Norway Approves Statoil's $981 Million Plan to Develop Reserves

June 14 2016 - 8:45AM

Dow Jones News

By Kjetil Malkenes Hovland

OSLO--The Norwegian government on Tuesday approved Statoil ASA's

(STL.OS) 8.2 billion-kroner ($981 million) Oseberg Vestflanken 2

plan, which is set to extend the life of the aging Oseberg field

center and provide much-needed work for the country's struggling

oil-service sector.

The field is estimated to hold 110 million barrels of oil

equivalent and will be worked with an unmanned wellhead platform,

remotely controlled from the Oseberg field center. Developed in

1988, Oseberg is one of Norway's biggest fields, with recoverable

oil and gas reserves estimated at 3.45 billion barrels.

Statoil said Oseberg Vestflanken 2 was the first of three phases

in a project to develop the remaining reserves in the area. The

project will be a key contributor to sustaining the company's

output in Norway at current levels until 2030, and extend the life

of the Oseberg field center, it said.

Statoil said it had reduced the project's break-even price--or

the price required for it to be profitable--by about 30%, but

didn't say from which level. The reduction was enabled by lowering

the project's capital expenditure and increasing the field's

volumes, which makes it more resilient to low oil prices, Statoil

said.

Brent crude traded Tuesday at $49 a barrel, less than half the

level before oil prices plunged in mid-2014.

The project's approval is good news for Norway's oil-field

service sector, where thousands of workers have been laid off due

to lower activity and rising competition for contracts, including

major downsizing efforts by Aker Solutions ASA and National Oilwell

Varco's Norwegian unit.

"This development generates activity and opportunities for

oil-sector suppliers with surplus capacity," said Tord Lien,

Norway's Minister of Petroleum and Energy. "Considering the

situation in the sector, it's very pleasing that the Oseberg

Vestflanken 2 development is commencing now."

The field is set to start producing by the second quarter of

2018.

Statoil is operator of Oseberg Vestflanken 2 with a 49.3% stake,

while state-owned holding company Petoro has 33.6%, Total has 14.7%

and ConocoPhillips 2.4%.

Write to Kjetil Malkenes Hovland at

kjetilmalkenes.hovland@wsj.com

(END) Dow Jones Newswires

June 14, 2016 08:30 ET (12:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

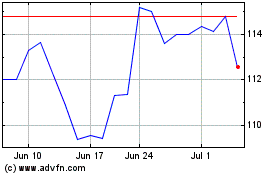

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

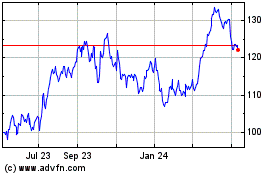

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024