ConocoPhillips Cuts 2016 Spending Plans

February 04 2016 - 8:10AM

Dow Jones News

ConocoPhillips further reduced its capital-spending plans to

$6.4 billion for 2016 and said its board slashed is quarterly

dividend, joining a list of major oil companies to get slammed by

low oil prices.

Shares fell 4.2% to $37 in recent premarket trading.

The company also posted a fourth-quarter loss of $3.5 billion,

or $2.78 a share as it posted $2.7 billion in asset write-down to

reflect commodities prices and changes in its energy exploration

plans.

ConocoPhillips said its board approved cutting the quarterly

dividend to 25 cents a share from the previous level of 74 cents a

share.

The company, which in December had projected 2016 capital

expenditures at $7.7 billion, on Thursday also cuts it operating

cost estimate to $7 billion from $7.7 billion.

Chairman and Chief Executive Ryan Lance said in a news release,

"While we don't know how far commodity prices will fall, or the

duration of the downturn, we believe it's prudent to plan for lower

prices for a longer period of time."

"The actions we have announced will improve net cash flow by

$4.4 billion in 2016," Mr. Lance stated.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

February 04, 2016 07:55 ET (12:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

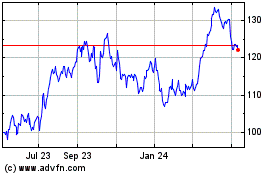

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

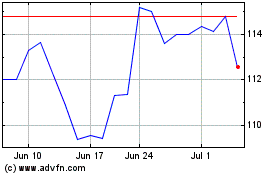

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024