Venezuela's Oil Company Sued Over Latest Citgo Deal

January 05 2017 - 3:45PM

Dow Jones News

By Andrew Scurria

Petróleos de Venezuela SA is facing new legal action from North

American multinationals over financial maneuvers they say are

designed to shield the state-owned oil giant's U.S. assets from

seizure.

Canadian mining company Crystallex International Corp. on

Wednesday expanded an existing lawsuit in Delaware federal court

against PdVSA, as the struggling national company is known. At

issue is a loan transaction that PdVSA quietly undertook last month

with Rosneft Trading SA, an affiliate of Russia's state-owned oil

company that was also named as a defendant.

Lawyers for U.S. oil producer ConocoPhillips, another plaintiff

suing PdVSA, also said on Wednesday that it would seek relief from

the court. The two companies are seeking large awards from

Venezuela in international arbitration tribunals over

nationalizations carried out under the nation's deceased president,

Hugo Chávez.

PdVSA, the major economic engine in recession-ravaged Venezuela,

has drawn the companies' ire by taking steps they say are meant to

mortgage the assets of its U.S. subsidiary Citgo Holdings and

repatriate the proceeds to Venezuela, beyond the reach of the U.S.

court system and the country's so-called judgment creditors.

International arbitration awards must be enforced for judgment

holders to collect anything, and Citgo, one of the largest U.S.

refiners, is a logical candidate for seizure.

Crystallex and ConocoPhillips filed lawsuits in Delaware in

October after PdVSA pledged its 50.1% stake in Citgo as collateral

for investors as part of a $2.8 billion bond swap. In the

transaction, which PdVSA struggled to complete, investors agreed to

exchange $2.8 billion in bonds maturing in 2017 for $3.4 billion in

bonds due in 2020.

The plaintiffs have asked the court to cancel the lien on

Citgo's stock and declare the pledge a fraudulent transfer. An

attorney for PdVSA couldn't be reached for comment.

The swap reduced the Venezuelan government's debt load between

now and 2018 to $13 billion from about $15 billion. It also gave

the company "breathing space" to stabilize a decline in oil

production and let investors collect juicy yields for longer, PdVSA

President Eulogio del Pino told The Wall Street Journal at the

time.

He also said in the interview that Citgo could be used as

collateral for other deals. The following month, PdVSA filed

financial documents in Delaware mortgaging its remaining 49.1%

stake in Citgo to Rosneft, according to court papers submitted by

the plaintiffs.

PdVSA confirmed in a Dec. 23 statement that it had used the

remainder of its Citgo stake "to raise new financing," though it

didn't detail what it received from Rosneft in return.

"It is clear that Citgo continues to be owned by PdVSA, a

company that has demonstrated to be absolutely sound, serious and

solvent," the statement said. A $3 billion tranche of 12.75% PdVSA

bonds sold in 2011 and maturing in 2022 traded on Thursday at 63.5

cents on the dollar, according to FactSet, having recovered from

their all-time low of 34.15 cents on the dollar last February.

Crystallex is also suing PdVSA to recoup a $2.8 billion dividend

that Citgo allegedly transferred to its parent in 2015 using the

proceeds of a U.S. bond sale. That was after PdVSA abandoned plans

in early 2015 to sell the subsidiary outright.

Write to Andrew Scurria at Andrew.Scurria@wsj.com

(END) Dow Jones Newswires

January 05, 2017 15:30 ET (20:30 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

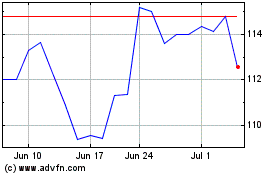

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

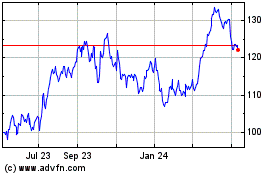

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024