Lehman Wants Ad Hoc Group To Disclose More About Itself

March 31 2011 - 1:30PM

Dow Jones News

Lehman Brothers Holdings Inc. (LEHMQ) says an ad hoc group of

creditors proposing a competing bankruptcy plan in its Chapter 11

case is acting as a "de facto committee" and thus must make more

disclosures about its interests in the case if it wants to be

involved.

In a Wednesday filing with U.S. Bankruptcy Court in Manhattan,

Lehman says the ad hoc group of 13 bondholders should be forced to

comply with a bankruptcy rule that requires certain groups to

disclose not only the total amount of their claims, but also the

dates they obtained the securities and how much they paid for them.

The bondholders' group consists of hedge fund managers including

Paulson & Co. and pension funds including California Public

Employees' Retirement System

The investors call themselves the ad hoc group of Lehman

Brothers Creditors, and in a March filing they disclosed they have

13 members holding $20.2 billion across several Lehman entities,

including $16.1 billion in senior secured notes. Besides Paulson

and Calpers, the group includes hedge-fund manager Perry Capital

and bond giant Pimco.

Such disclosures aren't enough to comply with bankruptcy Rule

2019, Lehman says in its court papers, because in Lehman's view the

group "functions as an entity or de facto committee," which if true

would step up the group's reporting requirements.

"The Ad Hoc Group has not publicly provided even minimal

information required under Rule 2019, and absent compliance, should

be barred from participation in these Chapter 11 cases," Lehman

said.

A spokesman for Paulson didn't immediately respond to a request

for comment.

On Tuesday, the group asked Judge James Peck of U.S. Bankruptcy

Court in Manhattan to consider its rival plan for the distribution

of Lehman's assets on the same timetable as Lehman's, meaning a

June 28 hearing to send the plan to creditors for a vote and a Nov.

17 court date for Peck to confirm the plan.

A hearing on the disclosure requirements and whether the two

plans can be considered simultaneously has been set for April 13 in

front of Peck.

Lehman's amended bankruptcy proposal, filed in late January,

gives creditors a better recovery than the original plan filed last

spring. Creditors holding senior unsecured claims against Lehman

would recover 21.4% under the new plan, up from 17.4%. Those

creditors must vote for the plan to get the full recovery. If they

vote against the plan, they would get less. Creditors of several

Lehman subsidiaries may see even-better improvements.

The ad hoc group filed a plan late last year that calls for

senior bondholders like its members to get more than 24 cents on

the dollar. Some other creditors would see a drop in their

recoveries.

The ad hoc group has said that its main problem with Lehman's

proposal is that it establishes a "pot of assets" to pay back

creditors, which is "seriously flawed," particularly in the way it

handles intercompany claims between various Lehman businesses. That

plan, the group said, could allow for double recovery, or a "double

dip," for some creditors.

Certain Lehman creditors, many of them big banks, have claims on

derivatives contracts against both their counterparty on the

contract and the Lehman parent company as a whole.

Lehman said in January it would incorporate some of the ad hoc

group's ideas into its plan, but in its new plan said it doesn't

support the competing proposal.

Lehman's collapse in September 2008 marked the largest

bankruptcy case ever filed. Since then, a team of hundreds of

bankruptcy professionals under the direction of restructuring firm

Alvarez & Marsal has managed Lehman's assets--which include

real-estate holdings, corporate debt and derivatives--for the

benefit of creditors.

Lehman estimated earlier this year that it will likely have $322

billion in allowed claims against the estate, with $272 billion

from the parent company and about $50 billion from its various

subsidiaries. The bank increased creditors' expected net recovery

by $2.6 billion from the $57.5 billion it estimated in a September

court presentation.

(Dow Jones Daily Bankruptcy Review covers news about distressed

companies and those under bankruptcy protection.)

-By Joseph Checkler; Dow Jones Newswires; 212-416-2152;

joseph.checkler@dowjones.com

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

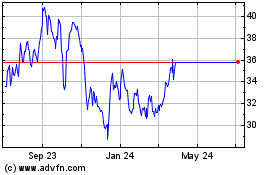

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Apr 2023 to Apr 2024