Current Report Filing (8-k)

May 18 2015 - 1:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report

May 14, 2015

(Date of earliest event reported)

Callon Petroleum Company

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-14039

|

64-0844345

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

200 North Canal St.

Natchez, Mississippi 39120

(Address of principal executive offices, including zip code)

(601) 442-1601

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The Company held its 2015 Annual Meeting of Shareholders (the “Annual Meeting”) on May 14, 2015. At the Annual Meeting, the Company’s shareholders approved the First Amendment (the “First Amendment”) to the Callon Petroleum Company 2011 Omnibus Incentive Plan (the “Plan”), which provided for (i) an increase in the number of shares of the Company’s common stock available for grant under the Plan by two million shares from 2,300,000 shares to 4,300,000 shares, (ii) the adoption of a “double trigger” meaning that, in the event of a Company change in control, early vesting or payment occurs only if a change in control occurs and the executive’s employment is terminated or constructively terminated, and (iii) the elimination of the adding back of terminated options and stock appreciation rights shares for future grants. The First Amendment was made effective as of May 14, 2015. A description of the material terms of the Plan was included in the Company's definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on April 2, 2015. In addition, the foregoing summary is qualified in its entirety by reference to the full text of the First Amendment, which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

Item 5.07 Submission of Matters to a Vote of Security Holders

At the Annual Meeting, shareholders (a) elected two (2) Class III directors and one (1) Class I director to hold office until the 2018 and 2016 annual meeting of shareholders, respectively (Proposal #1), (b) approved, in an advisory (non-binding) vote, the Company's executive compensation (Proposal #2), (c) approved the amendment to the 2011 Omnibus Incentive Plan (Proposal #3), (d) approved the increase in authorized shares (Proposal #4), and (e) ratified the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for the year ending December 31, 2015 (Proposal #5). For additional information on these proposals, please see the Company’s definitive proxy statement filed with the Securities and Exchange Commission on April 2, 2015.

Proposal 1 – Election of Directors.

Class III Directors

|

|

|

|

|

|

Nominee

|

Votes cast For

|

Votes Withheld

|

Broker Non-Votes

|

|

Fred L. Callon

|

47,172,205

|

1,958,343

|

7,972,969

|

|

L. Richard Flury

|

47,237,281

|

1,893,267

|

7,972,969

|

Class I Directors

|

|

|

|

|

|

Nominee

|

Votes cast For

|

Votes Withheld

|

Broker Non-Votes

|

|

Michael L. Finch

|

48,309,696

|

820,852

|

7,972,969

|

Proposal 2 – Approval, in an advisory (non-binding) vote, of the Company’s Executive Compensation.

|

|

|

|

|

|

Votes cast For

|

Votes cast Against

|

Votes Abstained

|

Broker Non-Votes

|

|

47,006,394

|

2,029,902

|

94,252

|

7,972,969

|

Proposal 3 – Approval of the Amendment to the 2011 Omnibus Incentive Plan.

|

|

|

|

|

|

Votes cast For

|

Votes cast Against

|

Votes Abstained

|

Broker Non-Votes

|

|

46,775,025

|

2,239,203

|

116,320

|

7,972,969

|

Proposal 4 – Approval of the Increase in Authorized Shares.

|

|

|

|

|

|

Votes cast For

|

Votes cast Against

|

Votes Abstained

|

Broker Non-Votes

|

|

54,142,740

|

2,618,963

|

341,814

|

—

|

Proposal 5 – Ratification of Appointment of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm for the year ending December 31, 2015.

|

|

|

|

|

|

Votes cast For

|

Votes cast Against

|

Votes Abstained

|

Broker Non-Votes

|

|

56,608,195

|

481,674

|

13,648

|

—

|

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Title of Document

|

|

10.1

|

|

First Amendment to the 2011 Omnibus Incentive Plan of Callon Petroleum Company

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Callon Petroleum Company

|

|

|

|

May 18, 2015

|

By: /s/ Joseph C. Gatto, Jr.

|

|

|

Joseph C. Gatto, Jr.

|

|

|

Senior Vice President, Chief Financial Officer and Treasurer

|

Exhibit Index

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Title of Document

|

|

10.1

|

|

First Amendment to the 2011 Omnibus Incentive Plan of Callon Petroleum Company

|

|

|

|

|

Exhibit 10.1

First Amendment to the Callon Petroleum Company 2011 Omnibus Incentive Plan

WHEREAS, Callon Petroleum Company (the “Company”) maintains the Callon Petroleum Company 2011 Omnibus Incentive Plan (the “Plan”); and

WHEREAS, the Company reserved the right to amend the Plan in Article 21 thereof, and now desires to amend the Plan;

NOW, THEREFORE, subject to approval of the Company’s stockholders as set out below, the Plan is hereby amended, effective as of May 14, 2015, as follows:

1. Section 2.26 is hereby amended, in its entirety, to read as follows:

2.26 “Extraordinary Items” means (a) extraordinary, unusual and/or nonrecurring items of gain or loss; (b) gains or losses on the disposition of a business; (c) changes in tax or accounting regulations or laws; or (d) the effect of a merger or acquisition, all of which must be identified in the audited financial statements, including footnotes, or the Management Discussion and Analysis section of the Company's annual report, pursuant to the then-current standards established by the U.S. Financial Accounting Standards Board.

2. Section 4.1 is hereby amended, in its entirety, to read as follows:

4.1Number of Shares Authorized and Available for Awards. Subject to adjustment as provided under the Plan, the total number of Shares constituting the Share Pool which is available for Awards under the Plan shall be equal to the sum of (a) Four Million Three Hundred Thousand (4,300,000) Shares, (b) any and all Shares that are available for awards under the Prior Plans as of the Effective Date that are not reserved for outstanding awards that were granted under the Prior Plans before the Effective Date, and (c) any and all Shares that may become available for awards under the Prior Plans on or after the Effective Date that were reserved for outstanding awards that were granted under the Prior Plans before the Effective Date, as provided in Section 4.2(b).

Any of the authorized Shares may be used for any type of Award under the Plan, and any or all of the available Shares may be allocated to Incentive Stock Options.

3. Section 4.2 is hereby amended, in its entirety, to read as follows:

4.2Calculation of Share Usage for Share Pool. The Committee shall determine the number of Shares constituting the Share Pool that is available for grants of Awards under the Plan, subject to the following:

|

(a)

Any Shares related to an Award granted under the Plan that (1) terminate by expiration, forfeiture, cancellation or otherwise without the issuance of the Shares, (2) are settled in cash in lieu of Shares, or (3) are exchanged with the Committee’s permission, prior to the issuance of Shares, for Awards not involving Shares, shall again be available immediately for grants under this Plan. Any Shares tendered or withheld in order to satisfy tax withholding obligations associated with the settlement of an Award (except with respect to an Option or SAR Award), shall again become available for grants under this Plan. |

(b)Any Shares related to an Award previously granted under any Prior Plan prior to the Effective Date that, on or after the Effective Date, (1) terminate by expiration, forfeiture, cancellation or otherwise without the issuance of the Shares, are settled in cash in lieu of Shares, or (2) are exchanged with the Committee’s permission, prior to the issuance of Shares, for Awards not involving Shares, shall again be available for grants under this Plan. Any Shares tendered or withheld in order to satisfy tax withholding obligations associated with the settlement of an

Award (except with respect to an Option or SAR Award), shall again become available for grants under this Plan.

4. The third from last paragraph of Section 14.2 is hereby amended, and the prior provisions that were in such paragraph have been deleted, such that Section 14.2 shall read, in its entirety, as follows:

The terms of the stated Performance Measures for each applicable Award, whether for a Performance Period of one (1) year or multiple years, must preclude the Committee's discretion to increase the amount payable to any Participant that would otherwise be due upon attainment of the Performance Measures, but may permit the Committee to reduce the amount otherwise payable to the Participant in the Committee's discretion.

5. Article 17, Effect of a Change in Control, is hereby amended by the addition of the following new Section 17(d), which reads as follows:

(d)In the event of a Change in Control, accelerated vesting or accelerated payment of an Award shall occur only in the event of a “double-trigger”, i.e., there is separation from service of the Participant within a designated time period following the Change in Control as set out in the Award Agreement for such Participant.

Except as amended hereby, the Plan shall continue in full force and effect and the Plan and this First Amendment shall be read, taken and construed as one and the same instrument.

Executed effective for all purposes as provided above; provided, however, if this First Amendment is not approved by the stockholders of the Company at the 2015 Annual Meeting of Stockholders, this First Amendment shall not become effective.

Callon Petroleum Company

By: /s/ Fred L. Callon

Name: Fred L. Callon

Title: Chairman, President, and Chief Executive Officer

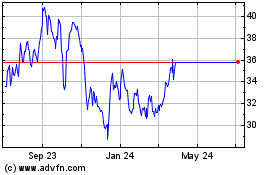

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Apr 2023 to Apr 2024