CALGARY, Alberta—Crude oil output from some of Canada's largest

producers dwindled on Thursday, affecting global prices, as raging

forest fires led to some reductions in oil sands mining

operations.

While no oil operations have sustained damage from the fires,

many operators curbed output amid evacuations of nonessential

staff, pipeline outages and the risk from encroaching blazes.

That's led to an output reduction of at least 475,000 barrels a

day, or almost one-fifth of Canada's 2.5 million barrels in total

oil sands production. Much of that is imported to crude oil

refineries in the U.S.

The outages are widely expected to be temporary, but they

increased the value of typically heavily discounted Canadian crude

in trading. West Texas Intermediate, the U.S. benchmark, rose 1.2%

to $44.32 a barrel, while the global benchmark Brent rose 0.9%, as

worries about lower supplies from Libya and Nigeria also affected

trading.

Oil prices have been weighed down for almost two years by excess

supply. But production has started to fall in the U.S. and

elsewhere following massive spending cuts by energy companies,

while demand continues to grow. That means the global crude market

is less oversupplied than it was even a few months ago, analysts

say, and producers' capacity to ramp up production has been

reduced.

That makes the market more vulnerable to a shortage if

production is halted in any part of the world.

The amount of daily oil production threatened by the Canadian

fires would be enough to nearly wipe out the world's oversupply,

said Tim Pickering, chief investment officer of Auspice Capital

Advisors, which manages $300 million and an exchange-traded fund

based on the Canadian Crude Index.

"This is the most important issue in oil today," Mr. Pickering

said. "That will put the system back in check really quick."

In addition to Canada, oil traders are currently worried about

lower supplies from Libya due to political unrest and from Nigeria

due to a pipeline outage. Some analysts also warn that Venezuela's

oil production could fall amid the country's struggling economy and

power shortages.

The longer-term impact of the Alberta fire remains unclear, with

some industry officials saying production will likely bounce back

quickly as soon as the fire threat recedes. Others say damage to

infrastructure and from displaced workers could hamper efforts to

ramp up output.

"I expect we'll recover fairly quickly, but it's too early to

say how much damage has been done to equipment and operations in

the town of Fort McMurray," Steve Laut, president of Canadian

Natural Resources Ltd., said on a conference call with analysts.

Mr. Laut said that oil sands output at his company, a major oil and

gas producer, hasn't been affected so far by the disaster.

But the Bank of Nova Scotia said the destruction of property and

loss of production at other oil sands operations could cast a long

shadow. The forest fire fallout could mean "very little" GDP growth

for the overall Canadian economy in the second quarter and that the

damage to infrastructure will slow the recovery in the country's

oil patch, the bank said in a report Thursday.

Western Canadian Select traded at less than $12 a barrel below

WTI, the highest level relative to U.S. prices since July 2015.

The oil-sands facilities aren't directly threatened by the

uncontrolled forest fires, but mandatory evacuations of workers

have affected some operations.

In the latest of a series of plant closures, ConocoPhillips on

Thursday shut down an oil sands site that produced 50,000 barrels a

day and evacuated all staff due to an encroaching fire near the

town of Anzac. That followed a similar move late Wednesday by Nexen

Energy ULC, a subsidiary of Chinese energy giant Cnooc Ltd., to

halt a nearby oil sands operation of 20,000 barrels a day.

ConocoPhillips began evacuating 865 people at its Surmont oil

sands site before dawn Thursday, including 196 displaced local

residents who had been offered shelter, in what a it called a

"precautionary measure."

Two of the biggest oil-sands producers already reduced or halted

production by at least 385,000 barrels a day. Suncor Energy Inc.,

Canada's largest producer, late Wednesday shut down its base mine

operation, consisting of a pair of strip mines and partial

refineries, with a combined capacity of 350,000 barrels a day,

though it had been running closer to 130,000 barrels a day as a

result of routine maintenance.

Suncor also cut output at its 350,000 barrels-a-day Syncrude

mining operation and 203,000 barrels-a-day Firebag well site, but

didn't specify by how much. The Canadian unit of Royal Dutch Shell

PLC shut down its oil sands mines producing 255,000 barrels a

day.

"That's largely being done to allow folks to focus on rendering

aid to the community and emergency response," Lee Tillman, CEO of

Marathon Oil, which holds a stake in the mines, said on a

conference call. "The mines themselves are not under any direct or

immediate threat."

Smaller operators, such as Husky Energy Inc., reduced output at

its oil sands site on Wednesday by 20,000 barrels a day, citing

cuts to supplies of a thinning agent called diluent needed to ship

extra heavy oil sands crude.

The operator of that system, Calgary-based Inter Pipeline Ltd.,

said Thursday it reopened that diluent pipeline, which also

supplies several other sites, including a large oil sands mine run

by Exxon Mobil Corp.'s Canadian unit Imperial Oil Ltd.

Representatives for Imperial did not reply to requests for comment

on the impact.

Inter Pipeline also partially closed another pipeline that

mostly carries raw crude oil from Shell's oil sands operations

mixed with diluent from the oil sands near Fort McMurray to

refineries near Edmonton. The company said Thursday that pipeline

is also "ready for operation subject to activity resuming at local

production facilities."

Nicole Friedman, Timothy Puko and Erin Ailworth contributed to

this article.

Write to Chester Dawson at chester.dawson@wsj.com

(END) Dow Jones Newswires

May 05, 2016 18:05 ET (22:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

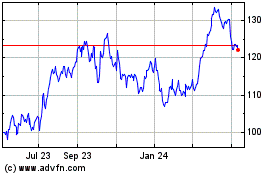

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

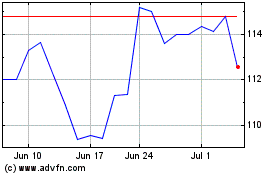

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024