Santos Plans First Cargo From Flagship Gas Project Within Weeks

September 23 2015 - 8:35PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Santos Ltd. (STO.AU) expects to ship the

first cargo of liquefied natural gas from its flagship project on

Australia's east coast in the coming weeks after production at the

facility began.

Exports of LNG would bring much-needed needed cash flow for the

Australian energy company at a time when its balance sheet has been

badly stretched by heavy investment in the US$18.5 billion GLNG

project at the port of Gladstone in Queensland state and a slump in

oil prices.

Santos said LNG is now being produced from the GLNG project's

first liquefaction unit, while a second unit is expected to be

ready for startup by the end of the year. The first cargo will be

shipped to Asian customers within weeks, it said.

"We said we'd produce first LNG around the end of the third

quarter, and that's exactly what we've done," Managing Director and

Chief Executive David Knox said.

He said revenue from the project is underpinned by binding

longterm sales contracts covering more than 90% of the plant's

capacity.

GLNG produces natural gas found in seams of coal in Queensland

and chills it into LNG for export. The plant will be able to

produce 7.8 million metric tons of LNG a year when fully

operational.

The project--operated by Santos, which owns a 30% interest, and

counting Petronas Bhd and France's Total SA (TOT) among its venture

partners--is one of three massive LNG plants in Queensland. BG

Group PLC's (BG.LN) US$20.4 billion QCLNG project began exporting

earlier this year, and Origin Energy Ltd.'s (ORG.AU) 24.7 billion

Australian dollar (US$17.3 billion) Australia-Pacific LNG project

with ConocoPhillips (COP) and Sinopec is scheduled to export its

first cargo by the end of the year.

Worries about Santos's debt burden and a possible need for a

dilutive equity raising have weighed heavily on the company's share

price, pulling it down about 65% over the last year. The company

last month launched a sweeping strategic review and said it would

consider selling assets, while Mr. Knox said he would step down

after seven years in the role as soon as a successor had been

found.

Write to Robb M. Stewart at robb.stewart@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 23, 2015 20:20 ET (00:20 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

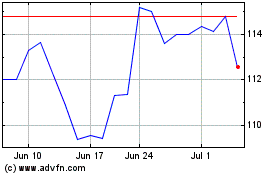

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

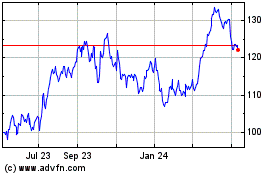

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024