UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

January 26, 2016

CRAWFORD & COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Georgia |

|

1-10356 |

|

58-0506554 |

| (State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS employer

Identification No.) |

|

|

| 1001 Summit Blvd., Atlanta, Georgia |

|

30319 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (404) 300-1000

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On January 7, 2016, the Compensation Committee of the Board of Directors of Crawford & Company (the “Company”)

awarded to Harsha V. Agadi, the Company’s interim president and chief executive officer, for his service in such roles, 100,000 restricted stock units (in the form of performance share units), subject to mutual agreement to the terms and

conditions of an award agreement relating thereto (the “Agreement”) and the Company’s Executive Stock Bonus Plan (the “Plan”). The Agreement terms were agreed and the Agreement was executed by the Company and

Mr. Agadi as of January 26, 2016. Pursuant to the terms of the Agreement, such award will vest on December 31, 2016 and thereafter be payable in an equivalent number of shares of Class A common stock of the Company provided that

Mr. Agadi complies with all of the terms and conditions contained in the Agreement and the Plan, including the non-solicit, non-compete, non-disclosure and confidentiality provisions contained in the Agreement.

The form of the Agreement is being filed as Exhibit 10.1 hereto and is incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

(a) |

Exhibits. The following exhibit is furnished with this report: |

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

Form of restricted stock unit award agreement under the Executive Stock Bonus Plan |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| CRAWFORD & COMPANY |

|

|

| By: |

|

/s/ R. Eric Powers, III |

| Name: |

|

R. Eric Powers, III |

| Title: |

|

Vice President |

Date: January 26, 2016

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

Form of restricted stock unit award agreement under the Executive Stock Bonus Plan |

Exhibit 10.1

CRAWFORD & COMPANY

EXECUTIVE STOCK BONUS PLAN

Long-Term Incentive Plan Award Agreement

THIS AGREEMENT, by and between Harsha V. Agadi (the “Participant”) and Crawford & Company

(“Crawford”), entered into as of the Grant Date (the “Agreement”);

WHEREAS, Crawford maintains the

Crawford & Company Executive Stock Bonus Plan (the “Plan”), which is incorporated into and forms a part of this Agreement;

WHEREAS, in connection with the Participant’s current service as Crawford’s interim President and Chief Executive Officer,

the Compensation Committee of Crawford’s Board of Directors (the “Committee”) desires to make an Award under the Plan to the Participant and to impose certain restrictions for a period of time on the Participant’s activities that

may be considered competitive with or otherwise potentially harmful to Crawford; and

WHEREAS, the Committee has approved an Award

to the Participant of Restricted Stock Units, in the form of Performance Share Units under the Plan, as consideration for the Participant agreeing to the restrictions on his activities described in this Agreement;

NOW, THEREFORE, IT IS AGREED, by and between Crawford and the Participant, as follows:

1. Terms of Award and Definitions. The following terms used in this Agreement shall have the meanings set forth in this Section 1:

(a) Company. “Company” means Crawford & Company, along with its subsidiaries, parents,

affiliated entities, and includes the successors and assigns of Crawford or any such related entities.

(b) Business of

the Company. The “Business of the Company” means claims management, claims adjusting, medical management, medical bill review, administrative services, and other services as identified and described in the Company’s 2015 Annual

Report.

(c) Code Section 409A. “Code Section 409A” means Section 409A of the Code and all

applicable regulations and other guidance issued under or related to Section 409A of the Code.

(d) Confidential

Information. “Confidential Information” means information about the Company and its employees and/or customers which is not generally known outside of the Company, which the Participant learns of in connection with the

Participant’s employment with the Company or service on the Board, which has value to the Company, and which would be useful to competitors of the Company. Confidential Information includes, but is not limited to: (1) the Company’s

business and employment policies, marketing methods and the targets of those methods, financial records, business plans, strategies and ideas, promotional materials, education and

training materials, research and development, technology and software systems, price lists, and recruiting strategies; (2) the nature, origin, composition and development of the

Company’s products and services; (3) the Company’s proprietary information and processes, and intellectual property; and (4) the Company’s customer information and the manner in which the Company provides products and

services to customers.

(e) Designated Beneficiary. The “Designated Beneficiary” shall be the beneficiary

or beneficiaries designated by the Participant in a writing filed with the Committee in such form and at such time as the Committee shall require.

(f) Grant Date. The “Grant Date” is January 7, 2016.

(g) Participant. The “Participant” is Harsha V. Agadi.

(h) Restricted Stock Units. The number of “Restricted Stock Units” (in the form of Performance Share Units

under the Plan) awarded under this Agreement shall be 100,000 shares.

(i) Restriction Period. The “Restriction

Period” is the period beginning on the Grant Date and ending on December 31, 2016.

(j) Trade Secrets.

“Trade Secrets” means Confidential Information which meets the additional requirements of the Georgia Trade Secrets Act.

Except where the

context clearly implies or indicates the contrary, a word, term, or phrase used in the Plan is similarly used in this Agreement.

2. Award; Settlement of Award. Subject to the terms and conditions of this Agreement and the Plan, the Participant is hereby

granted the number of Restricted Stock Units as set forth in Section 1(h). The Company shall deliver to the Participant one share of Stock for each vested Restricted Stock Unit, as determined in accordance with Section 3. The vested

Restricted Stock Units payable to the Participant in accordance with this Agreement shall be paid solely in shares of Stock. There shall be no adjustment to the Restricted Stock Units for dividends paid by the Company.

3. Vesting Condition; Transfer of Shares; Forfeiture of Shares. If the Participant complies with the terms of Section 4 throughout

the Restriction Period, the Restricted Stock Units awarded under this Agreement shall vest as of the last day of the Restriction Period. Payment of Stock for such vested Restricted Stock Units shall be made between January 1 and March 15

of the year following the last day of the Restriction Period. If the Participant violates any of the terms of Section 4 during the Restriction Period, the Restricted Stock Units granted under this Agreement shall be forfeited. Notwithstanding

any contrary provision of this Agreement or the Plan, if the Participant does not return a signed copy of this Agreement to the Committee (or its designated representative) reasonably promptly, the Participant’s entitlement to Restricted Stock

Units to be granted under this Agreement shall be forfeited.

4. Restrictive Covenant Agreement. The Participant acknowledges that

if he were to compete with the Company in the Business of the Company, he could cause serious harm to

2

the Company. The Participant further acknowledges that during his employment and service on the Board, he will gain valuable confidential business or professional information, including

information that qualifies as Trade Secrets under the Georgia Uniform Trade Secrets Act; maintain and build substantial relationships with specific prospective or existing customers or clients of the Company; and maintain and build customer or

client goodwill associated with the Business of the Company throughout the United States.

(a) Non-Competition. The

Participant agrees that, during the Restriction Period, he will not directly or indirectly engage in the Business of the Company or in any competitive business or provide services to a competitive business of the Business of the Company, as an

owner, partner or agent, or as employee, by engaging in activities that are the same as, or substantially similar to, those activities performed by the Participant on behalf of the Company during the parties’ employment relationship. The

Participant acknowledges that during his employment with the Company he serves as a “key employee” of the Company within the meaning of O.C.G.A. § 13-8-51 and that the Participant otherwise had a primary duty of managing and directing

the overall business of the Company. Therefore, the Participant agrees that the terms, territory, and scope of the restraint contemplated by this Section 4(a) are reasonable and necessary to protect the Company’s legitimate business

interests.

(b) Non-Solicitation of Customers. The Participant agrees that during the Restriction Period, he will

not, directly or indirectly, solicit or attempt to solicit any business in competition with the Business of the Company from any of the customers of the Company with whom the Participant had material contact during the Participant’s tenure as

interim President and Chief Executive Officer of the Company.

(c) Non-Solicitation/Non-Recruitment of Employees.

The Participant agrees that, during the Restriction Period, he will not, directly or indirectly, on his own behalf or on behalf of others, hire away or attempt to hire away any person employed by the Company with whom the Participant had contact in

the course of his employment with the Company.

(d) Duty of Confidentiality. The Participant agrees that, during the

Restriction Period, and thereafter as contemplated in this Section 4(d), the Participant will not, except in furtherance of the interests of the Company, directly or indirectly divulge or make use of any Confidential Information, without the

prior written consent of the Company, until such Confidential Information ceases to be confidential by reason of the actions of others or through an authorized disclosure by the Participant. The Participant further agrees that if the Participant is

questioned about information subject to this Agreement by anyone not authorized to receive such information, the Participant will promptly notify the General Counsel of the Company. This Agreement does not limit the remedies available under common

or statutory law, which may impose longer duties of non-disclosure.

The Participant agrees that, during the Restriction Period, and

thereafter as contemplated in this Section 4(d), the Participant will not, except in furtherance of the interests of the Company, directly or indirectly divulge or make use of any Trade Secrets, until such

3

Trade Secret(s) ceases to be a Trade Secret by reason of the actions of others or through an authorized disclosure by the Participant. The Participant further agrees that if the Participant is

questioned about information subject to this Agreement by anyone not authorized to receive such information, the Participant will promptly notify the General Counsel of the Company.

(e) Non-Disclosure of Personal Information. The Participant acknowledges that during the course of his employment with

the Company, he may obtain information regarding individuals as a result of services provided to customers of the Company such as (i) claim and personal health information, (ii) social security number, (iii) date of birth and

(iv) salary information (“Personal Information”). The Participant agrees:

(1) Not to acquire, use, or

distribute such Personal Information without the express consent of the subject of such Personal Information, or only to the extent federal or state law allows such acquisition and disclosure of Personal Information without consent.

(2) To acquire, use and/or distribute Personal Information solely for the purposes of carrying out the daily functions of the

Participant’s job.

(3) To disclose Personal Information only to authorized third parties. These agencies may include,

but are not necessarily limited to, independent review agents, claims adjusters, benefits administrators, attorneys and employers.

(4) To limit access to computerized Personal Information solely to staff, authorized users and administrative personnel and

abide by all security measures designed to assure that unauthorized personnel are not afforded access to Personal Information.

(f) Remedies. The parties acknowledge and agree that (1) this Agreement is reasonable and necessary for the

protection of the business and goodwill of the Company, (2) any breach of this Agreement by the Participant will cause the Company substantial and irreparable harm, and (3) the Participant has received good, valuable and adequate

consideration in exchange for the covenants contained in this Agreement. Consequently, if the Participant breaches any of the terms of this Section 4, the Participant will forfeit the Award described in this Agreement and all rights hereunder.

(g) Construction of Agreement. The covenants contained in this Section 4 shall be presumed to be enforceable,

and any reading causing unenforceability shall yield to a construction permitting enforcement. If any single covenant or clause shall be found unreasonable, unenforceable or both, it shall be modified as appropriate to protect the Company’s

interests or severed and the remaining covenants and clauses shall be enforced in accordance with the tenor of the Agreement. In the event a court should determine not to enforce a covenant as written due to overbreadth, the parties specifically

agree that said covenant shall be enforced to the extent reasonable, whether said revisions are in time, territory, or scope of prohibited activities. This Section 4 represents the entire understanding between the Participant and the Company on

the matters addressed

4

herein and supersedes any such prior agreements and may not be modified, changed or altered by any promise or statement by the Company until such modification has been approved in writing and

signed by both parties. The waiver by the Company of a breach of any provision of this Agreement by any employee shall not be construed as a waiver of rights with respect to any subsequent breach by the Participant.

(h) Survival. This Agreement shall remain in effect, unless modified in writing signed by both the Participant and on

behalf of the Company, throughout the Restriction Period, and shall survive the termination of the Participant’s employment with the Company.

5. Non-Transferable. This Award shall not be assignable or transferable except by will or by laws of descent and distribution.

6. Heirs and Successors.

(a) This Agreement shall be binding upon, and inure to the benefit of, the Company and the Participant and their respective

heirs, executors, administrators, successors and assigns, and upon any person acquiring, whether by merger, consolidation, purchase of assets or otherwise, all or substantially all of the Company’s assets and business.

(b) In the event of the Participant’s death during the Restriction Period, or thereafter but before payment of the Stock

for the Restricted Stock Units, and the Participant has complied with the terms of Section 4 prior to death, such Stock shall be delivered to the Designated Beneficiary, in accordance with the provisions of this Agreement and the Plan.

(c) If the Participant is deceased and has failed to designate a beneficiary, or if the Designated Beneficiary does not survive

the Participant, any stock distributable to the Participant shall be distributed to the legal representative of the estate of the Participant.

(d) If the Participant is deceased and has designated a beneficiary but the Designated Beneficiary dies before distribution of

stock to the Designated Beneficiary under this Agreement, then any stock distributable to the Designated Beneficiary shall be distributed to the legal representative of the estate of the Designated Beneficiary.

7. Withholding. The Participant hereby consents to whatever action the Committee directs to satisfy the minimum statutory tax

withholding requirements, if any, that the Committee in its discretion deems applicable to the Award of Restricted Stock Units or the satisfaction of any forfeiture or vesting conditions with respect to such Award. If the Committee so allows, the

Participant may elect to satisfy such minimum federal and state tax withholding requirements through a reduction in the number of shares of Stock actually transferred to him under the Plan. If the Participant does not make an election as to the

method of satisfying minimum statutory tax withholding requirements, if any, prior to the payment of Stock for such earned and vested Restricted Stock Units, the Participant hereby consents to satisfaction of such withholding by reduction of the

Participant’s paycheck. The Participant’s election as to the method of satisfying

5

minimum statutory tax withholding requirements, if any, shall apply for all awards issued under the Plan until such time as the Participant affirmatively changes the election.

8. Administration. The authority to manage and control the operation and administration of this Agreement shall be vested in the

Committee, and the Committee shall have all powers with respect to this Agreement as it has with respect to the Plan. Any interpretation of the Agreement by the Committee and any decision made by it with respect to the Agreement is final and binding

on all persons.

9. Securities Registration. Upon the receipt of Stock pursuant to the terms of this Agreement, the

Participant shall, if so requested by the Company, (a) hold such Stock for investment and not with a view of resale or distribution to the public and (b) deliver to the Company a written statement satisfactory to the Company to that

effect.

10. Other Laws. The Company shall have the right to refuse to issue or transfer any Stock under this Agreement if

the Company, acting in its absolute discretion, determines that the issuance or transfer of such Stock might violate any applicable law or regulation.

11. Disposition of Shares. The Participant shall, so long as he remains an employee of the Company or Subsidiary Corporation, be

obligated to notify the Company in the case of each sale or other disposition of any Stock acquired pursuant to the terms of this Agreement, such notice to be given to the Company immediately upon the occurrence of any such sale or other

disposition.

12. No Contract of Employment. Neither the Plan, this Agreement nor any related material shall give the

Participant the right to continue in employment by the Company or by a Subsidiary Corporation or shall adversely affect the right of the Company or a Subsidiary Corporation to terminate the Participant’s employment with or without cause at any

time.

13. Shareholder Rights. The Participant shall have no rights as a stockholder with respect to any shares of Stock

under this Agreement until such shares have been duly issued and delivered to the Participant, and no adjustment shall be made for dividends of any kind or description whatsoever or for distributions of other rights of any kind or description

whatsoever respecting such Stock except as expressly set forth in the Plan or this Agreement.

14. Section 409A

Compliance. The Company intends that the Restricted Stock Unit Awards granted hereunder comply with Code Section 409A to the extent applicable. The Restricted Stock Unit Awards shall be administered in a manner that shall be intended to

avoid resulting in the acceleration of taxation, or the imposition of penalty taxation or interest, under Code Section 409A upon a Participant. Any ambiguities in this Agreement shall be construed to effect this intent. Each payment under this

Agreement shall be treated as a separate payment for purposes of Code Section 409A.

15. Plan Governs. Notwithstanding

anything in this Agreement to the contrary, the terms of this Agreement shall be subject to the terms of the Plan, a copy of which may be obtained by the Participant from the office of the Secretary of the Company; and this Agreement is subject to

all interpretations, amendments, rules and regulations promulgated by the Committee from time to time pursuant to the Plan.

6

16. Governing Law, Jurisdiction and Venue. The Plan and this Agreement shall be governed

by the laws of the State of Georgia and the jurisdiction and venue of any suit, action, or other proceeding relating to this Agreement, including the enforcement of any rights under this Agreement shall be in the Superior Court of Fulton County,

Georgia and the United States District Court for the Northern District of Georgia. Any process or notice in connection with such suit, action or other proceeding may be served by certified or registered mail or personal service within or without the

State of Georgia, provided a reasonable time for appearance is allowed.

17. Amendment.

(a) The Committee may amend this Agreement by written agreement of the Participant and the Company, without the consent of any

other person.

(b) Notwithstanding Section 17(a), the Committee shall have the right to amend this Agreement

unilaterally or to withhold or otherwise restrict the transfer of any Stock under this Agreement to the Participant as the Committee deems appropriate in order to satisfy any condition or requirement under Rule 16b-3 to the extent Rule 16 of the

1934 Act might be applicable to such grant or transfer.

(c) Notwithstanding Section 17(a), the Committee shall have

the right to amend this Agreement unilaterally to the extent the Committee deems such amendment necessary to comply with Code Section 409A.

IN WITNESS WHEREOF, the Participant has executed this Agreement, and the Company has caused these presents to be executed in its name

and on its behalf, all as of the Grant Date.

|

|

|

|

|

|

|

|

|

| Crawford & Company |

|

|

|

Participant |

|

|

|

|

| By: |

|

/s/ Charles H. Ogburn |

|

|

|

/s/ Harsha V. Agadi |

| Title: |

|

Chairman of the Board |

|

|

|

Harsha V. Agadi |

7

CRAWFORD & COMPANY

EXECUTIVE STOCK BONUS PLAN

BENEFICIARY DESIGNATION FORM

I wish to designate the following person(s) as my beneficiary(ies) to receive my outstanding Awards, if any, under the Crawford &

Company Executive Stock Bonus Plan, as amended from time to time including any successor thereto (the “Plan”), in the event of my death. I reserve the right to change this designation with the understanding that this designation, and any

change thereof, will be effective only upon delivery to the Company. The right to receive my outstanding Awards under the Plan, if any, will be transferred to my primary beneficiaries who survive me, and to my secondary beneficiaries who survive me

only if none of my primary beneficiaries survive me.

|

|

|

|

|

|

|

| A. |

|

PRIMARY BENEFICIARY (BENEFICIARIES) |

|

|

|

|

|

|

|

|

Name of Beneficiary |

|

Relationship |

|

Percentage |

| 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| B. |

|

SECONDARY BENEFICIARY (BENEFICIARIES) |

|

|

|

|

|

|

|

|

Name of Beneficiary |

|

Relationship |

|

Percentage |

| 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

I acknowledge that execution of this form and delivery thereof to the Company revokes all prior beneficiary

designations I have made with respect to my outstanding Awards under the Plan.

Participant’s signature: ______________________________________.

Date: ____________________, ______________.

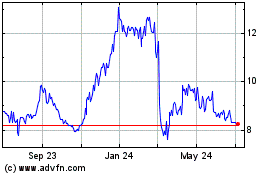

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

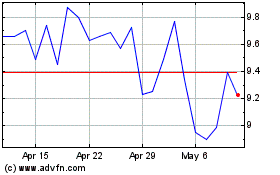

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Apr 2023 to Apr 2024