Current Report Filing (8-k)

February 15 2017 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report

February 13, 2017

(Date of earliest event reported)

Callon Petroleum Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

001-14039

|

64-0844345

|

|

(State or other jurisdiction of

|

(Commission File Number)

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification Number)

|

200 North Canal St.

Natchez, Mississippi 39120

(Address of principal executive offices, including zip code)

(601) 442-1601

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 2 – Financial Information

Item 2.01. Completion of Acquisition or Disposition of Assets.

As previously disclosed, on

December 13

, 2016,

Callon Petroleum Operating Company (“CPOC”), a wholly owned subsidiary of Callon Petroleum Company (“Callon” or the “Company”),

entered into a purchase and sale agreement (the “

Ameredev

Purchase Agreement”) with

American Resource Development

, LLC

,

American Resource Development Upstream, LLC, and American Resource Development Midstream, LLC (collectively, “Ameredev”)

for the purchase of certain oil and gas producing properties and undeveloped acreage in the

Delaware

Basin (the “

Ameredev

Acquisition”).

On

February 13

, 201

7

,

CPOC

completed the

Ameredev

Acquisition

for

a

total

purchase price of approximately $

633

million in cash

, subject to customary post-closing adjust

ments

.

The

Ameredev

Purchase Agreement

provides for customary adjustments to the purchase price based on an effective date of

October 1, 2016

.

The acquired properties include approximately

16,700 net

surface acres in

Ward and Pecos

Count

ies

, Texas

, comprised of an initial 16,098 net acres and an incremental 590 net acres acquired between signing and closing of the

transaction that are either within or contiguous to the Ward County footprint.

The foregoing description is qualified in its entirety by reference to the full text of the

Ameredev

Purchase Agreement, which ha

s

been filed as Exhibit 2.1 to the

Company’s

Current Report on Form 8-K dated

December 13

, 2016 and

is

incorporated in this Report by reference.

Section 7 – Regulation FD

Item 7.01. Regulation FD Disclosure.

On

February 13, 2017

, the Company issued a press release, attached as Exhibit 99.1, announcing the closing of the

Ameredev

Acquisition. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information set forth in the attached Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

|

|

(a)

|

|

Financial Statements of business Acquired

|

The Company will file the financial statements required by Item 9.01 (a) of Form 8-K by an amendment to this Current Report on Form 8-K no later than 71 days from the date this Current Report on Form 8-K is required to be filed.

|

|

(b)

|

|

Pro Forma Financial Information

|

The Company will file the financial statements required by Item 9.01 (a) of Form 8-K by an amendment to this Current Report on Form 8-K no later than 71 days from the date this Current Report on Form 8-K is required to be filed.

|

|

|

|

|

Exhibit Number

|

|

Title of Document

|

|

|

|

|

|

2.1

|

|

Purchase and Sale Agreement between

Ameredev

, as Seller

,

and CPOC, as Purchaser, dated

December 13

, 2016 (incorporated by reference to Exhibit 2.1 of the Company’s Form 8-K, filed on

December 13

, 2016)

|

|

|

|

|

|

99.1

|

|

Press release dated

February 13, 2017

, announcing the closing of the

Ameredev

Acquisition

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Callon Petroleum Company

|

|

|

|

(Registrant)

|

|

|

|

|

|

February 1

4

, 2017

|

|

By: /s/ Joseph C. Gatto, Jr.

|

|

|

|

Joseph C. Gatto, Jr.

|

|

|

|

President,

Chief Financial Officer and Treasurer

|

|

|

|

|

Exhibit Index

|

|

|

|

|

Exhibit Number

|

|

Title of Document

|

|

|

|

|

|

2.1

|

|

Purchase and Sale Agreement between Ameredev, as Seller, and CPOC, as Purchaser, dated

December 13

, 2016 (incorporated by reference to Exhibit 2.1 of the Company’s Form 8-K, filed on

December 13

, 2016)

|

|

|

|

|

|

99.1

|

|

Press release dated

February 13, 2017

, announcing the closing of the Ameredev Acquisition

|

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

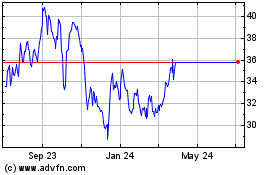

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Apr 2023 to Apr 2024