for each of the proposals submitted to a vote of the shareholders.

1. Election of Directors

Each of Paul Fulton and

Thomas E. Whiddon was elected as a Class III Director to serve a three-year term. The voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nominee |

|

Total votes

for |

|

|

Total votes

against |

|

|

Total votes

abstained |

|

|

Broker

non-votes |

|

| Paul Fulton |

|

|

45,970,657 |

|

|

|

353,708 |

|

|

|

17,777 |

|

|

|

2,622,850 |

|

| Thomas E. Whiddon |

|

|

46,005,326 |

|

|

|

319,118 |

|

|

|

17,698 |

|

|

|

2,622,850 |

|

2. Advisory Vote on Executive Compensation for Named Executive Officers

The shareholders of the Company approved, on an advisory basis, the 2014 compensation awarded to the Company’s named executive officers as disclosed in

the Company’s proxy statement filed in connection with the Annual Meeting. The voting results were as follows:

|

|

|

|

|

|

|

| Total votes

for |

|

Total votes

against |

|

Total votes

abstained |

|

Broker

non-votes |

| 45,997,542 |

|

309,133 |

|

35,467 |

|

2,622,850 |

3. Ratification of Appointment of Independent Registered Public Accounting Firm

The shareholders of the Company ratified the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for

fiscal 2015. The voting results were as follows:

|

|

|

|

|

| Total votes

for |

|

Total votes

against |

|

Total votes

abstained |

| 48,854,101 |

|

92,823 |

|

18,068 |

| Item 7.01 |

Regulation FD Disclosure. |

On May 7, 2015, the Company issued a press release announcing that its

Board of Directors had declared a quarterly dividend. The text of the Company’s press release, attached as Exhibit 99.1 to this Current Report on Form 8-K, is incorporated herein by reference.

Exhibit 99.1 is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934

(the “Exchange Act”), nor shall Exhibit 99.1 be deemed incorporated by reference in any filing under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except as shall be expressly set forth by specific

reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

Exhibits - The following exhibit is furnished as

part of this Current Report on Form 8-K.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release of Carter’s, Inc., dated May 7, 2015 |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, Carter’s, Inc. has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

May 7, 2015

|

|

|

| CARTER’S, INC. |

|

|

| By: |

|

/s/ Michael C. Wu |

| Name: |

|

Michael C. Wu |

| Title: |

|

Senior Vice President, General Counsel, and Secretary |

Exhibit 99.1

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact: |

|

|

|

|

|

|

|

|

|

|

Sean McHugh |

|

|

|

|

|

|

Vice President & Treasurer |

|

|

|

|

|

|

(678) 791-7615 |

Carter’s, Inc. Announces Quarterly Dividend

ATLANTA, May 7, 2015 – The Board of Directors of Carter’s, Inc. (NYSE:CRI) today declared a quarterly dividend of $0.22 per share, payable on

June 5, 2015, to shareholders of record at the close of business on May 21, 2015.

Future declarations of quarterly dividends and the

establishment of future record and payment dates will be at the discretion of the Board based on a number of factors, including the Company’s future financial performance and other considerations.

About Carter’s, Inc.

Carter’s, Inc. is the

largest branded marketer in the United States and Canada of apparel and related products exclusively for babies and young children. The Company owns the Carter’s and OshKosh B’gosh brands, two of the most recognized brands in

the marketplace. These brands are sold in leading department stores, national chains, and specialty retailers domestically and internationally. They are also sold through more than 800 Company-operated stores in the United States and Canada and

on-line at www.carters.com, www.oshkoshbgosh.com, and www.cartersoshkosh.ca. The Company’s Just One You, Precious Firsts, and Genuine Kids brands are available at Target, and its Child of Mine brand is available at

Walmart. Carter’s is headquartered in Atlanta, Georgia. Additional information may be found at www.carters.com.

Cautionary Language

This press release contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995

relating to the Company’s future performance, including, without limitation, statements with respect to the Company’s anticipated financial results for the second quarter of fiscal 2015 and fiscal year 2015, or any other future period,

assessment of the Company’s performance and financial position, and drivers of the Company’s sales and earnings growth. Such statements are based on current expectations only, and are subject to certain risks, uncertainties, and

1

assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated,

estimated, or projected. Factors that could cause actual results to materially differ include the risks of: losing one or more major customers, vendors, or licensees or financial difficulties for one or more of our major customers, vendors, or

licensees; the Company’s products not being accepted in the marketplace; changes in consumer preference and fashion trends; negative publicity; the Company failing to protect its intellectual property; incurring costs in connection with

cooperating with regulatory investigations and proceedings; the breach of the Company’s consumer databases, systems or processes; deflationary pricing pressures; decreases in the overall level of consumer spending; disruptions resulting from

the Company’s dependence on foreign supply sources; foreign currency risks due to the Company’s operations outside of the United States; the Company’s use of a small number of vendors over whom it has little control; the

Company’s foreign supply sources not meeting the Company’s quality standards or regulatory requirements; disruptions in the Company’s supply chain, including distribution centers or in-sourcing capabilities or otherwise, and the risk

of slow-downs, disruptions or strikes in the event that the new tentative agreement between the Pacific Maritime Association, which represents the operator of the port through which we source substantially all of our products, and the International

Longshore and Warehouse Union is not finalized and approved in a timely manner; product recalls; the loss of the Company’s principal product sourcing agent; increased competition in the baby and young children’s apparel market; the Company

being unable to identify new retail store locations or negotiate appropriate lease terms for the retail stores; the Company’s failure to successfully manage its eCommerce business; the Company not adequately forecasting demand, which could,

among other things, create significant levels of excess inventory; failure to achieve sales growth plans, cost savings, and other assumptions that support the carrying value of the Company’s intangible assets; increased leverage, not being able

to repay its indebtedness and being subject to restrictions on operations by the Company’s debt agreements; not attracting and retaining key individuals within the organization; failure to properly manage strategic projects; failure to

implement needed upgrades to the Company’s information technology systems; disruptions of distribution functions in its Braselton, Georgia facility; being unsuccessful in expanding into international markets and failing to successfully manage

legal, regulatory, political and economic risks of international operations, including maintaining compliance with worldwide anti-bribery laws; fluctuations in the Company’s tax obligations and effective tax rate; incurring substantial costs as

a result of various claims or pending or threatened lawsuits; and the failure to declare future quarterly dividends. Many of these risks are further described in the most recently filed Annual Report on Form 10-K and other reports filed with the

Securities and Exchange Commission under the headings “Risk Factors” and “Forward-Looking Statements.” The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

2

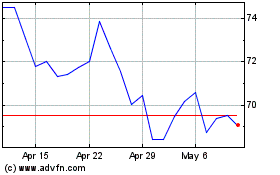

Carters (NYSE:CRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

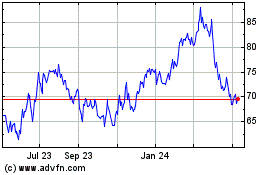

Carters (NYSE:CRI)

Historical Stock Chart

From Apr 2023 to Apr 2024