Uphill Ride For Canadian Pacific-Norfolk Southern Deal

November 27 2015 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 11/27/15)

By Ronald Barusch

Before it can get on the rails, Canadian Pacific Railway Ltd.'s

proposed acquisition of Norfolk Southern Corp. has some difficult

terrain to traverse.

Norfolk Southern hasn't formally responded to CP's bid, but it

has pledged to evaluate the offer. Yet even while making that

pledge, Norfolk Southern last week called the bid "unsolicited,

low-premium, nonbinding and highly conditional" -- all buzzwords

indicating an aggressive takeover defense is in the offing. Should

CP choose to proceed with a hostile deal, getting regulatory

approval could pose extraordinary challenges.

Unlike most other U.S. deals in which the primary regulatory

issue tends to be the effect on competition, a proposed merger of

CP and Norfolk Southern would be considered by the U.S. Surface

Transportation Board, which is required to determine if the deal is

"consistent with the public interest."

The law requires the board to consider factors in addition to

competition, including the effect on transportation, the interests

of employees and whether other railroads should be included in the

deal. The public interest review by the board can extend over many

months. One competing railroad, Union Pacific Corp., has already

indicated it generally opposes rail-industry mergers. Union Pacific

said "the regulatory hurdles for future consolidation would be

significant." Even CP's proposal letter to Norfolk Southern assumed

the closing would occur on Dec. 31, 2017.

If the Norfolk board opposes the deal, it could delay the

regulatory process and increase the risk approval may not

ultimately be obtained on acceptable terms.

CP Chief Executive Hunter Harrison has indicated he has a

solution: placing one of the railroads in a voting trust. With such

a structure, the business of the railroad in question would be

controlled by an independent trustee. The closing of the deal as

far as the Norfolk Southern shareholders are concerned would come

at a relatively early date. The two railroads would be run

separately until whatever the board ultimately determines is

implemented.

The use of this type of voting trust to allow early closings of

deals has a long history. But CP could face some challenges in

implementing it now.

To implement a voting trust requires formal approval by the

surface board following public comment.

We don't know how long the trust approval process would take

because it doesn't appear that there has been a proceeding relating

to a major transaction since the current rules were put in place

more than a decade ago.

Also, it appears Mr. Harrison is considering putting CP into the

trust and immediately becoming CEO of Norfolk Southern. That

structure would be unusual because generally the target railroad

goes into the trust. Mr. Harrison was involved in another

transaction in which it was tried, but that deal wasn't completed.

It is hard to figure out how, if Mr. Harrison immediately began

running Norfolk Southern and CP went into a trust, the eggs could

be unscrambled if the board didn't approve the merger.

There could be another issue with the interim trust structure.

In its proposal letter, CP calculated the value of the shares of

the combined company. Using that calculation, the shares to be

received by Norfolk Southern holders would constitute about

two-thirds of the value received by them. If CP proposes a

transaction in which one of the companies remains in limbo for a

time, that could make it difficult for Norfolk Southern's board to

value a significant part of the consideration. And that could add

to the difficulty for CP of getting a friendly deal.

Of course even if directors of Norfolk Southern don't warm to

the deal, it is possible a Norfolk Southern shareholder or even CP

could seek to elect new directors at next year's Norfolk Southern

annual meeting.

In an email, a spokesman for CP said the company believes the

deal would bolster competition and it would satisfy any concerns

from regulators.

Given that in heavily regulated industries like railroads,

enthusiastic support of a target is an important element in

facilitating a takeover, CP has its work cut out.

---

Mr. Barusch is a retired mergers and acquisitions lawyer who

writes about deal making for the Journal's MoneyBeat blog at

wsj.com/moneybeat.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 27, 2015 02:47 ET (07:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

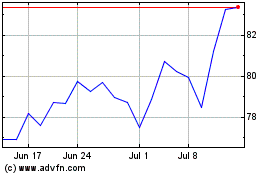

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

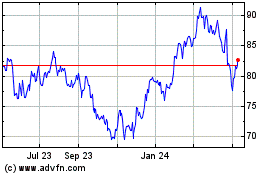

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024