(FROM THE WALL STREET JOURNAL 11/19/15)

By Ben Dummett and Tripp Mickle

Canadian Pacific Railway Ltd.'s proposal to buy Norfolk Southern

Corp. for about $28 billion would create a rail network stretching

across most of North America.

But the pact would need to satisfy the U.S. Surface

Transportation Board's rules on mergers -- and that could be a

tough sell.

The rules, which were passed in 2001 following decades of

industry consolidation, required future merger applicants "to bear

a heavier burden to show that a major rail combination is

consistent with the public interest" by enhancing competition.

CP would have to submit a tower of paperwork including a

so-called "Service Assurance Plan" providing information on how the

companies would be integrated, including training plans,

information technology systems, service disruption contingencies,

labor issues and other matters.

Experts estimate that approval would take a minimum of 18 months

and could take even longer because of the size and scope of the

deal.

The regulator wouldn't only review the CP-Norfolk Southern

merger but also evaluate whether or not it would trigger further

industry consolidation.

Even so, a deal would likely spur others. "There would be a

temptation for other railroads to merge," said Steven Ditmeyer, a

former federal railroad official who teaches railway management at

Michigan State University. He thinks companies like CSX Corp. and

Canadian National Railway Co. would also explore a merger to remain

competitive.

Rail competitors CSX, BNSF Railway Co. and Canadian National

Railway declined to comment on the potential merger.

In an email, a spokesman for Union Pacific Corp. -- another

major competitor -- said, "We oppose rail industry mergers,

generally, and believe the regulatory hurdles for future

consolidation would be significant."

To try to pre-empt competition concerns, CP said the combined

railroad company would allow other railroads to operate on its

tracks and in its terminals if the merged company couldn't provide

adequate service or competitive prices. CP said it also would give

shippers the choice of where they could connect with other

railroads on its network.

The so-called open access plan is something competing railroads

have opposed and would likely spark opposition to this deal, said

Anthony Hatch, a railroad analyst with ABH Consulting.

He added that the plan would reduce incentives for railroad

companies to invest in their infrastructure, which could be

problematic for regulators.

"Why would you build a new terminal if you thought someone else

would use it?" Mr. Hatch said. "The answer, as we've seen around

the world, is you won't."

Calgary, Alberta-based CP -- which hasn't launched a formal bid

-- is offering $46.72 in cash and 0.348 share of the merged company

for each share of Norfolk Southern.

Norfolk Southern, based in Norfolk, Va., has said it would

evaluate the bid, describing it as an "unsolicited, low-premium,

nonbinding and highly conditional indication of interest."

The two sides differed on the value of CP's proposal, signaling

that they are far apart on a potential combination. CP, in a letter

to Norfolk Southern that was made public Wednesday, said a merger

would allow the companies to achieve more than $1 billion in cost

savings, boosting the ultimate value of the deal to as much as

$42.64 billion.

Norfolk said the stock component of the offer is based on CP's

share price, which would put the value of the offer much lower.

CP's stock rose 5.8% to $146.65 Wednesday, while Norfolk

Southern gained 6.4% to $92.49.

CP made its proposal public after a meeting last week between

its chief executive, Hunter Harrison, and Norfolk Southern CEO

James Squires, at which CP got a cool reception, according to a

person familiar with the matter.

According to a person familiar with the matter, CP is making the

move in part because it believes its management could greatly boost

the margins at Norfolk, along the same lines that Mr. Harrison has

done since taking over CP in 2012.

That followed a successful proxy battle by New York activist

investor William Ackman to replace directors and management at CP,

one of Canada's oldest and most storied companies.

Mr. Harrison believes he can get to a combined operating ratio

in the mid-50% level, compared with Norfolk's approximately 70%

ratio at this point, the person said.

The lower a railroad's operating ratio, the more efficiently it

runs and the more profitable it can be.

---

David Benoit contributed to this article.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 19, 2015 02:47 ET (07:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

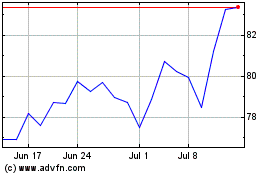

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

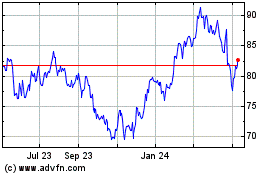

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024