UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 2)

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report

October 8, 2014

(Date of earliest event reported)

Callon Petroleum Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-14039 |

|

64-0844345 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

200 North Canal St.

Natchez, Mississippi 39120

(Address of principal executive offices, including zip code)

(601) 442-1601

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

EXPLANATORY NOTE

As previously disclosed in its Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on October 14,

2014, Callon Petroleum Operating Company (“CPOC”), a subsidiary of Callon Petroleum Company (“Callon” or the “Company”), on October 8, 2014, completed the acquisition of certain undeveloped acreage and producing

oil and gas properties (the “Acquired Properties”) located in the Midland, Andrews, Ector and Martin Counties, Texas (the “Acquisition”) for an aggregate purchase price of approximately $210 million in cash, including estimated

purchase price adjustments, with an effective date of May 1, 2014. In conjunction with the closing of the Acquisition, the Company amended the borrowing base under its existing $500 million senior secured revolving credit facility to $250

million and replaced its existing $125 million secured second lien term loan with a new $300 million secured second lien term loan.

This Current Report

on Form 8-K/A updates unaudited pro forma consolidated financial statements required by Item 9.01 of Form 8-K. The financial statements of businesses acquired, which are required by Item 9.01 of Form 8-K, were included in the

Company’s Form 8-K filed on September 8, 2014 and November 4, 2014. This Current Report on Form 8-K/A should be read in connection with the Form 8-K filed on September 8, 2014, the Form 8-K filed on October 14, 2014, and the Form

8-K/A filed on November 4, 2014, which provide a more complete description of the Acquisition.

Section 9 – Financial Statements and

Exhibits

Item 9.01. Financial Statements and Exhibits.

| |

(b) |

Pro forma financial information. |

Unaudited Pro Forma Consolidated Statement of

Operations for the year ended December 31, 2014, is attached hereto as Exhibit 99.1.

|

|

|

| Exhibit

Number |

|

Exhibit Description |

|

|

| 99.1 |

|

Unaudited Pro Forma Consolidated Statement of Operations |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Callon Petroleum Company |

|

|

|

|

(Registrant) |

|

|

|

|

| March 9, 2015 |

|

|

|

By: |

|

/s/ Joseph C. Gatto, Jr. |

|

|

|

|

Joseph C. Gatto, Jr. |

|

|

|

|

Chief Financial Officer, Senior Vice President and Treasurer |

Exhibit Index

|

|

|

| Exhibit

Number |

|

Exhibit Description |

|

|

| 99.1 |

|

Unaudited Pro Forma Consolidated Statement of Operations |

Exhibit 99.1

CALLON PETROLEUM COMPANY, INC.

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS

On October 8, 2014, Callon Petroleum Company, Inc., (“Callon” or the “Company”), completed the purchase of certain undeveloped

acreage and producing oil and gas assets (the “Acquired Properties”) located in Midland, Andrews, Martin and Ector Counties, Texas (the “Acquisition”) for an aggregate cash purchase price of $210 million (including purchase price

adjustments) with an effective date of May 1, 2014.

In connection with the closing of the Acquisition, on October 8, 2014, the borrowing base

under the Company’s existing $500 million senior secured revolving credit facility was amended to $250 million (the “Credit Facility”), and the Company replaced its existing $125 million secured second lien term loan (the “Second

Lien Loan”) with a new $300 million secured second lien term loan (the “New Second Lien Loan”). The Company used the proceeds from the initial advance under the New Second Lien Loan to pay a portion of the purchase price of the

Acquisition, repay in full the amounts outstanding under the existing Second Lien Loan, and repay borrowings under the Credit Facility.

On

September 15, 2014, the Company completed a public offering of 12,500,000 shares of its common stock at a price to the public of $9.00 per share, before underwriting discounts, and the exercise in full by the underwriters of their option to

purchase 1,875,000 additional shares of common stock at $9.00 per share, which also closed on September 15, 2014. Net proceeds from the sale of the 14,375,000 shares of common stock, after the underwriting discount and offering expenses of $6.9

million, were approximately $122 million. The Company used the net proceeds from this offering to fund a portion of the purchase price of the Acquisition.

We derived the unaudited pro forma consolidated statement of operations from the historical consolidated financial statements of the Company and the statement

of revenues and direct operating expenses of the Acquired Properties. The unaudited pro forma consolidated statement of operations for the year ended December 31, 2014 gives effect to the Acquisition, the debt transactions and the issuance of

common stock referred to above as if they occurred on January 1, 2013.

The pro forma adjustments are based on available information and certain

assumptions that we believe are reasonable. Assumptions underlying the pro forma adjustments are described in the accompanying notes, which should be read in conjunction with the unaudited pro forma consolidated statement of operations.

The unaudited pro forma consolidated statement of operations is presented for illustrative purposes only and does not purport to indicate the results of

operations of future periods or the results of operations that actually would have been realized had the transactions been consummated on the date or for the period presented. The unaudited pro forma consolidated statement of operations should be

read in conjunction with the audited December 31, 2014 consolidated financial statements and notes thereto contained in the Company’s Annual Report on Form 10-K filed on March 5, 2015.

1

CALLON PETROLEUM COMPANY

Unaudited Pro forma Consolidated Statement of Operations for the Year ended December 31, 2014

($ in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Historical |

|

|

Acquired

Properties |

|

|

Pro forma

Adjustments |

|

|

Pro forma |

|

| Operating revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Oil sales |

|

$ |

139,374 |

|

|

$ |

23,934 |

(a) |

|

$ |

— |

|

|

$ |

163,308 |

|

| Natural gas sales |

|

|

12,488 |

|

|

|

4,662 |

(a) |

|

|

— |

|

|

|

17,150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating revenues |

|

|

151,862 |

|

|

|

28,596 |

|

|

|

— |

|

|

|

180,458 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lease operating expenses |

|

|

22,372 |

|

|

|

4,188 |

(a) |

|

|

— |

|

|

|

26,560 |

|

| Production taxes |

|

|

8,973 |

|

|

|

1,103 |

(a) |

|

|

— |

|

|

|

10,076 |

|

| Depreciation, depletion and amortization |

|

|

56,724 |

|

|

|

— |

|

|

|

8,043 |

(b) |

|

|

64,767 |

|

| General and administrative |

|

|

25,109 |

|

|

|

— |

|

|

|

— |

|

|

|

25,109 |

|

| Accretion expense |

|

|

826 |

|

|

|

— |

|

|

|

6 |

(b) |

|

|

832 |

|

| Gain on sale of other property and equipment |

|

|

(1,080 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1,080 |

) |

| Acquisition expense |

|

|

668 |

|

|

|

— |

|

|

|

— |

|

|

|

668 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

113,592 |

|

|

|

5,291 |

|

|

|

8,049 |

|

|

|

126,932 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

38,270 |

|

|

|

23,305 |

|

|

|

(8,049 |

) |

|

|

53,526 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (income) expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

9,772 |

|

|

|

— |

|

|

|

9,405 |

(c) |

|

|

19,177 |

|

| Gain on early extinguishment of debt |

|

|

(151 |

) |

|

|

— |

|

|

|

— |

|

|

|

(151 |

) |

| Loss (gain) on derivative contracts |

|

|

(31,736 |

) |

|

|

— |

|

|

|

— |

|

|

|

(31,736 |

) |

| Other income expense |

|

|

(515 |

) |

|

|

— |

|

|

|

— |

|

|

|

(515 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other (income) expenses |

|

|

(22,630 |

) |

|

|

— |

|

|

|

9,405 |

|

|

|

(13,225 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

|

|

60,900 |

|

|

|

23,305 |

|

|

|

(17,454 |

) |

|

|

66,751 |

|

| Income tax expense |

|

|

23,134 |

|

|

|

— |

|

|

|

2,048 |

(d) |

|

|

25,182 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

37,766 |

|

|

|

23,305 |

|

|

|

(19,502 |

) |

|

|

41,569 |

|

| Preferred stock dividends |

|

|

(7,895 |

) |

|

|

— |

|

|

|

— |

|

|

|

(7,895 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) available to common stockholders |

|

$ |

29,871 |

|

|

$ |

23,305 |

|

|

$ |

(19,502 |

) |

|

$ |

33,674 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.67 |

|

|

|

|

|

|

|

|

|

|

$ |

0.57 |

|

| Diluted |

|

$ |

0.65 |

|

|

|

|

|

|

|

|

|

|

$ |

0.56 |

|

| Shares used in computing income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

44,848 |

|

|

|

|

|

|

|

14,375 |

(e) |

|

|

59,223 |

|

| Diluted |

|

|

45,961 |

|

|

|

|

|

|

|

14,375 |

(e) |

|

|

60,336 |

|

2

1. Basis of Presentation

On October 8, 2014, Callon Petroleum Company, Inc., (“Callon” or the “Company”), completed the purchase of certain undeveloped acreage

and producing oil and gas assets (the “Acquired Properties”) located in Midland, Andrews, Martin and Ector Counties, Texas (the “Acquisition”) for an aggregate cash purchase price of $210 million (including estimated purchase

price adjustments) with an effective date of May 1, 2014.

In connection with the closing of the Acquisition, on October 8, 2014, the borrowing

base under the Company’s existing $500 million senior secured revolving credit facility was amended to $250 million (the “Credit Facility”) and the Company replaced its existing $125 million secured second lien term loan (the

“Second Lien Loan”) with a new $300 million secured second lien term loan (the “New Second Lien Loan”). The Company used the proceeds from the initial advance under the New Second Lien Loan to pay a portion of the purchase price

of the Acquisition, repay in full the amounts outstanding under the existing Second Lien Loan, and repay borrowings under the Credit Facility.

On

September 15, 2014, the Company completed a public offering of 12,500,000 shares of its common stock at a price to the public of $9.00 per share, before underwriting discounts, and the exercise in full by the underwriters of their option to

purchase 1,875,000 additional shares of common stock at $9.00 per share, which also closed on September 15, 2014. Net proceeds from the sale of the 14,375,000 shares of common stock, after the underwriting discount and offering expenses of $6.9

million, were approximately $122 million. The Company used the net proceeds from this offering to fund a portion of the purchase price of the Acquisition.

The accompanying unaudited consolidated pro forma statement of operations for the year ended December 31, 2014 assumes the Acquisition, the debt transactions

and the issuance of common stock discussed above occurred on January 1, 2013.

The unaudited consolidated pro forma statement of operations is

presented for illustrative purposes only and does not purport to represent what the Company’s results of operations would have been if the Acquisition, the debt transactions and the issuance of common stock had occurred as presented, or to

project the Company’s results of operations for any future periods. The pro forma adjustments are based on available information and certain assumptions that management believes are reasonable. The pro forma adjustments are directly

attributable to the Acquisition, the debt transactions and the issuance of common stock and are expected to have a continuing impact on the Company’s results of operations. In the opinion of management, all adjustments necessary to present

fairly the unaudited consolidated pro forma financial statements have been made.

3

2. Pro Forma Adjustments

Pro forma Statement of Operations for the year ended December 31, 2014

| |

(a) |

To record the historical revenues and direct operating expenses related to the Acquired Properties. |

| |

(b) |

To record depreciation, depletion, and amortization and accretion of the asset retirement obligations related to the Acquired Properties. |

| |

(c) |

To record $20.2 million of interest related to borrowings under the New Second Lien Loan and $2.2 million of amortization of the deferred financing costs related to the Credit Facility and the New Second Lien Loan,

partially offset by the reversal of $5.5 million of interest expense and amortization of deferred financing costs related to the repayment of amounts outstanding under the Second Lien Loan and the Credit Facility. The interest expense adjustment of

$9.4 million is net of $7.6 million of estimated interest costs capitalized to unevaluated oil and gas properties. |

| |

(d) |

To record the income tax effects of the above pro forma adjustments based on the Company’s estimated effective income tax rate. |

| |

(e) |

To record the issuance of 14,375,000 shares of common stock at an offering price of $9.00 per share, resulting in approximately $122 million in net proceeds after deducting $6.9 million of estimated underwriting

commissions and issuance costs. |

The pro forma statement of operations does not include adjustments for the termination fee and write off of

deferred charges related to the extinguishment of the Second Lien Loan as such adjustments do not have a continuing impact on operations.

4

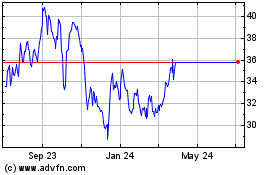

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Apr 2023 to Apr 2024