UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 12, 2016

CRAWFORD & COMPANY

(Exact Name of Registrant as Specified in Its Charter)

Georgia

(State or Other Jurisdiction of Incorporation)

|

|

|

| 1-10356 |

|

58-0506554 |

| (Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 1001 Summit Blvd., Atlanta, Georgia |

|

30319 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(404) 300-1000

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 7.01. |

Regulation FD Disclosure |

On Tuesday, January 12, 2016, members of executive management of

Crawford & Company (the “Company”) are expected to present information about the Company to certain investors, potential investors, and other interested parties. Attached as Exhibit 99.1 is a copy of the slide presentation that

will be discussed during this presentation. These materials may also be used by the Company at one or more subsequent conferences with investors, potential investors or other interested parties after the date hereof.

| ITEM 9.01. |

Financial Statements and Exhibits |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Investor Presentation on January 12, 2016 |

The information contained in this current report on Form 8-K and in the accompanying exhibits shall not be incorporated by

reference into any filing of the Company with the SEC, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such filing. The

information, including the exhibits hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and

12(a)(2) of the Securities Act of 1933, as amended.

2

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

CRAWFORD & COMPANY |

|

|

(Registrant) |

|

|

| By: |

|

/s/ R. Eric Powers, III |

|

|

R. Eric Powers, III |

|

|

Vice President |

Dated: January 12, 2016

3

EXHIBIT INDEX

|

|

|

| Number |

|

Descriptions |

|

|

| 99.1 |

|

Investor Presentation on January 12, 2016 |

4

Investor Presentation January, 2015

Crawford & Company Exhibit 99.1

Forward-Looking Statements —This

presentation contains forward-looking statements, including statements about the expected future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not

statements of historical fact may be "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause

actual results to differ materially from historical experience or Crawford & Company's present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made.

Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. Results for any interim period

presented herein are not necessarily indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and uncertainties involved in forward-looking

statements, please read Crawford & Company's reports filed with the Securities and Exchange Commission and available at www.sec.gov or in the Investor Relations section of Crawford & Company's website at www.crawfordandcompany.com.

—Crawford's business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and

the occurrence of natural and man-made disasters, which are a significant source of cases and revenue for the Company, are generally not subject to accurate forecasting. —In recent periods the Company has derived a material portion of its

revenues and operating earnings from a limited number of client engagements and special projects within its Legal Settlement Administration segment, specifically its work on the gulf-related class action settlement. These projects continue to wind

down, and related revenues and operating earnings have been and are expected to continue to be at a reduced rate in future periods. Revenues Before Reimbursements ("Revenues") —Revenues Before Reimbursements are referred to as "Revenues" in

both consolidated and segment charts, bullets and tables throughout this presentation. Segment and Consolidated Operating Earnings —Under the Financial Accounting Standards Board's Accounting Standards Codification ("ASC") Topic 280, "Segment

Reporting," the Company has defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its four operating segments. Segment operating earnings exclude income taxes, interest expense, amortization

of customer-relationship intangible assets, restructuring and special charges, stock option expense, earnings or loss attributable to non-controlling interests, and certain unallocated corporate and shared costs and credits. Consolidated operating

earnings is the total of segment operating earnings and certain unallocated and shared costs and credits. — Through the third quarter of 2015, we reported our results through the following business segments: Americas, EMEA/AP, Broadspire and

Legal Settlement Administration. All segment discussion in this presentation is under the operating structure in place for the Quarterly Report on Form 10-Q for the quarter and nine months ended 9/30/15. On November 24, 2015 we announced that,

effective immediately, we were restructuring our operations into the following business segments: U.S Property & Casualty, International Operations, Broadspire, and Garden City Group. We will begin reporting segments financial results in

accordance therewith when reporting results for the year ending December 31, 2015. At that time, prior period results will also be reclassified to conform to this presentation. (Loss) Earnings Per Share —The Company's two classes of stock are

substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock (CRDA) than on the voting Class B Common Stock (CRDB), subject to certain limitations. In

addition, with respect to mergers or similar transactions, holders of CRDA must receive the same type and amount of consideration as holders of CRDB, unless different consideration is approved by the holders of 75% of CRDA, voting as a class.

—In certain periods, the Company has paid a higher dividend on CRDA than on CRDB. This may result in a different earnings per share ("EPS") for each class of stock due to the two-class method of computing EPS as required by ASC Topic 260 -

"Earnings Per Share". The two-class method is an earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation rights in undistributed earnings as if all such earnings

had been distributed during the period. Non-GAAP Financial Information —For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation. FORWARD-LOOKING STATEMENTS AND

ADDITIONAL INFORMATION

The world's largest independent

provider of global claims management solutions Multiple globally recognized brand names: Crawford, Broadspire, GCG Clients include multinational insurance carriers, brokers and local insurance firms as well as over 200 of the Fortune 500

Consolidated revenues before reimbursements totaled $1.143 billion for 2014 GLOBAL BUSINESS SERVICES LEADER EMEA-A/P 1 Serves the U.K., European, Middle Eastern, African and Asia Pacific markets Revenues of $344 million in 2014 BROADSPIRE 3 Serves

large national accounts, carriers and self-insured entities Revenues of $269 million in 2014 AMERICAS 2 Serves the U.S., Canadian and Latin American markets Revenues of $359 million in 2014 LEGAL SETTLEMENTADMINISTRATION 4 Provides administration

for class action settlements and bankruptcy matters Revenues of $170 million in 2014

EXECUTIVE MANAGEMENT BACKGROUND Harsha

V. Agadi - Interim President and Chief Executive Officer 30 years of experience in leadership positions at both public and private companies, including several Fortune 500 companies Member of the Crawford Board of Directors since 2010 Chairman of

GHS Holdings, LLC, which has investments in restaurants, hospitality and other related industries Serves on the Boards of Belmond Ltd. and Diversified Foodservice Supply, Inc. Bruce Swain - EVP and Chief Financial Officer 30 years of experience in

public and corporate accounting Held multiple positions during nearly 25 years at Crawford Serves as CFO since 2006 CPA and a Chartered Global Management Accountant

Harsha V. Agadi appointed interim

President and CEO in August 2015 Strategic business review undertaken: The market backdrop continues to be challenging Crawford’s brand, competitive positioning and revenue base remain strong Administrative costs have grown significantly

pressuring margins Over $45 million of cost take out has been identified Revenue synergies are being identified to optimize client relationships Global Business Services Center initiative continues – expected to deliver improved customer

service as well as lower costs Renewed focus on delivering profitability and more predictable financial results STRATEGIC REVIEW

DRIVE IMPROVED PROFITABILITY AND

PREDICTABLE RESULTS Previously announced restructuring plans targeted to provide $22 million in cost savings during 2016 Headcount reduction in the Americas and EMEA / AP Senior management realignment to improve execution GBSC migration and GAB

Robins integration Additional $25 - $28 million restructuring plan announced November 2015 Reduce overhead costs in central functions and business segments Streamline senior management to reduce costs and further improve execution Restructuring

opportunities being reviewed in the Legal Settlement Administration segment given continued run off of large projects Restructuring and special charges expected to total approximately $32 - $37 million in 2015 and $13 million in 2016

GLOBAL BUSINESS SERVICES CENTER Located

in Manila, Philippines Crawford owned and operated - staffed by Crawford employees Consolidated global operations will drive improved customer service levels and lower costs Client impact: Improving turnaround time Enhancing process control

Increasing service levels Changing processes seamlessly Financial impact: ~1,400 Crawford employees to be transitioned to Manila through 2018 $6 million of the overall cost savings expected to be achieved by year end 2016

$47 - $50 MILLION OF COST TAKE-OUT

TARGETED Restructuring and Special Charges Expected Totals: 2015 ~ $32,000 - $37,0002016 ~ $13,000 $25,300 to $28,300 $47,400 to $50,400

U.S. Canada Latin America/ Caribbean

Revenues by Geographic Region ($ in millions) Americas Cases Received (In thousands) U.S. Canada Latin America/ Caribbean Operating Results (3Q 2015 v. 3Q 2014) Revenues of $92.0 million versus $92.2 million Exchange rates reduced revenues by 6.3%

Operating earnings of $12.2 million versus $7.0 million Operating earnings margin of 13.2% versus 7.6% U.S. Property and Casualty Revenues of $62.1 million versus $54.8 million Long-term outsourcing project to assist major U.S. insurer offset

decline in weather-related cases Cost reduction initiatives will continue through 2015 Canada Revenues of $27.0 million versus $33.6 million Revenues increased on constant dollar basis, but declined slightly due to negative exchange rate impact

Canadian Contractor Connection network expansion continued Latin America & Caribbean Revenues of $2.9 million versus $3.8 million Cost reduction initiatives will continue through 2015 Exiting certain unprofitable business lines in Brazil

AMERICAS SEGMENT HIGHLIGHTS

CONTRACTOR CONNECTION A

technology-enabled, best-in-class industry leader of contractor managed repair networks for residential and commercial losses. North American network of 4,800 general and specialty contractors 2014 Revenues of $50.5 million versus $36.0 million in

2013 Recognized by J.D. Power as #1 emergency service provider in recent study Additionally, 7 of the top 10 carriers rated by J.D. Power for customer satisfaction partner with Contractor Connection Over 250,000 assignments in 2015 and growing

rapidly with approximately $1.5 billion in estimates 300 staff dedicated to providing exceptional customer service and delivering increased policyholder satisfaction Expanding rapidly into new markets, such as consumer home improvement, real estate

and financial markets, all with global opportunities

U.K. Europe U.K. Asia-Pacific

Asia-Pacific Europe Revenues by Geographic Region ($ in millions) EMEA/AP Cases Received (In thousands) Operating Results (3Q 2015 v. 3Q 2014) Revenues of $98.3 million versus $86.2 million Exchange rates reduced revenues by 14.5% Operating earnings

of $6.7 million versus $4.2 million Operating earnings margin of 6.8% versus 4.9% U.K. Revenues of $47.9 million versus $32.0 million U.K. acquisition of GAB Robins drove revenue and case growth Restructuring initiatives benefited third quarter

margin expansion Europe Revenues of $21.6 million versus $24.7 million Claims volume increased in third quarter from high frequency claims Continued focus on improving operating performance Asia-Pacific Revenues of $28.8 million versus $29.5 million

Strong operating results in Australia Weak results in smaller country operations EMEA/AP SEGMENT HIGHLIGHTS

ACQUISITION OF GAB ROBINS

Acquisition makes Crawford the UK leader in claims management Purchase price of $74.0 million Revenues before reimbursements for GAB Robins of approximately $109 million in 2014 Increased prominence in the Lloyd’s and London insurance markets

Significant increased presence in key aviation sector Access to further technical and industry expertise which aligns to GTS strategy Overall, the U.K. market saw a material decline in business activity during 2015 pressuring both revenues and

profitability A restructuring plan was implemented in 2015

Revenues by Service Line ($ in

millions) Broadspire Cases Received (In thousands) Risk Mgmt Info. Svcs. Other Medical Mgmt. Casualty Workers' Comp. Workers' Comp. Operating Results (3Q 2015 v. 3Q 2014) Revenues of $74.2 million versus $68.2 million Operating earnings of $7.4

million versus $4.4 million Operating earnings margin of 10.0% versus 6.5% Broadspire Strong growth in casualty claims Medical management revenues increased from greater utilization Disability and absence management services products continue to

gain traction in the market BROADSPIRE SEGMENT HIGHLIGHTS

Backlog ($ in millions) Operating

Results (3Q 2015 v. 3Q 2014) Revenues of $28.8 million versus $47.2 million Operating earnings of $1.1 million versus $7.7 million Operating earnings margin of 4.0% versus 16.2% Backlog at $76 million versus $89 million Legal Settlement

Administration Deepwater Horizon class action settlement project continues to wind down pressuring revenues and margins Maintain active new business pipeline Focused on reducing costs to improve profitability Previous GCG executive management team

departed the company at year end - new leadership team announced GCG’s remaining senior management team is deep and experienced, will continue to run the day-to-day operations of the business LEGAL SETTLEMENT ADMINISTRATION SEGMENT HIGHLIGHTS

Revenues ($ in millions) 47.2 28.8 76 89

LOOKING TO 2016 Ø Exhibit cost

discipline Ø Be more client centric Deliver customized value propositions to clients Increase the speed of doing business enterprise wide Ø Continue to drive synergies in strategic initiatives

CRAWFORD IS FOCUSED ON SHAREHOLDER

RETURNS Global Footprint World’s Largest Independent Provider of Claims Management Solutions Global BPO Platform Global C atastrophe Response Specialized Resources Global Technical Services (GTS) Medical Cost Containment Contractor Connection

Crawford Specialty Markets Garden City Group (GCG) Focused on Profitability Strategic Review Implemented $47 - $50 Million of Cost Take Out Identified Further Cost and Revenue Synergies Exist Innovative Technology Platforms Crawford iQ Command

Center

Questions & Answers

Appendix: Supplementary Financial

Schedules

Unaudited ($ in thousands) September

30, 2015 December 31, 2014 Change Cash and cash equivalents $58,329 $52,456 $5,873 Accounts receivable, net 178,571 180,096 (1,525 ) Unbilled revenues, net 112,073 103,163 8,910 Total receivables 290,644 283,259 7,385 Goodwill and intangible assets

arising from business acquisitions 251,153 207,780 43,373 Deferred revenues 73,791 71,760 2,031 Pension liabilities 115,122 142,343 (27,221 ) Current portion of long-term debt, capital leases and short-term borrowings 8,374 2,765 5,609 Long-term

debt, less current portion 250,519 154,046 96,473 Total debt 258,893 156,811 102,082 Total stockholders' equity attributable to Crawford & Company 164,995 172,937 (7,942 ) Net debt (1) 200,564 104,355 96,209 Total debt / capitalization 61 % 48 %

(1) See Appendix for non-GAAP explanation and reconciliation BALANCE SHEET HIGHLIGHTS

Unaudited ($ in thousands) 2015 2015

2014 2014 Variance Variance Net Income Attributable to Shareholders of Crawford & Company $ 6,183 $ 27,308 $ (21,125 ) Depreciation and Other Non-Cash Operating Items 34,777 30,105 4,672 Unbilled and Billed Receivables Change 5,586 (51,649 )

57,235 Working Capital Change (11,462 ) (29,958 ) 18,496 U.S. and U.K. Pension Contributions (13,945 ) (20,054 ) 6,109 Cash Flows from Operating Activities 21,139 (44,248 ) 65,387 Property & Equipment Purchases, net (10,296 ) (9,207 ) (1,089 )

Capitalized Software (internal and external costs) (16,182 ) (12,204 ) (3,978 ) Free Cash Flow (1) $ (5,339 ) $ (65,659 ) $ 60,320 For the nine months ended September 30, OPERATING AND FREE CASH FLOW (1) See Appendix for non-GAAP

explanation

Crawford & Company guidance as

of November 9, 2015 was as follows: YEAR ENDING DECEMBER 31, 2015 Low End High End Consolidated revenues before reimbursements $1.15 $1.17 billion Consolidated operating earnings $60.0 $65.0 million Consolidated cash provided by operating activities

$20.0 $30.0 million Before restructuring and special charges, net income attributable to shareholders of Crawford & Company $20.0 $25.0 million Diluted earnings per share--CRDA $0.39 $0.48 per share Diluted earnings per share--CRDB $0.32 $0.41

per share After restructuring and special charges, net (loss) income attributable to shareholders of Crawford & Company $(4.0) $1.0 million Diluted (loss) earnings per share--CRDA $(0.04) $0.05 per share Diluted loss per share--CRDB $(0.11)

$(0.02) per share 2015 GUIDANCE In addition to the special charge of $5.0 million, the Company expects to incur pretax restructuring charges in 2015 totaling approximately $27.0 to $32.0 million. This is comprised of approximately $8.4 million for

the integration of GAB Robins and restructuring in the EMEA/AP segment, $6.3 million related to the establishment of a Global Business Services Center in Manila, Philippines, and $2.3 million related to restructuring activities in the Americas

segment. In addition, the Company expects to incur an additional restructuring charge of approximately $10.0 to $15.0 million during the 2015 fourth quarter to remove approximately $25.0 to $28.0 million of annual costs.

Appendix: Non-GAAP Financial

Information

Measurements of financial

performance not calculated in accordance with GAAP should be considered as supplements to, and not substitutes for, performance measurements calculated or derived in accordance with GAAP. Any such measures are not necessarily comparable to other

similarly-titled measurements employed by other companies. Reimbursements for Out-of-Pocket Expenses In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients.

Under GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues,respectively, in our consolidated results of operations. In this presentation, we do not believe it is

informative to include in reported revenues the amounts of reimbursed expenses and related revenues, as they offset each other in our consolidated results of operations with no impact to our net income or operating earnings (loss). As a result,

unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses. The GAAP-required gross up of our revenues including these pass-through reimbursed expenses is self-evident in the accompanying

reconciliation. Net Debt Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes that net debt is useful because it provides investors with an estimate of what

the Company's debt would be if all available cash was used to pay down the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt. Free Cash Flow Management believes free cash flow is

useful to investors as it presents the amount of cash the Company has generated that can be used for other purposes, including additional contributions to the Company's defined benefit pension plans, discretionary prepayments of outstanding

borrowings under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company available for discretionary expenditures. The reconciliation from Cash Flows from

Operating Activities is provided on slide 19. Segment and Consolidated Operating Earnings Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker to evaluate the financial

performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Management believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating

performance using the same criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs, but before net corporate interest

expense, stock option expense, amortization of customer-relationship intangible assets, restructuring and special charges, income taxes, and net income or loss attributable to noncontrolling interests. Non-GAAP Adjusted Net Income and Diluted

Earnings per Share Included in net (loss) income and (loss) earnings per share are restructuring and special charges, which arise from non-core items not directly related to our normal business or operations, or our future performance. Management

believes it is useful to others to exclude these charges when comparing net (loss) income and diluted (loss) earnings per share across periods, as these charges are not from ordinary operations. APPENDIX: NON-GAAP FINANCIAL INFORMATION

Quarter Ended Quarter Ended Quarter

Ended Quarter Ended Full Year Full Year September 30, September 30, September 30, September 30, Guidance Guidance Unaudited ($ in thousands) 2015 2015 2014 2014 2015 * 2015 * Revenues Before Reimbursements Total Revenues $ 309,984 $ 314,910 $

1,240,000 Reimbursements (16,649 ) (21,079 ) (80,000 ) Revenues Before Reimbursements $ 293,335 $ 293,831 $ 1,160,000 Costs of Services Provided, Before Reimbursements Total Costs of Services $ 227,755 $ 234,521 Reimbursements (16,649 ) (21,079 )

Costs of Services Provided, Before Reimbursements $ 211,106 $ 213,442 Revenues, Costs of Services Provided, and Operating Earnings Quarter Ended Quarter Ended Quarter Ended Quarter Ended Full Year Full Year September 30, September 30, September 30,

September 30, Guidance Guidance Unaudited ($ in thousands) 2015 2015 2014 2014 2015 * 2015 * Operating Earnings: Americas $ 12,163 $ 7,036 EMEA/AP 6,652 4,225 Broadspire 7,429 4,422 Legal Settlement Administration 1,141 7,668 Unallocated corporate

and shared costs (4,297 ) (500 ) Consolidated Operating Earnings 23,088 22,851 62,500 Deduct: Net corporate interest expense (2,332 ) (1,680 ) (10,700 ) Stock option expense (30 ) (184 ) (500 ) Amortization expense (2,350 ) (1,543 ) (10,000 )

Restructuring and special charges (11,078 ) — (34,500 ) Income taxes (8,385 ) (9,244 ) (9,500 ) Net income (loss) attributable to non-controlling interests 230 (8 ) 200 Net (Loss) Income Attributable to Shareholders of Crawford & Company $

(857 ) $ 10,192 $ (2,500 ) RECONCILIATION OF NON-GAAP ITEMS * Midpoints of Company's November 9, 2015 Guidance

RECONCILIATION OF NON-GAAP ITEMS

(cont.) Net Debt September 30, September 30, December 31, December 31, Unaudited ($ in thousands) 2015 2015 2014 2014 Net Debt Short-term borrowings $ 6,566 $ 2,002 Current installments of long-term debt and capital leases 1,808 763 Long-term debt

and capital leases, less current installments 250,519 154,046 Total debt 258,893 156,811 Less: Cash and cash equivalents 58,329 52,456 Net debt $ 200,564 $ 104,355

RECONCILIATION OF NON-GAAP ITEMS

(cont.) Non-GAAP Adjusted Net Income and Diluted Earnings Per Share Three Months Ended September 30, 2015 Unaudited ($ in thousands) Income Before Taxes Income Before Taxes Tax Expense Tax Expense Net (Loss) Income Net (Loss) Income Net (Loss)

Income Attributable to Crawford & Company Net (Loss) Income Attributable to Crawford & Company Diluted (Loss) Earnings per Share (CRDA) Diluted (Loss) Earnings per Share (CRDA) Diluted (Loss) Earnings per Share (CRDB) Diluted (Loss) Earnings

per Share (CRDB) GAAP $ 7,298 $ 8,385 $ (1,087 ) $ (857 ) $ (0.01 ) $ (0.03 ) Add back: Restructuring and special charges 11,078 3,124 7,954 7,954 0.15 0.15 Non-GAAP Adjusted $ 18,376 $ 11,509 $ 6,867 $ 7,097 $ 0.14 $ 0.12 Full Year Guidance for

2015 * Unaudited ($ in thousands) Income Before Taxes Income Before Taxes Tax Expense Tax Expense Net (Loss) Income Net (Loss) Income Net (Loss )Income Attributable to Crawford & Company Net (Loss )Income Attributable to Crawford & Company

Diluted Earnings per Share (CRDA) Diluted Earnings per Share (CRDA) Diluted (Loss) Earnings per Share (CRDB) Diluted (Loss) Earnings per Share (CRDB) GAAP $ (2,300 ) $ — $ (2,300 ) $ (2,500 ) $ 0.01 $ (0.06 ) Add back: Restructuring and

special charges 34,500 9,500 25,000 25,000 0.43 0.43 Non-GAAP Adjusted $ 32,200 $ 9,500 $ 22,700 $ 22,500 $ 0.44 $ 0.37 * Midpoints of Company's November 9, 2015 Guidance

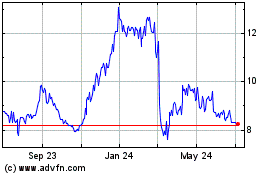

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

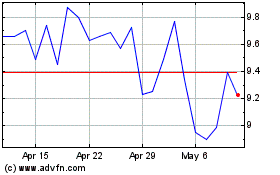

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Apr 2023 to Apr 2024