Canadian Pacific Railway

Railroad Warns On Weaker Results

Canadian Pacific Railway Ltd. warned on Tuesday its

second-quarter results would take a hit from declining shipping

volumes amid a commodity swoon that includes grain and potash,

wildfires in energy-rich Alberta and a stronger domestic

currency.

Canada's second-largest railroad said it expects second-quarter

revenue to fall about 12% from a year earlier while adjusted

per-share earnings could fall about 18%.

Both measures are well off current analyst estimates, which had

put earnings for the quarter ending June 30 up slightly from a year

earlier and revenue off just 5%, according to Thomson Reuters.

The railway, based in Calgary, Alberta, also expects its key

operating ratio to worsen to 62% for the period, up from 60.9% a

year earlier and 58.9% in the first quarter. The ratio is the

percentage of revenue consumed by operating costs, so an increase

represents a worsening.

The ratio's projected increase would represent the biggest such

rise since Hunter Harrison became chief executive of the railroad

in June 2012, following a proxy battle led by William Ackman, CEO

of Pershing Square Capital Management LP and a major CP

shareholder. CP's operating ratio stood at 81.3% at the end of

2011, making it the worst-performing railroad among its North

American peers at the time, but it has steadily improved under Mr.

Harrison's watch to an all-time low in the first quarter of this

year.

"CP will continue to focus on controlling costs in a difficult

environment," Mr. Harrison said in a release.

The commodity sector has been hard hit by slumping prices, which

have pressured shipping volumes, while wildfires in May around Fort

McMurray, Alberta, added to shipment headwinds. A recent rally in

the Canadian dollar will also mean lower revenue as U.S.-bound

cargo is often priced in U.S. dollars and results in a hit when

converted back to domestic currency.

Canadian National Railway Co., CP's main domestic rival, is also

feeling the pinch from lower shipping volumes. Incoming CEO Luc

Jobin told an industry conference last week the railroad's carload

volumes were down between 4% to 6% this year.

According to American Association of Railroads data, Canadian

railroads reported 15.4% fewer carloads in May than April, while

intermodal shipments -- the biggest revenue driver for CN and CP --

were down 6.0%. Total Canadian rail traffic is down about 7.6% so

far this year, while carloads have fallen for 14 consecutive

months.

In April, CP shelved its nearly $30 billion pursuit of Norfolk

Southern Corp. after encountering heavy opposition from rival

railroads, shippers and U.S. politicians. The proposed merger would

have created one of North America's largest railroads, with annual

revenues of about $16 billion.

The company said on its first-quarter earnings call that it

expected to cut about 1,300 jobs over the next year. It didn't

specify on Tuesday what its specific cost-reduction plans are.

During an investor conference last month, CP President Keith

Creel said the railroad plans to lay off an additional 200 workers

by the end of next month.

Despite cutting costs, weak shipping volumes reported by CP in

the quarter-to-date raise questions about whether the company can

achieve the results it forecast for 2016, said Benoit Poirier,

transportation analyst at Desjardins Capital Markets.

"We remain skeptical about CP's ability to achieve its 2016

guidance in light of the lack of visibility on a volume recovery in

the second half of 2016," Mr. Poirier said.

CP had revenue of 1.65 billion Canadian dollars ($1.29 billion)

in its year-ago second quarter and an adjusted profit of C$2.45 a

share. Guidance for this year's second quarter is for adjusted

earnings of C$2 a share.

The railway's latest guidance for the year is for double-digit

growth in earnings per share and an operating ratio below 59%.

CP plans to report second-quarter results on July 20.

--David George-Cosh and Judy McKinnon

Impax Laboratories

Pact Is Reached For Generic Drugs

Impax Laboratories Inc. said Tuesday that it would buy a

portfolio of generic drugs from Israel's Teva Pharmaceutical

Industries Ltd. and Allergan PLC for $586 million as Teva works to

complete its planned purchase of Allergan's generics unit.

The deal includes 15 currently sold generics, several drugs in

the pipeline and the rights to generic Concerta, which treats

attention-deficit hyperactivity disorder and was part of a

partnership between Impax and Teva.

For almost a year, Teva has been working to close its $40.5

billion purchase of Allergan's generics unit. In March, Teva said

the deal would be finalized later than expected as it works to

obtain regulatory approval.

This month, Teva and Allergan sold five abbreviated new drug

applications to hospital pharmaceutical provider Sagent

Pharmaceuticals Inc. $40 million, and Teva sold eight drugs to

India's Dr. Reddy's Laboratories for $350 million.

On Tuesday, Impax said the deal expands its portfolio of

difficult-to-make and limited-competition products.

The alread-to-market drugs included in the deal brought in $150

million in sales and about $100 million in gross profit in 2015, a

good chunk of Impax's $860.5 million in revenue that year.

Impax raised its profit guidance for the year because of the

deal. It now expects at least 20% profit growth, compared with at

least 10% previously. Analysts polled by Thomson Reuters had

expected 9% growth.

The deal is being funded by cash and $400 million in debt and is

subject to customary closing conditions, Federal Trade Commission

approval and the closing the Teva and Allergan deal.

--Austen Hufford

Kion Group

German Firm Makes Logistics Push

FRANKFURT -- Germany's Kion Group AG, a supplier of forklift

trucks and warehouse equipment, is buying Dematic Corp. of the U.S.

for roughly $2.1 billion in cash to grab a share of booming,

e-commerce-driven demand for automated logistics centers.

The move by Kion could help give its largest shareholder,

China's state-owned Weichai Power, a foothold in the U.S. Dematic

equipment and software have been used at production facilities of

companies including Ford Motor Co. and Harley-Davidson Inc. Dematic

also is involved in automating warehouses and distribution centers

of Amazon.Com and Wal-Mart Stores Inc.

"Kion Group and Dematic together will design and deliver

solutions that better position our customers to respond to dynamic

demand," said Ulf Henriksson, chief executive of Dematic.

Kion's largest shareholder is Chinese diesel-engine maker

Weichai Power, with a 38.3% stake. The remainder trades freely on

the Frankfurt Stock Exchange and it is included in Germany's MDAX

midcap index.

Kion said that by buying Dematic it aimed to become a "one-stop

supplier of intelligent supply-chain solutions." It predicts that

demand for supply-chain automation will grow 10% by 2019.

The company said it is the largest manufacturer of industrial

forklift trucks in Europe, the global number-two behind Toyota

Motor Corp. and the leading foreign supplier in China.

The deal comes amid growing competition between traditional

bricks-and-mortar retailers and e-commerce specialists for online

business. Peapod Inc., a food-retailing unit of pending merger

partners Ahold and Delhaize Group, for example, recently built a

400,000 sq. ft. fulfillment center, running in part on Dematic

software, to compete better with online grocery businesses such as

Amazon.com and Fresh Direct in New York.

Chinese companies have been on a buying spree in 2016, making

the country the world's top foreign acquirer to date, according to

data provider Dealogic. If it finishes in first place, it would be

the first the U.S. hasn't held pole position since 2007.

Together, Kion and Dematic would have had revenue of EUR6.7

billion ($7.6 billion) last year, an adjusted operating profit

margin of around 9.4% and a global workforce of 30,000, Kion

said.

The merged company should be able to cut costs and boost revenue

by combining the two firms' geographical reach in key markets such

as Europe, China, Brazil and the U.S., the Wiesbaden-based firm

said.

The company will initially fund the transaction via a EUR3

billion bridge loan from a group of banks. At 1310 GMT Kion shares

were trading 7% lower at EUR45.33.

--Ulrike Dauer and William Wilkes

Nissan Motor

Auto Maker Seeks Injunction Against 'Vote Leave'

TOKYO -- Nissan Motor Co. said it has taken legal action in the

U.K. to stop the "Vote Leave" campaign from using its name and logo

in materials backing a British departure from the European

Union.

Nissan said Tuesday that it asked Britain's High Court on Monday

for an injunction against Vote Leave, just ahead of the Thursday

vote.

The auto maker said in a statement that Vote Leave was using its

name and logo on its website and in promotional materials without

permission, and in ways that misrepresent its views on a possible

"Brexit." Vote Leave, which is the most prominent group campaigning

for a Brexit, hasn't stopped doing so despite repeated requests, it

said.

The Japanese auto maker isn't the only global company protesting

the use of its corporate identity in Vote Leave promotional

materials. Multinationals like General Electric Co., Unilever PLC

and Airbus Group SE have also complained that their logos were used

by the campaign without their permission.

Nissan, which employs about 8,000 people in the U.K. and ranks

as the second-biggest car maker there by output, has said it

opposes a Brexit. It makes more than 475,000 vehicles annually in

the U.K., 80% of which are exported. A British departure from the

EU would likely make it more difficult and costlier to export its

vehicles from the U.K.

"Our preference as a business is, of course, that the U.K. stays

within Europe. It makes the most sense for jobs, trade and costs.

For us, a position of stability is more positive than a collection

of unknowns," Nissan Chief Executive Carlos Ghosn said

previously.

Toyota Motor Co. said this month that it had also repeatedly

warned Vote Leave to stop the unauthorized use of the company's

trademark, and was considering legal action.

The world's largest car maker also prefers the U.K. stay in the

EU. Toyota employs 3,400 people at two production sites in the U.K.

Last year, it produced 190,000 vehicles and 240,000 engines

there.

--Megumi Fujikawa

(END) Dow Jones Newswires

June 22, 2016 02:52 ET (06:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

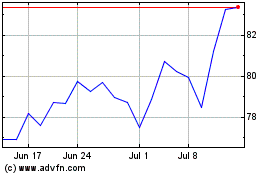

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024