CP, Norfolk Deal Decision Could Take U.S. Rail Regulator About 18 Months

November 20 2015 - 5:04PM

Dow Jones News

By Betsy Morris And Laura Stevens

The decision of whether to clear the combination of Canadian

Pacific Railway Ltd. and Norfolk Southern Corp.'s railroads could

take about 18 months and would likely be subject to an appeal

before a final decision is reached, according to a key U.S.

rail-industry regulator.

Daniel R. Elliott, chairman of the U.S. Surface Transportation

Board, said the merger of the two railroads, which would be subject

to his board's approval, would be "very complex." If it gets to

that stage, he said while speaking at Rail Trends, an annual

rail-industry conference in New York City on Friday, "there will be

a lot to consider."

Mr. Elliott's comments follow CP's public proposal this week to

acquire Norfolk Southern for more than $28 billion as it aims to

create a North American rail network that stretches from Canada's

West Coast to the Gulf of Mexico and Atlantic Ocean. Any deal would

need to satisfy the STB's merger rules, a potentially tough sell in

the first major test of requirements established by the agency in

2001 mandating that deals enhance competition.

Regulators would take under consideration the possibility that

such a big merger might spark further rail-industry consolidation

as they determine whether or not it would be in the public's

interest, Mr. Elliott said.

Three to six months before a railroad can begin its

merger-approval process with the STB, the applicant must submit a

pre-filing notification, Mr. Elliott said. The board then has a

month to accept or reject the application. The STB's

evidence-gathering and hearing phase can take a year, after the

conclusion of which the board has 90 days to make a decision on the

merger.

"I'm sure there would be an appeal," Mr. Elliott added, which

would take place in a federal appeals court.

CP on Wednesday released its letter to Norfolk Southern, in

which it said it expected the transaction to close Dec. 31,

2017.

CP made its proposal public after a meeting last week between

the two railroads' chief executives at which CP got a cool

reception, according to a person familiar with the matter.

The two signaled they were far apart on a potential combination,

differing on the value of CP's proposal. CP, in its letter, said a

merger would allow the companies to achieve more than $1 billion in

cost savings, boosting the ultimate value of the deal to as much as

$42.64 billion.

At an investor conference Thursday afternoon, CP CEO Hunter

Harrison said the companies hadn't spoken since the meeting with

his counterpart at Norfolk Southern. "That's been one of the

frustrating issues is it's hard to resolve issues and solve some of

the issues if you don't talk," Mr. Harrison said.

He also indicated that the value of the deal could increase. He

asked for a price, which Norfolk Southern hadn't given at the

meeting, he said. "Is that our final offer line in the sand? No.

And I tried to indicate that to them," he added.

When it comes to gaining regulatory approval, the STB is bound

by its rules, and CP will make a "compelling case," Mr. Harrison

said.

"Now if in their wisdom, if the board says there's some

downstream effects that we've overlooked or missed and they say no,

they say no and we move on," he said.

Write to Betsy Morris at betsy.morris@wsj.com and Laura Stevens

at laura.stevens@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 20, 2015 16:49 ET (21:49 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

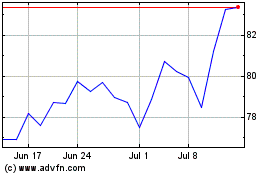

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024