Gas-Exporters Need to Collaborate, Share If Industry is to Grow, Executives Say

April 15 2016 - 4:22AM

Dow Jones News

By Robb M. Stewart

PERTH, Australia--In a world of constrained capital and

depressed energy prices, natural-gas exporters will need to work

more closely and find new ways to share infrastructure to grow,

industry executives say.

Collaboration emerged as a key theme at a major liquefied

natural gas conference held here this week against a backdrop of

weak oil and gas prices and an industry under pressure to protect

balance sheets. Australia has been an epicenter for

multibillion-dollar investments in liquefied natural gas facilities

in recent years, but also a string of delays and cost blowouts at

these big projects.

"We must put collaboration ahead of our industry's natural

desire to immortalize our own activities in concrete and steel,"

Andrew Smith, chairman of Royal Dutch Shell PLC's (RDSB) Australian

business, said in a speech closing out the gas conference.

"Australia's LNG industry will deliver greater economic value

and better international competitiveness when we get better at the

sharing of infrastructure on commercial terms," Mr. Smith said.

He echoed comments made during the week by executives at other

major energy firms. Total SA (TOT) Chief Executive Patrick Pouyanne

said it was the duty of companies to cooperate to improve project

economics, while Woodside Petroleum Ltd.'s (WOPEY) boss suggested

cooperation could be extended to sharing intellectual property

under license to help speed up industry advancements in

technology.

In an interview ahead of the conference, Geoffrey Cann, Deloitte

Touche Tohmatsu's Australia director for oil and gas, said

companies need to avoid getting swept up in a groundswell of

enthusiasm and "get it done at all costs" mentalities.

"The industry needs to collaborate a lot more to deliver

projects at a dramatically different cost formula than they can

achieve by just developing them on their own," he said. "If they

are unable to figure out how to do that, then these projects will

struggle economically in the long run."

Mr. Cann said energy companies don't ultimately need to own some

infrastructure after it is built, potentially opening it to

shareholders, such as pension funds, that are happy to own a

long-life, low-return asset like a pipeline.

Shell's Mr. Smith in his speech said even greater collaboration

is needed to rein in costs.

"As industry leaders we must come to terms with the fact that

local opportunities exist in a world with constrained capital,

particularly in a period of depressed commodity prices, and

collaboration will be key to continued growth," he said.

Energy companies regularly join forces. One of the most recent

LNG projects to begin production, the Chevron Corp. (CVX)-led

Gorgon project off Western Australia, brought in companies

including Shell and Exxon Mobil Corp. (XOM) But executives said

cooperation needs to be extended.

On Thursday, the Australian Competition and Consumer Commission

granted three recently developed LNG projects on the country's east

coast the right to share for a five-year period maintenance

schedules, providers and techniques. The change will allow the

plants, all closely located, to better coordinate the use of a

limited number of independent maintenance crews to help avoid

disruptions.

Mike Utsler, chief operating officer at Woodside, said the

Perth-based company had approached companies including Chevron and

ConocoPhillips (COP) about approaching the competition regulator to

see maintenance cooperation extended to LNG operators in

Australia's north and west.

There is an imperative for the industry to come together to look

at collaboration and standardization operations to survive and

thrive, Mr. Utsler said.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

April 15, 2016 04:07 ET (08:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

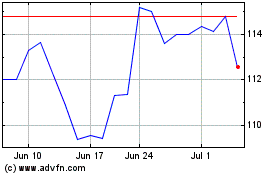

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

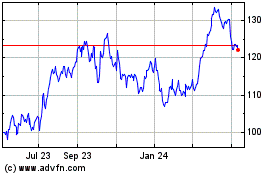

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024