SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

Form 10-Q

|

| | |

R | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| | |

| | for the quarterly period ended June 30, 2015 |

OR

|

| | |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| | |

| | for the transition period from ____ to ____ |

Commission file number 1-10356

CRAWFORD & COMPANY

(Exact name of Registrant as specified in its charter)

|

| | | | |

| Georgia | | 58-0506554 | |

| (State or other jurisdiction of | | (I.R.S. Employer | |

| incorporation or organization) | | Identification No.) | |

| | | | |

| 1001 Summit Boulevard | | | |

| Atlanta, Georgia | | 30319 | |

| (Address of principal executive offices) | | (Zip Code) | |

(404) 300-1000

(Registrant's telephone number, including area code)

____________________________________________________________

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | | |

| Large accelerated filer o | | Accelerated filer þ | | Non-accelerated filer o | | Smaller reporting company o |

| | | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No þ

The number of shares outstanding of each of the Registrant's classes of common stock as of July 24, 2015 was as follows:

Class A Common Stock, $1.00 par value: 30,822,826

Class B Common Stock, $1.00 par value: 24,690,172

CRAWFORD & COMPANY

Quarterly Report on Form 10-Q

Quarter Ended June 30, 2015

Table of Contents |

| | | | | |

| | | | | Page |

Part I. Financial Information | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | Quantitative and Qualitative Disclosures About Market Risk | | |

| | | | | |

| | | | |

| | | | | |

| | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | | |

| | |

|

| | |

Part I — Financial Information

Item 1. Financial Statements

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

Unaudited

|

| | | | | | | |

| Three Months Ended June 30, |

(In thousands, except per share amounts) | 2015 | | 2014 |

Revenues: | | | |

| | | |

Revenues before reimbursements | $ | 304,398 |

| | $ | 288,216 |

|

Reimbursements | 20,018 |

| | 18,837 |

|

Total Revenues | 324,416 |

| | 307,053 |

|

| | | |

Costs and Expenses: | | | |

| | | |

Costs of services provided, before reimbursements | 232,108 |

| | 208,249 |

|

Reimbursements | 20,018 |

| | 18,837 |

|

Total costs of services | 252,126 |

| | 227,086 |

|

| | | |

Selling, general, and administrative expenses | 57,221 |

| | 60,902 |

|

| | | |

Corporate interest expense, net of interest income of $195 and $158, respectively | 2,042 |

| | 1,551 |

|

| | | |

Special charges | 4,242 |

| | — |

|

| | | |

Total Costs and Expenses | 315,631 |

| | 289,539 |

|

| | | |

Other Income | 102 |

| | 42 |

|

| | | |

Income Before Income Taxes | 8,887 |

| | 17,556 |

|

| | | |

Provision for Income Taxes | 4,709 |

| | 6,962 |

|

| | | |

Net Income | 4,178 |

| | 10,594 |

|

| | | |

Net Income Attributable to Noncontrolling Interests | (124 | ) | | (130 | ) |

| | | |

Net Income Attributable to Shareholders of Crawford & Company | $ | 4,054 |

| | $ | 10,464 |

|

| | | |

Earnings Per Share - Basic: | | | |

Class A Common Stock | $ | 0.08 |

| | $ | 0.19 |

|

Class B Common Stock | $ | 0.06 |

| | $ | 0.18 |

|

| | | |

Earnings Per Share - Diluted: | | | |

Class A Common Stock | $ | 0.08 |

| | $ | 0.19 |

|

Class B Common Stock | $ | 0.06 |

| | $ | 0.18 |

|

| | | |

Weighted-Average Shares Used to Compute Basic Earnings Per Share: | | | |

Class A Common Stock | 30,673 |

| | 30,256 |

|

Class B Common Stock | 24,690 |

| | 24,690 |

|

| | | |

Weighted-Average Shares Used to Compute Diluted Earnings Per Share: | | | |

Class A Common Stock | 31,137 |

| | 30,914 |

|

Class B Common Stock | 24,690 |

| | 24,690 |

|

| | | |

Cash Dividends Per Share: | | | |

Class A Common Stock | $ | 0.07 |

| | $ | 0.05 |

|

Class B Common Stock | $ | 0.05 |

| | $ | 0.04 |

|

(See accompanying notes to condensed consolidated financial statements)

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

Unaudited

|

| | | | | | | |

| Six Months Ended June 30, |

(In thousands, except per share amounts) | 2015 | | 2014 |

Revenues: | | | |

| | | |

Revenues before reimbursements | $ | 592,175 |

| | $ | 563,565 |

|

Reimbursements | 38,857 |

| | 32,846 |

|

Total Revenues | 631,032 |

| | 596,411 |

|

| | | |

Costs and Expenses: | | | |

| | | |

Costs of services provided, before reimbursements | 451,431 |

| | 412,142 |

|

Reimbursements | 38,857 |

| | 32,846 |

|

Total costs of services | 490,288 |

| | 444,988 |

|

| | | |

Selling, general, and administrative expenses | 117,608 |

| | 120,632 |

|

| | | |

Corporate interest expense, net of interest income of $360 and $355, respectively | 3,906 |

| | 2,852 |

|

| | | |

Special charges | 5,305 |

| | — |

|

| | | |

Total Costs and Expenses | 617,107 |

| | 568,472 |

|

| | | |

Other Income | 484 |

| | 491 |

|

| | | |

Income Before Income Taxes | 14,409 |

| | 28,430 |

|

| | | |

Provision for Income Taxes | 6,950 |

| | 11,250 |

|

| | | |

Net Income | 7,459 |

| | 17,180 |

|

| | | |

Net Income Attributable to Noncontrolling Interests | (419 | ) | | (64 | ) |

| | | |

Net Income Attributable to Shareholders of Crawford & Company | $ | 7,040 |

| | $ | 17,116 |

|

| | | |

Earnings Per Share - Basic: | | | |

Class A Common Stock | $ | 0.15 |

| | $ | 0.32 |

|

Class B Common Stock | $ | 0.11 |

| | $ | 0.30 |

|

| | | |

Earnings Per Share - Diluted: | | | |

Class A Common Stock | $ | 0.14 |

| | $ | 0.32 |

|

Class B Common Stock | $ | 0.11 |

| | $ | 0.30 |

|

| | | |

Weighted-Average Shares Used to Compute Basic Earnings Per Share: | | | |

Class A Common Stock | 30,597 |

| | 30,088 |

|

Class B Common Stock | 24,690 |

| | 24,690 |

|

| | | |

Weighted-Average Shares Used to Compute Diluted Earnings Per Share: | | | |

Class A Common Stock | 31,079 |

| | 30,948 |

|

Class B Common Stock | 24,690 |

| | 24,690 |

|

| | | |

Cash Dividends Per Share: | | | |

Class A Common Stock | $ | 0.14 |

| | $ | 0.10 |

|

Class B Common Stock | $ | 0.10 |

| | $ | 0.08 |

|

(See accompanying notes to condensed consolidated financial statements)

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Unaudited

|

| | | | | | | |

| | | |

| Three Months Ended June 30, |

(In thousands) | 2015 |

| 2014 |

| | | |

Net Income | $ | 4,178 |

| | $ | 10,594 |

|

| | | |

Other Comprehensive (Loss) Income: | | | |

Net foreign currency translation (loss) income, net of tax of $0 and $0, respectively | (625 | ) | | 4,485 |

|

| | | |

Amortization of actuarial losses for retirement plans included in net periodic pension cost, net of tax of $995 and $931, respectively | 2,036 |

| | 1,967 |

|

| | | |

Other Comprehensive Income | 1,411 |

| | 6,452 |

|

| | | |

Comprehensive Income | 5,589 |

| | 17,046 |

|

| | | |

Comprehensive loss (income) attributable to noncontrolling interests | 182 |

| | (298 | ) |

| | | |

Comprehensive Income Attributable to Shareholders of Crawford & Company | $ | 5,771 |

| | $ | 16,748 |

|

| | | |

|

| | | | | | | |

| Six Months Ended June 30, |

(In thousands) | 2015 | | 2014 |

| | | |

Net Income | $ | 7,459 |

| | $ | 17,180 |

|

| | | |

Other Comprehensive (Loss) Income: | | | |

Net foreign currency translation (loss) income net of tax of $0 and $0, respectively | (11,258 | ) | | 80 |

|

| | | |

Amortization of actuarial losses for retirement plans included in net periodic pension cost, net of tax of $2,071 and $1,844, respectively | 4,801 |

| | 3,500 |

|

| | | |

Other Comprehensive (Loss) Income | (6,457 | ) | | 3,580 |

|

| | | |

Comprehensive Income | 1,002 |

| | 20,760 |

|

| | | |

Comprehensive loss attributable to noncontrolling interests | 310 |

| | 127 |

|

| | | |

Comprehensive Income Attributable to Shareholders of Crawford & Company | $ | 1,312 |

| | $ | 20,887 |

|

| | | |

(See accompanying notes to condensed consolidated financial statements)

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

Unaudited

|

| | | | | | | |

| | | * |

(In thousands) | June 30,

2015 | | December 31,

2014 |

ASSETS | | | |

Current Assets: | | | |

Cash and cash equivalents | $ | 62,454 |

| | $ | 52,456 |

|

Accounts receivable, less allowance for doubtful accounts of $12,358 and $10,960, respectively | 181,387 |

| | 180,096 |

|

Unbilled revenues, at estimated billable amounts | 117,169 |

| | 103,163 |

|

Income taxes receivable | 2,779 |

| | 2,779 |

|

Prepaid expenses and other current assets | 29,628 |

| | 29,089 |

|

Total Current Assets | 393,417 |

| | 367,583 |

|

Property and Equipment: | | | |

Property and equipment | 148,205 |

| | 143,273 |

|

Less accumulated depreciation | (107,204 | ) | | (102,414 | ) |

Net Property and Equipment | 41,001 |

| | 40,859 |

|

Other Assets: | | | |

Goodwill | 142,402 |

| | 131,885 |

|

Intangible assets arising from business acquisitions, net | 110,314 |

| | 75,895 |

|

Capitalized software costs, net | 78,770 |

| | 75,536 |

|

Deferred income tax assets | 70,357 |

| | 66,927 |

|

Other noncurrent assets | 34,614 |

| | 30,634 |

|

Total Other Assets | 436,457 |

| | 380,877 |

|

TOTAL ASSETS | $ | 870,875 |

| | $ | 789,319 |

|

* Derived from the audited Consolidated Balance Sheet

(See accompanying notes to condensed consolidated financial statements)

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS — CONTINUED

Unaudited

|

| | | | | | | |

| | | * |

(In thousands, except par value amounts) | June 30,

2015 | | December 31,

2014 |

LIABILITIES AND SHAREHOLDERS' INVESTMENT | | | |

Current Liabilities: | | | |

Short-term borrowings | $ | 3,320 |

| | $ | 2,002 |

|

Accounts payable | 49,723 |

| | 48,597 |

|

Accrued compensation and related costs | 72,289 |

| | 82,151 |

|

Self-insured risks | 13,601 |

| | 14,491 |

|

Income taxes payable | 4,616 |

| | 2,618 |

|

Deferred income taxes | 14,228 |

| | 14,523 |

|

Deferred rent | 12,464 |

| | 13,576 |

|

Other accrued liabilities | 39,870 |

| | 35,784 |

|

Deferred revenues | 45,623 |

| | 45,054 |

|

Current installments of long-term debt and capital leases | 1,885 |

| | 763 |

|

Total Current Liabilities | 257,619 |

| | 259,559 |

|

Noncurrent Liabilities: | | | |

Long-term debt and capital leases, less current installments | 249,447 |

| | 154,046 |

|

Deferred revenues | 26,800 |

| | 26,706 |

|

Self-insured risks | 10,110 |

| | 10,041 |

|

Accrued pension liabilities | 126,929 |

| | 142,343 |

|

Other noncurrent liabilities | 18,861 |

| | 17,271 |

|

Total Noncurrent Liabilities | 432,147 |

| | 350,407 |

|

Shareholders' Investment: | | | |

Class A common stock, $1.00 par value; 50,000 shares authorized; 30,706 and 30,497 shares issued and outstanding at June 30, 2015 and December 31, 2014, respectively | 30,706 |

| | 30,497 |

|

Class B common stock, $1.00 par value; 50,000 shares authorized; 24,690 shares issued and outstanding | 24,690 |

| | 24,690 |

|

Additional paid-in capital | 40,113 |

| | 38,617 |

|

Retained earnings | 301,254 |

| | 301,091 |

|

Accumulated other comprehensive loss | (227,686 | ) | | (221,958 | ) |

Shareholders' Investment Attributable to Shareholders of Crawford & Company | 169,077 |

| | 172,937 |

|

Noncontrolling interests | 12,032 |

| | 6,416 |

|

Total Shareholders' Investment | 181,109 |

| | 179,353 |

|

TOTAL LIABILITIES AND SHAREHOLDERS' INVESTMENT | $ | 870,875 |

| | $ | 789,319 |

|

* Derived from the audited Consolidated Balance Sheet

(See accompanying notes to condensed consolidated financial statements)

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Unaudited

|

| | | | | | | |

| Six Months Ended June 30, |

(In thousands) | 2015 | | 2014 |

Cash Flows From Operating Activities: | | | |

Net income | $ | 7,459 |

| | $ | 17,180 |

|

Reconciliation of net income to net cash provided by (used in) operating activities: | | | |

Depreciation and amortization | 21,407 |

| | 18,574 |

|

Stock-based compensation | 1,280 |

| | 743 |

|

Loss on disposals of property and equipment, net | 33 |

| | — |

|

Changes in operating assets and liabilities, net of effects of acquisitions and dispositions: | | | |

Accounts receivable, net | 13,338 |

| | (26,366 | ) |

Unbilled revenues, net | (11,507 | ) | | (13,564 | ) |

Accrued or prepaid income taxes | 2,371 |

| | 3,633 |

|

Accounts payable and accrued liabilities | (16,777 | ) | | (37,314 | ) |

Deferred revenues | (308 | ) | | (2,025 | ) |

Accrued retirement costs | (12,794 | ) | | (15,423 | ) |

Prepaid expenses and other operating activities | 5,718 |

| | (5,057 | ) |

Net cash provided by (used in) operating activities | 10,220 |

| | (59,619 | ) |

| | | |

Cash Flows From Investing Activities: | | | |

Acquisitions of property and equipment | (5,333 | ) | | (5,691 | ) |

Proceeds from disposals of property and equipment | — |

| | 1,289 |

|

Capitalization of computer software costs | (10,871 | ) | | (7,930 | ) |

Cash surrendered in sale of business | — |

| | (1,554 | ) |

Payments for business acquisitions, net of cash acquired | (66,077 | ) | | — |

|

Net cash used in investing activities | (82,281 | ) | | (13,886 | ) |

| | | |

Cash Flows From Financing Activities: | | | |

Cash dividends paid | (6,757 | ) | | (4,991 | ) |

Payments related to shares received for withholding taxes under stock-based compensation plans | (2 | ) | | (1,361 | ) |

Proceeds from shares purchased under employee stock-based compensation plans | 444 |

| | 518 |

|

Repurchases of common stock | (137 | ) | | (2,791 | ) |

Increases in short-term and revolving credit facility borrowings | 117,672 |

| | 79,142 |

|

Payments on short-term and revolving credit facility borrowings | (24,951 | ) | | (24,424 | ) |

Payments on capital lease obligations | (1,072 | ) | | (440 | ) |

Dividends paid to noncontrolling interests | — |

| | (142 | ) |

Other financing activities | (2 | ) | | (32 | ) |

Net cash provided by financing activities | 85,195 |

| | 45,479 |

|

| | | |

Effects of exchange rate changes on cash and cash equivalents | (3,136 | ) | | (193 | ) |

Increase (decrease) in cash and cash equivalents | 9,998 |

| | (28,219 | ) |

Cash and cash equivalents at beginning of year | 52,456 |

| | 75,953 |

|

Cash and cash equivalents at end of period | $ | 62,454 |

| | $ | 47,734 |

|

(See accompanying notes to condensed consolidated financial statements)

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS' INVESTMENT

Unaudited

(In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | | | Accumulated | | Shareholders' Investment Attributable to | | | | |

2015 | Class A Non-Voting | | Class B Voting | | Additional Paid-In Capital | | Retained Earnings | | Other Comprehensive Loss | | Shareholders of Crawford & Company | | Noncontrolling Interests | | Total Shareholders' Investment |

Balance at January 1, 2015 | $ | 30,497 |

| | $ | 24,690 |

| | $ | 38,617 |

| | $ | 301,091 |

| | $ | (221,958 | ) | | $ | 172,937 |

| | $ | 6,416 |

| | $ | 179,353 |

|

Net income | — |

| | — |

| | — |

| | 2,986 |

| | — |

| | 2,986 |

| | 295 |

| | 3,281 |

|

Other comprehensive loss | — |

| | — |

| | — |

| | — |

| | (7,445 | ) | | (7,445 | ) | | (423 | ) | | (7,868 | ) |

Cash dividends paid | — |

| | — |

| | — |

| | (3,373 | ) | | — |

| | (3,373 | ) | | — |

| | (3,373 | ) |

Stock-based compensation | — |

| | — |

| | 404 |

| | — |

| | — |

| | 404 |

| | — |

| | 404 |

|

Common stock activity, net | 36 |

| | — |

| | (44 | ) | | (120 | ) | | — |

| | (128 | ) | | — |

| | (128 | ) |

Increase in value of noncontrolling interest due to acquisition | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 5,926 |

| | 5,926 |

|

Balance at March 31, 2015 | 30,533 |

| | 24,690 |

| | 38,977 |

| | 300,584 |

| | (229,403 | ) | | 165,381 |

| | 12,214 |

| | 177,595 |

|

Net income | — |

| | — |

| | — |

| | 4,054 |

| | — |

| | 4,054 |

| | 124 |

| | 4,178 |

|

Other comprehensive income (loss) | — |

| | — |

| | — |

| | — |

| | 1,717 |

| | 1,717 |

| | (306 | ) | | 1,411 |

|

Cash dividends paid | — |

| | — |

| | — |

| | (3,384 | ) | | — |

| | (3,384 | ) | | — |

| | (3,384 | ) |

Stock-based compensation | — |

| | — |

| | 876 |

| | — |

| | — |

| | 876 |

| | — |

| | 876 |

|

Common stock activity, net | 173 |

| | — |

| | 260 |

| |

|

| | — |

| | 433 |

| | — |

| | 433 |

|

Balance at June 30, 2015 | $ | 30,706 |

| | $ | 24,690 |

| | $ | 40,113 |

| | $ | 301,254 |

| | $ | (227,686 | ) | | $ | 169,077 |

| | $ | 12,032 |

| | $ | 181,109 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | | | Accumulated | Shareholders' Investment Attributable to | | | | |

2014 | Class A Non-Voting | | Class B Voting | | Additional Paid-In Capital | | Retained Earnings | | Other Comprehensive Loss | | Shareholders of Crawford & Company | | Noncontrolling Interests | | Total Shareholders' Investment |

Balance at January 1, 2014 | $ | 29,875 |

| | $ | 24,690 |

| | $ | 39,285 |

| | $ | 285,165 |

| | $ | (179,210 | ) | | $ | 199,805 |

| | $ | 7,728 |

| | $ | 207,533 |

|

Net income | — |

| | — |

| | — |

| | 6,652 |

| | — |

| | 6,652 |

| | (66 | ) | | 6,586 |

|

Other comprehensive loss | — |

| | — |

| | — |

| | — |

| | (2,513 | ) | | (2,513 | ) | | (359 | ) | | (2,872 | ) |

Cash dividends paid | — |

| | — |

| | — |

| | (2,489 | ) | | — |

| | (2,489 | ) | | — |

| | (2,489 | ) |

Stock-based compensation | — |

| | — |

| | (449 | ) | | — |

| | — |

| | (449 | ) | | — |

| | (449 | ) |

Common stock activity, net | 187 |

| | — |

| | (1,471 | ) | | (1,218 | ) | | — |

| | (2,502 | ) | | — |

| | (2,502 | ) |

Decrease in value of noncontrolling interest due to sale of controlling interest | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (638 | ) | | (638 | ) |

Dividends paid to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (142 | ) | | (142 | ) |

Balance at March 31, 2014 | 30,062 |

| | 24,690 |

| | 37,365 |

| | 288,110 |

| | (181,723 | ) | | 198,504 |

| | 6,523 |

| | 205,027 |

|

Net income | — |

| | — |

| | — |

| | 10,464 |

| | — |

| | 10,464 |

| | 130 |

| | 10,594 |

|

Other comprehensive income | — |

| | — |

| | — |

| | — |

| | 6,284 |

| | 6,284 |

| | 168 |

| | 6,452 |

|

Cash dividends paid | — |

| | — |

| | — |

| | (2,502 | ) | | — |

| | (2,502 | ) | | — |

| | (2,502 | ) |

Stock-based compensation | — |

| | — |

| | 1,192 |

| | — |

| | — |

| | 1,192 |

| | — |

| | 1,192 |

|

Common stock activity, net | 153 |

| | — |

| | 163 |

| | (1,235 | ) | | — |

| | (919 | ) | | — |

| | (919 | ) |

Balance at June 30, 2014 | $ | 30,215 |

| | $ | 24,690 |

| | $ | 38,720 |

| | $ | 294,837 |

| | $ | (175,439 | ) | | $ | 213,023 |

| | $ | 6,821 |

| | $ | 219,844 |

|

(See accompanying notes to condensed consolidated financial statements)

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

Based in Atlanta, Georgia, Crawford & Company ("Crawford" or "the Company") is the world's largest (based on annual revenues) independent provider of claims management solutions to the risk management and insurance industry, as well as to self-insured entities, with an expansive global network serving clients in more than 70 countries. The Crawford SolutionSM offers comprehensive, integrated claims services, business process outsourcing and consulting services for major product lines including property and casualty claims management, workers' compensation claims and medical management, and legal settlement administration.

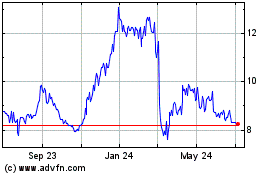

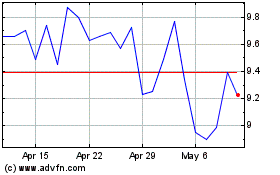

Shares of the Company's two classes of common stock are traded on the New York Stock Exchange under the symbols CRDA and CRDB, respectively. The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock than on the voting Class B Common Stock, subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of Class A Common Stock must receive the same type and amount of consideration as holders of Class B Common Stock, unless different consideration is approved by the holders of 75% of the Class A Common Stock, voting as a class. The Company's website is www.crawfordandcompany.com. The information contained on, or hyperlinked from, the Company's website is not a part of, and is not incorporated by reference into, this report.

1. Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with U.S. generally accepted accounting principles ("GAAP") for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X promulgated by the United States Securities and Exchange Commission (the "SEC"). Accordingly, these unaudited condensed consolidated financial statements do not include all of the information and footnotes required by GAAP for complete financial statements. Operating results for the three months and six months ended, and the Company's financial position as of, June 30, 2015 are not necessarily indicative of the results or financial position that may be expected for the year ending December 31, 2015 or for other future periods. The financial results from the Company's operations outside of the U.S., Canada, the Caribbean, and certain subsidiaries in the Philippines, are reported and consolidated on a two-month delayed basis (fiscal year-end of October 31) as permitted by GAAP in order to provide sufficient time for accumulation of their results.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. In the opinion of management, all adjustments (consisting only of normal recurring accruals and adjustments) considered necessary for a fair presentation have been included. There have been no material changes to our significant accounting policies and estimates from those disclosed in the Company's Annual Report on Form 10-K for the year ended December 31, 2014.

Certain prior period amounts within the EMEA/AP segment have been reclassified to conform to the current presentation. These reclassifications had no effect on the Company's reported segment or consolidated results. Significant intercompany transactions have been eliminated in consolidation.

The Condensed Consolidated Balance Sheet information presented herein as of December 31, 2014 has been derived from the audited consolidated financial statements as of that date, but does not include all of the information and footnotes required by GAAP for complete financial statements. For further information, refer to the consolidated financial statements and footnotes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2014.

The Company consolidates the liabilities of its deferred compensation plan and the related assets, which are held in a rabbi trust and considered a variable interest entity ("VIE") of the Company. The rabbi trust was created to fund the liabilities of the Company's deferred compensation plan. The Company is considered the primary beneficiary of the rabbi trust because the Company directs the activities of the trust and can use the assets of the trust to satisfy the liabilities of the Company's deferred compensation plan. At June 30, 2015 and December 31, 2014, the liabilities of the deferred compensation plan were $11,504,000 and $11,051,000, respectively, which represented obligations of the Company rather than of the rabbi trust, and the values of the assets held in the related rabbi trust were $15,706,000 and $15,519,000, respectively. These liabilities and assets are included in "Other noncurrent liabilities" and "Other noncurrent assets," respectively, on the Company's unaudited Condensed Consolidated Balance Sheets.

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

The Company owns 51% of the capital stock of Lloyd Warwick International Limited ("LWI"). The Company has also agreed to provide financial support to LWI of up to approximately $10,000,000. Because of this controlling financial interest, and because Crawford has the obligation to absorb certain of LWI's losses through the additional financial support that LWI may require, LWI is considered a VIE of the Company. LWI also does not meet the business scope exception, as Crawford provides more than half of its financial support, and because LWI lacks sufficient equity at risk to permit it to carry on its activities without this additional financial support. Creditors of LWI have no recourse to Crawford's general credit. Accordingly, Crawford is considered the primary beneficiary and is consolidating LWI. Total assets and liabilities of LWI as of June 30, 2015 were $8,611,000 and $10,694,000, respectively. Included in LWI's total liabilities is a loan from Crawford of $9,246,000.

2. Business Acquisition

On December 1, 2014, the Company acquired 100% of the capital stock of GAB Robins Holdings UK Limited ("GAB Robins"), a U.K. based international loss adjusting and claims management provider, for cash consideration of $71,812,000. Because the financial results of certain of the Company's international subsidiaries, including those in the U.K. through which GAB Robins reports, are included in the Company's consolidated financial statements on a two-month delayed basis, the results of operations of GAB Robins, and the preliminary application of purchase accounting to the assets acquired, and liabilities and noncontrolling interest assumed, in that acquisition have been reflected in the Company's unaudited condensed consolidated results for the three months and six months ended June 30, 2015. As a result, comparability to prior periods' results and financial condition may be limited. The purchase was accounted for under the guidance of Accounting Standards Codification ("ASC") 805-10 as a business combination under the acquisition method. For the three months and six months ended June 30, 2015, GAB Robins contribution to the Company's earnings and earnings per share were not material to the unaudited condensed consolidated financial statements and as such, no pro forma information is required to be presented.

As a requirement of accounting under the acquisition method, all identifiable assets acquired and liabilities assumed were recognized using fair value measurement. Based upon the timing of the acquisition, the allocation of the purchase price is preliminary and subject to change, as the Company gathers additional information related to, among other things, unbilled accounts receivable, intangible assets, deferred taxes, other assets, accrued liabilities, noncontrolling interests, and uncertain tax positions. The purchase price allocation may also be impacted by net debt and net working capital adjustments under the terms of the acquisition agreement. During the measurement period since the acquisition, adjustments have been made to the preliminary purchase accounting for receivables, prepaid and other current assets acquired, and other current liabilities assumed based on additional information gathered. These measurement period adjustments did not affect amounts recorded to the income statement during the first quarter of 2015. The purchase price included $6,329,000 placed in escrow for up to two years related to certain acquired contingencies and working capital adjustments per the terms of the acquisition agreement. As of June 30, 2015, $1,600,000 of the previously escrowed amount has been released. The acquisition was funded primarily through borrowings in the U.K. under the Company's credit facility.

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

The following table summarizes the preliminary purchase price allocation to the tangible and intangible assets acquired and liabilities assumed in the GAB Robins acquisition included in the Company's condensed consolidated financial statements on the two-month delayed basis as discussed above:

|

| | | | |

(in thousands) | | Opening Balance Sheet |

| | |

Assets | | |

Cash and cash equivalents | | $ | 5,735 |

|

Accounts receivable | | 19,182 |

|

Unbilled revenues, at estimated billable amounts | | 7,169 |

|

Prepaid expenses and other current assets | | 7,443 |

|

Property and equipment | | 4,083 |

|

Goodwill | | 14,119 |

|

Intangible assets | | 40,535 |

|

Other noncurrent assets | | 1,933 |

|

Deferred income tax assets | | 4,833 |

|

Total Assets | | $ | 105,032 |

|

| | |

Liabilities | | |

Other current liabilities | | $ | 22,714 |

|

Noncurrent liabilities | | 4,580 |

|

Total Liabilities | | 27,294 |

|

Net Assets Acquired, Before Noncontrolling Interests | | 77,738 |

|

Noncontrolling interests | | 5,926 |

|

Net Assets Acquired, Net of Noncontrolling Interests | | $ | 71,812 |

|

Intangible assets acquired include customer relationships, trademarks, internally developed software and non-compete agreements. The intangibles acquired are made up largely of customer relationships of $38,210,000 being amortized over a preliminary estimated life of 18 years, and the remaining assets listed above are being amortized over periods ranging from two to five years. For the three months and six months ended June 30, 2015, the Company recognized amortization expense of $749,000 and $1,259,000, respectively, in its unaudited condensed consolidated financial statements related to these intangibles. Goodwill is attributable to the synergies of the work force in place and business resources as a result of the combination of the companies. The Company does not expect that goodwill attributable to the acquisition will be deductible for tax purposes. For the three months and six months ended June 30, 2015, GAB Robins accounted for $21,820,000 and $38,095,000 of the Company's consolidated revenues before reimbursements, respectively. The results of GAB Robins are reported in the EMEA/AP segment.

3. Recently Issued Accounting Standards

Revenue from Contracts with Customers

In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2014-09, "Revenue from Contracts with Customers." Under ASU 2014-09, companies will be required to recognize revenue to depict the transfer of goods or services to customers in amounts that reflect the consideration (that is, payment) to which the company expects to be entitled in exchange for those goods or services. The new standard also will result in enhanced disclosures about revenue, provide guidance for transactions that were not previously addressed comprehensively (for example, service revenue and contract modifications) and modify guidance for multiple-element arrangements. On April 29, 2015 the FASB proposed and on July 9, 2015 approved, a one year deferral of the effective date of this standard, which would change the effective date for the Company to January 1, 2018. Early adoption is permitted, but not before the original effective date. The Company is currently evaluating the effect this standard may have on its results of operations, financial condition and cash flows.

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

Simplifying the Presentation of Debt Issuance Costs

In April 2015, the FASB issued ASU 2015-03, "Interest-Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs." The new standard focuses on simplification of the presentation of debt issuance costs by requiring that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. The standard is effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Early adoption is permitted. At the Emerging Issues Task Force ("EITF") meeting held in June 2015, the EITF clarified that fees incurred to secure revolver debt arrangements were not addressed by ASU 2015-03 and the SEC observer at the EITF meeting stated that the SEC would not object to an entity deferring and presenting debt issuance costs as an asset and subsequently amortizing the deferred debt issuance costs ratably over the term of the revolving debt agreement. Following this announcement, management determined that adoption of this standard is not expected to have any impact on the financial statements of the Company.

Accounting for Fees Paid in a Cloud Computing Arrangement

In April 2015, the FASB issued ASU 2015-05, "Intangibles-Goodwill and Other-Internal-Use Software (Subtopic 350-40), Customer's Accounting for Fees Paid in a Cloud Computing Arrangement." The FASB amended its guidance on internal use software to clarify how customers in cloud computing arrangements should determine whether the arrangement includes a software license. The new guidance specifies that these licenses will be accounted for as licenses of intangible assets. The guidance is effective for annual periods, including interim periods within those annual periods beginning after December 15, 2015. The Company is currently evaluating the effect this standard may have on its results of operations, financial condition and cash flows.

Amendments to the Consolidation Analysis

In February 2015, FASB issued ASU 2015-02, "Consolidation (topic 810): Amendments to the Consolidation Analysis." ASU 2015-02 focuses on the consolidation evaluation for reporting organizations (public and private companies) that are required to evaluate whether they should consolidate certain legal entities. The standard is effective for fiscal years beginning after December 15, 2016, and interim periods within those years. Early adoption is permitted. The Company is currently evaluating the effect this standard may have on its results of operations, financial condition and cash flows.

Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity

In April 2014, FASB issued ASU 2014-08, "Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity." Under ASU 2014-8, only disposals that represent a strategic shift that has (or will have) a major effect on the entity's results and operations would qualify as discontinued operations. In addition, the ASU (1) expands the disclosure requirements for disposals that meet the definition of a discontinued operation, (2) requires entities to disclose information about disposals of individually significant components, and (3) defines "discontinued operations" similarly to how it is defined under International Financial Reporting Standards 2, "Non-current Assets Held for Sale and Discontinued Operations." The standard became effective in the first quarter of 2015 for public organizations with calendar year-ends. The Company has adopted the standard effective for the first quarter 2015, although it had no impact on the Company's results of operations, financial condition and cash flows for the six months ended June 30, 2015.

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

4. Derivative Instruments

In February 2011, the Company entered into a U.S. dollar and Canadian dollar ("CAD") cross currency basis swap with an initial notional amount of CAD34,749,000 as an economic hedge to an intercompany note payable to the U.S. parent by a Canadian subsidiary. The cross currency basis swap requires the Canadian subsidiary to deliver quarterly payments of CAD589,000 to the counterparty and entitles the U.S. parent to receive quarterly payments of U.S. $593,000. The Canadian subsidiary also makes interest payments to the counterparty based on 3-month Canada Bankers Acceptances plus a spread, and the U.S. parent receives payments based on U.S. 3-month LIBOR. The cross currency basis swap expires on September 30, 2025. The Company has elected to not designate this swap as a hedge of the intercompany note from the Canadian subsidiary. Accordingly, changes in the fair value of this swap, as well as changes in the value of the intercompany note, are recorded as gains or losses in "Selling, general, and administrative expenses" in the Company's unaudited Condensed Consolidated Statements of Income over the term of the swap and are expected to substantially offset one another. The changes in the fair value of the cross currency basis swap will not exactly offset changes in the value of the intercompany note, as the fair value of this swap is determined based on forward rates while the value of the intercompany note is determined based on end of period spot rates. The net gains and losses for the three months and six months ended June 30, 2015 and 2014 were not significant. The Company believes there have been no material changes in the creditworthiness of the counterparty to this cross currency basis swap agreement and believes the risk of nonperformance by such party is minimal.

This swap agreement contains a provision providing that if the Company is in default under its Credit Facility, the Company may also be deemed to be in default under the swap agreement. If there were such a default, the Company could be required to contemporaneously settle some or all of the obligation under the swap agreement at values determined at the time of default. At June 30, 2015, no such default existed, and the Company had no assets posted as collateral under its swap agreement.

5. Income Taxes

The Company's consolidated effective income tax rate may change periodically due to changes in enacted tax rates, fluctuations in the mix of income earned from the Company's various domestic and international operations, which are subject to income taxes at different rates, the Company's ability to utilize net operating loss and tax credit carryforwards, and amounts related to uncertain income tax positions. At June 30, 2015, the Company estimates that its effective income tax rate for 2015 will be approximately 46% after considering known discrete items.

6. Defined Benefit Pension Plans

Net periodic benefit cost related to all of the Company's defined benefit pension plans recognized in the Company's unaudited Condensed Consolidated Statements of Income for the three months and six months ended June 30, 2015 and 2014 included the following components:

|

| | | | | | | | | | | | | | | |

| Three months ended | | Six months ended |

(in thousands) | June 30,

2015 | | June 30,

2014 | | June 30,

2015 | | June 30,

2014 |

Service cost | $ | 671 |

| | $ | 706 |

| | $ | 1,432 |

| | $ | 1,404 |

|

Interest cost | 8,045 |

| | 8,996 |

| | 16,272 |

| | 17,914 |

|

Expected return on assets | (10,323 | ) | | (11,600 | ) | | (20,824 | ) | | (23,062 | ) |

Amortization of actuarial loss | 2,952 |

| | 2,840 |

| | 6,264 |

| | 5,844 |

|

Net periodic benefit cost | $ | 1,345 |

| | $ | 942 |

| | $ | 3,144 |

| | $ | 2,100 |

|

For the six-month period ended June 30, 2015, the Company made contributions of $6,000,000 and $3,303,000, to its underfunded U.S. and U.K. defined benefit pension plans, respectively, compared with contributions of $11,950,000 and $3,432,000, respectively, in the comparable period in 2014. The Company is not required to make any additional contributions to its U.S. defined benefit pension plan or to the U.K. plans for the remainder of 2015; however, the Company expects to make additional contributions of approximately $3,000,000 and $3,400,000 to its U.S. and U.K. plans, respectively, during the remainder of 2015.

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

7. Net Income Attributable to Shareholders of Crawford & Company per Common Share

The Company computes earnings per share of its non-voting Class A Common Stock ("CRDA") and voting Class B Common Stock ("CRDB") using the two-class method, which allocates the undistributed earnings in each period to each class on a proportionate basis. The Company's Board of Directors has the right, but not the obligation, to declare higher dividends on the CRDA shares than on the CRDB shares, subject to certain limitations. In periods when the dividend is the same for CRDA and CRDB or when no dividends are declared or paid to either class, the two-class method generally will yield the same earnings per share for CRDA and CRDB. During the first and second quarters of 2015 and 2014 the Board of Directors declared a higher dividend on CRDA than on CRDB.

The computations of basic net income attributable to shareholders of Crawford & Company per common share were as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Six months ended |

| June 30,

2015 | | June 30,

2014 | | June 30,

2015 | | June 30,

2014 |

(in thousands, except earnings per share amounts) | CRDA | CRDB | | CRDA | CRDB | | CRDA | CRDB | | CRDA | CRDB |

Earnings per share - basic: | | | | | | | | | | | |

Numerator: | | | | | | | | | | | |

Allocation of undistributed earnings | $ | 371 |

| $ | 299 |

| | $ | 4,384 |

| $ | 3,578 |

| | $ | 156 |

| $ | 127 |

| | $ | 6,660 |

| $ | 5,465 |

|

Dividends paid | 2,149 |

| 1,235 |

| | 1,514 |

| 988 |

| | 4,288 |

| 2,469 |

| | 3,016 |

| 1,975 |

|

Net income available to common shareholders, basic | $ | 2,520 |

| $ | 1,534 |

| | $ | 5,898 |

| $ | 4,566 |

| | $ | 4,444 |

| $ | 2,596 |

| | $ | 9,676 |

| $ | 7,440 |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

Denominator: |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

Weighted-average common shares outstanding, basic | 30,673 |

| 24,690 |

| | 30,256 |

| 24,690 |

| | 30,597 |

| 24,690 |

| | 30,088 |

| 24,690 |

|

Earnings per share - basic | $ | 0.08 |

| $ | 0.06 |

| | $ | 0.19 |

| $ | 0.18 |

| | $ | 0.15 |

| $ | 0.11 |

| | $ | 0.32 |

| $ | 0.30 |

|

The computations of diluted net income attributable to shareholders of Crawford & Company per common share were as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Six months ended |

| June 30,

2015 | | June 30,

2014 | | June 30,

2015 | | June 30,

2014 |

(in thousands, except earnings per share amounts) | CRDA | CRDB | | CRDA | CRDB | | CRDA | CRDB | | CRDA | CRDB |

Earnings per share - diluted: | | | | | | | | | | | |

Numerator: | | | | | | | | | | | |

Allocation of undistributed earnings | $ | 374 |

| $ | 296 |

| | $ | 4,427 |

| $ | 3,535 |

| | $ | 157 |

| $ | 126 |

| | $ | 6,744 |

| $ | 5,381 |

|

Dividends paid | 2,149 |

| 1,235 |

| | 1,514 |

| 988 |

| | 4,288 |

| 2,469 |

| | 3,016 |

| 1,975 |

|

Net income available to common shareholders, diluted | $ | 2,523 |

| $ | 1,531 |

| | $ | 5,941 |

| $ | 4,523 |

| | $ | 4,445 |

| $ | 2,595 |

| | $ | 9,760 |

| $ | 7,356 |

|

| | | | | | | | | | | |

Denominator: | | | | | | | | | | | |

Weighted-average common shares outstanding, basic | 30,673 |

| 24,690 |

| | 30,256 |

| 24,690 |

| | 30,597 |

| 24,690 |

| | 30,088 |

| 24,690 |

|

Weighted-average effect of dilutive securities | 464 |

| — |

| | 658 |

| — |

| | 482 |

| — |

| | 860 |

| — |

|

| 31,137 |

| 24,690 |

| | 30,914 |

| 24,690 |

| | 31,079 |

| 24,690 |

| | 30,948 |

| 24,690 |

|

Earnings per share - diluted | $ | 0.08 |

| $ | 0.06 |

| | $ | 0.19 |

| $ | 0.18 |

| | $ | 0.14 |

| $ | 0.11 |

| | $ | 0.32 |

| $ | 0.30 |

|

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

Listed below are the shares excluded from the denominator in the above computation of diluted earnings per share for CRDA because their inclusion would have been antidilutive:

|

| | | | | | | | | | | |

| Three months ended | | Six months ended |

(in thousands) | June 30,

2015 | | June 30,

2014 | | June 30,

2015 | | June 30,

2014 |

Shares underlying stock options excluded due to the options' respective exercise prices being greater than the average stock price during the period | 15 |

| | — |

| | 15 |

| | — |

|

Performance stock grants excluded because performance conditions had not been met (1) | 2,094 |

| | 2,267 |

| | 2,094 |

| | 2,267 |

|

________________________________________________

| |

(1) | Compensation cost is recognized for these performance stock grants based on expected achievement rates; however, no consideration is given to these performance stock grants when calculating earnings per share until the performance measurements have been achieved. As of June 30, 2015, the Company does not expect these performance measurements to be achieved by December 31, 2015. |

The following table details shares issued during the three months and six months ended June 30, 2015 and June 30, 2014. These shares are included from their dates of issuance in the weighted-average common shares used to compute basic earnings per share for CRDA in the table above. There were no shares of CRDB issued during any of these periods.

|

| | | | | | | | | | | |

| Three months ended | | Six months ended |

(in thousands) | June 30,

2015 | | June 30,

2014 | | June 30,

2015 | | June 30,

2014 |

CRDA issued under non-employee director stock plan | 7 |

| | 6 |

| | 55 |

| | 60 |

|

CRDA issued under the U.K. ShareSave Scheme | 96 |

| | 255 |

| | 96 |

| | 261 |

|

CRDA issued under Executive Stock Bonus Plan | 70 |

| | 56 |

| | 74 |

| | 251 |

|

CRDA issued upon stock option plan exercises | — |

| | — |

| | — |

| | 106 |

|

Effective August 16, 2014, the Company's then existing stock repurchase authorization was replaced with a new authorization pursuant to which the Company has been authorized to repurchase up to 2,000,000 shares of CRDA or CRDB (or both) through July 2017 (the "2014 Repurchase Authorization"). Under the 2014 Repurchase Authorization, repurchases may be made in open market or privately negotiated transactions at such times and for such prices as management deems appropriate, subject to applicable contractual and regulatory restrictions.

During the three months and six months ended June 30, 2015, the Company repurchased 0 shares and 17,700 shares of CRDA, respectively, at an average cost of $7.79 per share. During the three months and six months ended June 30, 2014, the Company repurchased 163,830 and 337,938 shares of CRDA, respectively, at an average cost of $8.54 and $8.26 per share, respectively. The Company did not repurchase any shares of CRDB during any of these periods.

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

8. Accumulated Other Comprehensive Loss

Comprehensive income (loss) for the Company consists of the total of net income, foreign currency translation adjustments, and accrued pension and retiree medical liability adjustments. The changes in components of "Accumulated other comprehensive loss" ("AOCL"), net of taxes and noncontrolling interests, included in the Company's unaudited condensed consolidated financial statements were as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2015 | | Six months ended June 30, 2015 |

(in thousands) | Foreign currency translation adjustments | | Retirement liabilities (1) | | AOCL attributable to shareholders of Crawford & Company | | Foreign currency translation adjustments | | Retirement liabilities (1) | | AOCL attributable to shareholders of Crawford & Company |

Beginning balance | $ | (14,869 | ) | | $ | (214,534 | ) | | $ | (229,403 | ) | | $ | (4,659 | ) | | $ | (217,299 | ) | | $ | (221,958 | ) |

Other comprehensive loss before reclassifications | (319 | ) | | — |

| | (319 | ) | | (10,529 | ) | | — |

| | (10,529 | ) |

Amounts reclassified from accumulated other comprehensive income | — |

| | 2,036 |

| | 2,036 |

| | — |

| | 4,801 |

| | 4,801 |

|

Net current period other comprehensive (loss) income | (319 | ) |

| 2,036 |

|

| 1,717 |

| | (10,529 | ) | | 4,801 |

| | (5,728 | ) |

Ending balance | $ | (15,188 | ) |

| $ | (212,498 | ) |

| $ | (227,686 | ) | | $ | (15,188 | ) | | $ | (212,498 | ) | | $ | (227,686 | ) |

| | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2014 | | Six months ended June 30, 2014 |

(in thousands) | Foreign currency translation adjustments | | Retirement liabilities (1) | | AOCL attributable to shareholders of Crawford & Company | | Foreign currency translation adjustments | | Retirement liabilities (1) | | AOCL attributable to shareholders of Crawford & Company |

Beginning balance | $ | (502 | ) | | $ | (181,221 | ) | | $ | (181,723 | ) | | $ | 3,544 |

| | $ | (182,754 | ) | | $ | (179,210 | ) |

Other comprehensive income before reclassifications | 4,317 |

| | — |

| | 4,317 |

| | 271 |

| | — |

| | 271 |

|

Amounts reclassified from accumulated other comprehensive income | — |

| | 1,967 |

| | 1,967 |

| | — |

| | 3,500 |

| | 3,500 |

|

Net current period other comprehensive income | 4,317 |

|

| 1,967 |

|

| 6,284 |

| | 271 |

| | 3,500 |

| | 3,771 |

|

Ending balance | $ | 3,815 |

|

| $ | (179,254 | ) |

| $ | (175,439 | ) | | $ | 3,815 |

| | $ | (179,254 | ) | | $ | (175,439 | ) |

________________________________________________

| |

(1) | Retirement liabilities reclassified to net income are related to the amortization of actuarial losses and are included in "Selling, general, and administrative expenses" in the Company's unaudited Condensed Consolidated Statements of Income. See Note 6, "Defined Benefit Pension Plans" for additional details. |

The other comprehensive loss amounts attributable to noncontrolling interests shown in the Company's unaudited Condensed Consolidated Statements of Shareholders' Investment are foreign currency translation adjustments.

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

9. Fair Value Measurements

The following table presents the Company's assets and liabilities that are measured at fair value on a recurring basis and are categorized using the fair value hierarchy:

|

| | | | | | | | | | | | | | | |

| | | Fair Value Measurements at June 30, 2015 |

| | | | | Significant Other | | Significant |

| | | Quoted Prices in | | Observable | | Unobservable |

| | | Active Markets | | Inputs | | Inputs |

(in thousands) | Total | | (Level 1) | | (Level 2) | | (Level 3) |

Assets: | | | | | | | |

Money market funds (1) | $ | 11 |

| | $ | 11 |

| | $ | — |

| | $ | — |

|

Derivative not designated as hedging instrument: | | | | | | | |

Cross currency basis swap (2) | 4,530 |

| | — |

| | 4,530 |

| | — |

|

|

|

| |

|

| |

| |

|

|

Liabilities: | | | | | | | |

Contingent earnout liability (3) | 1,170 |

| | — |

| | — |

| | 1,170 |

|

| |

(1) | The fair values of the money market funds were based on recently quoted market prices and reported transactions in an active marketplace. Money market funds are included in the Company's unaudited Condensed Consolidated Balance Sheets as "Cash and cash equivalents." |

| |

(2) | The fair value of the cross currency basis swap was derived from a discounted cash flow analysis based on the terms of the swap and the forward curves for foreign currency rates and interest rates adjusted for the counterparty's credit risk. The fair value of the cross currency basis swap is included in "Other noncurrent assets" on the Company's unaudited Condensed Consolidated Balance Sheets, based upon the term of the cross currency basis swap. |

| |

(3) | The fair value of the contingent earnout liability for the 2014 acquisition of Buckley Scott Holdings Limited ("Buckley Scott") was estimated using an internally-prepared probability-weighted discounted cash flow analysis. The fair value analysis relied upon both Level 2 data (publicly observable data such as market interest rates and capital structures of peer companies) and Level 3 data (internal data such as the Company's operating projections). As such, the liability is a Level 3 fair value measurement. The valuation is sensitive to Level 3 data, with a maximum possible earnout of $2,017,000. As such, the fair value is not expected to vary materially from the balance recorded. The fair value of the contingent earnout liability is included in "Other noncurrent liabilities" on the Company's unaudited Condensed Consolidated Balance Sheets, based upon the term of the contingent earnout agreement. The fair value of the earnout was $1,153,000 at December 31, 2014. The change in the Level 3 fair value at June 30, 2015 was due to foreign currency translation adjustments and inputed interest. |

Fair Value Disclosures

There were no transfers of assets between fair value levels during the three months or six months ended June 30, 2015. The categorization of assets and liabilities within the fair value hierarchy and the measurement techniques are reviewed quarterly. Any transfers between levels are deemed to have occurred at the end of the quarter.

The fair values of accounts receivable, unbilled revenues, accounts payable and short-term borrowings approximate their respective carrying values due to the short-term maturities of the instruments. The interest rate on the Company's variable rate long-term debt resets at least every 90 days; therefore, the carrying value approximates fair value. These assets and liabilities are measured within Level 2 of the hierarchy.

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

10. Segment Information

Financial information for the three months and six months ended June 30, 2015 and 2014 related to the Company's reportable segments, including a reconciliation from segment operating earnings to income before income taxes, the most directly comparable GAAP financial measure, is presented below.

|

| | | | | | | | | | | | | | | |

| Three months ended | | Six months ended |

(in thousands) | June 30,

2015 | | June 30,

2014 | | June 30,

2015 | | June 30,

2014 |

Revenues: | | | | | | | |

Americas | $ | 99,190 |

| | $ | 93,601 |

| | $ | 188,657 |

| | $ | 181,492 |

|

Europe, Middle East, Africa and Asia-Pacific ("EMEA/AP") | 97,191 |

| | 87,246 |

| | 188,454 |

| | 167,582 |

|

Broadspire | 73,693 |

| | 66,706 |

| | 143,365 |

| | 131,464 |

|

Legal Settlement Administration | 34,324 |

| | 40,663 |

| | 71,699 |

| | 83,027 |

|

Total segment revenues before reimbursements | 304,398 |

| | 288,216 |

| | 592,175 |

| | 563,565 |

|

Reimbursements | 20,018 |

| | 18,837 |

| | 38,857 |

| | 32,846 |

|

Total revenues | $ | 324,416 |

| | $ | 307,053 |

| | $ | 631,032 |

| | $ | 596,411 |

|

| | | | | | | |

Segment Operating Earnings: | | | | | | | |

Americas | $ | 9,896 |

| | $ | 8,142 |

| | $ | 14,872 |

| | $ | 15,076 |

|

EMEA/AP | 1,106 |

| | 4,310 |

| | 2,634 |

| | 6,210 |

|

Broadspire | 6,006 |

| | 2,715 |

| | 9,543 |

| | 4,718 |

|

Legal Settlement Administration | 3,721 |

| | 5,700 |

| | 8,672 |

| | 10,667 |

|

Total segment operating earnings | 20,729 |

| | 20,867 |

| | 35,721 |

| | 36,671 |

|

| | | | | | | |

Deduct/Add: | | | | | | | |

Unallocated corporate and shared (costs) and credits, net | (3,046 | ) | | 53 |

| | (7,342 | ) | | (1,690 | ) |

Net corporate interest expense | (2,042 | ) | | (1,551 | ) | | (3,906 | ) | | (2,852 | ) |

Stock option expense | (178 | ) | | (202 | ) | | (327 | ) | | (496 | ) |

Amortization of customer-relationship intangible assets | (2,334 | ) | | (1,611 | ) | | (4,432 | ) | | (3,203 | ) |

Special charges | (4,242 | ) | | — |

| | (5,305 | ) | | — |

|

Income before income taxes | $ | 8,887 |

| | $ | 17,556 |

| | $ | 14,409 |

| | $ | 28,430 |

|

Intersegment transactions are not material for any period presented.

Operating earnings is the primary financial performance measure used by the Company's senior management and chief operating decision maker ("CODM") to evaluate the financial performance of the Company's four operating segments and make resource allocation decisions. The Company believes this measure is useful to others in that it allows them to evaluate segment operating performance using the same criteria used by the Company's senior management and CODM. Operating earnings will differ from net income computed in accordance with GAAP since operating earnings represent segment earnings before certain unallocated corporate and shared costs and credits, net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, special charges, income taxes, and net income or loss attributable to noncontrolling interests.

Segment operating earnings includes allocations of certain corporate and shared costs. If the Company changes its allocation methods or changes the types of costs that are allocated to its four operating segments, prior period amounts presented in the current period financial statements are adjusted to conform to the current allocation process.

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

Revenues by major service line in the U.S. and by area for other regions in the Americas segment and by major service line for the Broadspire segment are shown in the following table. It is not practicable to provide revenues by service line for the EMEA/AP segment. The Company considers all Legal Settlement Administration revenues to be derived from one service line.

|

| | | | | | | | | | | | | | | |

| Three months ended | | Six months ended |

(in thousands) | June 30,

2015 | | June 30,

2014 | | June 30,

2015 | | June 30,

2014 |

Americas | | | | | | | |

U.S. Claims Field Operations | $ | 19,928 |

| | $ | 25,235 |

| | $ | 39,980 |

| | $ | 51,955 |

|

U.S. Technical Services | 7,503 |

| | 6,314 |

| | 14,066 |

| | 13,025 |

|

U.S. Catastrophe Services | 23,337 |

| | 11,489 |

| | 40,705 |

| | 17,797 |

|

Subtotal U.S. Claims Services | 50,768 |

| | 43,038 |

| | 94,751 |

| | 82,777 |

|

U.S. Contractor Connection | 16,131 |

| | 14,221 |

| | 28,852 |

| | 27,130 |

|

Subtotal U.S. Property & Casualty | 66,899 |

| | 57,259 |

| | 123,603 |

| | 109,907 |

|

Canada--all service lines | 29,205 |

| | 32,815 |

| | 58,241 |

| | 64,508 |

|

Latin America/Caribbean--all service lines | 3,086 |

| | 3,527 |

| | 6,813 |

| | 7,077 |

|

Total Revenues before Reimbursements--Americas | $ | 99,190 |

| | $ | 93,601 |

| | $ | 188,657 |

| | $ | 181,492 |

|

| | | | | | | |

Broadspire | | | | | | | |

Workers' Compensation and Liability Claims Management | $ | 30,352 |

| | $ | 27,720 |

| | $ | 59,537 |

| | $ | 56,004 |

|

Medical Management | 39,678 |

| | 35,054 |

| | 76,318 |

| | 67,846 |

|

Risk Management Information Services | 3,663 |

| | 3,932 |

| | 7,510 |

| | 7,614 |

|

Total Revenues before Reimbursements--Broadspire | $ | 73,693 |

| | $ | 66,706 |

| | $ | 143,365 |

| | $ | 131,464 |

|

11. Commitments and Contingencies

As part of the Company's credit facility, the Company maintains a letter of credit facility to satisfy certain of its own contractual requirements. At June 30, 2015, the aggregate committed amount of letters of credit outstanding under the credit facility was $17,211,000.

In the normal course of its business, the Company is sometimes named as a defendant or responsible party in suits or other actions by insureds or claimants contesting decisions made by the Company or its clients with respect to the settlement of claims. Additionally, certain clients of the Company have in the past brought, and may, in the future bring, claims for indemnification on the basis of alleged actions by the Company, its agents, or its employees in rendering services to clients. The majority of these claims are of the type covered by insurance maintained by the Company. However, the Company is responsible for the deductibles and self-insured retentions under various insurance coverages. In the opinion of Company management, adequate provisions have been made for such known and foreseeable risks.

The Company is subject to numerous federal, state, and foreign employment laws, and from time to time the Company faces claims by its employees and former employees under such laws. Such claims or litigation involving the Company or any of the Company's current or former employees could divert management's time and attention from the Company's business operations and could potentially result in substantial costs of defense, settlement or other disposition, which could have a material adverse effect on the Company's results of operations, financial position, and cash flows. In the opinion of Company management, adequate provisions have been made for items that are probable and reasonably estimable.

The 2014 acquisition of Buckley Scott contains an earnout provision based on Buckley Scott achieving certain financial results during the two-year period following the completion of the acquisition, with a current estimated fair value of $1,170,000. The maximum potential earnout is $2,017,000.

Effective June 24, 2015, the Company entered into 10-year operating leases for approximately 16,000 square feet of office space in London, England, for its EMEA/AP segment as a replacement and consolidation of certain of its London facilities. The Company has future total lease payments associated with the leases of approximately $15,230,000 subject to market rate adjustments on the fifth anniversary of the lease commitment date. Additionally, the Company is responsible for certain value-added taxes and operating expenses.

CRAWFORD & COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Unaudited

12. Special Charges and Other Income

Special Charges

Special charges for the three months and six months ended June 30, 2015, of $4,242,000 and $5,305,000 respectively were incurred related to the establishment of the Company's Global Business Services Center ("the Center") in Manila, Philippines, integration costs related to the GAB Robins acquisition, and expenses related to restructuring activities in the EMEA/AP and Americas segments. For the quarter and six-month period ended June 30, 2015, $1,196,000 and $2,259,000 respectively were recorded in costs related to the establishment of the Center primarily for professional fees. Additionally, $1,046,000 and $2,000,000 respectively were incurred for the quarter and six-month period ended June 30, 2015 related to the GAB Robins acquisition integration and restructuring activities in the EMEA/AP and Americas segments, primarily for severance costs. There were no special charges during the three months and six months ended June 30, 2014.

As of June 30, 2015, the following liabilities remained on the Company's unaudited Condensed Consolidated Balance Sheets related to special charges recorded in 2012, and related to the 2015 special charges. The rollforwards of these costs to June 30, 2015 are as follows:

|

| | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2015 |

(in thousands) | Deferred rent | | Accrued compensation and related costs | | Accounts payable | | Other accrued liabilities | | Total |

Beginning balance, March 31, 2015 | $ | 1,171 |

| | $ | 89 |

| | $ | 1,050 |

| | $ | 308 |

| | $ | 2,618 |

|

Additions | — |

| | 2,598 |

| | 1,644 |

| | — |

| | 4,242 |

|

Adjustments to accruals | (110 | ) | | — |

| | — |

| | — |

| | (110 | ) |

Cash payments | — |

| | (2,097 | ) | | (1,401 | ) | | — |

| | (3,498 | ) |

Ending balance, June 30, 2015 | $ | 1,061 |

|

| $ | 590 |

|

| $ | 1,293 |

|

| $ | 308 |

|

| $ | 3,252 |

|

| | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | |

| Six months ended June 30, 2015 | |

(in thousands) | Deferred rent | | Accrued compensation and related costs | | Accounts payable | | Other accrued liabilities | | Total |

Beginning balance, January 1, 2015 | $ | 1,431 |

| | $ | 131 |

| | $ | — |

| | $ | 308 |

| | $ | 1,870 |

|

Additions | — |

| | 2,598 |

| | 2,707 |

| | — |

| | 5,305 |

|

Adjustments to accruals | (370 | ) | | — |

| | — |

| | — |

| | (370 | ) |

Cash payments | — |

| | (2,139 | ) | | (1,414 | ) | | — |

| | (3,553 | ) |

Ending balance, June 30, 2015 | $ | 1,061 |

| | $ | 590 |

| | $ | 1,293 |

| | $ | 308 |

| | $ | 3,252 |

|

| | | | | | | | | |

Other Income

Other income consists of dividend income from the Company's unconsolidated subsidiaries and miscellaneous other income.

REVIEW REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Shareholders and Board of Directors of

Crawford & Company

We have reviewed the condensed consolidated balance sheet of Crawford & Company as of June 30, 2015, and the related condensed consolidated statements of income, comprehensive income, and shareholders' investment for the three-month and six-month periods ended June 30, 2015 and 2014, and the condensed consolidated statements of cash flows for the six-month periods ended June 30, 2015 and 2014. These financial statements are the responsibility of the Company's management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the condensed consolidated financial statements referred to above for them to be in conformity with U.S. generally accepted accounting principles.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Crawford & Company as of December 31, 2014, and the related consolidated statements of income, comprehensive income, cash flows, and shareholders' investment for the year then ended (not presented herein) and we expressed an unqualified opinion on those consolidated financial statements in our report dated February 23, 2015. In our opinion, the accompanying condensed consolidated balance sheet as of December 31, 2014 is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

/s/ Ernst & Young LLP

Atlanta, Georgia

August 3, 2015

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Statement Concerning Forward-Looking Statements

This report contains forward-looking statements within the meaning of that term in the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. Statements contained in this report that are not statements of historical fact are forward-looking statements made pursuant to the "safe harbor" provisions thereof. These statements may relate to, among other things, expectations regarding the performance of our various operating segments, anticipated contributions to our underfunded defined benefit pension plans, collectability of our billed and unbilled accounts receivable, our continued compliance with the financial and other covenants contained in our financing agreements, our expected future operating results and financial condition, and other long-term liquidity requirements. These statements may also relate to our business strategies, goals and expectations concerning our market position, future operations, margins, case and project volumes, profitability, contingencies, liquidity position, and capital resources. The words "anticipate", "believe", "could", "would", "should", "estimate", "expect", "intend", "may", "plan", "goal", "strategy", "predict", "project", "will" and similar terms and phrases, or the negatives thereof, identify forward-looking statements contained in this report.

Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations and the forward-looking statements related to our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially adversely affect our financial condition and results of operations, and whether the forward-looking statements ultimately prove to be correct. Included among the risks and uncertainties we face are risks related to the following:

| |

• | a decline in cases referred to us for any reason, including changes in the degree to which property and casualty insurance carriers outsource their claims handling functions, |

| |

• | the project-based nature of our Legal Settlement Administration segment, including associated fluctuations in revenue, |

| |

• | changes in global economic conditions, |

| |