Pension Funds Press For Changes At Massey Energy

October 05 2010 - 6:36PM

Dow Jones News

An investor group including Calpers is asking shareholders to

vote on Massey Energy Co.'s (MEE) management-sponsored governance

proposals at a meeting Wednesday that marks the latest in an

investor push for changes in management.

The issues at stake--including proposals that would institute

annual elections of directors, eliminate supermajority voting

requirements and allow shareholders to call special

meetings--gained momentum after the deadliest U.S. coal mining

accident in 40 years killed 29 at a Massey mine in April.

"Last spring's disaster at Upper Big Branch invited sharp

demands for improved approaches to safety, health, management,

compensation and governance practices," Pennsylvania State

Treasurer Rob McCord said in a statement from the investor

group.

The group does not support a proposal to remove cumulative

voting, which would let shareowners apply all of their combined

shares for director seats to one or more candidates rather than

separately for each director.

"Investors have pushed for these governance changes to

strengthen accountability," said Anne Simpson, senior portfolio

manager heading the corporate governance program for the California

Public Employees' Retirement System, the biggest U.S. public

pension fund by assets. "Now is the time to act and make sure those

changes take place."

"My only comment would be to urge shareholders to vote," said

Roger Hendriksen, Richmond, Va.-based Massey's director of investor

relations.

The company came under fire this spring from institutional

investors alleging that company safety lapses contributed to an

April 5 explosion in Montcoal, W.Va., that killed 29 men.

Public-pension fund managers urged the ouster of three board

members at the company's annual meeting in May.

Massey recently added two new outside directors amid concern

from some investors that existing directors aren't sufficiently

independent of Massey's CEO Don Blankenship. This spring the

union-backed CtW Investment Group said Blankenship should be

removed from his posts.

The investors coalition--which also includes the Office of

Connecticut State Treasurer, Illinois State Board of Investment,

Maryland State Pension and Retirement System, New York State Common

Retirement Fund, North Carolina Department of State Treasurer, and

Pennsylvania Treasury--owns 1,556,331 shares of Massey Energy

valued at over $23 million.

-By Matt Whittaker, Dow Jones Newswires; 212-416-2139;

matt.whittaker@dowjones.com

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

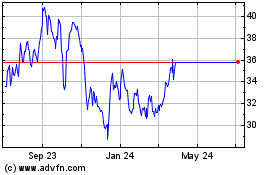

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Apr 2023 to Apr 2024