PT Medco Energi to Buy Oil-and-Gas Stake in Indonesia -- Update

September 19 2016 - 11:03AM

Dow Jones News

By Sara Schonhardt

JAKARTA -- Indonesian listed energy company PT Medco Energi

Internasional Tbk announced Monday that it had signed a sales

agreement to acquire Houston-based ConocoPhillips' 40% stake in an

oil and gas block off the northern coast of Indonesia's part of

Borneo island.

The acquisition comes at a time of increasing resource

nationalism and amid a push by officials to ramp up energy projects

to strengthen defenses of Indonesia's maritime borders. The block

is located in the Natuna Islands, an energy-rich chain at the edge

of the South China Sea where Indonesia has faced increasingly

aggressive maritime moves by China.

It also follows an agreement Medco sealed in late June, along

with a group of local investors, to purchase a controlling stake in

a copper and gold mine operated by U.S.-based Newmont Mining Corp.

for $1.3 billion.

A Medco spokeswoman said the company couldn't disclose the

amount of the ConocoPhillips transaction but said that it was "much

smaller" than the Newmont deal. Company shareholders are expected

to vote on that acquisition by the end of September.

A spokesman for ConocoPhillips' Indonesia operations confirmed

the information in Medco's announcement, which also covers related

transportation systems and an onshore receiving terminal.

Indonesia "is an important part of our portfolio," the spokesman

said. "We hope in the future be able to continue our partnership as

well as our investment."

The transaction is expected to be completed later this year

pending necessary government endorsements and staffing.

Medco CEO Roberto Lorato said in a statement that once the

acquisition takes effect Medco's daily production will increase

more than 35%. The company expects the purchase to add around $100

million annually to earnings.

Medco plans to purchase the asset using funds already committed

by foreign banks as well as existing cash, the spokeswoman said. It

is still in discussion with domestic and foreign banks for further

funding.

ConocoPhillips announced in August 2015 that it was seeking to

sell its interest in Block B and associated facilities in the

Natunas. It said its sale of the asset would depend on finding the

"proper buyer."

Big oil companies have been cutting back operations globally

over the past year in the wake of falling prices. At the same time,

growing regulatory uncertainty and a lack of incentives to invest

in exploration and expansion have added to the challenges of

operating in Indonesia.

Medco's director Hilmi Panigoro said the transaction will

strengthen the company's footprint in Indonesia and "significantly

enhance its upstream oil and gas capabilities."

The block in the Natunas produces around 300 million standard

cubic feet of gas and 30,000 barrels of oil a day. Its other

investors are Chevron Corp. and Japan's Inpex Corp. ConocoPhillips

has been operating the facility for nearly 50 years and has an

operating contract that is good to 2028.

The company also has oil and gas assets in other parts of

Indonesia's portion of Borneo island and in the south of Sumatra

island.

--Deden Sudrajat contributed to this article.

Write to Sara Schonhardt at Sara.Schonhardt@wsj.com

(END) Dow Jones Newswires

September 19, 2016 10:48 ET (14:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

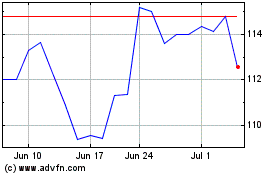

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

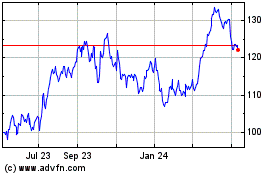

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024