Norfolk Southern to Cut Jobs, Rail Lines--Update

January 27 2016 - 10:23AM

Dow Jones News

By Anne Steele

Norfolk Southern Corp. said it would cut 2,000 jobs and downsize

its rail lines after reporting its profit dropped a

worse-than-expected 29% in the final quarter of the year as the

railway tries to fend off a takeover attempt and deals with weak

demand for coal.

The job cuts are part of Norfolk Southern's cost-reduction plan,

which it had previously announced but hadn't detailed. The company

said Wednesday it would cut expenses by more than $650 million

annually by 2020 on compensation and benefits cuts as well as

savings on fuel, purchased services and rents.

The sweeping cost reduction plans come as the company tries to

rebuff a takeover attempt from Canadian Pacific Railway Ltd. Last

month, the board shot down Canadian Pacific's latest offer--$30

billion in cash-and-stock plus a financial incentive known as a

contingent-value right--calling it "grossly inadequate" in a

sharply-worded letter that challenged the rationale for a

merger.

To achieve cost savings, Norfolk will reduce its overall head

count by about 6.7%, focusing on areas affected by lower coal

traffic, and cut its overtime to half its 2015 level. A company

spokesperson said its workforce totaled about 30,000.

The company said it would consolidate its operating regions to

two from three and halt or reduce operations in several hump or

secondary yards in 2016. The railroad will dispose of or downgrade

1,500 miles of its secondary lines by 2020, including 1,000 miles

in 2016, and reroute traffic onto higher-density lines.

Norfolk Southern said the improved productivity would help save

$420 million annually, accounting for a significant chunk of the

$650 million target, by 2020.

"This plan will enable us to achieve significant annual expense

savings beginning in 2016 without compromising the company's

ability to capitalize on volume and revenue growth opportunities,"

Chief Executive James Squires said in prepared remarks.

In the most recent quarter, the company posted a profit of $361

million, or $1.20 a share, down from $511 million, or $1.64 a

share, a year earlier. Revenue dropped 12% to $2.52 billion.

Analysts surveyed by Thomson Reuters forecast earnings of $1.23 a

share on $2.57 billion in revenue.

The railroad operator cited the restructuring of the company's

Triple Crown Services unit and the closing of offices in Roanoke,

Va., for hurting earnings by $31 million.

Meanwhile, revenue from coal--which continues to be a drag on

the railroad sector's results--plunged 20% to $433 million when

compared with the same period a year ago. Coal volumes fell

18%.

There has been less demand for coal as natural-gas prices have

fallen, making the alternative attractive. And slowing economic

growth in China and the strengthening of U.S. dollar--which makes

most American products and services more expensive overseas--also

has dented coal exports. Sliding fuel prices have also pinched

fuel-surcharge fees, a key revenue stream for railways.

Intermodal revenue skidded 13% to $563 million, as the Triple

Crown restructuring and fewer domestic shipments dented traffic

volume 5%.

Shares of Norfolk Southern, which have erased 33% of their value

over the past 12 months, were up 1.6% to $70 in morning

trading.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

January 27, 2016 10:08 ET (15:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

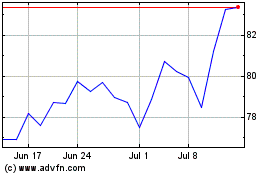

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024