UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

(Mark One)

| x |

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2014

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

Commission file number 001-32395

CONOCOPHILLIPS SAVINGS PLAN

(Full title of the Plan)

ConocoPhillips

(Name of

issuer of securities)

|

|

|

| 600 North Dairy Ashford

Houston, Texas |

|

77079 |

| (Address of principal executive office) |

|

(Zip code) |

FINANCIAL STATEMENTS AND EXHIBITS

Financial statements of the ConocoPhillips Savings Plan, filed as part of this

annual report, are listed in the accompanying index.

|

|

|

| Exhibit 23 |

|

Consent of Independent Registered Public Accounting Firm |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the ConocoPhillips Company Benefits Committee has duly caused this annual report to be

signed on its behalf by the undersigned hereunto duly authorized.

|

| CONOCOPHILLIPS COMPANY |

| BENEFITS COMMITTEE |

|

| /s/ Timothy H. Kiehl |

| Timothy H. Kiehl, Chair |

| ConocoPhillips Company Benefits Committee |

June 23, 2015

1

|

|

|

| Index To Financial Statements |

|

ConocoPhillips Savings Plan |

| And Schedule |

|

|

2

Report of Independent Registered Public Accounting Firm

The ConocoPhillips Company Benefits Committee

ConocoPhillips

Savings Plan

We have audited the accompanying statements of net assets available for benefits of ConocoPhillips Savings Plan as of December 31, 2014

and 2013, and the related statement of changes in net assets available for benefits for the year ended December 31, 2014. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an

opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting

Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the

Plan’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of

expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in

the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of ConocoPhillips

Savings Plan at December 31, 2014 and 2013, and the changes in its net assets available for benefits for the year ended December 31, 2014, in conformity with U.S. generally accepted accounting principles.

The accompanying supplemental schedule of assets held at end of year as of December 31, 2014, has been subjected to audit procedures performed in

conjunction with the audit of ConocoPhillips Savings Plan’s financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the

information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming

our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement

Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

Tulsa, Oklahoma

June 23, 2015

3

|

|

|

| Statements of Net Assets |

|

ConocoPhillips Savings Plan |

| Available for Benefits |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thousands of Dollars |

|

| At December 31 |

|

2014 |

|

|

2013 |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

|

|

| Plan interest in Stable Value Fund Master Trust |

|

|

1,577,911 |

|

|

|

1,692,237 |

|

| |

|

| Common Stock: |

|

|

|

|

|

|

|

|

| ConocoPhillips Stock Fund |

|

|

1,609,764 |

|

|

|

1,735,147 |

|

| ConocoPhillips Leveraged Stock Fund |

|

|

454,673 |

|

|

|

530,410 |

|

| Phillips 66 Stock Fund |

|

|

562,683 |

|

|

|

701,867 |

|

| Phillips 66 Leveraged Stock Fund |

|

|

228,226 |

|

|

|

279,398 |

|

| DuPont Stock Fund |

|

|

78,157 |

|

|

|

78,636 |

|

| |

|

| Total Common Stock |

|

|

2,933,503 |

|

|

|

3,325,458 |

|

| |

|

| Mutual Funds |

|

|

3,223,794 |

|

|

|

2,819,602 |

|

| |

|

| Total Investments |

|

|

7,735,208 |

|

|

|

7,837,297 |

|

| Notes receivable from participants |

|

|

43,044 |

|

|

|

41,471 |

|

| Company contributions receivables |

|

|

1,605 |

|

|

|

1,482 |

|

| |

|

| Net assets reflecting investments at fair value |

|

|

7,779,857 |

|

|

|

7,880,250 |

|

|

|

|

| Adjustment from fair value to contract value for fully benefit-responsive investment contracts |

|

|

(49,336 |

) |

|

|

(41,405 |

) |

| |

|

| Net assets available for benefits |

|

$ |

7,730,521 |

|

|

$ |

7,838,845 |

|

| |

|

See Notes to Financial Statements.

4

|

|

|

| Statement of Changes In Net |

|

ConocoPhillips Savings Plan |

| Assets Available for Benefits |

|

|

|

|

|

|

|

| Year Ended December 31, 2014 |

|

Thousands

of Dollars |

|

|

|

| Additions |

|

|

|

|

| Company matching contributions |

|

$ |

115,000 |

|

| Active employee contributions |

|

|

133,502 |

|

| Rollovers |

|

|

53,394 |

|

| |

|

| Total contributions |

|

|

301,896 |

|

| |

|

| Investment income |

|

|

|

|

| Dividends and interest |

|

|

218,060 |

|

| Plan interest in Stable Value Fund Master Trust |

|

|

31,350 |

|

| Net appreciation in fair value of investments |

|

|

42,413 |

|

| |

|

| Total investment income |

|

|

291,823 |

|

| |

|

| Interest income on notes receivable from participants |

|

|

1,412 |

|

| Other additions |

|

|

1,119 |

|

| |

|

|

|

| Total additions |

|

|

596,250 |

|

| |

|

|

|

| Deductions |

|

|

|

|

| Distributions to participants or their beneficiaries |

|

|

704,154 |

|

| Administrative expenses |

|

|

378 |

|

| Other deductions |

|

|

42 |

|

| |

|

|

|

| Total deductions |

|

|

704,574 |

|

| |

|

|

|

| Net Decrease |

|

|

(108,324 |

) |

|

|

| Net assets available for benefits |

|

|

|

|

| Beginning of year |

|

|

7,838,845 |

|

| |

|

|

|

| End of year |

|

$ |

7,730,521 |

|

| |

|

See Notes to Financial Statements.

5

|

|

|

| Notes To Financial Statements |

|

ConocoPhillips Savings Plan |

Note 1—Plan Description

The following description of the ConocoPhillips Savings Plan (Plan) is as of December 31, 2014, and provides only general information.

Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution, 401(k) profit sharing plan, which included an employee stock ownership plan (ESOP) component. The Vanguard Group, Inc.

serves as recordkeeper. Vanguard Fiduciary Trust Company (Vanguard) serves as a trustee for the Plan.

The Plan is subject to the provisions of the

Employee Retirement Income Security Act of 1974, as amended (ERISA).

Eligibility

Generally, active employees of ConocoPhillips Company (Company or COP) and its subsidiaries, wholly-owned subsidiaries of ConocoPhillips, on the direct U.S.

dollar payroll are eligible to participate in the Plan.

On April 30, 2012, the separation of Phillips 66 from ConocoPhillips was completed.

As a result of the separation, participants invested in the ConocoPhillips Stock Fund and the ConocoPhillips Leveraged Stock Fund as of April 30, 2012,

received 1 share of Phillips 66 stock for every 2 shares of ConocoPhillips stock held in the Plan. These new shares were immediately transferred to a new Phillips 66 Stock Fund and a new Phillips 66 Leveraged Stock Fund.

Contributions

An active employee may contribute

between 1% and 75% of eligible pay (Pay), as defined in the Plan, subject to statutory limits, on a before-tax basis, after-tax basis, Roth 401(k) basis or in any combination thereof. The Company makes matching contributions of nine times the first

1% of eligible pay that a participant contributes each pay period to the Plan, subject to statutory limits. The matching contributions are invested in the same manner as the participants’ contributions are invested.

Active employees are eligible to make catch-up contributions to the Plan beginning in the year they attain the age of 50.

Plan assets are invested in a variety of investment funds; however, the DuPont Stock Fund, ConocoPhillips Leveraged Stock Fund, Phillips 66 Leveraged Stock

Fund, and Phillips 66 Stock Fund are closed to new investment elections. Investments in the Plan are participant-directed.

6

Participant Accounts

Each participant’s account is credited with the active employee contributions, Company contributions, if applicable, Plan earnings and losses, and charged

with an allocation of investment and administrative expenses, as applicable. Allocations are based on participant earnings or account balances. The benefit to which a participant is entitled is the balance in the participant’s vested account.

Vesting

Participants are immediately vested

in all amounts credited to their accounts in all funds.

Voting Rights

As a beneficial owner of Company Stock, Plan participants and beneficiaries are entitled to direct the trustee to vote the Company Stock attributable to their

accounts.

Diversification

Generally,

participants may make unlimited exchanges out of any investment fund in any dollar amount, whole percentages, or shares of their account to another investment fund subject to the exchange rules in the Plan. In addition, using selected investment

percentages, a participant may request a reallocation of both the existing account and future contribution allocations or a rebalancing of the participant’s existing account.

Share Accounting Method for Company Stock

Any

shares purchased or sold for the Plan on any business day are valued at the Participant Transaction Price, as defined by the Plan, which is calculated using a weighted-average price of the Company Stock traded on that business day and any carryover

impact as described in the Plan document.

Distributions

Total distributions from participant accounts can be made upon the occurrence of specified events, including the attainment of the age of 59 1⁄2, death, disability, or termination of employment. Partial distributions are permitted in cases of specified financial hardship.

Installment Payments

A terminated employee or a

beneficiary who is the surviving spouse of a participant is eligible to elect a distribution based on a fixed dollar amount or life expectancy installment payments.

Dividend Pass Through

A participant can make an

election to receive cash dividends from the ConocoPhillips Stock Fund and the ConocoPhillips Leveraged Stock Fund on a portion of that participant’s account invested in Company Stock. The distribution of these dividends is made on each dividend

payment date.

Forms of Payment

Generally,

distributions from participant accounts invested in Company Stock, Phillips 66 Stock and DuPont Stock can be made in cash, stock, or a combination of both. Distributions from all other funds in the Plan are made in cash. An election to make an

eligible rollover distribution is also available.

7

Participant Loans

Active employee participants can request a loan from their account in the Plan. The minimum loan is $1,000. Generally, the maximum loan is the lesser of

$50,000 or one-half of the vested value of the participant’s account. For those eligible for loans, three outstanding loans are available at any one time, one of which can be a home loan. The maximum term of a home loan is 238 months, and the

maximum term of a general purpose loan is 58 months.

Trust Agreements

The trust agreement with Vanguard provides for the administration of certain assets in the Plan.

Additionally, the Stable Value Fund (SVF) is managed under the Stable Value Fund Master Trust Agreement. The assets in this fund include stable value

investment contracts and short-term investments. The trustee is State Street Bank and Trust Company. Underlying the stable value investment contracts are units of common collective trust (CCT) funds and a pooled separate account (PSA).

Administration

Prior to January 1, 2014, the

Plan was administered by the ConocoPhillips Savings Plan Committee (Committee), a Plan Financial Administrator, a Plan Benefits Administrator, and the Chief Financial Officer of the Company, collectively referred to as the Plan Administrators.

Members of the Committee were appointed by the Chief Executive Officer or the Board of Directors of the Company. The Plan Financial Administrator and the Plan Benefits Administrator were the persons who occupy, respectively, the Company positions of

Treasurer, and General Manager, Compensation and Benefits. Plan Administrators serve without compensation, but were reimbursed by the Company for necessary expenditures incurred in the discharge of their duties. Administrative expenses of the Plan

were paid from assets of the Plan to the extent allowable by law, unless paid by the Company.

Effective January 1, 2014, the Plan is administered by

the ConocoPhillips Company Benefits Committee (Committee). Members of the Committee are appointed by the Board of Directors of the Company and serve without compensation, but are reimbursed by the Company for necessary expenditures incurred in the

discharge of their duties. Administrative expenses of the Plan are paid from assets of the Plan to the extent allowable by law, unless paid by the Company.

Note 2—Significant Accounting Policies

Basis of Presentation

The

Plan’s financial statements are presented on the accrual basis of accounting in conformity with U.S. generally accepted accounting principles (GAAP). Distributions to participants or their beneficiaries are recorded when paid.

The SVF invests in fully benefit-responsive investment contracts. These investment contracts are recorded at fair value (see Note 9); however, since these

contracts are fully benefit-responsive, an adjustment is reflected in the statements of net assets available for benefits to present these investments at contract value. Contract value is the relevant measurement attributable to fully

benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. The contract value represents contributions plus earnings, less

participant withdrawals and administrative expenses.

8

Notes Receivable From Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest.

Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of

December 31, 2014 or 2013. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

New Accounting Pronouncement

In

May 2015, the FASB issued Accounting Standards Update 2015-07, Disclosures for Investments in Certain Entities that Calculate Net Asset Value Per Share (or its Equivalent), (ASU 2015-07). ASU 2015-07 removes the requirement to categorize

within the fair value hierarchy investments for which fair values are estimated using the net asset value practical expedient provided by Accounting Standards Codification 820, Fair Value Measurement. Disclosures about investments in certain

entities that calculate net asset value per share are limited under ASU 2015-07 to those investments for which the entity has elected to estimate the fair value using the net asset value practical expedient. ASU 2015-07 is effective for entities

(other than public business entities) for fiscal years beginning after December 15, 2016, with retrospective application to all periods presented. Early application is permitted. We are currently evaluating the impact of the adoption of this

ASU.

Use of Estimates

The preparation

of financial statements in conformity with GAAP requires management to make estimates that affect the amounts reported in the financial statements and accompanying notes and supplemental schedule. Actual results could differ from those estimates.

Note 3—Investments

Investment Valuation and Income Recognition

Investments held by the Plan are stated at fair value less costs to sell, if those costs are significant. The fair value of a financial instrument is the

amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (the exit price).

Common stock values are based on their quoted market prices. Mutual funds are valued using quoted market prices, which represent the net asset values of

shares held by the Plan at year-end. The assets in the SVF include investment contracts and a short-term investment fund (STIF). The investment contracts are backed by units of common collective trusts (CCTs) and a pooled separate account (PSA). The

STIF is valued at amortized cost, which approximates fair value. (See Note 9 for more detail on the SVF including the fair value computation techniques and inputs.)

Purchases and sales of investments are recorded on a trade-date basis. Dividends are recorded on the ex-dividend date. Interest income is recorded on the

accrual basis.

Investment securities are exposed to various risks, including interest rate, market, and credit risks. Due to the level of risk associated

with certain investment securities, it is at least reasonably possible that changes in values of investments will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in

the statements of net assets available for benefits.

9

Net Appreciation

During 2014, the Plan’s investments (including gains and losses on investments bought and sold, as well as held, during the year) appreciated in value as

follows:

|

|

|

|

|

| |

|

Thousands

of Dollars |

|

| Common Stock |

|

|

|

|

| ConocoPhillips Stock Fund |

|

$ |

39,720 |

|

| ConocoPhillips Leveraged Stock Fund |

|

|

12,394 |

|

| Phillips 66 Stock Fund |

|

|

(41,095 |

) |

| Phillips 66 Leveraged Stock Fund |

|

|

(16,521 |

) |

| DuPont Stock Fund |

|

|

10,076 |

|

| Mutual funds |

|

|

37,839 |

|

| |

|

| Net appreciation in fair value of investments |

|

$ |

42,413 |

|

| |

|

Note 4—Fair Value Measurements

Accounting Standards Codification (ASC) 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to

measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three

levels of the fair value hierarchy are described below:

|

|

|

| Level 1 |

|

Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets. |

|

|

| Level 2 |

|

Inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full

term of the financial instrument. |

|

|

| Level 3 |

|

Inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is

significant to the fair value measurement.

10

The following tables set forth by level, within the fair value hierarchy, the Plan’s investment assets at

fair value. (See Note 9 for the fair value hierarchy for the SVF master trust investments):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thousands of Dollars |

|

| |

|

Assets at Fair Value as of December 31, 2014 |

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Mutual Funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balanced Funds |

|

$ |

842,233 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

842,233 |

|

| Bond Funds |

|

|

409,956 |

|

|

|

— |

|

|

|

— |

|

|

|

409,956 |

|

| Domestic Stock Funds |

|

|

1,515,048 |

|

|

|

— |

|

|

|

— |

|

|

|

1,515,048 |

|

| International Stock Funds |

|

|

278,242 |

|

|

|

— |

|

|

|

— |

|

|

|

278,242 |

|

| Short–Term Reserves |

|

|

178,315 |

|

|

|

— |

|

|

|

— |

|

|

|

178,315 |

|

| |

|

| Total Mutual Funds |

|

|

3,223,794 |

|

|

|

— |

|

|

|

— |

|

|

|

3,223,794 |

|

| |

|

| Common Stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ConocoPhillips Stock Fund |

|

|

1,609,764 |

|

|

|

— |

|

|

|

— |

|

|

|

1,609,764 |

|

| COP Leveraged Stock Fund |

|

|

454,673 |

|

|

|

— |

|

|

|

— |

|

|

|

454,673 |

|

| Phillips 66 Stock Fund |

|

|

562,683 |

|

|

|

— |

|

|

|

— |

|

|

|

562,683 |

|

| Phillips 66 Leveraged Stock Fund |

|

|

228,226 |

|

|

|

— |

|

|

|

— |

|

|

|

228,226 |

|

| DuPont Stock Fund |

|

|

78,157 |

|

|

|

— |

|

|

|

— |

|

|

|

78,157 |

|

| |

|

| Total Common Stock |

|

|

2,933,503 |

|

|

|

— |

|

|

|

— |

|

|

|

2,933,503 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| Total investment assets at fair value |

|

$ |

6,157,297 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

6,157,297 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thousands of Dollars |

|

| |

|

Assets at Fair Value as of December 31, 2013 |

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Mutual Funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balanced Funds |

|

$ |

685,872 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

685,872 |

|

| Bond Funds |

|

|

336,286 |

|

|

|

— |

|

|

|

— |

|

|

|

336,286 |

|

| Domestic Stock Funds |

|

|

1,358,663 |

|

|

|

— |

|

|

|

— |

|

|

|

1,358,663 |

|

| International Stock Funds |

|

|

260,150 |

|

|

|

— |

|

|

|

— |

|

|

|

260,150 |

|

| Short – Term Reserves |

|

|

178,631 |

|

|

|

— |

|

|

|

— |

|

|

|

178,631 |

|

| |

|

| Total Mutual Funds |

|

|

2,819,602 |

|

|

|

— |

|

|

|

— |

|

|

|

2,819,602 |

|

| |

|

| Common Stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ConocoPhillips Stock Fund |

|

|

1,735,147 |

|

|

|

— |

|

|

|

— |

|

|

|

1,735,147 |

|

| COP Leveraged Stock Fund |

|

|

530,410 |

|

|

|

— |

|

|

|

— |

|

|

|

530,410 |

|

| Phillips 66 Stock Fund |

|

|

701,867 |

|

|

|

— |

|

|

|

— |

|

|

|

701,867 |

|

| Phillips 66 Leveraged Stock Fund |

|

|

279,398 |

|

|

|

— |

|

|

|

— |

|

|

|

279,398 |

|

| DuPont Stock Fund |

|

|

78,636 |

|

|

|

— |

|

|

|

— |

|

|

|

78,636 |

|

| |

|

| Total Common Stock |

|

|

3,325,458 |

|

|

|

— |

|

|

|

— |

|

|

|

3,325,458 |

|

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| Total investment assets at fair value |

|

$ |

6,145,060 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

6,145,060 |

|

| |

|

11

Note 5—Employee Stock Ownership Plan

All Company Stock held by the Plan is considered part of the ESOP. This includes the ConocoPhillips Stock Fund and the ConocoPhillips Leveraged Stock Fund. The

ConocoPhillips Stock Fund contains shares of Company Stock purchased with active employee contributions, Company contributions, dividends reinvested in participant accounts, and shares allocated to participant accounts as a result of allocations

other than those purchased with the proceeds of acquisition loans. The ConocoPhillips Leveraged Stock Fund primarily contains shares of Company Stock that were purchased with the proceeds of acquisition loans and allocated to participant accounts as

a result of allocations. Participants may direct that all of these contributions be exchanged from the ConocoPhillips Stock Fund and the ConocoPhillips Leveraged Stock Fund into other investment funds at any time.

Note 6—Tax Status

The Plan received a determination

letter from the Internal Revenue Service (IRS) dated September 13, 2013, stating that the Plan is qualified under Section 401(a) of the Internal Revenue Code (the Code) and, therefore, the related trust is exempt from taxation. Subsequent

to this determination by the IRS, the Plan has been amended. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualification. The Committee believes the Plan as amended is being operated in compliance with

the applicable requirements of the Code and, therefore, believes the Plan is qualified and the related trust is tax exempt.

Accounting principles

generally accepted in the United States require plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical

merits, to be sustained upon examination by the IRS. The Committee has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2014, there are no uncertain positions taken or expected to be taken. The Plan has

recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Committee believes it is no longer

subject to income tax examinations for years prior to 2011.

Note 7—Related Party Transactions

Certain of the Plan’s assets are invested in Company Stock. Because ConocoPhillips is the ultimate parent of the Company, transactions involving Company

Stock qualify as related party transactions. In addition, certain investments of the Plan are in shares of mutual funds managed by Vanguard. Because Vanguard is the Plan’s trustee, these transactions also qualify as related party transactions.

All of these types of transactions are exempt from the prohibited transaction rules.

Note 8—Plan Termination

In the event of termination of the Plan, participants and beneficiaries of deceased participants would be vested with respect to, and would receive, within a

reasonable time, any funds in the participants’ accounts as of the date of the termination.

12

Note 9—Master Trust

At December 31, 2014 and 2013, one investment option of the Plan, the SVF, was held in a master trust.

Stable Value Fund

The Plan’s share of SVF

Master Trust net assets was 100% as of December 31, 2014 and 2013.

The SVF consists of a STIF and synthetic investment contracts (SYNs). The STIF

seeks to provide safety of principal and daily liquidity by investing in high-quality money market instruments that include, but are not limited to, certificates of deposit, repurchase agreements, commercial paper, bank notes, time deposits,

corporate debt, and U.S. Treasury and agency debt. While the intent of this fund is to allow daily withdrawals on each business day when the Federal Reserve’s wire system is open, the trustee of the fund may suspend withdrawal rights at its

sole discretion in certain situations such as a breakdown in the means of communication normally employed in determining the value of the investments of the fund or a state of affairs in which the disposition of the assets of the fund would not be

reasonably practicable or would be seriously prejudicial to the fund participants. In a SYN contract structure, the underlying investments are owned by the SVF Master Trust and held in trust for Plan participants. The underlying investments of the

SYNs in the SVF Master Trust consist of CCTs, a STIF, and a PSA. The SVF Master Trust purchases a wrapper contract from an insurance company or bank to provide market and cash flow protection to the Plan. The wrapper contract amortizes the realized

and unrealized gains and losses on the underlying fixed-income investments, typically over the duration of the investment, through adjustments to the future interest crediting rate. The issuer of the wrapper contract provides assurance that the

adjustments to the interest crediting rate do not result in a future interest crediting rate that is less than zero.

There are no reserves against

contract value for credit risk of the contract issuers or otherwise. The crediting rates for most SYNs are reset monthly or quarterly and are based on the fair value of the underlying portfolio of assets backing these contracts.

Key factors influencing future interest crediting rates for a wrapper contract include:

| |

• |

|

the level of market interest rates; |

| |

• |

|

the amount and timing of participant contributions, transfers, and withdrawals into/out of the wrapper contract; |

| |

• |

|

the investment returns generated by the fixed-income investments that back the wrapper contract; and |

| |

• |

|

the duration of the underlying investments backing the wrapper contract. |

While there may be slight variations

from one wrapper contract to another, the formula for determining interest crediting rate resets is based on the characteristics of the underlying fixed-income portfolio. Over time, the crediting rate formula amortizes the SVF’s realized and

unrealized fair value gains and losses over the duration of the underlying investments. The resulting gains and losses in the fair value of the underlying investments relative to the wrapper contract value are represented in the SVF asset values as

the “Adjustment from fair value to contract value for fully benefit-responsive investment contracts.”

13

The SVF values as of December 31, 2014 and 2013 were as follows:

|

|

|

|

|

|

|

|

|

| |

|

Thousands of Dollars |

|

| December 31 |

|

2014 |

|

|

2013 |

|

| SVF, at fair value |

|

|

|

|

|

|

|

|

| Short-term investment fund |

|

$ |

18,607 |

|

|

$ |

44,916 |

|

| SYNs – CCTs |

|

|

1,462,913 |

|

|

|

1,544,092 |

|

| Pooled Separate Account |

|

|

95,870 |

|

|

|

102,691 |

|

| Wrapper contracts |

|

|

521 |

|

|

|

538 |

|

| |

|

| Net assets reflecting investments at fair value |

|

|

1,577,911 |

|

|

|

1,692,237 |

|

| Adjustment from fair value to contract value for fully benefit-responsive investment contracts |

|

|

(49,336 |

) |

|

|

(41,405 |

) |

| |

|

|

|

|

| Net assets |

|

$ |

1,528,575 |

|

|

$ |

1,650,832 |

|

| |

|

|

|

|

| Ratio of year-end market value yield to investments, at fair value |

|

|

1.51 |

% |

|

|

1.34 |

% |

|

|

|

| Ratio of year-end crediting rate to investments, at fair value |

|

|

2.15 |

% |

|

|

1.90 |

% |

Both the CCTs and PSA are valued at fair value using the net asset value as determined by the Trustee of the CCTs or by the

insurance company sponsoring the PSA or their designees based on the current fair values of the underlying assets of such trust. These CCTs and PSA are designed to be high-quality, fixed-income portfolios appropriate for a conservative, moderate

duration investment option. The CCTs and PSA invest in fixed-income securities, including, but not limited to, government-issued securities; mortgages; corporate bonds; structured securities, including, but not limited to, asset-backed securities

and mortgage-backed securities; and other CCTs that invest in fixed-income securities. The CCTs and PSA may invest in derivatives, including, but not limited to, futures, options, forwards, swaps and mortgage derivatives. While it is intended for

participating plans to generally receive liquidity from these CCTs or PSA in one to three business days, there are both market conditions and withdrawal sizes (as determined by the Trustee of the CCTs or by the insurance company sponsoring the PSA)

that may extend this period. Withdrawals from the CCTs and PSA may be made upon at least 10 business days advance written notice to the Trustee or insurance company or such lesser period to which the Trustee or insurance company may agree. Any

withdrawal shall be valued as of the close of business on the day of or the day next succeeding the expiration of the notice period (the Valuation Date) and shall be effected within 60 days following such Valuation Date or such other time as may be

agreed to by the Trustee or insurance company and the plan sponsor, provided that such withdrawal may be delayed if the Trustee or insurance company determines that it cannot reasonably make such distribution on account of any order, directive or

legal impediment by an official or agency of any government or any other cause reasonably beyond its control.

The STIF is valued at amortized cost, which

approximates fair value. The fair value of wrapper contracts is determined by calculating the present value of excess future wrap fees. When the replacement cost of the wrapper contract (a re-pricing provided annually by the contract issuer) is

greater than the current wrap fee, the difference is converted into the implied additional fee payment cash flows for the duration of the holding. The present value of that cash flow stream is calculated using a swap curve yield that is based on the

duration of the holding, and adjusted for the holding’s credit quality rating.

14

The significant components of the changes in net assets relating to the SVF are as follows:

|

|

|

|

|

| |

|

Thousands

of Dollars |

|

| Year Ended December 31, 2014 |

|

|

|

|

| Contributions |

|

$ |

31,007 |

|

| Interest income, net |

|

|

31,350 |

|

| Other additions |

|

|

346 |

|

| Interfund transfers out, net |

|

|

(2,282 |

) |

| Distributions |

|

|

(180,859 |

) |

| Participant loans |

|

|

(1,780 |

) |

| Other deductions |

|

|

(39 |

) |

| |

|

| Net decrease |

|

|

(122,257 |

) |

| Beginning of year |

|

|

1,650,832 |

|

| |

|

| End of year |

|

$ |

1,528,575 |

|

| |

|

In certain circumstances, the amount withdrawn from investment contracts would be payable at fair value rather than contract

value. These events include, but are not limited to, termination of the Plan or SVF, a material adverse change to the provisions of the Plan, a decision by the administrators of the Plan to withdraw from or terminate an investment contract without

securing a replacement contract, and in the event of a spin-off or sale of a division if the terms of a successor plan do not meet the investment contract issuer’s underwriting criteria for issuance of a clone investment contract. However, the

events described above are not probable of occurring in the foreseeable future.

Examples of events that would permit a contract issuer to terminate an

investment contract upon short notice include the Plan’s loss of its qualified tax status, uncured material breaches of responsibilities, or material and adverse changes to the provisions of the Plan. If one of these occurred, the investment

contract issuer could terminate the investment contract at fair value. The Committee does not anticipate that any of these events are probable of occurrence.

15

The following tables set forth by level, within the fair value hierarchy, the SVF Master Trust’s investment

assets at fair value.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thousands of Dollars |

|

| |

|

Assets at Fair Value as of December 31, 2014 |

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Common Collective Trusts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Multi-Mgr Interm. |

|

$ |

— |

|

|

$ |

707,113 |

|

|

$ |

— |

|

|

$ |

707,113 |

|

| Multi-Mgr Core Fixed Income |

|

|

— |

|

|

|

153,736 |

|

|

|

— |

|

|

|

153,736 |

|

| Short-term bond |

|

|

— |

|

|

|

602,064 |

|

|

|

— |

|

|

|

602,064 |

|

| |

|

| Total Common Collective Trusts |

|

|

— |

|

|

|

1,462,913 |

|

|

|

— |

|

|

|

1,462,913 |

|

| |

|

| Pooled Separate Account |

|

|

— |

|

|

|

95,870 |

|

|

|

— |

|

|

|

95,870 |

|

| Short-term investment fund |

|

|

— |

|

|

|

18,607 |

|

|

|

— |

|

|

|

18,607 |

|

| Wrapper contracts |

|

|

— |

|

|

|

— |

|

|

|

521 |

|

|

|

521 |

|

| |

|

| Total SVF Master Trust investment assets at fair value |

|

$ |

— |

|

|

$ |

1,577,390 |

|

|

$ |

521 |

|

|

$ |

1,577,911 |

|

| |

|

|

|

| |

|

Thousands of Dollars |

|

| |

|

Assets at Fair Value as of December 31, 2013 |

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Common Collective Trusts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Multi-Mgr Interm. |

|

$ |

— |

|

|

$ |

717,348 |

|

|

$ |

— |

|

|

$ |

717,348 |

|

| Multi-Mgr Core Fixed Income |

|

|

— |

|

|

|

298,378 |

|

|

|

— |

|

|

|

298,378 |

|

| Short term bond |

|

|

— |

|

|

|

528,366 |

|

|

|

— |

|

|

|

528,366 |

|

| |

|

| Total Common Collective Trusts |

|

|

— |

|

|

|

1,544,092 |

|

|

|

— |

|

|

|

1,544,092 |

|

| |

|

| Pooled Separate Account |

|

|

— |

|

|

|

102,691 |

|

|

|

— |

|

|

|

102,691 |

|

| Short-term investment fund |

|

|

— |

|

|

|

44,916 |

|

|

|

— |

|

|

|

44,916 |

|

| Wrapper contracts |

|

|

— |

|

|

|

— |

|

|

|

538 |

|

|

|

538 |

|

| |

|

| Total SVF Master Trust investment assets at fair value |

|

$ |

— |

|

|

$ |

1,691,699 |

|

|

$ |

538 |

|

|

$ |

1,692,237 |

|

| |

|

Level 3 Gains and Losses

There were no transfers in or out of Level 3 for the year ended December 31, 2014. The table below sets forth a summary of changes in the fair value of

the SVF Master Trust’s Level 3 investment assets for the year ended December 31, 2014:

|

|

|

|

|

| |

|

Thousands of Dollars |

|

| |

|

Wrapper contracts |

|

| Balance, beginning of year |

|

$ |

538 |

|

| Unrealized losses |

|

|

(17 |

) |

| |

|

| Balance, end of year |

|

$ |

521 |

|

| |

|

Unrealized losses for the year ended December 31, 2014, are included in the Plan interest in Stable Value Fund Master

Trust line on the Statement of Changes in Net Assets Available for Benefits.

16

Note 10—Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net assets available for benefits as of December 31, 2014 and 2013, as reflected in these

financial statements, to the amounts reflected in the Plan’s Form 5500:

|

|

|

|

|

|

|

|

|

| |

|

Thousands of Dollars |

|

| |

|

2014 |

|

|

2013 |

|

| Net assets available for benefits as reported in the financial statements |

|

$ |

7,730,521 |

|

|

$ |

7,838,845 |

|

| Adjustment from contract value to fair value for certain fully benefit-responsive investment contracts |

|

|

49,336 |

|

|

|

41,405 |

|

| |

|

| Net assets available for benefits as reported in the Form 5500 |

|

$ |

7,779,857 |

|

|

$ |

7,880,250 |

|

| |

|

The following is a reconciliation of net decreases for the year ended December 31, 2014, as reflected in these financial

statements, to the net loss reflected in the Plan’s Form 5500:

|

|

|

|

|

| |

|

Thousands

of Dollars |

|

| Year Ended December 31, 2014 |

|

|

|

|

|

|

| Net decrease as reported in the financial statements |

|

$ |

(108,324 |

) |

| Adjustment from contract value to fair value for certain fully benefit-responsive investment contracts at

December 31,

2014 |

|

|

49,336 |

|

| Reverse adjustment from contract value to fair value for certain fully benefit-responsive investment contracts at December 31,

2013 |

|

|

(41,405 |

) |

| |

|

| Net loss as reported in the Form 5500 |

|

$ |

(100,393 |

) |

| |

|

17

|

|

|

| Schedule H, Line 4i — |

|

ConocoPhillips Savings Plan |

| Schedule of Assets (Held at End of Year) |

|

EIN 73-0400345, Plan 022 |

At December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Thousands of Dollars |

|

| (a)(b)

Identity of issue

borrower, lessor or

similar party |

|

(c)

Description of investment including maturity date, rate of interest,

collateral, par or maturity value |

|

(d)

Historical

Cost |

|

|

(e)

Current

Value |

|

|

|

|

|

| * ConocoPhillips |

|

6,583,740 shares, ConocoPhillips Leveraged Stock Fund |

|

$ |

|

** |

|

$ |

454,673 |

|

|

|

|

|

| * ConocoPhillips |

|

23,309,315 shares, ConocoPhillips Stock Fund |

|

|

|

** |

|

|

1,609,764 |

|

|

|

|

|

| Phillips 66 |

|

3,183,076 shares, Phillips 66 Leveraged Stock Fund |

|

|

|

** |

|

|

228,226 |

|

|

|

|

|

| Phillips 66 |

|

7,847,524 shares, Phillips 66 Stock Fund |

|

|

|

** |

|

|

562,683 |

|

|

|

|

|

| DuPont |

|

1,056,857 shares, DuPont Stock Fund |

|

|

|

** |

|

|

78,157 |

|

|

|

|

|

| Fidelity Investments |

|

1,316,617 units, Fidelity Low-Priced Stock Fund |

|

|

|

** |

|

|

66,160 |

|

|

|

|

|

| PIMCO Funds |

|

8,327,883 units, PIMCO Total Return Fund – Institutional Class |

|

|

|

** |

|

|

88,775 |

|

|

|

|

|

| * The Vanguard Group |

|

2,841,923 units, Vanguard Balanced Index Fund Inst |

|

|

|

** |

|

|

84,348 |

|

|

|

|

|

|

|

5,755,456 units, Vanguard Infla-Protected Sec Inst |

|

|

|

** |

|

|

60,667 |

|

|

|

|

|

|

|

935,262 units, Vanguard Explorer Fund Admiral |

|

|

|

** |

|

|

80,853 |

|

18

|

|

|

| Schedule H, Line 4i — Schedule

of Assets (Held at End of Year) |

|

ConocoPhillips Savings Plan

EIN 73-0400345, Plan 022 |

At December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Thousands of Dollars |

|

| (a)(b)

Identity of issue

borrower, lessor or

similar party |

|

(c)

Description of investment including maturity date, rate of interest,

collateral, par or maturity value |

|

(d)

Historical

Cost |

|

|

(e)

Current

Value |

|

|

|

|

|

| * The Vanguard Group |

|

1,967,274 units, Vanguard Inst Index Fund |

|

|

|

** |

|

|

371,185 |

|

|

|

|

|

|

|

1,084,477 units, Vanguard International Growth Fund |

|

|

|

** |

|

|

74,257 |

|

|

|

|

|

|

|

178,414 units, Vanguard Prime MM Inst |

|

|

|

** |

|

|

178,315 |

|

|

|

|

|

|

|

2,395,171 units, Vanguard International Value Fund |

|

|

|

** |

|

|

81,316 |

|

|

|

|

|

|

|

18,556,145 units, Vanguard Total Bond Mkt Inst |

|

|

|

** |

|

|

201,702 |

|

|

|

|

|

|

|

4,505,890 units, Vanguard Long-Term Treasury Fund |

|

|

|

** |

|

|

58,812 |

|

|

|

|

|

|

|

3,651,204 units, Vanguard Mid-Cap Index Fund Ins |

|

|

|

** |

|

|

123,374 |

|

|

|

|

|

|

|

489,007 units, Vanguard Morgan Growth Fund |

|

|

|

** |

|

|

38,392 |

|

|

|

|

|

|

|

1,179,738 units, Vanguard Total Int’l Stock Idx |

|

|

|

** |

|

|

122,669 |

|

|

|

|

|

|

|

2,385,460 units, Vanguard PRIMECAP Fund |

|

|

|

** |

|

|

254,192 |

|

19

|

|

|

| Schedule H, Line 4i — Schedule

of Assets (Held at End of Year) |

|

ConocoPhillips Savings Plan

EIN 73-0400345, Plan 022 |

At December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Thousands of Dollars |

|

| (a)(b)

Identity of issue

borrower, lessor or

similar party |

|

(c)

Description of investment including maturity date, rate of interest,

collateral, par or maturity value |

|

(d)

Historical

Cost |

|

|

(e)

Current

Value |

|

|

|

|

|

| * The Vanguard Group |

|

2,652,205 units, Vanguard Small-Cap Growth Idx Ins |

|

|

|

** |

|

|

94,028 |

|

|

|

|

|

|

|

2,887,328 units, Vanguard Small-Cap Value Idx Ins |

|

|

|

** |

|

|

73,318 |

|

|

|

|

|

|

|

2,473,855 units, Vanguard Total Stock Market Idx Inst |

|

|

|

** |

|

|

127,651 |

|

|

|

|

|

|

|

1,021,909 units, Vanguard Extended Mkt Index Inst |

|

|

|

** |

|

|

68,068 |

|

|

|

|

|

|

|

1,343,515 units, Vanguard Value Index Fund Inst |

|

|

|

** |

|

|

44,255 |

|

|

|

|

|

|

|

1,051,106 units, Vanguard Growth Index Fund Ins |

|

|

|

** |

|

|

56,446 |

|

|

|

|

|

|

|

2,431,570 units, Vanguard Wellington Fund |

|

|

|

** |

|

|

164,403 |

|

|

|

|

|

|

|

1,769,268 units, Vanguard Windsor II Fund |

|

|

|

** |

|

|

117,126 |

|

|

|

|

|

|

|

68,194 units, Vanguard Target Retirement 2060 |

|

|

|

** |

|

|

1,923 |

|

|

|

|

|

|

|

839,976 units, Vanguard Target Retirement 2010 |

|

|

|

** |

|

|

22,108 |

|

20

|

|

|

| Schedule H, Line 4i — Schedule

of Assets (Held at End of Year) |

|

ConocoPhillips Savings Plan

EIN 73-0400345, Plan 022 |

At December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Thousands of Dollars |

|

| (a)(b)

Identity of issue

borrower, lessor or

similar party |

|

(c)

Description of investment including maturity date, rate of interest,

collateral, par or maturity value |

|

(d)

Historical

Cost |

|

|

(e)

Current

Value |

|

|

|

|

|

| * The Vanguard Group |

|

5,310,812 units, Vanguard Target Retirement 2015 |

|

|

|

** |

|

|

81,202 |

|

|

|

|

|

|

|

4,542,337 units, Vanguard Target Retirement 2020 |

|

|

|

** |

|

|

129,273 |

|

|

|

|

|

|

|

5,470,409 units, Vanguard Target Retirement 2025 |

|

|

|

** |

|

|

90,426 |

|

|

|

|

|

|

|

2,002,704 units, Vanguard Target Retirement 2045 |

|

|

|

** |

|

|

37,350 |

|

|

|

|

|

|

|

1,931,888 units, Vanguard Target Retirement 2030 |

|

|

|

** |

|

|

56,102 |

|

|

|

|

|

|

|

2,299,751 units, Vanguard Target Retirement 2035 |

|

|

|

** |

|

|

41,028 |

|

|

|

|

|

|

|

981,780 units, Vanguard Target Retirement 2050 |

|

|

|

** |

|

|

29,080 |

|

|

|

|

|

|

|

1,177,712 units, Vanguard Target Retirement 2040 |

|

|

|

** |

|

|

35,049 |

|

|

|

|

|

|

|

373,081 units, Vanguard Target Retirement 2055 |

|

|

|

** |

|

|

11,931 |

|

|

|

|

|

|

|

4,493,379 units, Vanguard Target Retirement Income |

|

|

|

** |

|

|

58,010 |

|

|

|

|

|

| * Participants |

|

Loans to Plan participants, Interest rates ranging from 3.25% to 9.5% |

|

|

|

** |

|

|

43,044 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

6,200,341 |

|

| |

|

| ** |

Historical cost information is not required for participant-directed investments. |

21

|

|

|

| Exhibit Index |

|

ConocoPhillips Savings Plan |

|

|

EIN 73-0400345, Plan 022 |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 23 |

|

Consent of Independent Registered Public Accounting Firm |

22

Exhibit 23

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statements (Form S-8 Nos. 333-98681, 333-116216, 333-133101, and 333-171047) pertaining to

the ConocoPhillips Savings Plan of our report dated June 23, 2015, with respect to the financial statements and schedule of the ConocoPhillips Savings Plan included in this Annual Report (Form 11-K) for the year ended December 31, 2014.

/s/ Ernst & Young LLP

Tulsa, Oklahoma

June 23, 2015

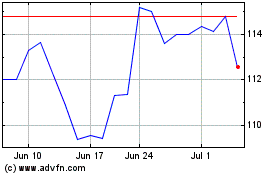

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

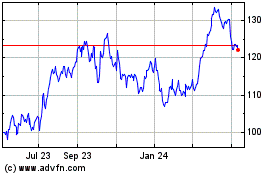

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024