Merger Breakups Increase to Record -- WSJ

May 09 2016 - 3:02AM

Dow Jones News

By Stephen Grocer

For deal makers, 2016 is set to be another record year, just not

the type of record anyone wants.

Last week Halliburton Co. and Baker Hughes Inc. called off their

nearly $35 billion deal after facing resistance from regulators.

The transaction's failure brought the value of withdrawn U.S. deals

to $378 billion. That is not only the highest level year to date

for U.S. withdrawn deals, it is the highest total for a full year,

according to Dealogic.

World-wide buyers have canceled $489 billion of deals so far

this year, according to Dealogic, the second highest year-to-date

level since the $505 billion in 2007.

The failure of the Halliburton-Baker Hughes deal comes after

Pfizer Inc. called off its $150 billion tie-up with Allergan PLC

after the Treasury introduced new rules further curbing inversions.

Other deals were abandoned for more traditional reasons: Honeywell

International Inc. and Canadian Pacific Railway Ltd. dropped

unsolicited bids to buy United Technologies Corp. and Norfolk

Southern Corp., while China's Anbang Insurance Group Co. walked

away from a $14 billion proposal to buy Starwood Hotels &

Resorts Worldwide Inc.

The stream of withdrawn deals is likely to continue. There are a

number of large deals that face hurdles to closing. Just last week

Energy Transfer Equity LP Chief Executive Kelcy Warren told

investors his company's proposed $32 billion takeover of Williams

Cos. can't go forward as is.

There are also $114 billion in unsolicited or hostile bids that

are still pending, according to Dealogic.

--

Stephen Grocer

(END) Dow Jones Newswires

May 09, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

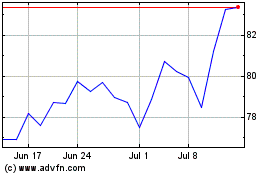

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024