Carter's Inc Avoids Prosecution In SEC Enforcement Deal

December 20 2010 - 5:03PM

Dow Jones News

Carter's Inc. (CRI) on Monday became the first company to

benefit from a new Securities and Exchange Commission program that

allows a company to avoid prosecution in exchange for cooperation

with fraud investigations.

The deal, known as a non-prosecution agreement, offers more

incentive to company officials than deferred prosecution programs

that have strings attached. The tool is among a series of measures

the SEC announced in January to encourage greater cooperation from

companies and individuals in SEC probes. Under the initiative, the

SEC enforcement division authorized its staff to use new tools and

expanded some existing tools.

In written agreements, the SEC can offer leniency for an entity

that cooperates, agrees to defer prosecution or agrees to forgo

prosecution altogether, as it did in this case.

"Not only does it put us in a better litigating position, but

when we're in a better litigating position it encourages defendants

to settle on terms that are more favorable for the agency and

investors," said SEC Deputy Enforcement Director Lorin L. Reisner,

who worked on the Carter's case.

Reisner said the case provided a road map for using

non-prosecution agreements, calling the case "a very clear example

of the benefits to be obtained from cooperation."

The SEC charged former Carter's executive Joseph M. Elles with

fraud and insider trading for his role in an overstatement of the

company's net income. But the SEC said that it agreed not to

prosecute Carter's because of the company's extensive cooperation

in the investigation and the "isolated nature of the unlawful

conduct."

While he was a sales executive with the company between 2004 and

2009, Elles allegedly gave discounts to Kohl's Corp. (KSS)

department stores, Carter's largest wholesale customer, and

persuaded the company to defer the discounts to future reporting

periods.

According to the SEC, he then exercised company stock options

that resulted in a pre-tax profit of approximately $4,739,862

before Carter's publicly disclosed the fraud on Oct. 27, 2009,

which led the company's shares to tumble 24% immediately afterward.

Elles's attorney didn't respond to requests for comment.

Monday, Carter's shares closed down 0.5% at $31.45. The stock is

up 20% so far this year.

-By Jamila Trindle, Dow Jones Newswires; 202-862-6684;

jamila.trindle@dowjones.com

--Tess Stynes and Jessica Holzer contributed to this

article.

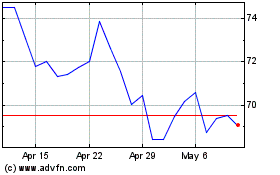

Carters (NYSE:CRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

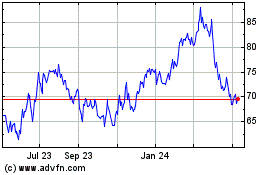

Carters (NYSE:CRI)

Historical Stock Chart

From Apr 2023 to Apr 2024