UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report

March 21, 2015

(Date of earliest event reported)

Callon Petroleum Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

001-14039

|

64-0844345

|

|

(State or other jurisdiction of

|

(Commission File Number)

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification Number)

|

200 North Canal St.

Natchez, Mississippi 39120

(Address of principal executive offices, including zip code)

(601) 442-1601

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On March 21, 2015, Callon Petroleum Company (the “Company” or “Callon”) entered into an agreement (the “Agreement”) with Lone Star Value Investors, L.P., Lone Star Value Co-Invest I, L.P., Lone Star Value Investors GP, LLC, Lone Star Value Management, LLC, and Jeffery E. Eberwein (collectively, the “Lone Star Value Stockholders”) and Michael L. Finch. Pursuant to the Agreement, the Company agreed to increase its board of directors from seven to eight members by creating a vacancy in the Class I directors and to appoint Michael L. Finch to the board of directors to fill such vacancy effective the day prior to the 2015 annual meeting of stockholders (the “2015 Annual Meeting”). In addition to any other committee assignments the board of directors may make, Callon has agreed that Mr. Finch will be appointed to the Nominating and Corporate Governance Committee. Prior to his appointment to the board, Mr. Finch will attend board meetings as an observer, subject to a confidentiality agreement. Also pursuant to the Agreement, the Company agreed that its board of directors would take all necessary actions, pursuant to the Bylaws, so that there are three Class I directorships to be filled by election at the 2016 annual meeting of stockholders of the Company (the “2016 Annual Meeting”).

Except as provided in the Agreement, each of the Lone Star Value Stockholders has also agreed not to nominate or recommend for nomination any person for election at the 2015 Annual Meeting or submit any proposal for consideration at the 2015 Annual Meeting. In addition, each of the Lone Star Value Stockholders has agreed to vote their respective shares of Company common stock (i) in favor of the Company’s nominees for election to the board at the 2015 Annual Meeting and the ratification of the Company’s auditors and (ii) in accordance with the recommendations of Institutional Shareholder Services with respect to other proposals anticipated to be presented at the 2015 Annual Meeting.

Each of the Lone Star Value Stockholders has also agreed to a standstill, which prohibits such stockholder from: (i) soliciting or participating in the solicitation of proxies with respect Callon’s securities, (ii) acquiring Callon voting securities such that, following such acquisition, the Lone Star Value Stockholders would beneficially own in the aggregate in excess of 12.5% of Callon’s then-outstanding voting securities, or (iii) taking certain other specified actions, in each case in connection with Callon’s securities, until the termination of the Agreement.

The Agreement terminates 30 days prior to the expiration of the Company’s advance notice period for the nomination of directors at the 2016 Annual Meeting.

The above summary is qualified in its entirety by reference to the full text of the Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 5.02 Departures of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Pursuant to the Agreement, Callon agreed to appoint Mr. Finch to the Company’s board of directors as of the day prior to the 2015 Annual Meeting.

Other than the Agreement, the Company is not aware of any other arrangement or understanding between Mr. Finch and any other person pursuant to which Mr. Finch will be appointed to the board of directors. Mr. Finch will participate in the non-employee director compensation programs of the Company, as described in its most recent proxy statement, as such programs are amended from time to time.

Item 7.01 Regulation FD Disclosure.

On March 23, 2015, the Company issued a press release announcing the Agreement. The full text of the press release is set forth as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

Exhibit Number

|

|

Title of Document

|

|

|

|

|

|

10.1

|

|

Agreement dated March 21, 2015, among the Company and Lone Star Value Investors, L.P., Lone Star Value Co-Invest I, L.P., Lone Star Value Investors GP, LLC, Lone Star Value Management, LLC, Jeffery E. Eberwein and Michael L. Finch.

|

|

|

|

|

|

99.1

|

|

Press release dated March 23, 2015 announcing the Agreement.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Callon Petroleum Company

|

|

|

|

(Registrant)

|

|

|

|

|

|

March 25, 2015

|

|

By: /s/ Joseph C. Gatto, Jr.

|

|

|

|

Joseph C. Gatto, Jr.

|

|

|

|

Chief Financial Officer, Senior Vice President and Treasurer

|

|

|

|

|

Exhibit Index

|

|

|

|

|

Exhibit Number

|

|

Title of Document

|

|

|

|

|

|

10.1

|

|

Agreement dated March 21, 2015, among the Company and Lone Star Value Investors, L.P., Lone Star Value Co-Invest I, L.P., Lone Star Value Investors GP, LLC, Lone Star Value Management, LLC, Jeffery E. Eberwein and Michael L. Finch.

|

|

|

|

|

|

99.1

|

|

Press release dated March 23, 2015 announcing the Agreement.

|

Exhibit 10.1

Callon Petroleum Company

1401 Enclave Parkway, Suite 600

Houston, Texas 77077

Lone Star Value Investors L.P.

Lone Star Value Co-Invest I, L.P.

Lone Star Value Investors GP, LLC

Jeffrey Eberwein

Lone Star Value Management, LLC

Michael L. Finch

53 Forest Avenue, 1st Floor

Old Greenwich, Connecticut 06870

Facsimile No.: (203) 990-0727

Attention: Jeffrey E. Eberwein

March 21, 2015

Ladies and Gentleman:

Reference is made to the Agreement dated March 9, 2014 by and among Callon Petroleum Company (the “Company”), Lone Star Value Investors L.P. (“LS LP”), Lone Star Value Co-Invest I, L.P. (“LS Co-Invest I”), Lone Star Value Investors GP, LLC (“LS GP”), Lone Star Value Management, LLC (“LS Management”), Jeffrey E. Eberwein (“Eberwein” and, together with LS LP, LS Co-Invest I, LS GP, LS Management and Eberwein, the “Lone Star Value Stockholders”) and Matthew R. Bob (“M. Bob”) attached as Exhibit A (the “2014 Agreement”) to this letter agreement (this “Agreement”). Each of the Lone Star Value Stockholders and the Company are referred to in this Agreement as a “Party” and collectively, the “Parties.” Capitalized terms used but not defined herein have the meanings set forth in the 2014 Agreement.

Following discussion between the Company and members of the Lone Star Value Stockholders, the Parties have determined to come to an agreement with respect to the composition of the Company’s board of directors (the “Board”), certain matters related to the 2015 annual meeting of stockholders of the Company, including any adjournment or postponement thereof (the “2015 Annual Meeting”) and certain other matters, as provided in this Agreement. The Parties hereby agree as follows.

|

1.

Board Matters; Board Appointments; 2015 Annual Meeting. |

Effective as of the execution of this Agreement, each of the Lone Star Value Stockholders on behalf of itself and its respective Affiliates and Associates severally and not jointly further agrees that it will not, and that it will not permit any of its Affiliates or Associates to, (i) except as provided in this Agreement, nominate or recommend for nomination any person for election at the 2015 Annual Meeting, directly or indirectly, (ii) submit any proposal for consideration at, or bring any other business before, the 2015 Annual Meeting, directly or indirectly, or (iii) initiate, encourage or participate in any “withhold” or similar campaign with respect to the 2015 Annual Meeting, directly or indirectly. Effective as of the execution of this Agreement, each of the Lone Star Value Stockholders on behalf of itself and its respective Affiliates and Associates severally and not jointly agrees that it shall not publicly or privately encourage or support any other stockholder to take any of the actions described in this Section 1(a).

The Board and all applicable committees of the Board shall take all necessary actions, pursuant to the Bylaws so that (i) the Board shall increase in size from 7 to 8 members, effective the day prior to the 2015 Annual Meeting, creating a vacancy in Class I directors (whose term expire in 2016); and (ii) Michael L. Finch (the “Nominee”), who has consented to such appointment and has agreed to serve on the Board, shall be appointed to the Board to fill the resulting vacancy from the increase of the size of the Board.

The Board shall take all necessary actions, pursuant to the Bylaws, so that there are three Class I directorships to be filled by election at the 2016 annual meeting of stockholders of the Company.

As of the date of this Agreement, the Nominee will be appointed as an observer to the Board (the “Board Observer”) until the 2015 Annual Meeting. The Board Observer will (i) receive copies of all notices and written information furnished to the full Board, reasonably in advance of each meeting to the extent practicable, and (ii) be permitted to be present at all meetings of the full Board (whether by phone or in person). Notwithstanding the foregoing, (A) the Company shall be entitled to withhold any information and exclude the Board Observer from any meeting, or any portion thereof, as is reasonably determined by the Company to be necessary to protect the Company’s attorney-client privilege, or as otherwise may be appropriate until the Nominee is elected to the Board, and (B) the Board Observer shall execute a confidentiality agreement in form and substance reasonably acceptable to the Company with respect to the information and discussions to which the Board Observer will have access.

The Nominee will be required to: (i) comply with all policies, procedures, processes, codes, rules, standards and guidelines applicable to members of the Board; (ii) to keep confidential all Company confidential information and to not disclose to any third parties discussions or matters considered in meetings of the Board or Board committees; and (iii) complete the Company’s standard director & officer questionnaire and other reasonable and customary director onboarding documentation (including a representation agreement) required by the Company in connection with the election of Board members. The Company agrees that if the Nominee is unable to serve as a director, resigns as a director or is removed as a director prior to the Termination Date, then the Lone Star Value Stockholders shall have the ability to recommend a substitute person(s); provided that any substitute person recommended by the Lone Star Value Stockholders shall qualify as “independent” pursuant to New York Stock Exchange listing standards, and have relevant financial and business experience to fill the resulting vacancy. In the event the Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”) does not accept a substitute person recommended by the Lone Star Value Stockholders, the Lone Star Value Stockholders will have the right to recommend additional substitute person(s) for consideration by the Nominating Committee. Upon the acceptance of a replacement director nominee by the Nominating Committee, the Board will take such actions as to appoint such replacement director to the Board no later than 5 business days after the Nominating Committee recommendation of such replacement director.

The Company agrees that the Nominee shall be appointed to the Nominating and Corporate Governance Committee and shall be considered along with all other Board members for Board committee appointments in connection with the Board’s annual review of committee composition.

Effective as of the execution of this Agreement, each of the Lone Star Value Stockholders on behalf of itself and its respective Affiliates and Associates severally and not jointly agrees to appear in person or by proxy at the 2015 Annual Meeting and to vote all shares of Common Stock of the Company beneficially owned by such person and over which such person has voting power at the meeting (i) in favor of the Company’s nominees for election to the Board at the 2015 Annual Meeting, (ii) according to the recommendation of Institutional Shareholder Services (ISS) with respect to the Company’s “say-on-pay” proposal, (iii) according to the recommendation of ISS with respect to the Company’s authorized shares, (iv) according to the recommendation of ISS with respect to the Company’s LTIP, and (v) in favor of the ratification of the Company’s auditors.

The Company shall use its reasonable best efforts to hold the 2015 Annual Meeting no later than May 31, 2015.

|

2.

Section 2 of the 2014 Agreement in incorporated into this Agreement; provided that references to “Agreement” therein shall be deemed to be references to this Agreement; references to the “Lone Star Value

|

Stockholders” shall be deemed to be references to the Lone Star Value Stockholders party to this Agreement; and references to the “Termination Date” shall have the meaning set forth in Section 4 of this Agreement. |

|

3.

As of the date this Agreement, (i) The Company represents and warrants to the Lone Star Value Stockholders that the representations and warranties set forth in Section 3 of the 2014 Agreement are true and correct and (ii) each of the Lone Star Value Stockholders jointly and severally represents and warrants to the Company that the representations and warranties set forth in Section 4 of the 2014 Agreement are true and correct; provided that, in each case, references to “Agreement” therein shall be deemed to be references to this Agreement, references to the “Lone Star Value Stockholders” shall be deemed to be references to the Lone Star Value Stockholders party to this Agreement, references to the ownership of securities by Lone Star Value Stockholders shall be as of the date of the Group 13D and references to the “Group 13D” shall be deemed to be references to the Schedule 13D filed by Lone Star Value Stockholders with the SEC on October 30, 2014, as may be subsequently amended. |

|

4.

This Agreement shall terminate on the date (the “Termination Date”) that is 30 days prior to the expiration of the Company’s advance notice period for the nomination of directors at the 2016 annual meeting of stockholders of the Company, which date shall only be deemed to refer to the notice period as established by the Company’s bylaws and shall not, in any event, be deemed to refer to the date for submission of stockholder proposals as established by Rule 14a-8 of the Exchange Act. |

|

5.

Each Party shall each be responsible for its own fees and expenses incurred in connection with the negotiation, execution and effectuation of this Agreement and the transactions contemplated hereby, including, but not limited to, any matters related to the 2014 Annual Meeting; provided, however, that the Company shall reimburse the Lone Star Value Stockholders of the fees and expenses of Olshan Frome Wolosky LLP, in an amount not to exceed $40,000. |

|

6.

Sections 6, 7, 9, 10, 11, 12, 13, 14 and 15 of the 2014 Agreement are incorporated into this Agreement; provided that (i) the reference to Exhibit A in Section 6 of the 2014 Agreement shall be deemed instead to refer to Exhibit B to this Agreement; (ii) references to “Agreement” therein shall be deemed to be references to this Agreement; and (iii) references to the “Lone Star Value Stockholders” shall be deemed to be references to the Lone Star Value Stockholders party to this Agreement; . |

[Signature Page Follows]

IN WITNESS WHEREOF, this Agreement has been duly executed and delivered by the duly authorized signatories of the Parties as of the date first above written.

Callon Petroleum Company

By: /s/ Fred L. Callon

Name: Fred L. Callon

Title: Chairman & CEO

Lone Star Value Investors, LP

By: Lone Star Value Investors GP, LLC, its General Partner

By:/s/ Jeffrey E. Eberwein

Name: Jeffrey E. Eberwein

Title: Manager

Lone Star Value Co-Invest I, LP

By: Lone Star Value Investors GP, LLC, its General Partner

By:/s/ Jeffrey E. Eberwein

Name: Jeffrey E. Eberwein

Title: Manager

Lone Star Value Investors GP, LLC

By:/s/ Jeffrey E. Eberwein

Name: Jeffrey E. Eberwein

Title: Manager

[Signature Pages Continue]

[Signature Page to Letter Agreement]

Lone Star Value Management, LLC

By:/s/ Jeffrey E. Eberwein

Name: Jeffrey E. Eberwein

Title: Sole Member

/s/ Jeffrey E. Eberwein

Jeffrey E. Eberwein

(The undersigned is signing this Agreement solely for the purpose of acknowledging that he is willing to assume the obligations of a Director of Callon Petroleum Corporation, including those set forth in the first sentence of Section 1(e))

/s/ Michael L. Finch

Michael L. Finch

[Signature Page to Letter Agreement]

Exhibit A

[2014 Agreement]

AGREEMENT

This Agreement (this “Agreement”) is made and entered into as of March 9, 2014, by and among Callon Petroleum Company (the “Company”), Lone Star Value Investors L.P. (“LS LP”), Lone Star Value Co-Invest I, L.P. (“LS Co-Invest I”), Lone Star Value Investors GP, LLC (“LS GP”), Lone Star Value Management, LLC (“LS Management”), Jeffrey E. Eberwein (“Eberwein”) and Matthew R. Bob (together with LS LP, LS Co-Invest I, LS GP, LS Management and Eberwein, the “Lone Star Value Stockholders”) (each of the Company and the Lone Star Value Stockholders, a “Party” to this Agreement, and collectively, the “Parties”).

RECITALS

WHEREAS, the Company and the Lone Star Value Stockholders have engaged in various discussions and communications concerning the Company and its capital structure;

WHEREAS, the Lone Star Value Stockholders are deemed to beneficially own shares of common stock, $.01 par value, of the Company (the “Common Stock”) totaling, in the aggregate, 2,530,000 shares on the date of this Agreement, and Matthew R. Bob owns no shares of Common Stock; and

WHEREAS, the Company and the members of the Lone Star Value Stockholders have determined to come to an agreement with respect to the election of members of the Company’s board of directors (the “Board”) at the 2014 annual meeting of stockholders of the Company, including any adjournment or postponement thereof (the “2014 Annual Meeting”), certain matters related to the 2014 Annual Meeting and certain other matters, as provided in this Agreement.

NOW, THEREFORE, in consideration of the foregoing premises and the mutual covenants and agreements contained in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are acknowledged, the Parties, intending to be legally bound hereby, agree as follows:

|

1.

Board Matters; Board Appointments; 2014 Annual Meeting. |

|

(a)

Effective as of the execution of this Agreement (as defined below), each of the Lone Star Value Stockholders on behalf of itself and its respective Affiliates and Associates hereby severally and not jointly irrevocably withdraws the Lone Star Value Stockholder’s nomination letter submitted to the Company in December 2013 and any related materials, notices or demands submitted to the Company in connection therewith. Effective as of the execution of this Agreement, each of the Lone Star Value Stockholders on behalf of itself and its respective Affiliates and Associates hereby severally and not jointly further agrees that it will not, and that it will not permit any of its Affiliates or Associates to, (i) nominate or recommend for nomination any person for election at the 2014 Annual Meeting, directly or indirectly, (ii) submit any proposal for consideration at, or bring any other business before, the 2014 Annual Meeting, directly or indirectly, or (iii) initiate, encourage or participate in any “withhold” or similar campaign with respect to the 2014 Annual Meeting, directly or indirectly. Effective as of the execution of this Agreement, each of the Lone Star Value Stockholders on behalf of itself and its respective Affiliates and Associates hereby severally and not jointly agrees that it shall not publicly or privately encourage or support any other stockholder to take any of the actions described in this Section 1(a). During the term of this Agreement, the Board and all applicable committees of the Board shall not increase the size of the Board to more than eight (8) directors. |

|

(b)

The Board and all applicable committees of the Board shall take all necessary actions, pursuant to the Bylaws so that (i) the Board shall increase in size from 6 to 8 members, effective March 14, 2014; (ii) Matthew R. Bob and James M. Trimble, each of whom has consented to such appointment and has agreed to serve on the Board, shall be appointed to the Board to fill the resulting vacancies from the increase of the size of the Board, effective March 14, 2014; (iv) the Board shall nominate each of Matthew R. Bob, James M. Trimble and Anthony J. Nocchiero (collectively, the “2014 Board Nominees”) as Class II Directors for election to the Board at the 2014 Annual Meeting (and will announce that B.F. Weatherly does not intend to stand for reelection to the Board at the 2014 Annual Meeting); and (v) the Company shall recommend, support and solicit proxies at the 2014 Annual Meeting for each of the 2014 Board Nominees as the Company has solicited proxies for each nominee at the 2013 Annual Meeting. |

All 2014 Board Nominees will be required to: (i) comply with all policies, procedures, processes, codes, rules, standards and guidelines applicable to members of the Board; (ii) to keep confidential all Company confidential information and to not disclose to any third parties discussions or matters considered in meetings of the Board or Board committees; and (iii) complete the Company’s standard director & officer questionnaire and other reasonable and customary director onboarding documentation (including a representation agreement) required by the Company in connection with the election of Board members.

The Company agrees that if Mr. Bob is unable to serve as a director, resigns as a director or is removed as a director prior to the Termination Date, then the Lone Star Value Stockholders shall have the ability to recommend a substitute person(s); provided that any substitute person recommended by the Lone Star Value Stockholders shall qualify as “independent” pursuant to New York Stock Exchange listing standards, and have relevant financial and business experience to fill the resulting vacancy. In the event the Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”) does not accept a substitute person recommended by the Lone Star Value Stockholders, the Lone Star Value Stockholders will have the right to recommend additional substitute person(s) for consideration by the Nominating Committee. Upon the acceptance of a replacement director nominee by the Nominating Committee, the Board will take such actions as to appoint such replacement director to the Board no later than 5 business days after the Nominating Committee recommendation of such replacement director.

The Company agrees that the 2014 Board Nominees shall be considered along with all other Board members for Board committee appointment in connection with the Board’s annual review of committee composition. Notwithstanding the foregoing, the Company agrees that (i) each Messrs. Bob and Trimble shall be appointed to serve on the Strategic Planning Committee, (ii) Mr. Bob shall be appointed to serve on the Nominating Committee, and (iii) Mr. Trimble shall be appointed to serve as a member of the Compensation Committee The Board shall not establish an Executive Committee at any time prior to the Termination Date (as defined below).

Effective as of the execution of this Agreement, each of the Lone Star Value Stockholders on behalf of itself and its respective Affiliates and Associates hereby severally and not jointly agrees to appear in person or by proxy at the 2014 Annual Meeting and to vote all shares of Common Stock of the Company beneficially owned by such person and over which such person has voting power at the meeting (i) in favor of the 2014 Board Nominees, (ii) according to the recommendation of Institutional Shareholder Services (ISS) with respect to the Company’s “say-on-pay” proposal, and (iii) in favor of the ratification of the Company’s auditors.

The Company shall use its reasonable best efforts to hold the 2014 Annual Meeting no later than May 30, 2014.

|

1.

Standstill Provisions. Each of the Lone Star Value Stockholders on behalf of itself and its respective Affiliates and Associates (as each is defined below) hereby severally and not jointly agrees that from the date of this Agreement until the termination of this Agreement in accordance with Section 5 of this Agreement (the “Termination Date”), neither it nor any of its Affiliates or Associates will, and it will cause each of its Affiliates and Associates not to, directly or indirectly, in any manner: |

solicit, or encourage or in any way engage in any solicitation of, any proxies or consents or become a “participant” in a “solicitation” as such terms are defined in Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) of proxies or consents (including, without limitation, any solicitation of consents with respect to the call of a special meeting of stockholders), in each case, with respect to securities of the Company, or call or seek to call, or encourage, support or influence anyone with respect to the call of, a special meeting of stockholders;

advise, encourage, support or influence any person with respect to the voting of any securities of the Company at any annual or special meeting of stockholders, or seek to do so;

form, join or in any way participate in any “group” (within the meaning of Section 13(d)(3) of the Exchange Act) with respect to the Common Stock (other than a “group” that includes all or some of the persons identified on the Schedule 13D, as amended, filed by the Lone Star Value Stockholders prior to the date of this Agreement (the “Group 13D”), but does not include any other entities or persons not identified on Group 13D as of the date of this Agreement);

deposit any Common Stock in any voting trust or subject any Common Stock to any arrangement or agreement with respect to the voting of any Common Stock, other than any such voting trust, arrangement or agreement solely among the Lone Star Value Stockholders and otherwise in accordance with this Agreement;

seek or encourage any person to submit nominations in furtherance of a “contested solicitation” for the election or removal of directors with respect to the Company or seek, encourage or take any other action with respect to the election or removal of any directors or with respect to the submission of any stockholder proposal;

(i) make any proposal for consideration by stockholders at any annual or special meeting of stockholders of the Company or (ii) make any public suggestion or recommendation or makes any public or private offer or proposal (with or without conditions) in each case with respect to a share repurchase, dividend, self-tender or other change in capitalization, or with respect to any merger, acquisition, disposition, consolidation, recapitalization, restructuring, liquidation, dissolution, or other business combination or extraordinary transaction, in the case of any of the foregoing involving the Company or any subsidiary, business, division or Affiliate of the Company or encourage or assist any person or entity in connection therewith;

other than as provided in this Agreement, seek, alone or in concert with others, representation on the Board;

otherwise act, alone or in concert with others to make or cause to be made any statement disparaging of the Company, its directors or management including: (i) in any document or report filed with or furnished to the SEC or any other governmental agency, (ii) in any press release or other publicly available format, or (iii) to any analyst, journalist or member of the media (including without limitation, in a television, radio,

newspaper or magazine interview), or otherwise (it being agreed that the prosecution in good faith of litigation asserting that the Company has breached its obligations under this Agreement, in and of itself, shall not constitute a violation of this clause (h) to the extent it is necessary in such litigation to describe the facts underlying the asserted breach);

acquire, offer or propose to acquire, or agree to acquire (except by way of stock dividends, stock splits, reverse stock splits or other distributions or offerings made available to holders of any Voting Securities (as defined below) generally), directly or indirectly, whether by purchase, tender or exchange offer, through the acquisition of control of another person, by joining a partnership, limited partnership, syndicate or other group (as defined under Section 13(d) of the Exchange Act or otherwise, any Voting Securities if, as a result of such acquisition, the Lone Star Value Stockholders would beneficially own in the aggregate in excess of 12.5% of the then outstanding Voting Securities;

enter into any discussions, negotiations, arrangements or understandings with any third party with respect to the matters set forth in this Section 2; or

take any action which could cause or require the Company or any Affiliate of the Company to make a public announcement regarding any of the foregoing, seek or request permission to do any of the foregoing, make any request to amend, waive or terminate any provision of this Section 2 (including, without limitation, this Section 2(k)), or make or seek permission to make any public announcement with respect to any of the foregoing.

The Company, on behalf of itself and its respective Affiliates and Associates agrees that from the date of this Agreement until the Termination Date, neither it nor any of its Affiliates or Associates will, and it will cause each of its Affiliates and Associates not to, directly or indirectly, in any manner otherwise act, alone or in concert with others to make or cause to be made any statement disparaging of the Lone Star Value Stockholders, their respective directors or management including: (i) in any document or report filed with or furnished to the SEC or any other governmental agency, (ii) in any press release or other publicly available format, or (iii) to any journalist or member of the media (including without limitation, in a television, radio, newspaper or magazine interview), or otherwise (it being agreed that the prosecution in good faith of litigation asserting that any of the Lone Star Value Stockholders has breached its obligations under this Agreement, in and of itself, shall not constitute a violation of this paragraph to the extent it is necessary in such litigation to describe the facts underlying the asserted breach).

|

2.

Representations and Warranties of the Company. |

The Company represents and warrants to the Lone Star Value Stockholders that (a) the Company has the corporate power and authority to execute this Agreement and to bind it thereto, (b) this Agreement has been duly and validly authorized, executed and delivered by the Company, constitutes a valid and binding obligation and agreement of the Company, and is enforceable against the Company in accordance with its terms, and (c) the execution of this Agreement, the consummation of any of the transactions contemplated by this Agreement, and the fulfillment of the terms of this Agreement, in each case in accordance with the terms of this Agreement, will not conflict with, or result in a breach or violation of the organizational documents of the Company as currently in effect and (d) the execution, delivery and performance of this Agreement by the Company does not and will not violate or conflict with (i) any law, rule, regulation, order, judgment or decree applicable to the Company, or (ii) result in any breach or violation of or constitute a default (or an event which with notice or lapse of time or both could constitute such a breach, violation or default) under or pursuant to, or result in the loss of a material benefit under, or give any right of termination, amendment, acceleration or cancellation of, any organizational document, agreement, contract, commitment, understanding or arrangement to which the Company is a party or by which it is bound.

|

3.

Representations and Warranties of the Lone Star Value Stockholders. |

Each of the Lone Star Value Stockholders jointly and severally represents and warrants to the Company that (a) the authorized signatory of such Lone Star Value Stockholder set forth on the signature page hereto has the power and authority to execute this Agreement and any other documents or agreements to be entered into in connection with this Agreement and to bind it thereto, (b) this Agreement has been duly authorized, executed and delivered by such Lone Star Value Stockholder, and is a valid and binding obligation of such Lone Star Value Stockholder, enforceable against each in accordance with its terms, (c) the execution of this Agreement, the consummation of any of the transactions contemplated by this Agreement, and the fulfillment of the terms of this Agreement, in each case in accordance with the terms of this Agreement, will not conflict with, or result in a breach or violation of the organizational documents of such Lone Star Value Stockholder as currently in effect and (d) the execution, delivery and performance of this Agreement by such Lone Star Value Stockholder does not and will not violate or conflict with (i) any law, rule, regulation, order, judgment or decree applicable to such Lone Star Value Stockholder, or (ii) result in any breach or violation of or constitute a default (or an event which with notice or lapse of time or both could constitute such a breach, violation or default) under or pursuant to, or result in the loss of a material benefit under, or give any right of termination, amendment, acceleration or cancellation of, any organizational document, agreement, contract, commitment, understanding or arrangement to which such member is a party or by which it is bound. Each of the Lone Star Value Stockholder jointly and severally represents that, as of the date of this Agreement, it is deemed to beneficially own such number of shares of Common Stock as are indicated in the Group 13D. Each of the Lone Star Value Stockholders on behalf of itself and its respective Affiliates and Associates represents and warrants that it does not currently have, and does not currently have any right to acquire, any interest in any other securities of the Company or any Other Equity Rights (as defined below) (except as otherwise disclosed in the Group 13D) and is not “short” any Common Stock (as such term is commonly used by securities trading professionals). For purposes of this Agreement, the term “Other Equity Rights” shall mean any rights, options or other securities convertible into or exercisable or exchangeable (whether or not convertible, exercisable or exchangeable immediately or only after the passage of time or the occurrence of a specified event or otherwise) for Voting Securities or any obligations measured by the price or value of any securities of the Company or any of its Affiliates, including any swaps or other derivative arrangements designed to produce economic benefits and risks that correspond to the ownership of Voting Securities, whether or not any of the foregoing would give rise to beneficial ownership (as determined under Rule 13d3 promulgated under the Exchange Act), and whether or not to be settled by delivery of Voting Securities, payment of cash or by other consideration, and without regard to any “short” position under any such contract or arrangement, or other securities carrying any voting rights with respect to any of the foregoing.

|

4.

Termination. This Agreement shall terminate on the date that is 30 days prior to the expiration of the Company’s advance notice period for the nomination of directors in each case at the 2015 annual meeting of stockholders of the Company, which date shall only be deemed to refer to the notice period as established by the Company’s bylaws and shall not, in any event, be deemed to refer to the date for submission of stockholder proposals as established by Rule 14a-8 of the Exchange Act. |

|

5.

Press Release and SEC Filing. |

Promptly following the execution of this Agreement, the Company and Lone Star Value Stockholders shall jointly issue a mutually agreeable press release (the “Agreed Press Release”) announcing this Agreement, in the form attached hereto as Exhibit A. Neither the Company nor any Lone Star Value Stockholder shall make any public announcement or public statement that is inconsistent with or contrary to the statements made

in the Agreed Press Release, except as required by law or the rules of any stock exchange or with the prior written consent of the other Party.

The Lone Star Value Stockholders shall promptly prepare and file an amendment (the “13D Amendment”) to the Group 13D, reporting the entry into this Agreement and amending applicable items to conform to its obligations hereunder. The 13D Amendment shall be consistent with the Press Release and the terms of this Agreement. The Lone Star Value Stockholders shall provide the Company with reasonable opportunity to review and comment upon the 13D Amendment prior to filing, and shall consider in good faith but shall not be obligated in any way to accept any changes proposed by the Company necessary to cause such 13D Amendment to comply with this Agreement.

Each of the Lone Star Value Stockholders, on the one hand, and the Company, on the other hand, acknowledges and agrees that irreparable injury to the other Party hereto would occur in the event any of the provisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached and that such injury would not be adequately compensable by the remedies available at law (including the payment of money damages). It is accordingly agreed that each Lone Star Value Stockholder, on the one hand, and the Company, on the other hand (the “Moving Party”), shall each be entitled to specific enforcement of, and injunctive relief to prevent any violation of, the terms of this Agreement, and the other Party hereto will not take action, directly or indirectly, in opposition to the Moving Party seeking such relief on the grounds that any other remedy or relief is available at law or in equity. This Section 7 is not the exclusive remedy for any violation of this Agreement.

Each Party shall each be responsible for its own fees and expenses incurred in connection with the negotiation, execution and effectuation of this Agreement and the transactions contemplated hereby, including, but not limited to, any matters related to the 2014 Annual Meeting; provided, however, that the Company shall reimburse the Lone Star Value Stockholders of the fees and expenses of Olshan Frome Wolosky LLP, in an amount not to exceed $60,000.

If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to be invalid, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions of this Agreement shall remain in full force and effect and shall in no way be affected, impaired or invalidated. It is hereby stipulated and declared to be the intention of the Parties that the Parties would have executed the remaining terms, provisions, covenants and restrictions without including any of such which may be hereafter declared invalid, void or unenforceable. In addition, the Parties agree to use their best efforts to agree upon and substitute a valid and enforceable term, provision, covenant or restriction for any of such that is held invalid, void or enforceable by a court of competent jurisdiction.

Any notices, consents, determinations, waivers or other communications required or permitted to be given under the terms of this Agreement must be in writing and will be deemed to have been delivered: (i) upon receipt, when delivered personally; (ii) upon receipt, when sent by facsimile (provided confirmation of transmission is

mechanically or electronically generated and kept on file by the sending Party); or (iii) one business day after deposit with a nationally recognized overnight delivery service, in each case properly addressed to the Party to receive the same. The addresses and facsimile numbers for such communications shall be:

If to the Company:

Callon Petroleum Company

1401 Enclave Parkway, Suite 600

Houston, Texas 77077

Facsimile No.: (281) 589-8216

Attention: Joseph C. Gatto, Jr.

With copies (which shall not constitute notice) to:

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, New York 10019

Facsimile No.: (212) 403-2000

Attention: David A. Katz

and:

Haynes & Boone, LLP

One Houston Center

1221 McKinney, Suite 2100

Houston, Texas 77010

Facsimile No.: (713) 236-5699

Attention: George G. Young , III

If to any Lone Star Value Stockholder:

Lone Star Value Management, LLC

53 Forest Avenue, 1st Floor

Old Greenwich, Connecticut 06870

Facsimile No.: (203) 990-0727

Attention: Jeffrey E. Eberwein

With a copy (which shall not constitute notice) to:

Olshan Frome Wolosky LLP

Park Avenue Tower

65 East 55th Street

New York, New York 10022

Facsimile No.: (212) 451-2222

Attention: Steve Wolosky

This Agreement shall be governed by and construed and enforced in accordance with the laws of the State of Delaware without reference to the conflict of laws principles thereof that would result in the application of the laws of another jurisdiction. Each of the Parties hereto irrevocably agrees that any legal action or proceeding with respect to this Agreement and the rights and obligations arising hereunder, or for recognition and enforcement of any judgment in respect of this Agreement and the rights and obligations arising hereunder brought by the other Party hereto or its successors or assigns, shall be brought and determined exclusively in the Court of Chancery of the State of Delaware (or, if any such court declines to accept jurisdiction over a particular matter, any state or federal court within the State of Delaware) and any appellate court therefrom. Each of the Parties hereto hereby irrevocably submits with regard to any such action or proceeding for itself and in respect of its property, generally and unconditionally, to the personal jurisdiction of the aforesaid courts and agrees that it will not bring any action relating to this Agreement in any court other than the aforesaid courts. Each of the Parties hereto hereby irrevocably waives, and agrees not to assert in any action or proceeding with respect to this Agreement, (i) any claim that it is not personally subject to the jurisdiction of the above-named courts for any reason, (ii) any claim that it or its property is exempt or immune from jurisdiction of any such court or from any legal process commenced in such courts (whether through service of notice, attachment prior to judgment, attachment in aid of execution of judgment, execution of judgment or otherwise) and (iii) to the fullest extent permitted by applicable legal requirements, any claim that (A) the suit, action or proceeding in such court is brought in an inconvenient forum, (B) the venue of such suit, action or proceeding is improper or (C) this Agreement, or the subject matter of this Agreement, may not be enforced in or by such courts.

|

11.

Affiliates and Associates. The obligations of each Lone Star Value Stockholder herein shall be understood to apply to each of their respective Affiliates and Associates, and each Lone Star Value Stockholder agrees that it will cause its respective Affiliates and Associates to comply with the terms of this Agreement. As used in this Agreement, the terms “Affiliate” and “Associate” shall have the respective meanings set forth in Rule 12b-2 promulgated by the Securities and Exchange Commission under the Exchange Act, and shall include all persons or entities that at any time during the term of this Agreement become Affiliates or Associates of any person or entity referred to in this Agreement. |

|

12.

Voting Securities. As used in this Agreement, the term “Voting Securities” means the Common Stock, and any other securities (including voting preferred stock) issued by the Company which are entitled to vote generally for the election of directors of the Company, whether currently outstanding or hereafter issued (other than securities having such powers only upon the occurrence of a contingency). |

|

13.

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be considered one and the same agreement and shall become effective when counterparts have been signed by each of the Parties and delivered to the other Party (including by means of electronic delivery or facsimile). |

|

14.

Entire Agreement; Amendment and Waiver; Successors and Assigns; Third Party Beneficiaries. This Agreement contains the entire understanding of the Parties hereto with respect to its subject matter. There are no restrictions, agreements, promises, representations, warranties, covenants or undertakings between the Parties other than those expressly set forth herein. No modifications of this Agreement can be made except in writing signed by an authorized representative of each the Company and the Lone Star Value Stockholders . No failure on the part of any Party to exercise, and no delay in exercising, any right, power or remedy hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of such right, power or remedy by such Party preclude any other or further exercise thereof or the exercise of any other right, power or remedy. All remedies hereunder are cumulative and are not exclusive of any other remedies provided by law. The terms and conditions of this Agreement shall be binding upon, inure to the benefit of, and be enforceable by the Parties hereto and their respective successors, heirs, executors, legal representatives, and permitted assigns. No Party shall assign this

|

Agreement or any rights or obligations hereunder without, with respect to any member of the Lone Star Value Stockholders , the prior written consent of the Company, and with respect to the Company, the prior written consent of the Lone Star Value Stockholders . This Agreement is solely for the benefit of the Parties hereto and is not enforceable by any other persons. |

[The remainder of this page intentionally left blank]

IN WITNESS WHEREOF, this Agreement has been duly executed and delivered by the duly authorized signatories of the Parties as of the date first above written.

Callon Petroleum Company

By: /s/ Fred L. Callon

Name: Fred L. Callon

Title: Chairman & CEO

Lone Star Value Investors, LP

By: Lone Star Value Investors GP, LLC, its General Partner

By: /s/ Jeff Eberwein

Name: Jeffrey E. Eberwein

Title: Manager

Lone Star Value Co-Invest I, LP

By: Lone Star Value Investors GP, LLC, its General Partner

By: /s/ Jeff Eberwein

Name: Jeffrey E. Eberwein

Title: Manager

Lone Star Value Investors GP, LLC

By: /s/ Jeff Eberwein

Name: Jeffrey E. Eberwein

Title: Manager

Lone Star Value Management, LLC

By: /s/ Jeff Eberwein

Name: Jeffrey E. Eberwein

Title: Sole Member

/s/ Jeff Eberwein

Jeffrey E. Eberwein

/s/ Matthew R. Bob

Matthew R. Bob

Exhibit B

[Press Release]

NOT FOR IMMEDIATE RELEASE

Callon Petroleum Announces Agreement with Lone Star Value and Appointment of New Independent Director

Natchez, MS (March 23, 2015) – Callon Petroleum Company (NYSE: CPE) (“Callon” or the “Company”) today announced that it has entered into an agreement with Lone Star Value Management, LLC (“Lone Star Value”), pursuant to which Callon has agreed to expand the size of the Company’s Board of Directors (the “Board”) from seven to eight directors and to designate one new independent director – Michael L. Finch – to fill the newly-created directorship, effective the day prior to Callon’s 2015 annual meeting of stockholders. Mr. Finch will also be nominated by the Company for re-election to the Board, at the Company’s 2015 annual meeting of stockholders, as a Class I director (whose term expires at the 2016 annual meeting of stockholders).

Fred Callon, Callon’s Chairman and CEO, said, “Callon has long benefited from a strong Board that comprises industry leaders who have diverse expertise relevant to Callon’s strategies for growth and value creation. We look forward to additional contributions from Mike. We are pleased with the progress we are making as we continue to execute on the next phase of our growth strategy as a pure-play, onshore operator in the Permian Basin.”

“We appreciate Callon’s openness to adding fresh insight on the Board,” said Jeffrey E. Eberwein, founder and Chief Executive Officer of Lone Star Value. “Mike’s expertise in finance, audit, and oil and gas will be a strong complement to Callon’s Board. We look forward to continuing to work constructively with Callon and the Board to help enhance value for all stockholders.”

Pursuant to its agreement with Callon, Lone Star Value has agreed to certain customary standstill and voting provisions. The agreement will be filed on a Form 8-K with the Securities and Exchange Commission.

About Michael L. Finch

Michael L. Finch served as Chief Financial Officer and a member of the Board of Directors of Stone Energy Corporation from 1993 until his retirement in 1999. He was affiliated with Stone in a variety of capacities for nineteen years. Prior to his service with Stone, he was employed by an international public accounting firm in New Orleans, Louisiana. Mr. Finch also has served as a director and Audit Committee Chairman of PetroQuest Energy, Inc. since November 2003. Mr. Finch has been a private investor since 1999. He was licensed as a Certified Public Accountant in 1978, and received a Bachelor of Science in Accounting from the University of South Alabama in 1976.

About Callon Petroleum

Callon is an independent energy company focused on the acquisition, development, exploration, and operation of oil and gas properties in the Permian Basin in West Texas.

This news release is posted on the Company’s website at www.callon.com and will be archived there for subsequent review. It can be accessed from the “News Releases” link on the top of the homepage.

Cautionary Statement Regarding Forward Looking Statements

This news release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than historical facts, that address activities (including about the Pending Acquisition) that the Company assumes, plans, expects, believes, intends or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking

statements. The forward-looking statements are based on management's current beliefs, based on currently available information, as to the outcome and timing of future events. These forward-looking statements involve certain risks and uncertainties that could cause the results to differ materially from those expected by the Company's management. Information concerning these risks and other factors can be found in the Company's filings with the Securities and Exchange Commission, including its Annual Reports on Form 10-K, available on the Company's website or the SEC's website at www.sec.gov.

For further information contact:

Joe Gatto

Callon Petroleum, Senior Vice President and Treasurer

800-451-1294

Exhibit 99.1

Callon Petroleum Announces Agreement with Lone Star Value and Appointment of New Independent Director

Natchez, MS (March 23, 2015) – Callon Petroleum Company (NYSE: CPE) (“Callon” or the “Company”) today announced that it has entered into an agreement with Lone Star Value Management, LLC (“Lone Star Value”), pursuant to which Callon has agreed to expand the size of the Company’s Board of Directors (the “Board”) from seven to eight directors and to designate one new independent director – Michael L. Finch – to fill the newly-created directorship, effective the day prior to Callon’s 2015 annual meeting of stockholders. Mr. Finch will also be nominated by the Company for re-election to the Board, at the Company’s 2015 annual meeting of stockholders, as a Class I director (whose term expires at the 2016 annual meeting of stockholders).

Fred Callon, Callon’s Chairman and CEO, said, “Callon has long benefited from a strong Board that comprises industry leaders who have diverse expertise relevant to Callon’s strategies for growth and value creation. We look forward to additional contributions from Mike. We are pleased with the progress we are making as we continue to execute on the next phase of our growth strategy as a pure-play, onshore operator in the Permian Basin.”

“We appreciate Callon’s openness to adding fresh insight on the Board,” said Jeffrey E. Eberwein, founder and Chief Executive Officer of Lone Star Value. “Mike’s expertise in finance, audit, and oil and gas will be a strong complement to Callon’s Board. We look forward to continuing to work constructively with Callon and the Board to help enhance value for all stockholders.”

Pursuant to its agreement with Callon, Lone Star Value has agreed to certain customary standstill and voting provisions. The agreement will be filed on a Form 8-K with the Securities and Exchange Commission.

About Michael L. Finch

Michael L. Finch served as Chief Financial Officer and a member of the Board of Directors of Stone Energy Corporation from 1993 until his retirement in 1999. He was affiliated with Stone in a variety of capacities for nineteen years. Prior to his service with Stone, he was employed by an international public accounting firm in New Orleans, Louisiana. Mr. Finch also has served as a director and Audit Committee Chairman of PetroQuest Energy, Inc. since November 2003. Mr. Finch has been a private investor since 1999. He was licensed as a Certified Public Accountant in 1978, and received a Bachelor of Science in Accounting from the University of South Alabama in 1976.

About Callon Petroleum

Callon is an independent energy company focused on the acquisition, development, exploration, and operation of oil and gas properties in the Permian Basin in West Texas.

This news release is posted on the Company’s website at www.callon.com and will be archived there for subsequent review. It can be accessed from the “News Releases” link on the top of the homepage.

Cautionary Statement Regarding Forward Looking Statements

This news release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than historical facts, that address activities (including about the Pending Acquisition) that the Company assumes, plans, expects, believes, intends or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking statements. The forward-looking statements are based on management's current beliefs, based on currently available

information, as to the outcome and timing of future events. These forward-looking statements involve certain risks and uncertainties that could cause the results to differ materially from those expected by the Company's management. Information concerning these risks and other factors can be found in the Company's filings with the Securities and Exchange Commission, including its Annual Reports on Form 10-K, available on the Company's website or the SEC's website at www.sec.gov.

For further information contact:

Joe Gatto

Callon Petroleum, Senior Vice President and Treasurer

800-451-1294

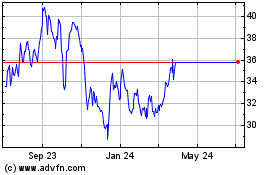

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Apr 2023 to Apr 2024